The Must-Knows Before Market Opens (13/11/2016)

Taurus Brown Research

Publish date: Sun, 13 Nov 2016, 02:44 AM

News Highlights:

- Malaysia's Ekovest Plans $500 Million IPO for Infrastructure Assets

- IHH Healthcare to divest 30% stake in China unit for RM689.6m

- BHIC bags RM15m contract from Defence Ministry

Ekovest Bhd (Last price: RM2.50)

Malaysia’s Ekovest Plans $500 Million IPO for Infrastructure Assets

The Malaysian construction and property company Ekovest Bhd. is planning to list its infrastructure assets in a public offering that will raise at least $500 million in proceeds. Ekovest’s managing director Lim Keng Cheng confirmed that the company was considering taking its highway-concession business public as part of its effort to realize the value of its assets. It sold a 40% stake in its highway-operating unit to state pension fund Employees Provident Fund for 1.13 billion ringgit ($270.6 million) cash. - The Edge

IHH Healthcare Bhd (Last price: RM6.31)

IHH Healthcare to divest 30% stake in China unit for RM689.6m

IHH Healthcare Bhd, the world's second largest private healthcare group by market capitalisation, is divesting a 29.9% equity stake in PCH Holding Pte Ltd – the holding entity for the group's China portfolio of primary care clinics and greenfield hospital projects – to China's Taikang Insurance Group Inc for RMB1.1 billion (RM689.6 million) cash.

Its indirect wholly-owned subsidiary Parkway Group Healthcare Pte Ltd has entered into a share purchase agreement with Taikang Insurance Group, through its indirect wholly-owned unit TK Healthcare Investment Ltd for the proposed deal. PCH will become an indirect 70.1% subsidiary of IHH. – The Edge

Boustead Heavy Industries Corp Bhd (RM1.92)

BHIC bags RM15m contract from Defence Ministry

Boustead Heavy Industries Corp Bhd (BHIC) has bagged a RM15 million contract from the Defence Ministry for the maintenance and supply of spare parts for the Skyguard radar and 35mm Oerlikon guns for the Malaysian Armed Forces. The contract will have no material effect on the earnings of the group for the financial year ending Dec 31, 2016, but will contribute positively to its future earnings. – The Edge

Domestic Market

Still in sideways amid lack of trigger

Technical Rebound at ~1621.76. In the past one year, we have seen the FTSE Bursa Malaysia KLCI index trading in a rangebound manner amid lack of deciding triggers of a new direction. After the stunning win of Donald Trump in the 2016 US Presidential Election, global stock markets were sent into gyrations with the S&P500 index futures at one point were limit down, before rallying its way back near the record-high level. In Malaysia however, the KLCI index continued to decline along the shorter-term bearish trendline as investors assimilated the impact of Trump’s anti-trade stance. Notwithstanding that, we reckon that the index will continue trading in a sideways trend before any significant market-direction trigger. All in, we expect KLCI to rebound from the support at 1621.76, with the first notable resistance at 1691.22 and the next at 1724.44. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

