Mplus Market Pulse - 10 Feb 2021

MalaccaSecurities

Publish date: Wed, 10 Feb 2021, 10:55 AM

Market Review

Malaysia: Bargain hunting activities lifted the FBM KLCI (+0.8%) higher as the key index mirrored the positive performance on Wall Street, coupled with the ascending crude oil prices. Both the lower liners and the broader market closed fairly mixed with the financial services sector (+1.3%) topped the broader market gainers list amid the prospect of softer MCO 2.0 measures to balance economic growth.

Global markets: US stockmarkets snapped a six-day rally to retreat from their record high levels as the Dow fell 0.1% on mild profit taking activities following the recent run-up as investors monitor on the developments surrounding the stimulus bill. Both the European and Asia stockmarkets closed mixed.

The Day Ahead

Despite mixed trading tone on Wall Street overnight, the FBM KLCI tracked its regional peers to close higher yesterday. We reckon the local bourse to remain upside bias view at the current juncture, lifted by buying interest in recovery themed stocks and the energy sector – the latter could be focused on the back of firmer crude oil price. In view of the number of Covid-19 cases dropped below 3,000 level yesterday, market should position themselves into recovery themed stocks at least for this week.

Sector focus: Trading interest may be seen in the energy sector with firmer crude oil price. On the recovery themed sectors, construction, building materials and gaming sectors are likely to be focused. Also, we like consumer electronics, furniture and plantation sectors for their high earnings certainty.

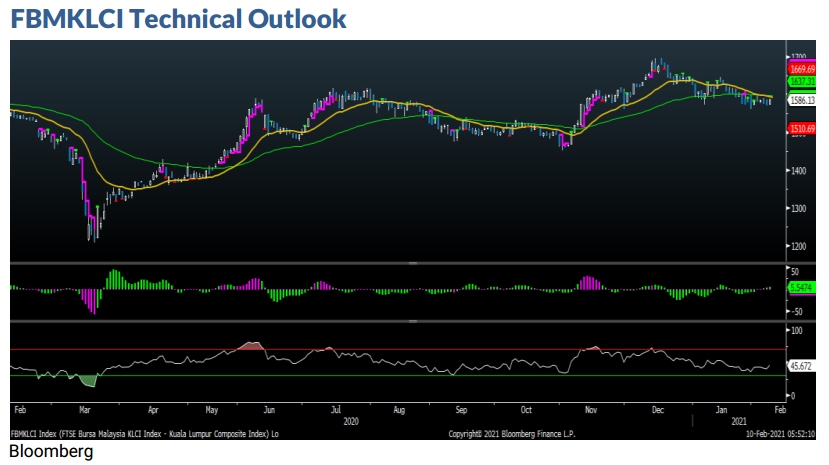

The FBM KLCI snapped its two-day losing streak to close higher at its EMA120 level. Whilst the key index failed to cross above its immediate resistance at 1,600, it may continue to stay in consolidation mode. Support is pegged around 1,550- 1,560. Meanwhile, indicators remained mixed as the MACD Histogram has extended another green bar, while the RSI remained below 50.

Company Brief

Sapura Energy Bhd has clarified that its joint venture with Seadrill in Brazil, Sapura Navegacao Maritima SA (SNM) was not impacted by the recent bankruptcy Chapter 11 cases filed by several Seadrill subsidiaries operating in Asia. Sapura Energy also reported that the filing has no financial impact on its business plans and financial strength. (The Star)

Mitrajaya Holdings Bhd has secured a RM200.0m transit oriented development project from Putrajaya Development Sdn Bhd with the letter of award dated 8th February 2021 for the proposed construction and completion of 10 levels of podium and external works at Plot 7MD7 in Precinct 7. The project is expected to be completed in two years. (The Star)

Dialog Group Bhd’s 2QFY21 net profit fell 22.9% YoY to RM121.8m, on lower contributions from a joint venture. Revenue for the quarter decreased 42.7% YoY to RM351.0m. (The Star)

Sarawak Consolidated Industries Bhd’s units have bagged contracts worth RM821.3m in Malaysia and Qatar for engineering, procurement, construction and commissioning (EPCC) projects. The first contract is for an EPCC project in Kuching worth RM422.0m for the proposed mixed development in the Muara Tuang Land District and part of River Bank reserve, with an expected duration of 108 months. The second contract is for an EPCC contract in Qatar worth US$98.0m (RM399.4m) to be completed in 30 months. (The Edge)

