Will U.S Retail Sales add a new good figure for the US economy?

ATFX

Publish date: Tue, 11 Aug 2020, 03:39 PM

Surrounded by riots, social distancing, health crisis, spikes in Covid-19 cases, upcoming presidential election, tensioned relationship with China, financial uncertainties and a stock market overly detached from the current economic situation. The scene seems like Hollywood “Sci-fi” movie. With all of what’s happening during 2020, what can we expect of the upcoming U.S retail sales report?

Fearful about the present and worried about what would come, Americans have grown less optimistic about their future, economy and financial prospects. Such uncertainty would certainly affect consumer behaviour and spending, therefore, the speed and steadiness of the economic recovery.

A key indicator of retail sales forecast would be the U.S. consumer confidence that witnessed a fall to 92.6 in July from its previous reading of 98.3. The Data collected from the conference board report evaluated consumer views on business, labour, income and overall market conditions.

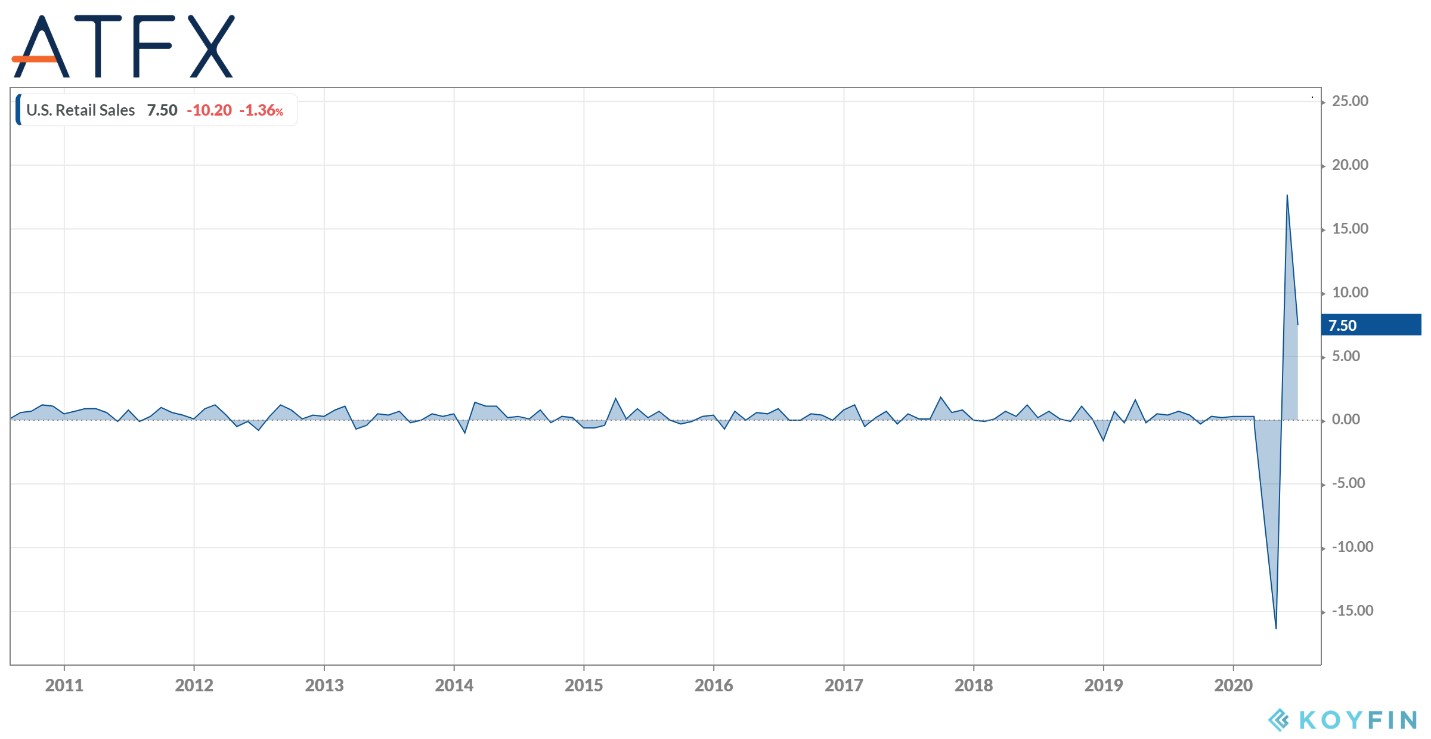

The present situation might be even blurrier than during early stages when consumers “reemerged” from isolation willing to spend and more hopeful of a V-shaped recovery; After its fall in March to -8.3% and -14.7% in April, U.S retail sales rebounded well in May with a rise of 18.2% followed by a less upbeat momentum of a 7.5% in June.

The reopening and easing helped the economy to pick up fast, was it too fast though?

As Covid-19 cases surged again by the end of June, many consumers – still able to spend, or using their relief packages - preferred to limit their spending, which explains the soft rebound witnessed in June. And as consumers face a prolonged period of financial uncertainty, a new norm of consumer behaviour begins.

This observation is supported by the fact that even with an unemployment rate dropping over the last three months – Non-farm payrolls increased from 2699K in May to 4800K in June – retail sales dropped as well.

And with the recent uplifting data from July’s Non-Farm payrolls – showing a rise of 1763K – we can’t predict to see a new spike in U.S Retail Sales, especially if we take into consideration other key elements affecting consumers will spend. And it probably shouldn’t be what we aim for.

A slow but sustainable rise in U.S retail sales, along with a steadier epidemic control while having the time to grasp and evaluate the shift in consumers behaviour is the healthy way towards economic recovery. As the basic economic key that Covid-19 reminded us of, is that no matter what the Fed, governments or big banks do, in its essence it’s all about whether a consumer decides to spend or not.

Written by Ramy Abouzaid, ATFX (CY) Dubai Rep Office Head of Market Research.

Legal: ATFX is a trading name of AT GLOBAL MARKETS LLC (ATGM, registration number 333 LLC 2020). ATGM is an International Business Company in Saint Vincent and the Grenadines. Registered address is : First Floor, First St. Vincent Bank Ltd, James Street, Kingstown, St.Vincent and the Grenadines.

More articles on ATFX Market Analysis

Created by ATFX | Jul 28, 2021