Not to be optimistic about Amazon, read it before the earnings announced

ATFX

Publish date: Fri, 17 Jul 2020, 03:31 PM

Since the pandemic effect reached the stocks market in March and brought major stocks to new lows, Amazon stock price (AMZN) managed to increase of 87% - hitting new record highs.

Nevertheless, taking a step back to pre-COVID-19 – which seem like a century ago – Amazon stock remained in a long sideways move; with many uncertainties in the market and a caution approach from investors the company seemed under pressure, especially with its high spending on new programs that worried Amazon stockholders of its profitable outcome.

Covid-19 did really change a lot of things, with major economies going into lockdowns, Amazon benefited from the shift to online purchases from both consumer and business perspective. Amazon wasted no time in introducing new services tailored to new demands, such as free shipping, video and music content, which helped increasing purchases of 52% for Amazon Prime customers – and a total of 69 million Prime subscribers in the U.S - and 32% among non-Prime customers. With Amazon introducing multiple services and business units, many analysts believe the e-commerce giant will witness a robust rise in profit margins and revenue growth for years, with online purchasing on the rise, On the contrary, I have reasons to not be optimistic about Amazon temporarily.

The first reason: exaggerating the current share price.

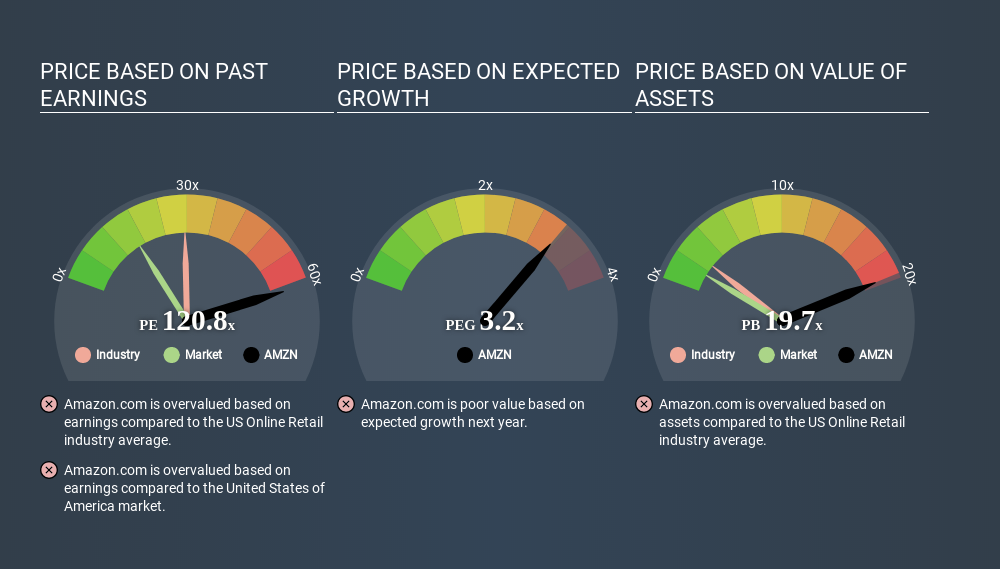

It makes sense when investing in a stock to look at the popular price-to-earnings ratio, in Amazon case, you simply expect to recover your invested capital from the company earnings after more than 120 years. Which is incredibly more than the market average PE ratio, standing at 16.8, as well as, when comparing amazon to the industry PE ratio, we will find the ratio stands at 30.6. If we look at the price-to-earnings growth ratio, we will find that the ratio stands higher than 3.6, which is an indication that the stock price is clearly exaggerated.

