Insider Asia’s Stock Of The Day: PWROOT (13/11/2015)

Tan KW

Publish date: Fri, 13 Nov 2015, 10:36 AM

This article first appeared in The Edge Financial Daily, on November 13, 2015.

Power Root Bhd (![]() Valuation: 2.10, Fundamental: 2.40)

Valuation: 2.10, Fundamental: 2.40)

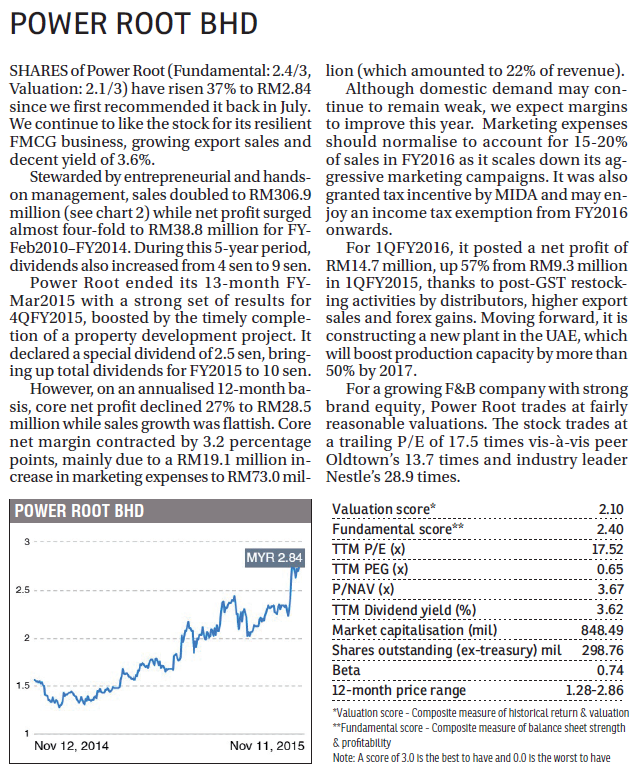

SHARES of Power Root (Fundamental: 2.4/3, Valuation: 2.1/3) have risen 37% to RM2.84 since we first recommended it back in July. We continue to like the stock for its resilient FMCG business, growing export sales and decent yield of 3.6%.

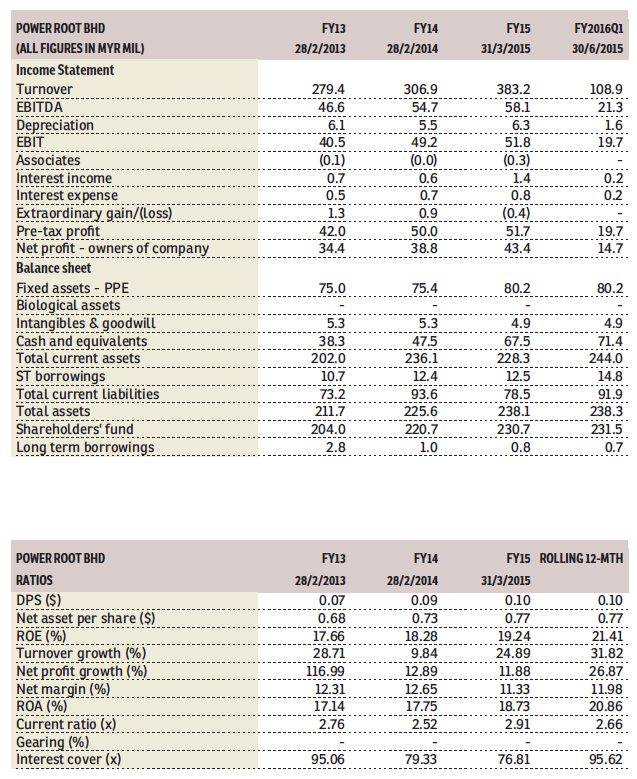

Stewarded by entrepreneurial and hands-on management, sales doubled to RM306.9 million (see chart 2) while net profit surged almost four-fold to RM38.8 million for FYFeb2010–FY2014. During this 5-year period, dividends also increased from 4 sen to 9 sen.

Power Root ended its 13-month FYMar2015 with a strong set of results for 4QFY2015, boosted by the timely completion of a property development project. It declared a special dividend of 2.5 sen, bringing up total dividends for FY2015 to 10 sen.

However, on an annualised 12-month basis, core net profit declined 27% to RM28.5 million while sales growth was flattish. Core net margin contracted by 3.2 percentage points, mainly due to a RM19.1 million increase in marketing expenses to RM73.0 million (which amounted to 22% of revenue).

Although domestic demand may continue to remain weak, we expect margins to improve this year. Marketing expenses should normalise to account for 15-20% of sales in FY2016 as it scales down its aggressive marketing campaigns. It was also granted tax incentive by MIDA and may enjoy an income tax exemption from FY2016 onwards.

For 1QFY2016, it posted a net profit of RM14.7 million, up 57% from RM9.3 million in 1QFY2015, thanks to post-GST restocking activities by distributors, higher export sales and forex gains. Moving forward, it is constructing a new plant in the UAE, which will boost production capacity by more than 50% by 2017.

For a growing F&B company with strong brand equity, Power Root trades at fairly reasonable valuations. The stock trades at a trailing P/E of 17.5 times vis-à-vis peer Oldtown’s 13.7 times and industry leader Nestle’s 28.9 times.

http://www.theedgemarkets.com/my/article/insider-asia%E2%80%99s-stock-day-power-root-0?type=InsiderAsia%20Stock%20of%20The%20Day

Insider Asia’s Stock Of The Day: PWROOT (13/11/2015)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|