The crisis continues: Can the Fed alone guide the markets to salvation?

ATFX

Publish date: Mon, 27 Jul 2020, 10:24 AM

The key discussion in the financial world can be summed up into this question, ahead of the US Federal Reserve monetary policy meeting scheduled for this week.

In all fairness, this question lingers since the Covid-19 outbreak and economic shutdowns, when the U.S. central bank did what it did best during “exogenous shocks”; keeping liquidity flowing in the markets. But having money to spend is one thing, actual spending is another.

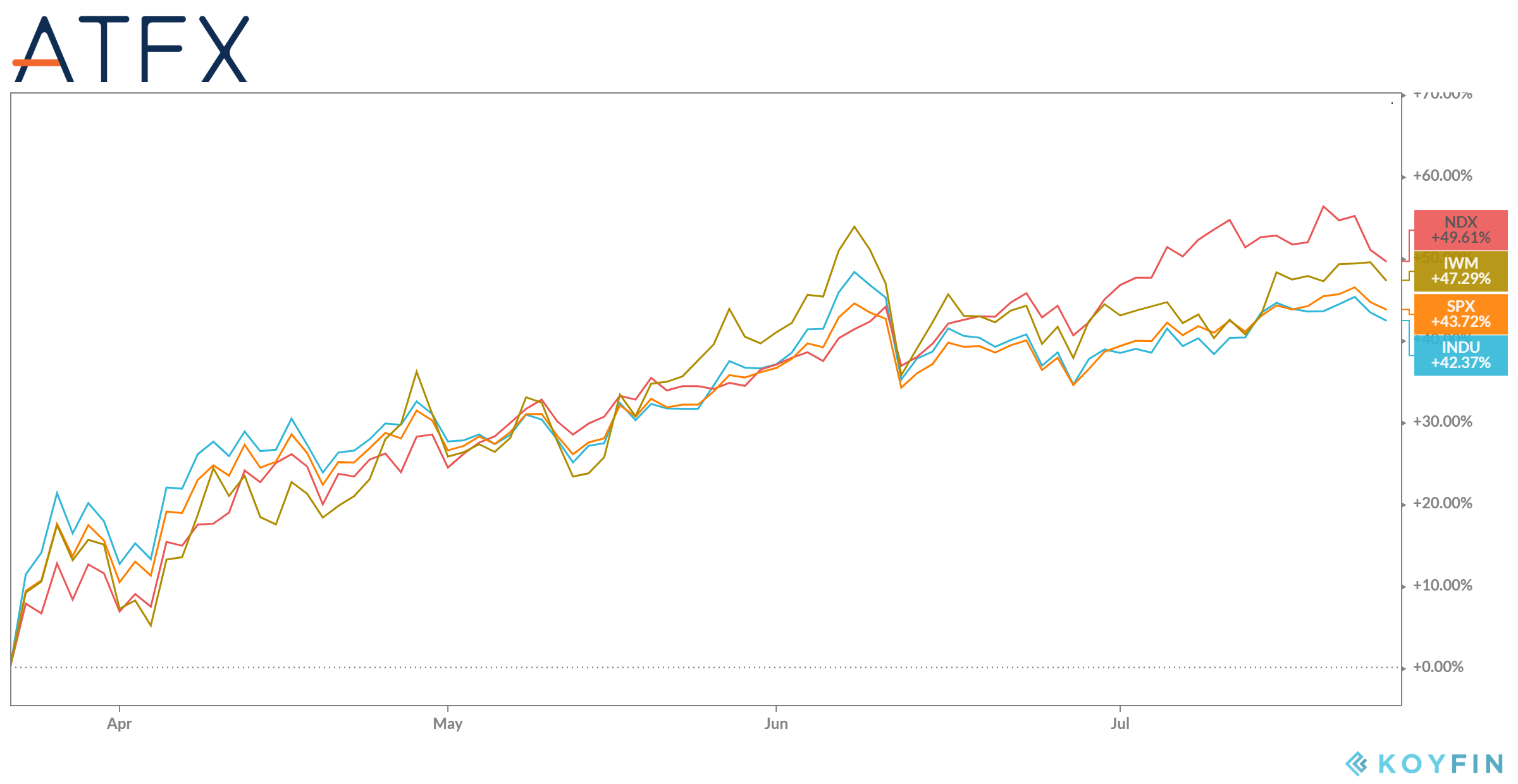

The Fed “succeeded” with its emergency cuts on interest’s rates to a range of 0-0.25% - “until the economy weather recent events”- and it's trillions of dollars’ worth of mortgages and bonds buying, in drowning the markets in cheap cash. Their monetary policy helped the markets rebounding sharply from its worst first quarter in history. The S&P 500 index, recovered from its collapse in March – a fall of 34% - to record rise of 43% from that lows.

With these celebratory figures in the stock market, it seems like the current policy reached its target, and the Fed would possibly hold its horses on additional measures while the Congress discusses further fiscal aid.

