The Must-Knows Before Market Opens (15/01/2017)

Taurus Brown Research

Publish date: Sun, 15 Jan 2017, 03:37 PM

News Highlights:

- AirAsia To Seek Dual Listing

- Nintendo’s shares tumbles after Switch announcement

- Moody’s to pay 864million over pre-crisis rating

AirAsia Berhad (Last Price: RM2.44)

AirAsia To Seek Dual Listing

AirAsia group is seeking for a secondary listing on the Hong Kong Stock Exchange (HKSE). Tan Sri Tony Fernandes has confirmed that the plan is list a portion of the group’s share in Hong Kong-listed vehicle to provide new access of capital to the group. The listing in HKSE is expected to give AirAsia flexibility in raising funds as well as providing investors an option to invest in the vibrant HKSE. Tan Sri Tony Fernandes also informed that the exact form of listing is subject to the board’s approval but the appointed bankers are working on it and the group is expected to make the announcement soon. – The Star

Nintendo Co. Ltd (Last Price: JPY 23,750.00)

Nintendo’s shares tumbles after Switch announcement

Nintendo priced Switch at USD$299, above market expectation disappoints investors and jeopardizes its prospects of winning smartphones-gamer back to consoles. Switch is a hybrid home console and handheld device that is set for launching on March 3 this year. In United States, the pricing is the same as its predecessor, Wii U console but the pricing in Japan is 20% higher than Wii U. A senior fund manager in Japan opine that Switch’s price is on the high side and there are not enough software titles to justify that price.

The launch caused Nintendo’s shares at 2-month low after falling as much as 6.3% - The Edge

Moody’s Corp (Last Price: USD96.96)

Moody’s to pay 864million over pre-crisis rating

Moody’s Corp has agreed on USD864 million settlement with U.S federal and state authorities over its rating on risky mortgage securities which caused the 2008 financial crisis. Moody’s will pay USD437.5 million penalty to the Justice Department and USD426.3 million to the states and Washington, D.C. Moody’s is also required to ensure its integrity and keeping analytic employees out of commercial-related discussions as part of the settlement. Moody’s chief executive also must certify compliance with the measures for at least five years.

The rating agency’s shares fell more than 5% on the day where U.S Justice Department informed that it was planning to sue Moody’s. – Reuters

Domestic Market

A bull market awakens in early 2017

Reversal: Bullish entry. The FBMKLCI index has not seen significant development in the past one week. Recently, the index rebounded from its support at 1613.35 and rallied above the EMA200 line (purple). In our view, this is a strong signal of an entry into a bullish trend. Meanwhile, the EMA10 (red) line is also on the verge of crossing above the EMA50 line (green), coupled with an upward crossover above the signal line seen in the MACD. Collectively, we believe signs are pointing toward a bullish rally in the immediate term with the first notable resistance at 1691.22 (dotted blue) and the next at 1724.44. All in, we reiterate that the index is on track to re-enter the 1700 territory and eventually come to test the strong resistance seen at 1724.44. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

International Market

Market has yet to set its new year resolution

Retracement in the immediate term. The S&P500 index has not seen significant development in the past one week. Recently, the S&P500 index retraced from the upper boundary of the channel (purple) to the EMA10 line (red). Subsequent to that, the index has resumed its rally to its previous record-high level. This week, the MACD continues to exhibit a downward bias after it retraced from its resistance (dotted blue). To sum up, we believe the index will see a rally pause in the immediate term, but maintain that the overall trend technically remains bullish. – To know what’s next, follow us on Facebook now at fb.com/TaurusBrownCo to get updates on the chart readings or visit www.taurusbrown.com.

