MHB (BSKL : 5186) - Potential Beneficiary of Kasawari Mega Project !

Investhor

Publish date: Thu, 26 Jul 2018, 11:30 AM

MHB (BSKL : 5186)

TP 1 - 86c (short term), TP 2 - 95c (medium term), TP 3 - above RM 1 (for long term investors)

Recently, many oil & gas counters have been picking up steam. I would like to turn attention to a recent stock which has been picking up momentum due to many reasons, Malaysia Marine & Heavy Engineering Holdings Berhad (MHB).

1. Mega Project Potential - Kasawari Gas Development Project - Estimated USD 1.5 Billion Or More

Article by AmInvest Research titled "Oil & Gas Sector - Huge Kasawari Project Back on the Radar" is referred :

http://klse.i3investor.com/blogs/aminvest/162660.jsp

According to the article, PETRONAS has launched the Engineering, Procurement, Construction, Installation & Commissioning (EPCIC) tender for its Kasawari giant gas field development off Sarawak that will likely be one of the largest platform jobs in Malaysia and the region this year.

MHB might be the favourite to secure this project as compared to SAPURA ENERGY as recently SAPURA ENERGY had been awarded the PEGAGA Project which is 19,500 tonne platform for Mubadala Petroleum (refer extract from article below):

![]()

Given the size of the project, they expect the EPCIC portion to reach over USD 1.5 billion which underpins the rising momentum of the region's offshore CAPEX spending.

Securing this project would be a big boost of earnings for MHB as it rides on the momentum of booming oil & gas upstream projects as crude oil price has stabilized over USD 70 / barrel.

2. Shareholding Analysis - Very Small Share Float

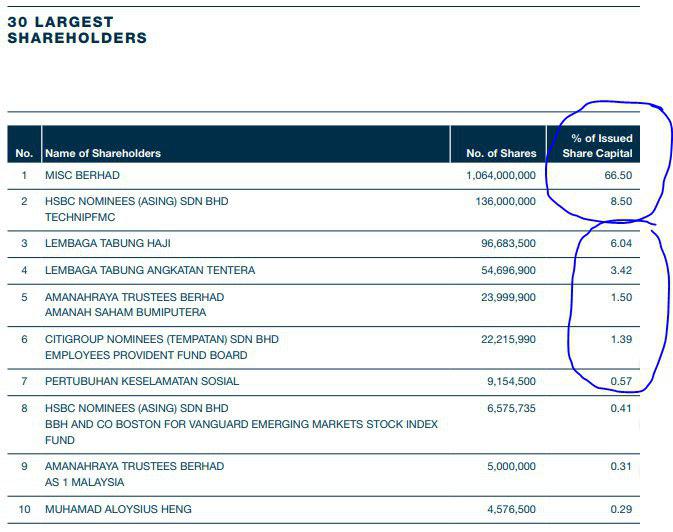

Below image referred taken from the MHB 2017 Annual Report on the shareholding analysis section

The first 2 largest shareholders already hold 75% of the company. Number 3 - 7 institutional holders own about 13% of the company. This totals to about 88% being held by long term shareholders.

This leaves balance float of 12% out of total 1.6B shares (roughly 192 million shares). As the potential prospect of oil & gas sector grows tremendously, there will be lesser sellers compared to buyers for this stock, as such possibility of price rising up will be much faster should such situation happen.

3. Technical Analysis Point of View - Double Breakout - Breakout of Downtrend and Kumo Breakout

Below daily chart of MHB as of closing 25/7/2018 is referred:

MHB recently had been on a downtrend since hitting peak of 98c on 8th January 2018. Since then it had tried to break downtrend 2 times in April and May 2018 but failed and resumed downtrend (refer circles 1 and 2).

Recently, MHB had hit low of 62c but the small volume of transactions tell us that the sellers were small in nature (possible retailers). Starting 12th July 2018, MHB had started uptrend momentum, however only recently MHB had successfully broken the double line downtrend band with significant increase in volume (refer circle 3). Today MHB had achieved an Ichimoku Cloud breakout above 75c attracting more prospective buyers to join in on the momentum.

Next immediate resistances are seen at 86c to 90c level, followed by 95c to RM 1.00. A breakout above RM 1 will suggest movement towards RM 1.20-1.30.

4. Very High Historical Price Compared to Current Pricing

Monthly Chart for MHB is referred below since IPO listing :

According to monthly chart, MHB had reached its peak in 2011 at RM 8.82 (refer circle 1). Since then it went on downtrend and consolidated at RM 3 - 4 area (circle 2) before further downtrending to below RM 1 since 2015 onwards until now (circle 3).

If crude oil resumes uptrend and hits above USD 100 per barrel, it wouldn't surprise me to see MHB trading at above RM 1.50 heading towards RM 2.50 - 3.00 levels as seen before during its glory old days.

Therefore, as compared to the historical prices, the current price levels seem dirt cheap for investors who believe that oil & gas sector will boom and once again achieve its glory days.

In Conclusion

It is my own opinion that MHB is a strong counter to buy and keep for long term capital appreciation due to:

-riding on overall trend of increasing CAPEX spendings in oil & gas sector due to rise in crude oil price

-huge potential to add order book of USD 1.5 billion (or above) for Kasawari Project

-low share float for institutional buyers to pickup and buy more shares

-strong momentum in the short and long term charts

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020