Malaysian Rating Corp Bhd (MARC) has upgraded Top Glove Corp Bhd's corporate credit rating to AA+ and kept its outlook at stable. The rating upgrade is premised on the significant increase in Top Glove's revenue and cash flow on the back of recording unprecedented sales of gloves resulting from the Covid-19 pandemic. (The Edge)

Supermax Corp Bhd is implementing a temporary three-day stoppage at its manufacturing facility in Meru, Klang, from 10th February 2021 as it discovered several positive cases of Covid-19 among its workers. (The Edge)

Lienteh Technology Sdn Bhd, which is expected to obtain necessary approvals to commence production of nitrile gloves is seeking a back-door listing via Eonmetall Group Bhd. Eonmetall, via a share sale agreement is planning to acquire a 51.0% stake in Lienteh Technology for RM51.0m. The purchase consideration will be entirely satisfied via the issuance of 72.9m Eonmetall shares and the granting of a call option by the vendors to Eonmetall for the acquisition of the remaining 49.0% equity interest for RM49.0m. (The Edge)

LKL International Bhd’s wholly-owned subsidiary LKL Advance Metaltech Sdn Bhd has entered into a Memorandum of Understanding with Singapore-based iWOW Technology Pte Ltd to explore a potential cooperation to market and develop an electronic Covid-19 contact tracing product. (The Edge)

AirAsia Group Bhd is navigating its recovery phase exceptionally well as key operational metrics improved in December 2020 in comparison to September 2020. This is shown by the 31.0% increase in passengers carried by AirAsia Thailand (TAA), doubling of passengers carried by AirAsia Philippines (PAA), and number of passengers carried by AirAsia Indonesia, which multiplied by a whopping 11.0x. (The Edge)

Genting Malaysia Bhd's (GENM) 49.0%-owned associate Genting Empire Resorts LLC, which operates the Resorts World Catskills (RWC) casino in New York is developing a video gaming machine facility in Orange County. The move has been part of RWC's long-term vision for Hudson Valley and Catskills within the US state. (The Edge)

Berjaya Food Bhd’s 2QFY21 net profit rose 38.8% YoY to RM11.1m, thanks to the implementation of effective cost management. Revenue for the quarter, however, fell 5.4% YoY to RM174.1m. (The Edge)

Malaysia Marine and Heavy Engineering Holdings Bhd’s (MHB) 4QFY20 net loss stood at RM8.6m vs. a net profit of RM9.3m recorded in the previous corresponding quarter, dragged by higher operating losses in the heavy engineering segment. Revenue for the quarter, however, jumped 152.3% YoY to RM695.5m. (The Edge)

Oriental Interest Bhd is eyeing to acquire a piece of land measuring 59,745-sqm in Klang for RM64.3m from Gabungan Efektif Sdn Bhd. The land would complement its existing development around the Klang Valley. (The Edge)

Three subsidiaries of Scomi Energy Services Bhd — Scomi Oiltools Sdn Bhd, Scomi KMC Sdn Bhd and KMCOB Capital Bhd (KMCOB) are to remain under judicial management for a further six months from 14th February 2021. The extension order was granted by Justice Datuk Azmi Ariffin at the Shah Alam High Court today. (The Edge)

Source: Mplus Research - 10 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

CAPITALA2024-11-22

DIALOG2024-11-22

DIALOG2024-11-22

GENM2024-11-22

SAPNRG2024-11-22

SCOMIES2024-11-22

SUPERMX2024-11-22

TOPGLOV2024-11-22

TOPGLOV2024-11-22

TOPGLOV2024-11-22

TOPGLOV2024-11-21

BJFOOD2024-11-21

CAPITALA2024-11-21

DIALOG2024-11-21

DIALOG2024-11-21

DIALOG2024-11-21

SAPNRG2024-11-21

SAPNRG2024-11-21

SAPNRG2024-11-21

SCIB2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

TOPGLOV2024-11-19

DIALOG2024-11-19

SAPNRG2024-11-19

TOPGLOV2024-11-18

DIALOG2024-11-16

BJFOOD2024-11-15

BJFOOD2024-11-15

BJFOOD2024-11-15

BJFOOD2024-11-15

SCOMIES2024-11-15

SCOMIES2024-11-14

CAPITALA2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

TOPGLOV2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

GENM2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-13

SAPNRG2024-11-13

TOPGLOV2024-11-12

DIALOG2024-11-12

GENMMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024