TNLOGIS - Golden Entry Opportunity and Riding Growth in E-Commerce Business

Investhor

Publish date: Mon, 09 Jul 2018, 02:05 PM

TNLOGIS - my take TP1 1.20, TP2 1.40

Today we had seen in the paper that Alibaba group is undeterred by shift in Malaysian policy and will continue to remain committed to its business growth in Malaysia and ASEAN region. Therefore, one of the beneficiaries from the growth of e-commerce sector will be logistics sector which will see rise in transaction and deliveries.

Why TNLOGIS is attractive at current pricing? Refer to chart below:

Based on the below chart, TNLOGIS is now trading at SMA200 support area between 95c to RM 1.00. Being a profitable company every quarter with EPS averaging around 2c to 9c, I see this level as a golden opportunity for a long term entry. Immediate resistances are around 1.20 and 1.40.

TNLOGIS-WC - Attractive Valuation

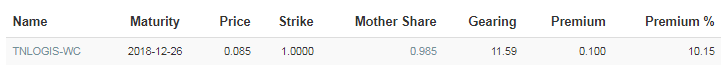

For a cheaper entry point into the company, TNLOGIS also offers warrant, TNLOGIS-WC. Refer the profile below:

In June 2017 last year, TNLOGIS-WC had a peak price of around 80c. At the current premium of around 10% and low strike price of RM 1, I also see the warrant as chance for buyers to pickup and hold for capital gains. Should TNLOGIS go to 1.20 area, the warrant should be able to go to 20-25c in theory.

DISCLAIMER : The above article is solely for my own reference and is educational in nature.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

didi2005

TNLOGIS-WC going to expire on 26 Dec 2018...

2018-10-09 08:03