International Market

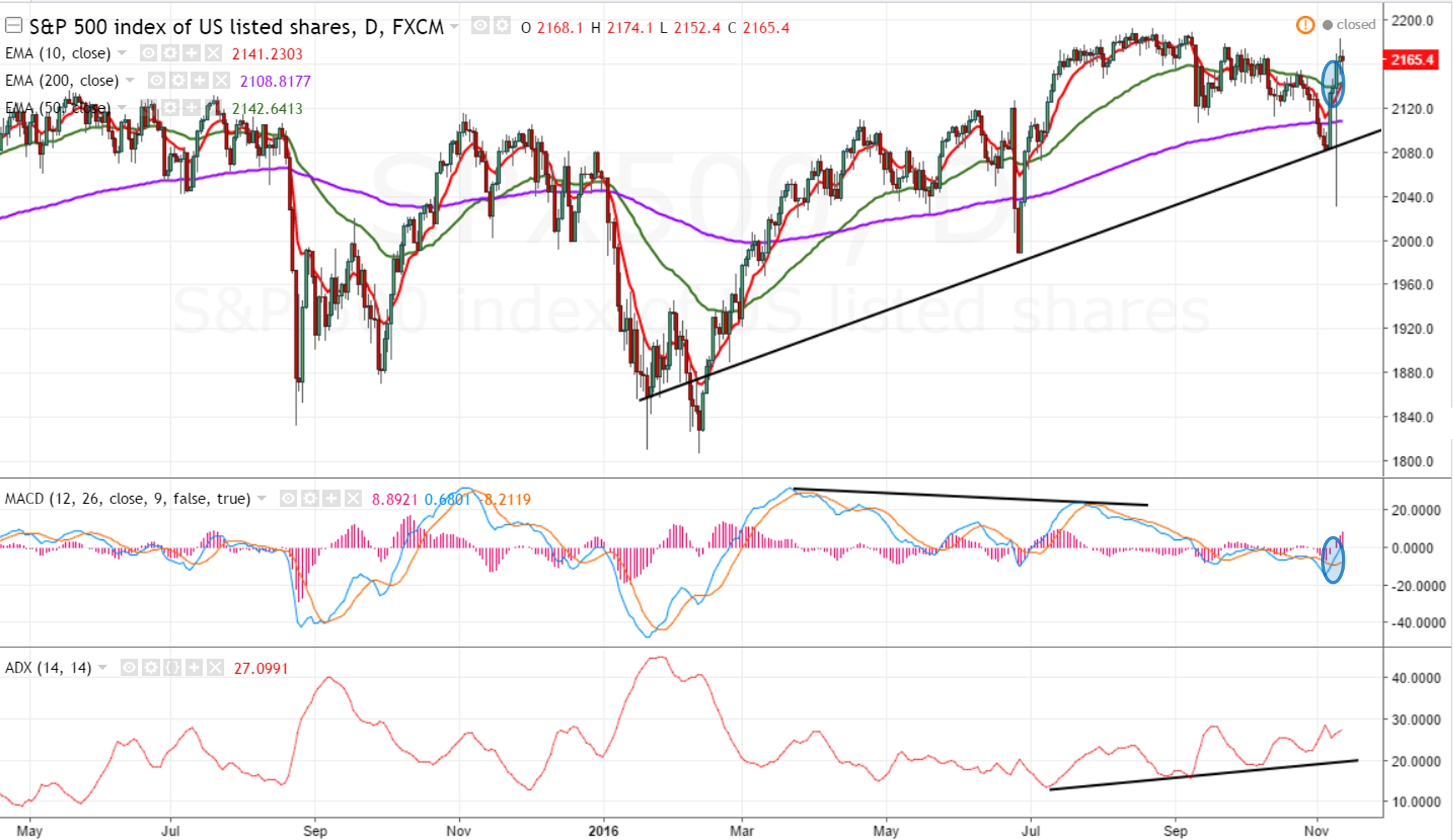

MACD signals trend continuation with ADX’s endorsement, but can it last?

Bullish in the immediate term. The S&P500 index has rebounded strongly from the upward trendline and penetrated above the EMA10 line amid a post-election rally. Subsequently, the index spotted an upward crossover in the MACD reading, which flashes signs of a continuation in the bullish trend. In addition, this was supported by an upward trending average directional index (ADX) as depicted above, indicating that the upward trend has been experiencing a slight pickup in momentum. However, we note that the index recently saw a MACD bearish divergence, as elucidated by a pair with a higher-trending index and a lower-trending MACD reading, that could indicate the end of the current trend. Therefore, to confirm the uptrend, a new MACD reading above the previous high (~24) will ascertain that the bullish signal is healthy. All in, we anticipate the index to rally in the immediate term, but remain cautious on the larger trend while we closely watch the MACD development. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

Economic Outlook

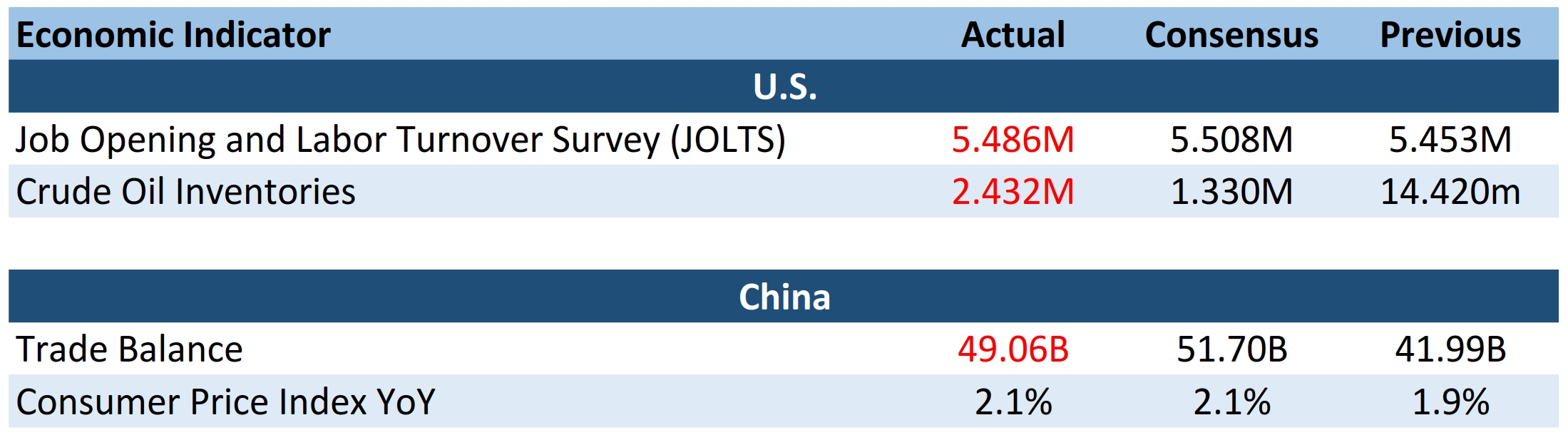

The U.S. Department of Labor reported 5.496M job openings in September, marginally lower than the consensus of 5.508M. This release (JOLTS) includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions. As at the last day of September, job openings were little change from August at 5.5M. Hires edged down to 5.1 million and total separations were little changed at 4.9 million. Within separations, the quits rate was unchanged at 2.1 percent and the layoffs and discharges rate decreased to 1.0 percent.

This week’s change in crude oil inventories held by commercial firms were at 2.432M, recording 82.2% above estimates. Crude oil prices closed lower this week amid sustained supply glut concerns. As compared to last week’s prices, WTI edge down 2.3% to close at $43.09 and Brent closed 3.78% lower at $44.54 on Friday.

China’s CPI for October went up by 2.1% YoY with prices grown by 2.2% in cities and 1.8% in rural areas. Prices of consumer goods and services were up by 1.9% and 2.5% respectively. Food prices went up by 3.7%. On average from January to October, the overall consumer prices were up by 2.0% over the same period of the previous year.

Trade balance reported by China’s National Bureau of Statistics for October was at 49.06B, disappointing estimates of 51.70. Chinese exports remain in a funk, falling for 7 consecutive months. Overseas shipment slumped 7.3% YoY and exports to the U.S. fell 5.6%.

More articles on Weekly Commentary by Taurus Brown Research

Created by Taurus Brown Research | Aug 11, 2016