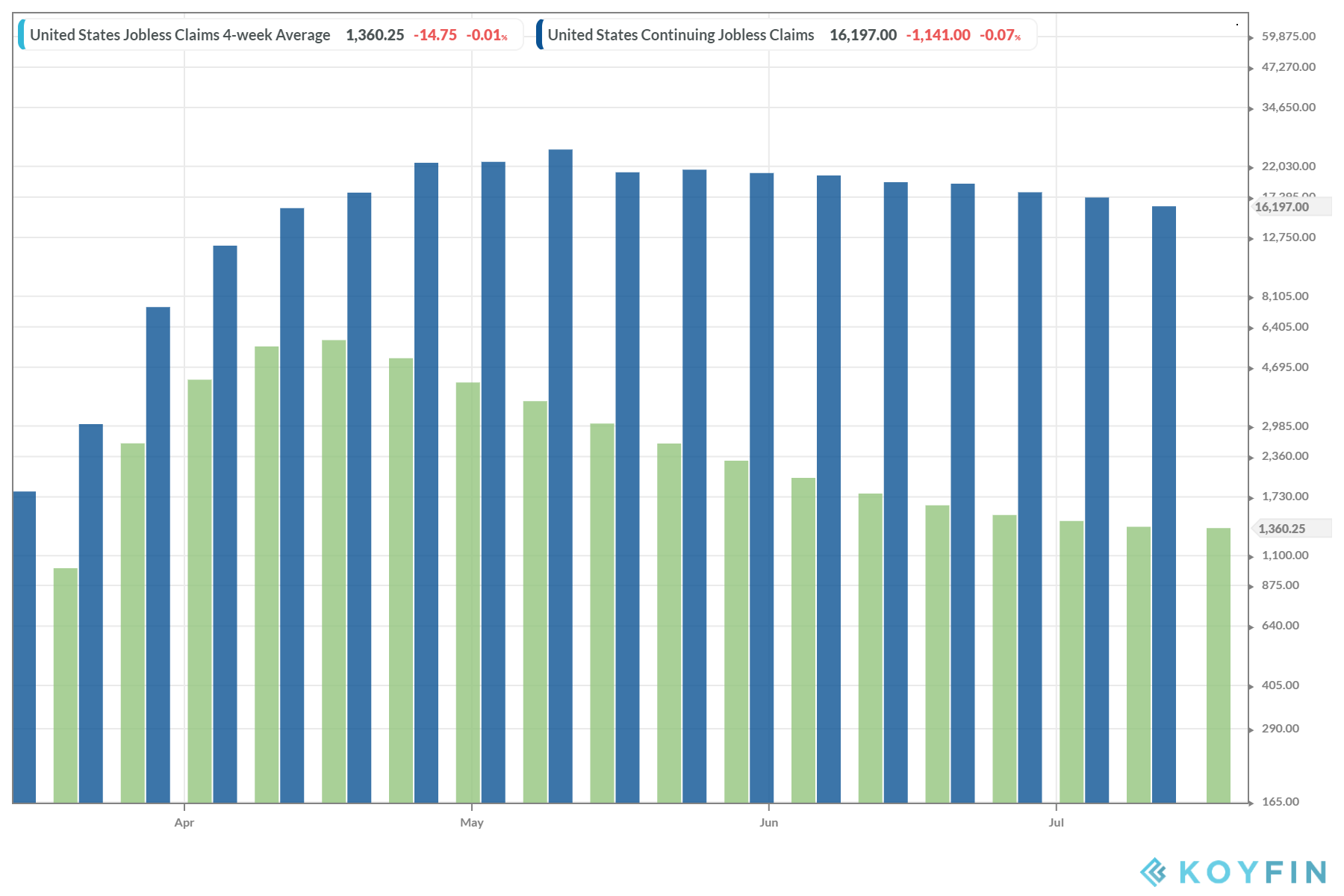

While the cheap cash helped major indexes reach new highs, albeit over the past 3 months the total US jobless claims have reached a record high of 43 million claim - meaning one in four Americans lost his job during the Covid-19 pandemic, and the GDP is predicted to fall by 34% for the second quarter of the year according to Atlanta fed recent survey.

This de-synchronization between economic data and the stock market could be alarming, as markets always witnessed a bubble right before a crash. Yet many analysts believe that this is not the case. With a vaccine right around the corner, the upbeat mood in stocks is supposed to reflect market expectations of the future profits and not its current value, that is why it is not totally bizarre to see better results in stocks before a witnessing an economic rebound.

Then again, when an economic recovery is linked to uncontrollable events, the Fed should come up with more formal guidance helping the markets in setting near and extended expectations, be ready in case of a downturn to start a yield curve control to keep the ratio of the Fed’s target rates level and borrowing curve in balance, through its treasury bond-buying strategy. While going for negative interest rates a very farfetched tool according to fed officials’ statements, The Fed could discuss a more flexible approach to inflation.

All of that brings us back to the main dilemma; The will to spend.

The cash needs to whirling in the markets this is known as the cash velocity, if the Fed continues injecting cash while businesses lay off employees, governments reduce spending and consumers turn to savings, in such scenario, it doesn’t matter how aggressive or powerful the monetary “lending” stimulus program is.

That is why, we believe that future Fed policies will be highly relying on the federal government economic stimulus, at least for the upcoming quarter, where a new fiscal stimulus bill would have the greater impact on the U.S economic recover.

So, we don't expect any major change in this Fed meeting, but at the same time, the market will closely watch any negative hints from Fed chair Jerome Powell.

Written by Ramy Abouzaid, ATFX (CY) Dubai Rep Office Head of Market Research.

Legal: ATFX is a trading name of AT GLOBAL MARKETS LLC (ATGM, registration number 333 LLC 2020). ATGM is an International Business Company in Saint Vincent and the Grenadines. Registered address is : First Floor, First St. Vincent Bank Ltd, James Street, Kingstown, St.Vincent and the Grenadines.

More articles on ATFX Market Analysis

Created by ATFX | Jul 28, 2021