The second reason: the company has reached a stage of maturity, so it’s revenue growth will be limited

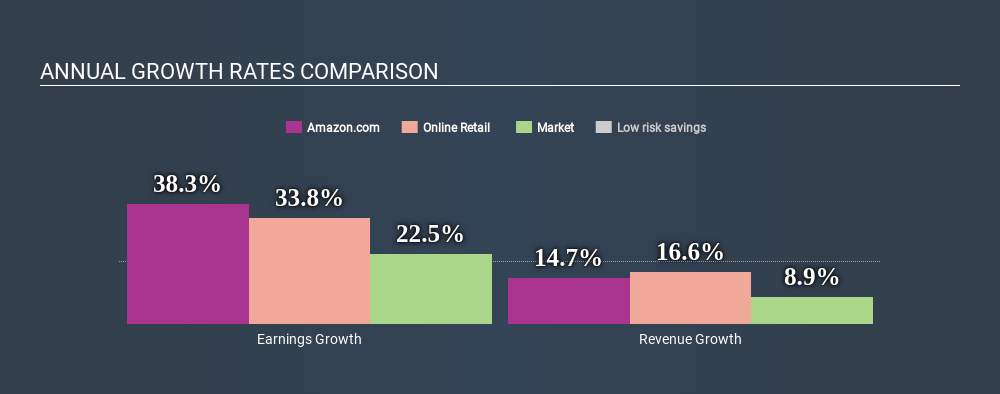

As we can see from the graph, the company's earnings are expected to grow by 38.3% a higher percentage than its industry earning growth (at 33.8%), as well as, higher than the average earnings growth of the market as a whole (at 22.5%). In spite of this, it is also expected that the company's revenues will grow only by 14.7% on an annual basis, while the revenues of its competitors in the industry are expected to grow by 16.6%, which can be explained by the rapid growth of the company's business and its revenues during recent years. This is what we can call the stage of maturity where the opportunities for revenue growth are limited and the company must work to maximize profits from existing revenue streams.

Third reason: earnings are not expected to rise for the upcoming two quarters.

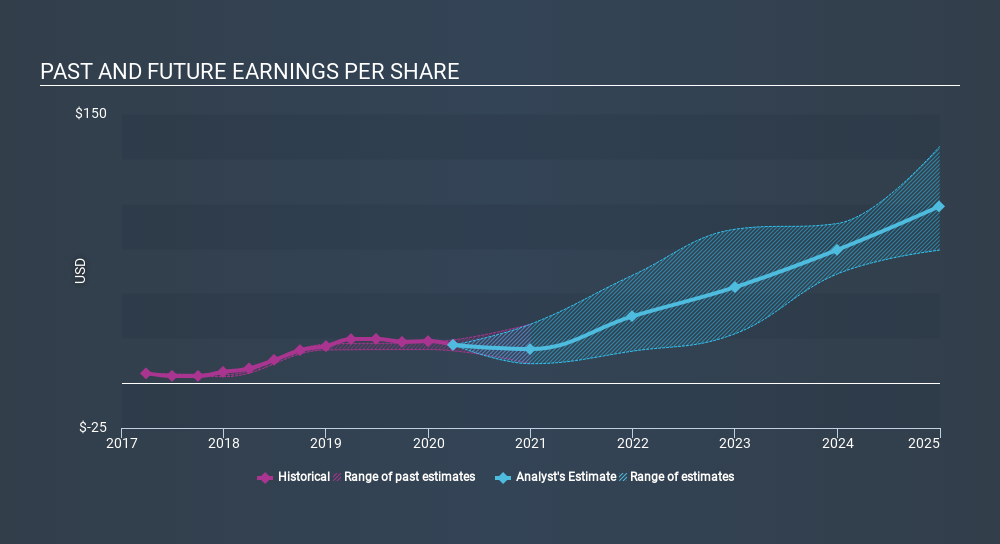

Based on the averge expectation of market analysts, Amazon expected earnings per share, for the upcoming two quarters would decline, and at its best scenario we might see a stablization of earnings in Q4. Which would lead us to believe that we might see a strong price correction in the near future, trageting the 200MA level around 2094.55 USD.

More articles on ATFX Market Analysis

Created by ATFX | Jul 28, 2021