|

| |

OverviewFinancial Highlight

Headlines

Business Background Malayan Banking Bhd is a financial-services group with a mostly regional presence in the Association of Southeast Asian Nations. Maybank provides a comprehensive range of financial services under three key reporting segments, including community financial services, global banking, and insurance. The majority of its profit activities are in consumer, corporate, investment, transaction, retail, and business banking for mostly small and midsize enterprises. Much of Maybank’s business model is leveraged to distribute banking products to its key target market of Islamic clients.

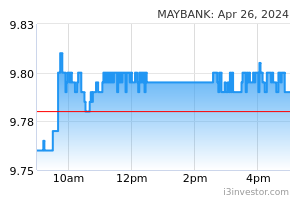

stkoay @speakup, if u so sure Pmx forced local govt funds to push up the CI.....then buy index link stocks and make some money, why complain ? 23/04/2024 10:05 PM stkoay If anyone is thinking that the local fund esp EPF is pushing up Maybank to support the index, then please do your home work. YTD EPF net SOLD 55m Maybank shares https://klse.i3investor.com/web/insider/detail/SBSH_576642_1126816715 https://klse.i3investor.com/web/insider/detail/SBSH_584147_573217724 Foreign fund holding of 20.11% as at end March is 5 year high. https://www.maybank.com/en/investor-relations/share-information/shareholdings.page 23/04/2024 10:16 PM stkoay .....latest foreign holding of MBB shares are at 5 year high. So, who bought and who sold ?? 23/04/2024 10:24 PM stkoay EPF has been trading and taking profit on Maybank, YTD share price up 10% (ex dividend) EPF has been supporting/net buy PBB, YTD price still down. If the share price performance is not doing well, support from EPF is not enuf to push up the price. Do your home work before commenting it's all due to local fund support. 23/04/2024 10:40 PM stkoay Previously, I don't share this kind of info here, bcos sometimes I am still doing DIY DRP....but now price is too high for me to collect anymore, so don't mind to share the positives ...haha :) 23/04/2024 10:46 PM stkoay Now, I am switching my attention to the No.2 (in asset value) ....if ppl think it's PBB, then please do your home work again...haha :p 23/04/2024 10:50 PM stkoay So interesting to see the Monday 22/4 trade... Foreign net bought 115m Local Institution also net bought 42m Local Retail net sold 157m ....haha one local retail sold to 2 big funds :p 24/04/2024 12:06 AM stkoay @linges NAPS multiply NOSH ....PBB is No.2 by market cap not by asset value 24/04/2024 12:16 PM stkoay When banks are to be taken over, the buyer look at NTA. so, bank with high market cap but low asset is considered more expensive than bank with high asset but low market cap. 24/04/2024 12:20 PM stkoay Amongst banks, the cheapest i think is RHB, trading below 1 time book value... 24/04/2024 12:22 PM linges @stkoay…thanks for details. AAppreciated. Yeah, RHB is most undervalued, but i think need to hold for medium or long, wait for real potential. 24/04/2024 1:19 PM stkoay If afternoon pattern is the trend, then next few days will be profit taking days.....it rebounded too fast from recent low of 9.53....traded on 17th April 24/04/2024 5:01 PM stkoay Last Friday when many investors sold at 9.70, EPF bought 8m shares out of 11m total traded....haha LOL 24/04/2024 6:32 PM stkoay I thought it was FF taking advantage of the weak market sentiment to collect at 9.70 😀 24/04/2024 6:37 PM jeffchan1901 @stkoay haha.. nice to see you active again in Tiger forum. Such Fire! Anyway I missed the boat to kutip at 9.50 as only drop till 9.53. Miss the boat. Should have just went in. I hope it will drop again. The only chance is next ex-date I think. Btw, I know which is your No. 2 - its also a Banking stock which pity that I also missed out on. Too bad. ;-) 25/04/2024 10:54 AM jeffchan1901 @Steven Chan Sotong kering is also another word for underwear being had out to dry. Sotong also used to describe a feminine guy / Gay. So please use the word Sotong in the right context. 