The challenge of economic figures prediction in an unpredictable scene - retail sales figures

ATFX

Publish date: Mon, 20 Apr 2020, 12:56 PM

For most investors and traders, retail sales report significantly affect their investment strategies. As the figures reflect the retail consumption appetite - how much consumers are spending and the retailers they are spending with - therefore the overall wellness of the US economy, as the personal consumption represent two-thirds of the US GDP.

Obviously, it is already clear that the sudden stopover most economic activities would create a nose-dive in stock market therefor consumer confidence will follow.

For now, any data would suggest an inevitable recession, the question is how the consumption appetite would be affected during and post-COVID-19?

March would only mark the beginning of a recessionary fall in retail sales, but the decline is expected to deepen in April.

With retail sales and jobless claims coming out this week in the US, all we can do is try to gauge the amount of harm the COVID-19 pandemic is causing nearly 16.5 million Americans already filing for jobless claims in the past three weeks – and an expected 5 million initial claims to follow for the upcoming week, the appetite for consumption will definitely go drastically down.

Already by the second week of March, U.S. retail traffic was down more than 30% year over year, according to data from Cowen.

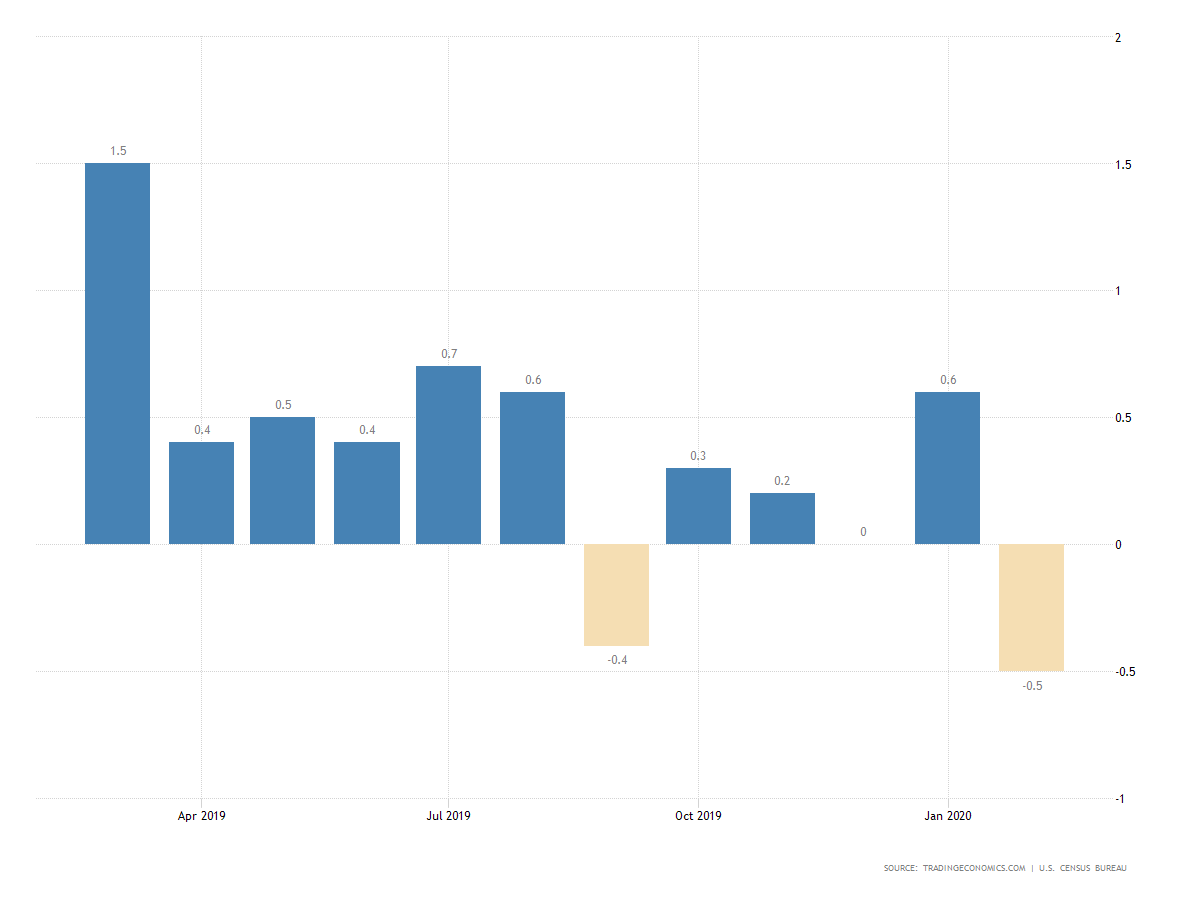

The average market consensus showing a drop of 8% from the previous data, and a fall of 5% in retail sales excluding autos; a catastrophic number compared to the decline by 0.5% witnessed in February when we started to feel the COVID-19 spread impact.

It is also crucial to mention that in January, a revised data showed an upward trend in retails sales of 0.6% (but it was still a weak uptrend, indicating that consumption appetite was also shaky prior to the coronavirus outbreak).

With data reports coming out dramatically worse than forecasts. the most likely the retail sales data will show us another misguiding sign from the actual figures comparing to the expected one. would be the possibility of an irregular gain in March report, caused by lockdowns and quarantines all over the country forcing households to stock up on supplies more than their actual need but at the end, this increasing if happen will be in one or two sectors of the retail sales in the opposite side the logic expectations that we will witness a huge decline in the retail sales numbers in many sectors, for example, motor vehicles & parts, furniture, electronics & appliances, building materials, clothing, restaurants & bars.

Over the next quarter and the whole year, these difficult challenges would direct the consumption behavior, and even if we manage to survive the recession a whole new approach of consumption might present itself in the new world of post novel coronavirus.

Analysis was written by Ramy Abouzaid, ATFX (AE) Head of Market Research.

Legal: ATFX is a trading name of AT Global Markets Limited (ATGM, registration number 24226 IBC 2017). ATGM is an International Business Company in Saint Vincent and the Grenadines. Registered address is : The Financial Services Centre, Stoney Ground, Kingstown, St.Vincent & the Grenadines.

More articles on ATFX Market Analysis

Created by ATFX | Jul 28, 2021