Why SAM? Order book of RM3Billions and pure cash company (RM103Millions)- (TP:RM10.95)

itjustabouttheprofit

Publish date: Sat, 20 Jun 2015, 05:31 AM

EPS estimation : 18.25 x 4 =73sen

PE ratio : 15 (higher PE ratio due to stable

income in the next 5 year, pure cash

company with no debt and high dividend

yield)

Target price : RM10.95 (might be more in

long term)

I am here to ANSWER a simple question. Why

SAM?

1) Strong order books of RM3billions keep the

company busy until 2026

2) Management determination - Become global

player with annual revenue more than

RM1billions

3) Strong balance sheet -RM103millions cash

with zero borrowing, dividend yield of 4.14%

4) Reputable customers, GE Aviation. subsidiary

of General Electric, which is listed company

in Dow Jones index

Introduction

On 27 September 2012, SAM Engineering &

Equipment (M) Berhad have completed the

acquisition of the entire issued and paid-up

capital for Avitron Pte Ltd from Singapore

Aerospace Manufacturing Pte Ltd for

RM135millions.

After the acquisition, it began the new chapter

for SAM Engineering in aerospace industries.

There are three main business involvement:

a) Aerospace (69% of total revenue)

b) Equipment Manufacturing (24% of total

revenue)

c) Precision Engineering (7% of total revenue)

According to annual report 2014, Temasek

Holdings (Private) Limited (investment company

for Singapore government) owned 74.18% of

indirect interest in SAM Engineering & Equipment

(M) Berhad.

1) Strong order books of RM3billions keep the

company busy until 2026

http://www.thestar.com.my/Business/Business-News/2014/09/08/SAM-plans-to-grow-via-additional-investments-and-acquisitions/?style=biz

From the Star report as at 8 September 2014, the company already have RM2billions orderbook on September 2014.

http://www.sam-malaysia.com/wp-content/uploads/2015/06/Latest-News_17-June-2015.pdf

http://www.sam-malaysia.com/wp-content/uploads/2015/05/Latest-News_26-May-2015.pdf

Refer to the link above, Avitron Pte Ltd, wholly-owned subsidiaries of the company have received RM450millions contracts from GE Aviation on 26 May 2015 and RM900millions contracts from GE Aviation on 17 June 2015. These brought the company currently stood at RM3billions order book.

Calculations are as follows:

| RM'000 | |

| Total order book as per Sep 14 | 2,000,000 |

| Revenue as per 30/09/2014 | (112,328) |

| Revenue as per 31/12/2014 | (113,542) |

| Revenue as per 31/03/2015 | (132,493) |

| New contracts on 26/05/2015 | 450,000 |

| New contracts on 17/06/2015 | 900,000 |

| Total order book as per 17/06/2015 | 2,991,637 |

The order book of RM3billions will keep the company busy until 2026.

With the RM3billions order book, the company will able to maintain revenue for the latest quarter, which is RM132million for 5 and a half year!!! (5.5 x 4 x 132 = RM2.904billions)

2) Management determination - Become global

player with annual revenue more than

RM1billions

Refer to the annual report 2014, the company management planned to target annual revenue of RM1billions in the next 2 to 3 years. For year 2015 (up to 17/06/2015),the company have received order book of RM1.35billion (as stated above). These marked the management determination to archieve the target annual revenue of RM1billion, which is 121% inceased in total revenue from rolling revenue for the past 4 quarters!! From The Star news above, the management also stated that they are targetting to become the leading player in Asia Pacific in aerospace industry.

3) Strong balance sheet -RM103millions cash

with zero borrowing, dividend yield of 4.14%

As per latest quarterly report, the company held RM103millions of cash and cash equivalents, which is RM1.23 per share!! Other than that, the company have zero bank borrowing and RM79million of trade and other payables. Net assets for the company stood at RM4.46 per share.

Also, the company have declared RM0.1725 per shares of final and special dividends during 2014, which translated to 4.14% of dividend yield. For financial year 2015, the company expected to declare the dividend during July 2015, which is one month from now. As the company's profit grew for current financial year, hence we expected a better dividend payout for this year.

4) Reputable customers, GE Aviation, subsidiary

of General Electric, which is listed company

in Dow Jones index

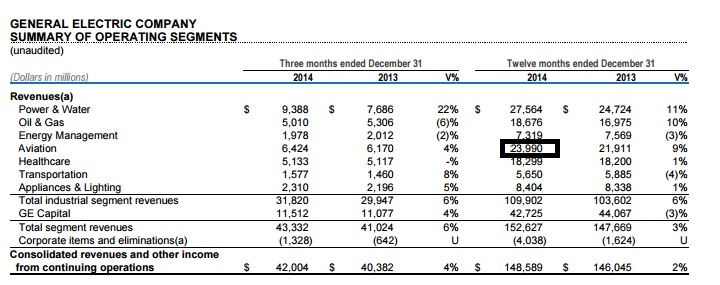

The main customer of the company, GE Aviation, which is among the top aircraft engine suppliers and offers engines for the majority of commercia aircraft in the world.

GE Aviation is one of the subsidiaries for General Electric Company which is listed in the Dow Jones Index (top 30 largest company in term of market value in US).

https://www.ge.com/sites/default/files/ge_webcast_pressrelease_01232015_1.pdf

According to the quarterly report for General Electric Company. GE Aviation have contributed USD24billions revenue during financial year 2014 for General Electric Company.

5) Strong currency exchange against ringgit lead

to increase in total revenue

As most the contract signed in US dollar (refer to the attachment for the latest contract on 17 June 2015 and 26 May 2015), we expected the total order book will increased (in term of ringgit) as ringgit have been depreciation about 10% to 20% during 2015.

Trade at your own risk!!! Do research before any investment decision!! Happy trading :-)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Ultimate undervalue club

Created by itjustabouttheprofit | Dec 08, 2020

Created by itjustabouttheprofit | Sep 04, 2018

Created by itjustabouttheprofit | Aug 28, 2016

Created by itjustabouttheprofit | Jun 05, 2016

Created by itjustabouttheprofit | Apr 16, 2016

Discussions

This company is run by Singaporean. They are efficient and competent.

A bit cocky though, too much chest thumping in the annual report, ha ha

2015-06-20 08:32

I like efficient people running a company, unlike in Malaysia run by clowns.

Did u attend the AGM?

2015-06-20 08:36

Icon8888: completely agreed with u haha cocky annual report. Especially first few pages. But it is a good company.

2015-06-20 08:38

Good morning itjustabouttheprofit and Icon8888 and RosmahMansur..

Harlo. U guys no sleep meh? Long short SAM during weekend? Why so serious?

Guys... Happy dumpling day.

2015-06-20 08:48

This stock is like Fimacorp. Too tightly held by top shareholders. Institution funds will never get to buy a piece of SAM. The share price of this counter will solely depend on retail investors perception

2015-06-20 09:21

You guys are forgetting the diluting effects of the ICUTS - take this into account, I think SAM is trading at circa 16x PE 2015.

Is this reasonable? Perhaps, with the good balance sheet and healthy growth but it's definitely not as cheap as you make it out to be. :-)

2015-06-20 23:15

Gosh...a one buyer Company...acquired Avitrton...how about its debts,,,what are the liabilities that came with it ??

2015-06-21 16:05

Who is the 2nd largest shareholder? Is it just coincidence that SAM gets attention just 3 days after he left MEGB?

2015-06-22 12:53

Icon8888

Great pick. Absolutely agree. This us a lean and mean company

2015-06-20 07:56