25/04/2024 10:59 AM SeekUndervalued Just done meeting. For shareholders that demand increase salary for its workers, etc. let the management does it works. If salary of all the workers increase substantially (over the market many folds), it will eat into their profit margin. That time you will complain why maybank earns so less, why EPS so low, dividend so less, etc. On one hand, you want their workers to have high salary, and on the other hand, you want maybank to earn lots of money so you can have lots of dividend. It is hard to achieve it… 25/04/2024 2:14 PM Cslee1215 @Seek, i voted for, as they got me what i target for. Tongiht shoppi loor 25/04/2024 2:41 PM stkoay @jeffchan1901, what I look see look see RHB are : It is cheap in term of PE & PB It's dividend yield is high Its price has been trading at a very narrow range for years Its foreign holding has been declining over the years ( from 25.65 in 2020 to 15.41 current March) When come the share price movement, I think MBB is between RHB & CIMB....so I opt for MBB, (higher beta than RHB but lower than CIMB) Just my one sen :) 25/04/2024 3:45 PM stkoay Another "pump & dump" day? Morning sui sui reached 9.85...afternoon hit a low of 9.76 before closing 9.78. Hmm.....profit taking days must be.... 25/04/2024 5:28 PM i3gambler stkoay, It is not accurate to say RHB's DY is higher than MAYBANK's. MAYBANK's DY = 0.60/9.78 = 6.13%. For RHB, Out of the 40 sen dividend, 10 sen is DRIP, Look at past record, RHB DRIP take-up rate was around 85%, Therefore RHB's DY = (0.3+0.015) / 5.51 = 5.72%. 25/04/2024 8:05 PM Tedinvestor Having large foreign holdings not necessarily good during bear market. 25/04/2024 9:21 PM prudentinvestor @i3gambler, you must have failed your SPM mathematics badly. After being allocated drp shares, you also choose to sell those shares. Suppose the amount of dividend that you can use to subscribe for drp share is RM4880, you would be allocated 1000 new RHB Bank shares which are worth RM5510 today. Can you re calculate RHB Bank's dividend yield? 25/04/2024 9:41 PM stkoay Agree that high foreign holding may not necessarily be good....high means chance of selling is higher than adding. What I am referring to is the trend....whether FF has been buying or selling. 25/04/2024 9:54 PM Steven Chan @jeffchan so tong in Chinese context is multi hands multi tasks pak chat keok a slicker 26/04/2024 9:10 AM jeffchan1901 @Stkoay agree. when FF exit and big boys come in, only a matter of time when FF will come again. That time the stocks will fly. Of course big boys will exit to take profit. All these horse trading happens all the time. The trick is when to come in and scoop on the cheap. So as long as KLCI is below 1600 points sure got many more opportunities. At mid 1600 the gravy train will slow down considerably and even stop. the highest was 1800s during the bull run of yester years. Just sharing my thoughts with all here. Dont flame me ya 26/04/2024 11:50 AM Cslee1215 https://klse.i3investor.com/web/blog/detail/ceomorningbrief/2024-04-26-story-h-182821192-Asia_8217_s_Hawks_Get_Put_on_Alert_After_Indonesia_8217_s_Shock_Rate_Hi Someone beh tahan liow. foerigner got new play ground liow. 26/04/2024 11:55 AM GreatDreamer Indonesia rate hike affect CIMB more than Maybank. Brokerhouse has been promoting CIMB based on its Indonesia growth story. As for Malaysia, raise rate unlikely as inflation still low for time being. 26/04/2024 1:29 PM lpalani49 Moomoo does not come with Bursa CDS Account. That keeps me away. It may change later? don't know. 26/04/2024 10:15 PM masterus Reports suggest US has ‘preliminarily discussed sanctions on some Chinese banks’ over their trade with Russia Analysts say moves to remove China from the Swift interbank financial system could create a ‘huge problem’ for global trade 27/04/2024 7:04 AM masterus In the future, will the US seize the whole China foreign exchange reserves like what did to Russia? Borrow money and do not need to pay back the money with interest rate. 27/04/2024 7:10 AM prudentinvestor China's economy is about as big as the US's economy. Seizing China's foreign exchange reserves will also hurt the US badly as China has the ability to fight back on many fronts. Mindful of this eventuality, China has already reduced its US dollar holdings by about $400 billion over the past 6 to 7 years and increased its holdings in gold and other currencies. Anyway, there is absolutely no reason for the US to do such thing even if China were to attack Taiwan one day because it is basically an internal affair. 27/04/2024 2:41 PM | |