U.S. second-quarter real GDP forecasts and the dollar forecasts

ATFX

Publish date: Mon, 29 Jul 2019, 12:49 PM

U.S. second-quarter real GDP forecasts and the dollar forecasts

The Federal Open Market Committee (FOMC), which votes on Fed funds rate through its discussion meetings, holds eight regular meetings each year in Washington, US and its schedule is made public each year.

The interest rates increase or decrease reflects the good and bad of economic growth and inflation. During a booming economy, higher interest rates mean faster growth and higher returns on investment, which is good for the dollar. Generally, during the period of economic growth and inflation growth in certain of the time. The federal reserve will raise interest rates reasonably according to the economic growth expectations and match the growth rate level, against inflation. But the inflation and economic growth that attracting the market to the value of the dollar’s asset investments, bullish dollars. If the economy drops, interest rates will also be cut at a reasonable level, which will lower the value of the dollar's asset investments.

Gross Domestic Product is an abbreviation for GDP.

GDP is generally defined as the total market value of all final products and services produced in a country or region within a given period. (a quarter or a year).

The growth of GDP strong reflects the country's economic growth, the national income increase, consumption power increase and reflected the currency value stronger, but the decline of purchasing power. In this case, the central bank will likely raise interest rates and tighten the money supply, and rising interest rates will increase the attractiveness of its currency. It causes overseas investors to buy currencies, making the country's currency rise.

The general calculating of GDP is (C+I+G+(X-M), i.e. Consumption + Investment + Government spending + (Export - Import).

If U.S. consumption and investment rose in the most recent quarter, but fears that government spending and imports and exports fell by more than expected, it would reduce expectations for real GDP in the second quarter. The market expectation in this month.

The slowdown in U.S. growth in the second quarter was not expected to be downward in dollar and economy. Investors are also very smart, so the dollar index can remain strong in the near term, staying at 97, without a significant drop. Only earlier news that fed officials wanted to cut rates by more than 50 basis points sent the dollar index tumbling to 96.6.

The dollar bounced back to 97 after the fed clarified that it would consider a cut only 25 basis points at most. Now, investors are waiting for the latest estimate of real GDP for the second quarter, which could lead to the interest rate expectation that would be volatility in the dollar index and gold prices.

GDP is generally used to consider the country's monetary policy and find a reasonable interest rate level and methods.

First, the central bank measures the reasonable value of interest rates in a country by looking at past economic growth rates. In the United States, in particular, every time the Fed sets interest rates, it first compares the pace of economic growth over the past quarter with the level of current interest rates and then US inflation rates as a proxy.

General GDP and inflation will increase by 0.25% on average, and a 25 basis point interest rate rise will be taken into account.

On the contrary, GDP and inflation fell by an average of 0.25% and interest rates were cut by 25 basis points

For example, the fed's target fed fund rate was capped at 1.75% in May last year and was raised to 2% in June.