Economic Outlook

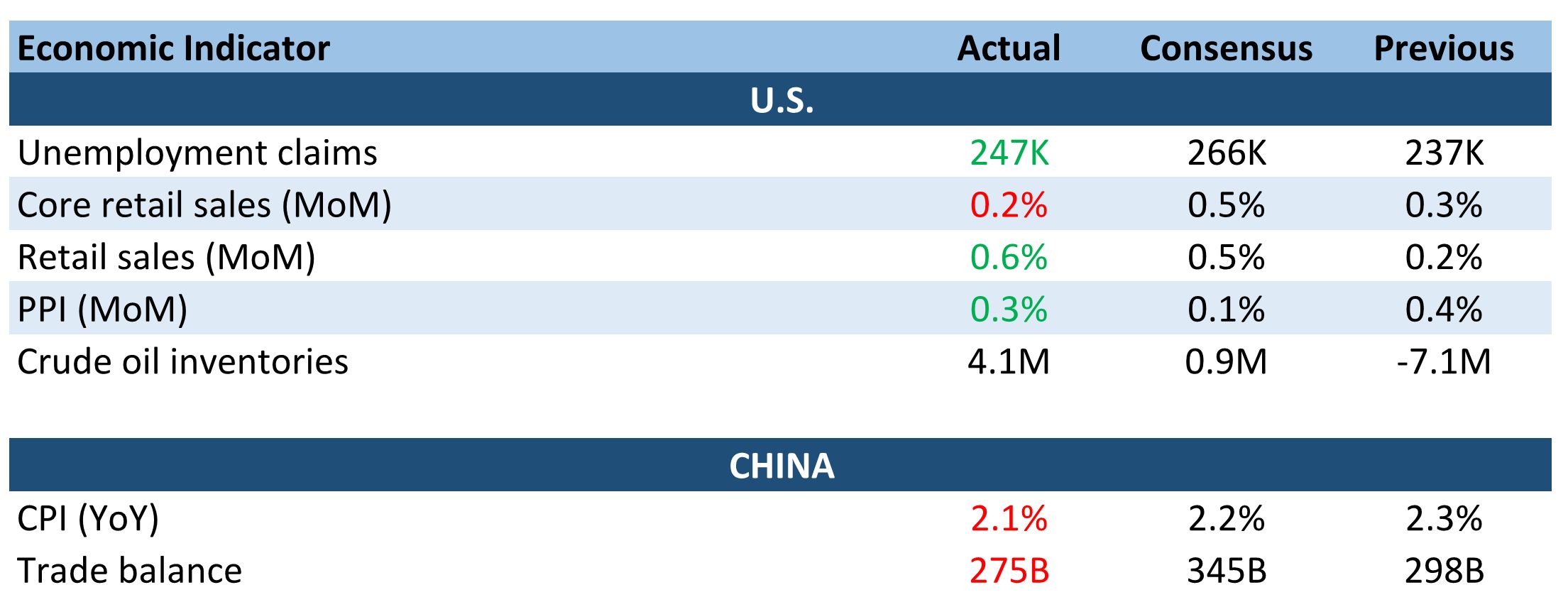

U.S. retailers experienced accelerated growth for the month of December on the heels of stronger demand for motor vehicles. The 0.6% gain for December followed a revised gain of 0.2% in November, according to the U.S. Census Bureau. On a whole, retail sales for 2016 advanced 3.3%, exceeding the 2.3% gain a year earlier. Stripping off car sales and gasoline receipts which accounts for about 20% of retail sales shows that core retail sales ticked up 0.2%, below the consensus of 0.5%.

The Producer Price Index (PPI) for final demand goods and services rose for the third month in four months, boosted by rising fuel costs that are putting an upward pressure on inflation in the economy. Gasoline prices climbed 7.8%, accounting for almost half of the 0.7% jump in final demand goods prices. Final demand services inched up 0.1% in December after increasing 0.5% in November. Most of the December increase in final demand services can be traced to prices for securities brokerage, dealing, investment advice, and related services, which advanced 4.4%.

The amount of individuals who applied for unemployment benefit for the week was at 247,000, below estimates of 266,000. The less volatile 4-week moving average was 256,500, a decrease of 1,750 from the previous week's revised average. With unemployment rate near a nine-year old of 4.7%, the current labor market is considered to be at or near full employment.

This week’s change in crude oil inventories held by commercial firms saw an increase of 4.1mil barrels following last week’s decrease of -7.1 mil barrels. Oil gains came despite government data came in above consensus of 0.9 mil barrels. WTI and Brent gained 1.45% and 1.5% this week to $52.51 and $55.54 respectively.

Over in China, the trade balance came in well below consensus of 345B at 275B. Exports in all of 2016 fell 7.7% from a year earlier, while imports slid 5.5%. On the other hand, the National Bureau of Statistics reported the consumer prices in China were up 2.1%, coming in shy of expectation of 2.2% and down below 2.3% in November.

More articles on Weekly Commentary by Taurus Brown Research

Created by Taurus Brown Research | Aug 11, 2016

speakup

it's a SUPER BULL RUN!

just simply whack any share can make money!

everybody, YES even YOU, can become make money!

LOAD UP BOYZ! cos we now in BULL RUN!!!!

close eye.....BUY!

open eye.....BUTA MONEY IN YOUR HANDS!

2017-01-16 07:42