Sector Focus: Plantations

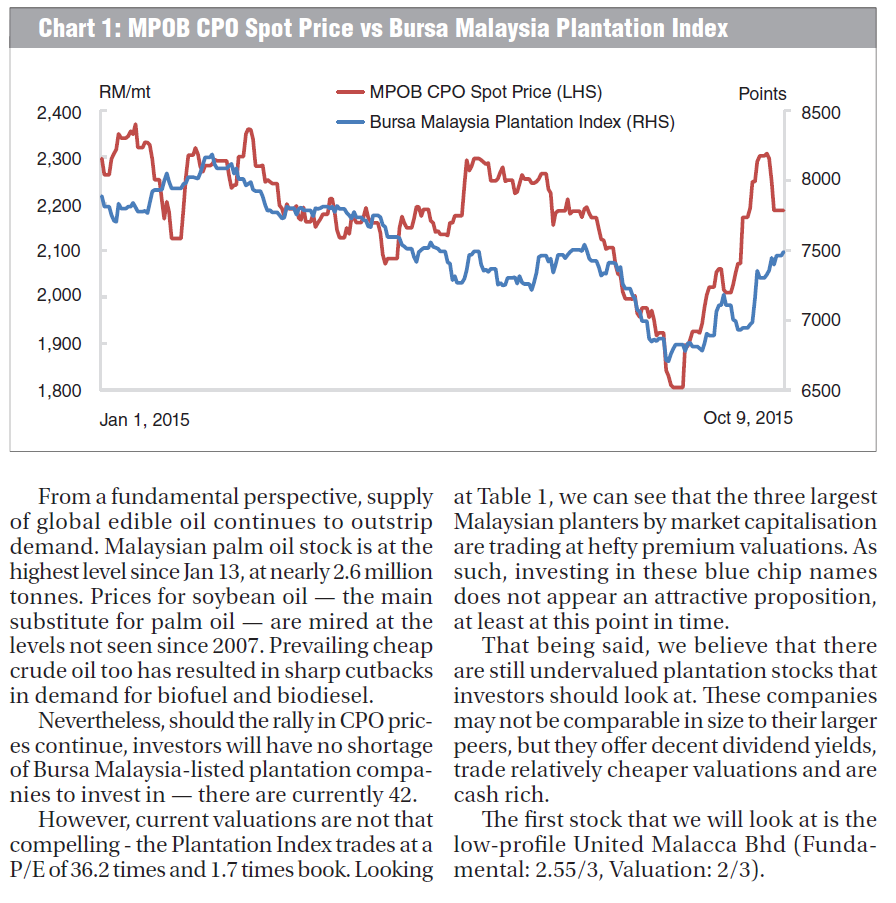

THE first half of 2015 was largely uneventful for crude palm oil (CPO) (refer to Chart 1). After peaking at RM2,371/mt on Jan 15, prices were largely range-bound between RM2,100/mt and RM2,300/mt.

Things, however, took a turn for the worse in August. Global financial markets were rattled as evidence of a steeper than expected slowdown in China piled up. Commodities, in particular, were hammered given that China is the world’s largest consumer for almost all commodities types, from energy to industrial metals to agriculture products. Confidence was further buffeted following the unexpected devaluation of the Chinese yuan and faced with an imminent US rate hike.

Amid the commodities rout, CPO prices tumbled to a low of RM1,806/mt on Aug 27 - a level not seen since 2009. In comparison, the average selling price of CPO in 2014 was much higher at RM2,408/mt according to the Malaysian Palm Oil Board (MPOB).

Low CPO prices took its toll on the profitability of plantation companies, as witnessed by their disappointing quarterly results. The Bursa Malaysia Plantation Index fell to a 4-year low of 6,707 on Aug 25. Compared to the end of 2014, this was a 15% fall.

On a more positive note, the storm clouds appeared to have cleared, for now. CPO staged a dramatic 20.3% rally from its Aug 27 lows to close at RM2,173/mt on Monday. Accordingly, the Plantation Index also rebounded off its multi-year lows, closing 783.7 points or 11.7% higher at 7,490.6

There are several catalysts behind the current recovery in CPO prices.

Firstly, the onslaught of the “El Nino” dry season, which usually happens in the middle of the year, triggered fears of below-average rainfall. This would, in turn, cause fresh fruit bunch (FFB) yields to fall, leading to a supply shortage in the coming months.

Secondly, Malaysian CPO prices, which are denominated in ringgit, rose in tandem with the strengthening of the US dollar. In August alone, the ringgit dropped by 8.6% against the US dollar and is still down 16.5% YTD at 4.1860

Finally, CPO prices were given a boost when the US Federal Reserve postponed the long awaited US rate hike in its meeting on Sep 16. Continuation of extreme accommodative monetary policy is seen to support flagging growth, and by extension, demand for commodities like CPO.

It remains to be seen if the rally has legs.

From a fundamental perspective, supply of global edible oil continues to outstrip demand. Malaysian palm oil stock is at the highest level since Jan 13, at nearly 2.6 million tonnes. Prices for soybean oil — the main substitute for palm oil — are mired at the levels not seen since 2007. Prevailing cheap crude oil too has resulted in sharp cutbacks in demand for biofuel and biodiesel.

Nevertheless, should the rally in CPO prices continue, investors will have no shortage of Bursa Malaysia-listed plantation companies to invest in — there are currently 42.

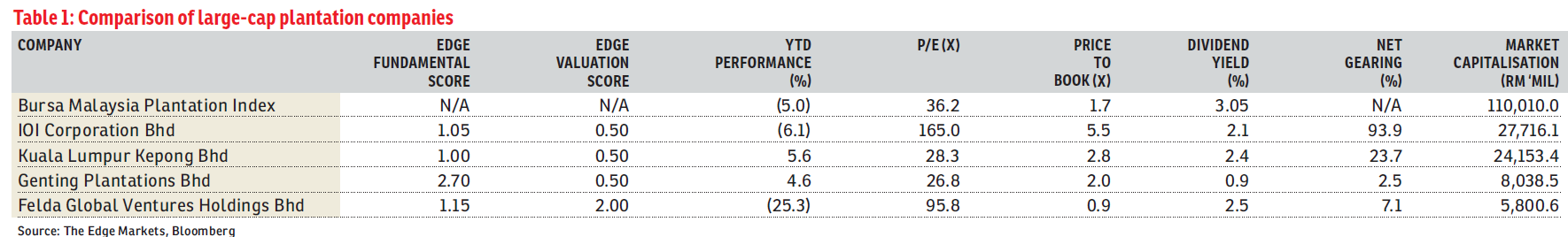

However, current valuations are not that compelling - the Plantation Index trades at a P/E of 36.2 times and 1.7 times book. Looking at Table 1, we can see that the three largest Malaysian planters by market capitalisation are trading at hefty premium valuations. As such, investing in these blue chip names does not appear an attractive proposition, at least at this point in time.

That being said, we believe that there are still undervalued plantation stocks that investors should look at. These companies may not be comparable in size to their larger peers, but they offer decent dividend yields, trade relatively cheaper valuations and are cash rich.

The first stock that we will look at is the low-profile United Malacca Bhd (![]() Valuation: 2.00, Fundamental: 2.55) (Fundamental: 2.55/3, Valuation: 2/3).

Valuation: 2.00, Fundamental: 2.55) (Fundamental: 2.55/3, Valuation: 2/3).

http://www.theedgemarkets.com/my/article/insider-asia%E2%80%99s-stock-day-sector-focus-plantations