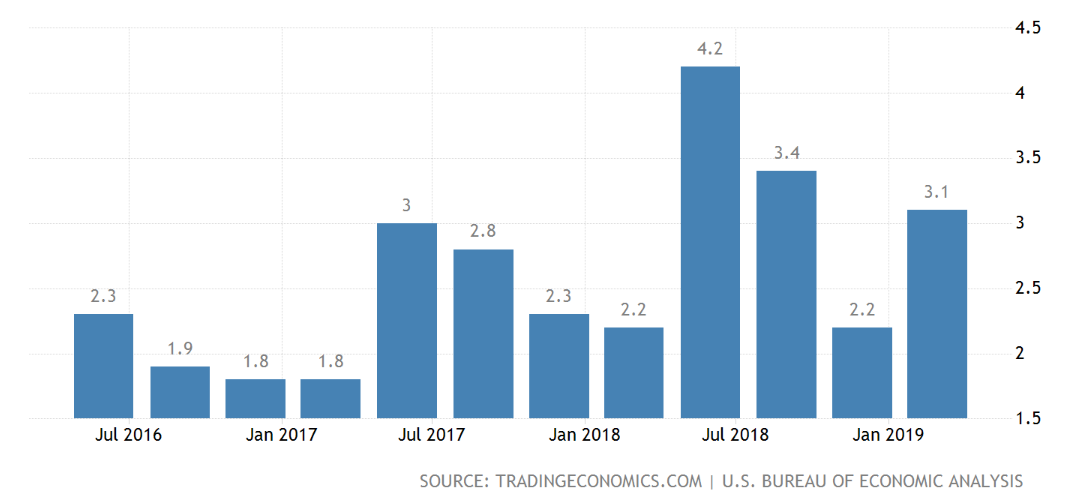

Refer to figure 1 and figure 2 for comparison.

figure 1: US Real GDP graph.

figure 2: Fed fund rate level graph

In the first quarter of 2018 and the last two quarters, U.S. GDP growth strong and the Fed fund rate at 1.75%. The Fed then looked at growth from the second quarter to the fourth quarter, and the country's average GDP growth rate was more than 2.5%, also higher than the fed's rate at the time. By June 2018, the Fed fund rate was increased to 2.5% after three increases from the original 1.75%. The economy has slowed since then, and the fed kept the Fed fund rates steady at 2.5% from January to June 2019.

According to the fed's interest rate decision, it will raise interest rates in line with the GDP growth rate of the last two quarters to cover the relevant interest rate level.

Use rate rise or cut, balance American economic growth and rate level range.

At present, the market and the President of the United States have concluded that the federal reserve should cut interest rates because of the economic slowdown in the United States. If you look at the real GDP growth chart of the United States in figure 2, you can see that the current GDP growth rate of the United States is still above the 2.5% level. Therefore, it is reasonable to evaluate the current level of the federal reserve interest rate.

But if the first reading of real GDP in the second quarter comes down, and GDP growth falls sharply below 2%, or if the fed needs to seriously consider cutting rates, the rate cut will remain close to GDP growth.

At the end of this month, the fed will hold its fifth meeting of the year.

The first estimate of second-quarter U.S. gross domestic product will be released on July 26. The correlation between the two is believed to be very high.

This approach is used by both institutional and professional investors to determine the trading strategy of the middle line, analyze and predict market movements, calculate the value of the dollar ahead of time, and prepare for the announcement of the results.

The dollar value is reflected step by step before the results are released, adjusting the relevant value level and showing a reasonable exchange rate level.

For example, if the first estimate of U.S. GDP in the second quarter was 1.8 % to 1.9%, the current fed rate target is 2.25% to 2.5 %. The fed is expected to be ready to cut rates by 25 basis points, bringing its target rate to a range of 2% to 2.25%.

The fed's target rate is likely to remain unchanged, and more likely to raise rates again at a pace that would add to the dollar's gains, if U.S. second-quarter GDP results are in line with the growth of 2% or more. Conversely, if the GDP result falls below 1.75% or below, the fed fund rate will consider cutting 50 basis points or more, with a target rate of 1.75% to 2% or lower, which is bearish for the dollar.

It can be seen that the higher the GDP growth rate is, the greater the chance and rate increase will be to match the relative economic growth level. On the contrary, if the GDP growth rate is lower than the forecast value, the fed will significantly cut interest rate, also in line with the economic growth rate to fall, mutual coordination. If the second-quarter GDP figures are available on July 26, it is believed that markets will use them to assess how much the fed will raise or lower rates next week.

If U.S. GDP in the second quarter falls below market estimates or below 1.75% growth, a cut of more than 25 basis points could be more likely than a 50 basis point cut, and the dollar could fall more sharply. On the contrary, with U.S. GDP higher than market estimates in the second quarter, the Fed may not consider cutting interest rates, boosting the dollar and dollar assets.

More articles on ATFX Market Analysis

Created by ATFX | Jul 28, 2021