No crucial changes are expected at Sept. Fed meeting, but you should to watch

ATFX

Publish date: Tue, 15 Sep 2020, 06:07 PM

No crucial changes are expected at Sept. Fed meeting, but you should to watch

Markets are waiting for the US Federal Reserve September meeting, which will be held throughout Tuesday, September 15 and Wednesday, September 16, 2020, and market expectations revolve around keeping the monetary policy stance on the current situation without an influencing change. Regardless of that, the US Federal Reserve is not like any other central bank, usually Hover around its meetings and decisions Ambiance of importance and influence from the smallest details, and therefore attention must be paid to some important details that may have an impact on the markets directly following the announcement of the statement, as well as at the time of holding of the press conference of the President of the Federal Reserve, here are these points briefly:

First: The consensus of the officials

After the Fed’s president statement during Jackson Hole summit led to a lot of market reactions, as he indicated that the Fed will target the average inflation, and the markets translated that, by accepting monetary policymakers to see temporary and acceptable increases in inflation rates, without quick policy reactions, which means that low-interest rate will remain for a longer period than expected. Therefore, the importance of ensuring that the members of the FOMC are on the same page.

Second: Fed officials’ projections

It is worth noting that the September meeting comes accompanied by the Fed members ’expectations for growth rates, inflation, unemployment, and their expectations for the average interest. These expectations create a clearer understanding among the markets of the expected range of economic moves and the expected interaction of the Fed in various scenarios, and the expectations of the Fed’s members for the current month are especially important because they come nine months after the outbreak of the Covid-19 crisis, which gives members more confidence in building their economic expectations.

Third: The asset purchase program

Although it is a low possibility for the Fed to resort to strengthening the current stimulus policy, by buying longer-term bonds or increasing the volume of purchases, if that happen, it would send a message that the Fed will not accept that the markets decline sharply, as happened last March, and that would also enhance the liquidity in the banking sector.

The Fed and the potential impact on the markets

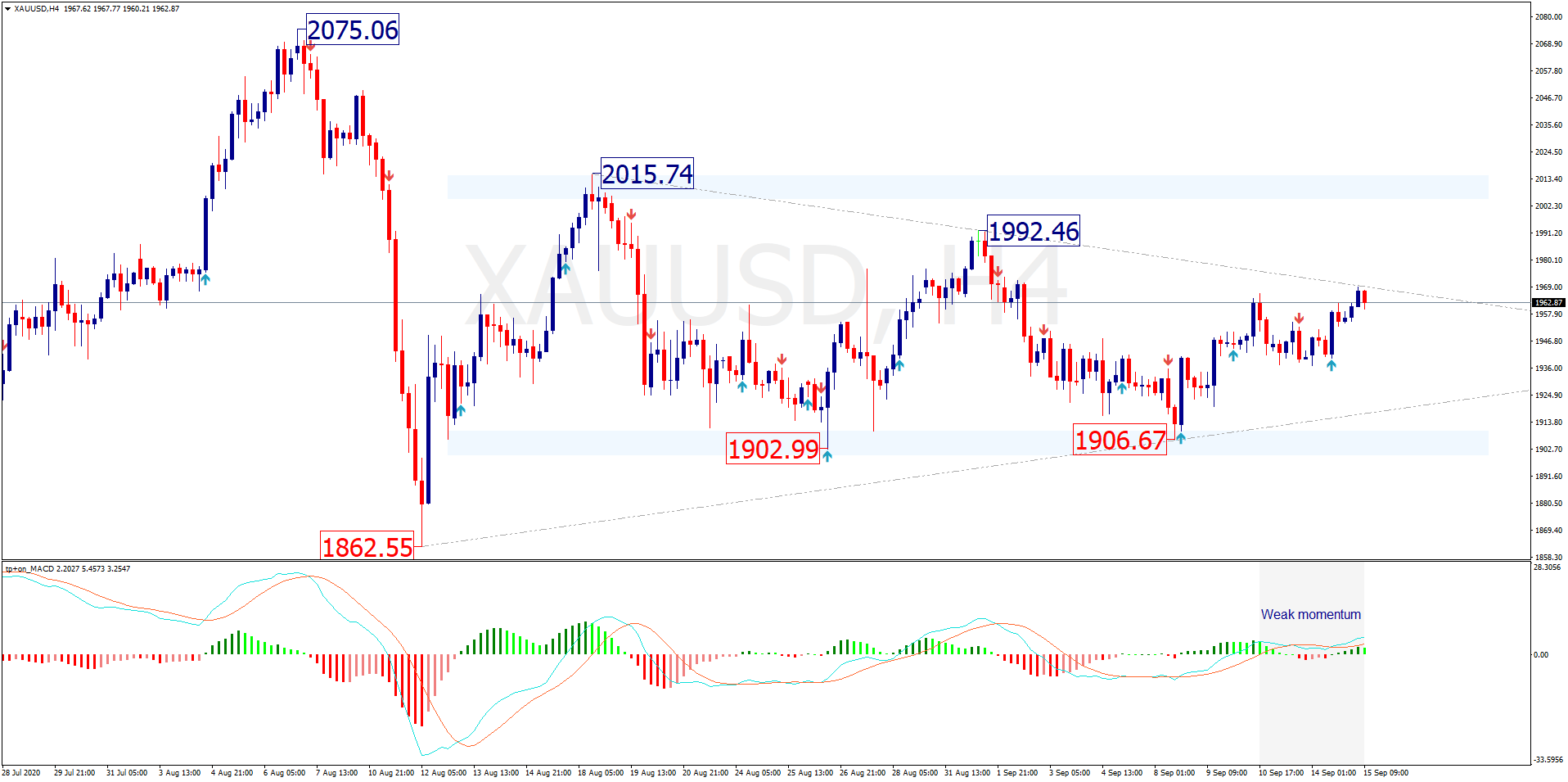

In any case, the markets are waiting for the monetary policy statement and the Fed’s projections, along with the Fed Chair press conference, to react to all the changes and signals that may come with that meeting. In the event of any pessimistic hints that may bring the US dollar back under strong selling pressure, that will It will help some major currencies to benefit, led by the euro, and will also boost gold's gains again, as well as, if there are signs of further stimulus, this will return stock markets to the bullish rally that has become lukewarm in recent weeks.

- AT Global Markets (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom with registration number 760555. The Registered Office: 1st Floor, 32 Cornhill, London EC3V 3SG, United Kingdom.

- AT Global Markets LLC is a Limited Liability Company in Saint Vincent and the Grenadines with company number 333 LLC 2020. The Registered Office: 1st Floor, First St. Vincent Bank Bldg, James Street, Kingstown, St. Vincent and the Grenadines.

- ATFX Global Markets (CY) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under the license no. 285/15. The Registered Office: 159 Leontiou A' Street, Maryvonne Building Office 204, 3022, Limassol, Cyprus.

- AT Global Markets Intl Ltd is authorized and regulated by the Financial Services Commission with license Number C118023331. The Registered Office: Suite 207, 2nd Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebène, Republic of Mauritius.

More articles on ATFX Market Analysis

Created by ATFX | Jul 28, 2021