Mplus Market Pulse - 25 Feb 2021

MalaccaSecurities

Publish date: Thu, 25 Feb 2021, 10:17 AM

Market Review

Malaysia: The FBM KLCI (-0.5%) finished in the red alongside with the weakness across its regional peers, dragged down by the extended selling pressure amongst the gloves heavyweights as the key index recorded its third day of losing streak. The lower liners were battered, while the broader market ended mostly in the red.

Global markets: US stockmarkets trended mostly higher as the Dow jumped 1.4% after US Federal Reserve Chairman Jerome Powell reaffirmed his stance on the dovish economic policies. European stockmarkets were upbeat, but Asia stockmarkets finished lower after Hong Kong Exchange (HKEX) plans to raise stamp duty to 0.13% (from 0.1%).

The Day Ahead

Selling pressure in the glove counters persisted, pushing the FBM KLCI into the negative territory in the afternoon trading session. Whilst the National Covid-19 Immunisation Programme kickoff did not boost the local bourse yesterday, we opine some bargain hunting activities to arise in lower liners after close to 1,000 counters closing in the red. Meanwhile, the Brent oil price continues to climb above USD67.

Sector focus: We continue to favour the recovery-theme sectors such as aviation, gaming and selected consumer stocks as the vaccination programme began. Besides, given the higher Brent oil price at USD67, traders may refocus on the oil & gas sector. Also, with the anticipation of stronger earnings under the steel counters, we expect trading interest to revolve around the building material segment.

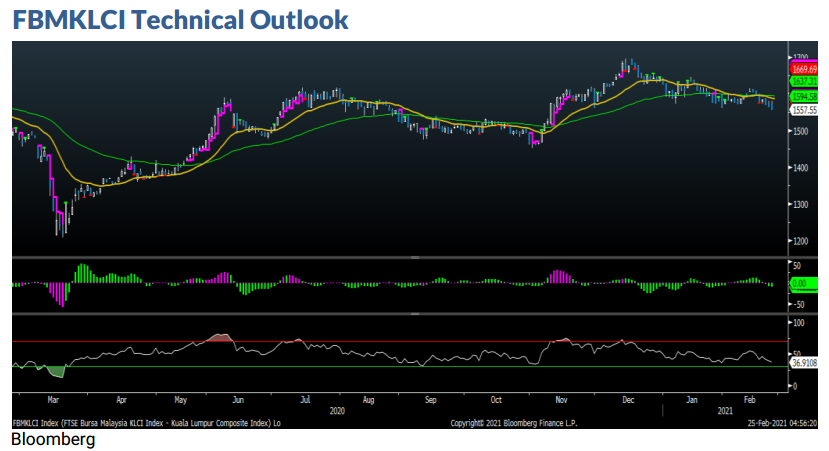

The FBM KLCI declined for the third session to close below the 1,560 level. Technical indicators remained negative as the MACD Histogram has extended another red bar, while the RSI was hovering below 50. The key index should continue to rangebound with support pegged at 1,550, and resistance level is set around 1,590-1,600.

Company Brief

AEON Co. (M) Bhd’s 4QFY20 net profit fell 45.5% YoY to RM27.2m, as sales suffered due to the Covid-19 restrictions. Revenue for the quarter declined 20.0% YoY to RM917.0m. (The Star)

Telekom Malaysia Bhd’s (TM) 4QFY20 net profit stood at RM259.4m vs. a net loss of RM51.1m recorded in the previous corresponding quarter, boosted by lower operating costs and other gains. Revenue for the quarter, however, declined marginally by 1.1% YoY to RM3.00bn. A final interim single-tier cash dividend of 7.5 sen, payable on 31st March 2021 was declared. (The Edge)

VSTECS Bhd’s 4QFY20 net profit ended grew 19.8% YoY to RM12.9m, driven by the new normal of working and learning from home. Revenue for the quarter added 21.7% YoY to RM659.6m. A second interim dividend of 4.5 sen per share, payable on 21st May 2021 was announced. (The Edge)

Vitrox Corp Bhd’s 4QFY20 net profit jumped 79.4% YoY to RM31.9m, on the back of higher revenue. Revenue for the quarter climbed 68.0% YoY to RM159.8m. (The Edge)

D&O Green Technologies Bhd’s 4QFY20 net profit surged 118.9% YoY to RM30.3m, benefiting from increased demand and recovery in the automotive industry. Revenue for the quarter grew 39.3% YoY to RM209.6m. (The Edge)

