Are retail sales catching up with the surprise data of the US labor market?

ATFX

Publish date: Fri, 12 Jun 2020, 11:02 AM

What the market witnessed post COVID-19 can’t really be categorized under economic labels - as the downturn has been too fast and very unpredictable - defying everything seen by economists in recent history.

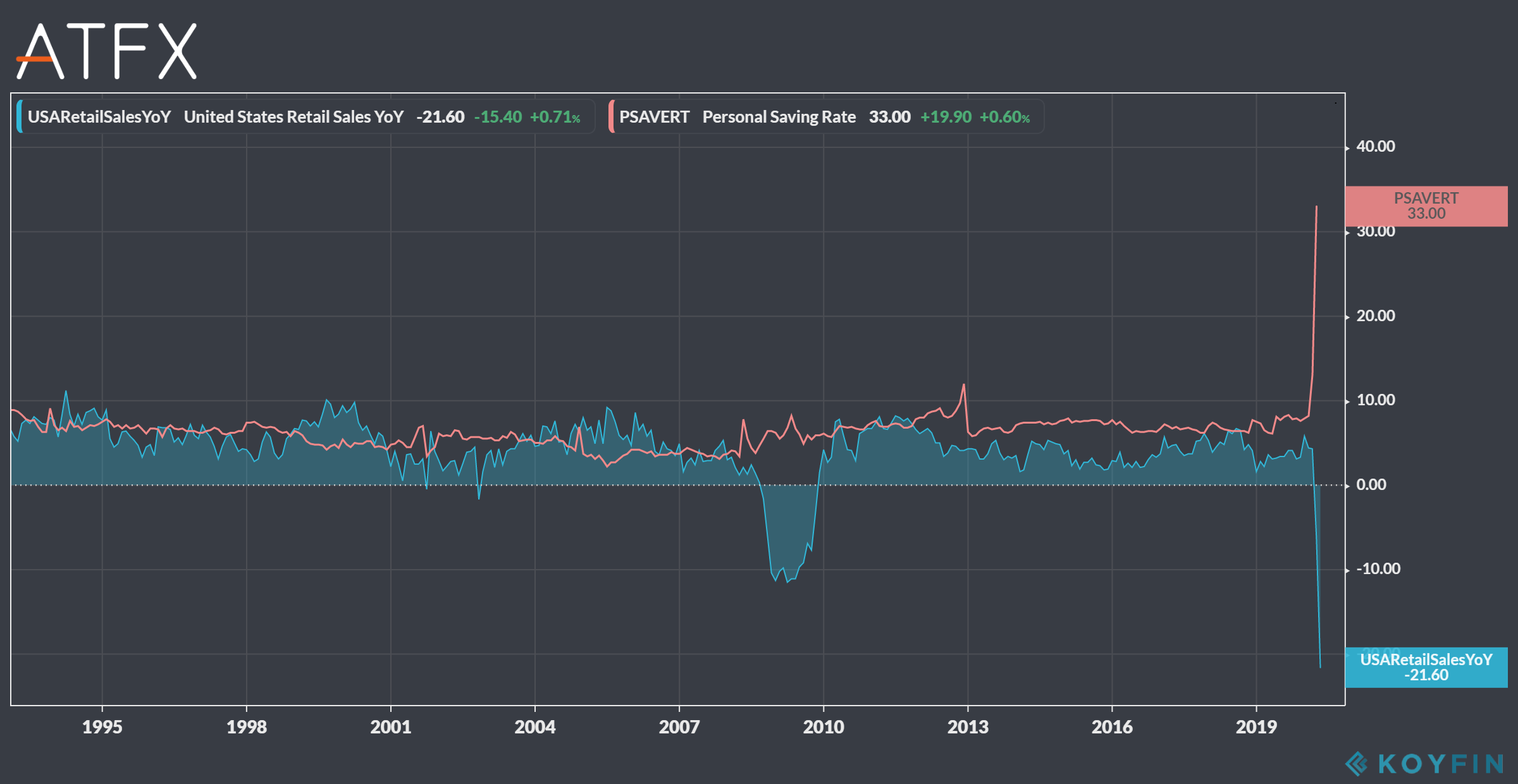

Since the government started tracking retail sales in 1992, last month’s plunge was the biggest; with a drop of 16.4%. This decline came worse than expectations which were around 12.3%, creating a second straight month of record lows post lockdowns. In just a couple weeks, as consumers self-isolated at their homes, retail sales fell drastically, with sales hitting their lowest point of the year in Q2 and the economy shrinking to its worse contraction since the Great Depression. The question remains will consumer activity return to normal?

To understand the impact of US retail sector on the economy, it is vital to mention that the US has the most retail selling space per capita of any country yet the lowest sales per square feet, according to commercial real estate company Cushman & Wakefield.

Nevertheless, lockdowns are over with hundreds of millions of people moving around again since the beginning of May.

So, how would this new “liberty” effect consumption and sales in an economy driven - for over 70% - by personal consumption?

May would be the first chapter dictating the aftermath of the COVID-19 lockdowns on the economy. Even with restrictions easing, many shops are providing limited service and it seems that this approach would remain for quite some time, while about 4000 retail shops closed permanently by the end of May.

Before the duration and extent of lockdowns were clear, Coresight research estimated, back in March, that about 15,000 stores would permanently close in 2020, with many declaring bankruptcies.

Then the surprising non-farm payrolls data for the month of May was published, with a record-breaking jobs report in the United States leaving analysts and markets stunned. A growth by 2.5 million positions for the month of May, and a fall to 13.3 % in US unemployment rate brought the V-shape economic recovery scenario back from the dead.

Back to the main question, are we going back to normal soon?

A great rebound in jobs doesn’t necessarily mean great rebounds in sales. Couple of months of lockdowns mean people had to rethink their consuming habits and behavior, spend from their savings or take loans to survive. And even if the spending capacity rose it doesn’t necessarily mean that the will to spend would rise at the same rate. Concerned consumers might still prefer saving cash, refrain from spending in large amounts, avoid shopping malls and retail shops. In fact, many forecasts estimate total retail sales won’t rebound to pre-pandemic levels until 2022.

So, in trying to answer our main question, we should redefine “normality”, at least for the upcoming quarters.

A promising support for the upcoming data would be in the U.S. e-commerce sales, which could come to rescue to many retail shops.

According to a new forecast released by eMarketer, e-commerce sales would rise by 18%, reaching reach $709.78 billion dollar. This percentage would represent 14.5% of the total U.S retail sales, not quite enough to make up for the overall hit that the U.S. retail sector will take this year but it surely opens an opportunity for retailers.

The analysis was written by Ramy Abouzaid, ATFX (CY) Dubai Rep Office Head of Market Research.

Legal: ATFX is a trading name of AT GLOBAL MARKETS LLC (ATGM, registration number 333 LLC 2020). ATGM is an International Business Company in Saint Vincent and the Grenadines. Registered address is : First Floor, First St. Vincent Bank Ltd, James Street, Kingstown, St.Vincent and the Grenadines.

More articles on ATFX Market Analysis

Created by ATFX | Jul 28, 2021