Rubberex Corp Bhd’s 4QFY20 net profit surged 15.3x YoY to RM59.4m, due to higher average glove selling prices amid higher demand. Revenue for the quarter jumped 203.8% YoY to RM152.8m. (The Edge)

Allianz Malaysia Bhd’s 4QFY20 net profit gained 8.2% YoY to RM144.0m, mainly due to higher gross earned premiums and investment income. Revenue for the quarter increased 8.5% YoY to RM1.53bn. (The Edge)

Press Metal Aluminium Holdings Bhd’s 4QFY20 net profit grew 6.0% YoY to RM142.6m, on higher aluminium prices. Revenue for the quarter, however, slipped 3.7% YoY to RM2.12bn. A fourth interim single-tier dividend of 1.25 sen per share, payable on 31st March 2021 was declared. (The Edge)

Inari Amertron Bhd’s 2QFY21 net profit jumped 140.3% YoY to RM90.1m, driven by stronger sales volume generated by its radio frequency (RF) business. Revenue for the quarter grew 42.0% YoY to RM376.8m. A second interim dividend of 2.5 sen per share, payable on 8th April 2021 was declared. (The Edge)

Genting Plantations Bhd’s 4QFY20 net profit grew 28.1% YoY to RM79.0m, due to stronger palm products prices. Revenue for the quarter rose 14.9% YoY to RM739.2m. A final dividend of four sen per share, payable on a date to be fixed later as well as a special dividend of 11 sen per share to be paid on 30th March 2021 was declared. (The Edge)

Globetronics Technology Bhd’s 4QFY20 net profit rose 16.0% YoY to RM16.9m, on higher revenue. Revenue for the quarter grew 7.1% YoY to RM63.2m. (The Edge)

Dayang Enterprise Holdings Bhd’s 4QFY20 net profit slumped 83.2% YoY to RM13.2m, dragged by slower work orders due to the Covid-19 pandemic. Revenue for the quarter fell 44.5% YoY to RM158.2m. (The Edge)

Parkson Holdings Bhd’s 2QFY21 net loss narrowed to RM28.3m, from a net loss of RM81.1m recoded in the previous corresponding quarter, mainly thanks to better operating profits from its China operations. Revenue for the quarter, however, declined 11.1% YoY to RM877.8m. (The Edge)

DRB-Hicom Bhd’s 4QFY20 net profit surged 20.8x YoY to RM986.0m, underpinned by completion of the disposals of property assets and investments by the group and higher sales of vehicles and components by Proton. Revenue for the quarter added 36.2% YoY to RM4.85bn. (The Edge)

Hap Seng Plantations Holdings Bhd’s 4QFY20 net profit increased 18.5% YoY to RM37.0m, on the combination of higher commodity prices and sales volume. Revenue for the quarter gained 22.8% YoY to RM153.3m. A second interim dividend of 5.5 sen per share, payable on 24th March 2021 was declared. (The Edge)

UOA Development Bhd's 4QFY20 net profit slumped 69.0% YoY to RM35.0m, due to lower recognition from ongoing projects and a fair value loss from the revaluation of its investment properties. Revenue for the quarter fell 14.5% YoY to RM194.1m. A first and final single-tier dividend of 14 sen and a proposed special dividend of one sen were proposed. (The Edge)

Prestar Resources Bhd’s 4QFY20 net profit soared 405.1% YoY to RM15.8m, driven by strong demand and higher selling prices of its products. Revenue for the quarter grew 22.6% YoY to RM137.1m. A final dividend of 1 sen per share, subject to shareholders' approval was proposed. (The Edge)

Tek Seng Holdings Bhd’s 4QFY20 net profit stood at RM8.2m vs. a net loss of RM12.9m recorded in the previous corresponding quarter, underpinned by higher profit in its polyvinyl chloride (PVC) segment. Revenue for the quarter rose 14.3% YoY to RM48.5m. A final dividend of 0.5 sen per share was proposed. (The Edge)

Majuperak Holdings Bhd aims to raise up to RM20.0m via a proposed private placement by issuing up to 56.66 m in new shares, representing not more than 20% of its total number of issued shares. The funds are to support its operating expenditure, repay bank borrowings and fund upcoming projects involving the provision of clinical support service for four Ministry of Health clinics in Terengganu. (The Edge)

Destini Bhd has entered into an agreement with Keretapi Tanah Melayu Bhd (KTMB) to establish a joint-venture (JV) company, ET Sdn Bhd (ETSB) to expand its capabilities in maintenance, repair and overhaul (MRO) services in the rail sector. Both parties have inked a subscription, JV, and shareholders agreement that will see Destini acquiring a 70.0% stake in ETSB, an indirect wholly-owned subsidiary of KTMB, through its 100.0%-owned subsidiary, Destini Rail Sdn Bhd. The remaining 30.0% shareholding will be held by KTMB, through its wholly-owned subsidiary KTMB Technics Sdn Bhd. (The Edge)

LKL International Bhd has announced that its subsidiary LKLAdvance Metaltech Sdn Bhd has secured exclusive distributorship rights for Singapore-based iWOWTechnology Pte Ltd’s trace token nationwide and targets Selangor to be the first State in Malaysia to adopt the device. The exclusive distributorship agreement has been signed for an initial duration of two years and renewable thereafter upon future consensus between both LKL and iWOW Technology. (The Edge)

Datasonic Group Bhd’s 3QFY21 net profit sank 96.7% YoY to RM0.6m, following lower demand for its passport, consumables and personalisation services. Revenue for the quarter shrank by 60.7% YoY to RM29.5m. (The Edge)

Source: Mplus Research - 25 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

GTRONIC2024-11-22

AEON2024-11-22

AEON2024-11-22

AEON2024-11-22

AEON2024-11-22

AEON2024-11-22

AEON2024-11-22

D&O2024-11-22

D&O2024-11-22

D&O2024-11-22

D&O2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

GTRONIC2024-11-22

GTRONIC2024-11-22

GTRONIC2024-11-22

GTRONIC2024-11-22

HSPLANT2024-11-22

PMETAL2024-11-22

TM2024-11-22

TM2024-11-22

TM2024-11-21

ALLIANZ2024-11-21

D&O2024-11-21

D&O2024-11-21

DAYANG2024-11-21

DRBHCOM2024-11-21

GENP2024-11-21

GTRONIC2024-11-21

GTRONIC2024-11-21

HEXCARE2024-11-21

HSPLANT2024-11-21

HSPLANT2024-11-21

HSPLANT2024-11-21

HSPLANT2024-11-21

HSPLANT2024-11-21

INARI2024-11-21

TM2024-11-21

TM2024-11-21

TM2024-11-21

UOADEV2024-11-21

UOADEV2024-11-21

UOADEV2024-11-21

UOADEV2024-11-21

VSTECS2024-11-20

AEON2024-11-20

D&O2024-11-20

D&O2024-11-20

INARI2024-11-20

TM2024-11-20

TM2024-11-20

TM2024-11-20

TM2024-11-20

UOADEV2024-11-20

VITROX2024-11-20

VITROX2024-11-20

VITROX2024-11-20

VITROX2024-11-19

AEON2024-11-19

D&O2024-11-19

DRBHCOM2024-11-19

INARI2024-11-19

PMETAL2024-11-19

TM2024-11-19

TM2024-11-19

TM2024-11-19

VSTECS2024-11-18

D&O2024-11-18

D&O2024-11-18

D&O2024-11-18

DAYANG2024-11-18

DAYANG2024-11-18

DAYANG2024-11-18

DRBHCOM2024-11-18

GENP2024-11-18

INARI2024-11-18

PMETAL2024-11-18

PMETAL2024-11-18

TM2024-11-18

TM2024-11-18

TM2024-11-15

AEON2024-11-15

D&O2024-11-15

D&O2024-11-15

DRBHCOM2024-11-15

GENP2024-11-15

GENP2024-11-15

MJPERAK2024-11-15

PMETAL2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-15

VSTECS2024-11-14

D&O2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DRBHCOM2024-11-14

GENP2024-11-14

INARI2024-11-14

INARI2024-11-14

INARI2024-11-14

INARI2024-11-14

TM2024-11-14

TM2024-11-14

TM2024-11-14

VSTECS2024-11-14

VSTECS2024-11-14

VSTECS2024-11-14

VSTECS2024-11-14

VSTECS2024-11-13

D&O2024-11-13

D&O2024-11-13

GENP2024-11-13

PMETAL2024-11-13

PMETAL2024-11-13

TEKSENG2024-11-13

TEKSENG2024-11-13

TM2024-11-13

TM2024-11-13

TM2024-11-13

VSTECS2024-11-12

D&O2024-11-12

DESTINI2024-11-12

DESTINI2024-11-12

DESTINI2024-11-12

DESTINI2024-11-12

DRBHCOM2024-11-12

GENP2024-11-12

INARI2024-11-12

INARI2024-11-12

INARI2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-12

UOADEV2024-11-12

UOADEVMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024