(CHOIVO CAPITAL) A brief analysis and valuation of WCE Holdings Berhad (WCEHB).

Choivo Capital

Publish date: Sun, 11 Mar 2018, 03:28 PM

WCE Berhad has always been one of the companies I have always been interested in. And one of the main reason, is because an investor whose thought process i trust, keeps talking about it. That person is of course, "Felicity".

However, I couldn’t really place a value on it beyond, “Yeap, from the feel of things, it looks like it’s going to be very valuable, or is very valuable already”.

However, a few days ago, i decided to properly do a DCF valuation of WCEHB, and what I saw helped me understand why felicity and so many other large investors like the Pang’s (Mamee) are willing to hold that stock through lower and lower fund placements and zero positive price movements.

Here is my brief analysis and valuation of WCEHB.

Introduction.

Whatever background info you need to know about WCEHB is already written down by felicity here.

http://www.intellecpoint.com/search/label/WCE

However, here is a brief overview.

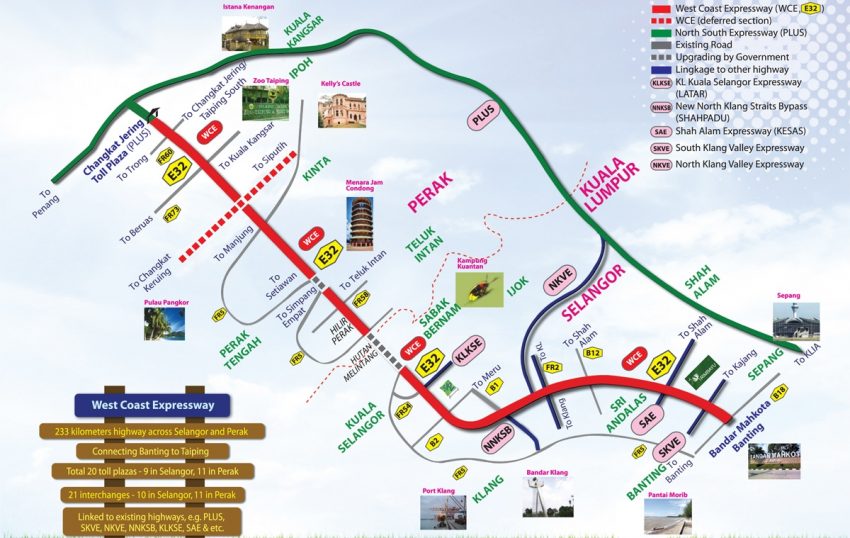

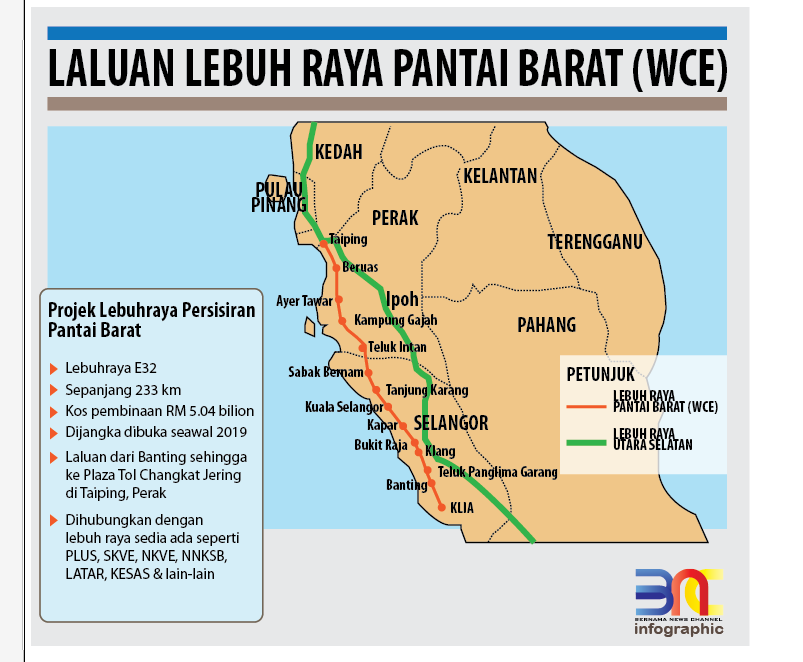

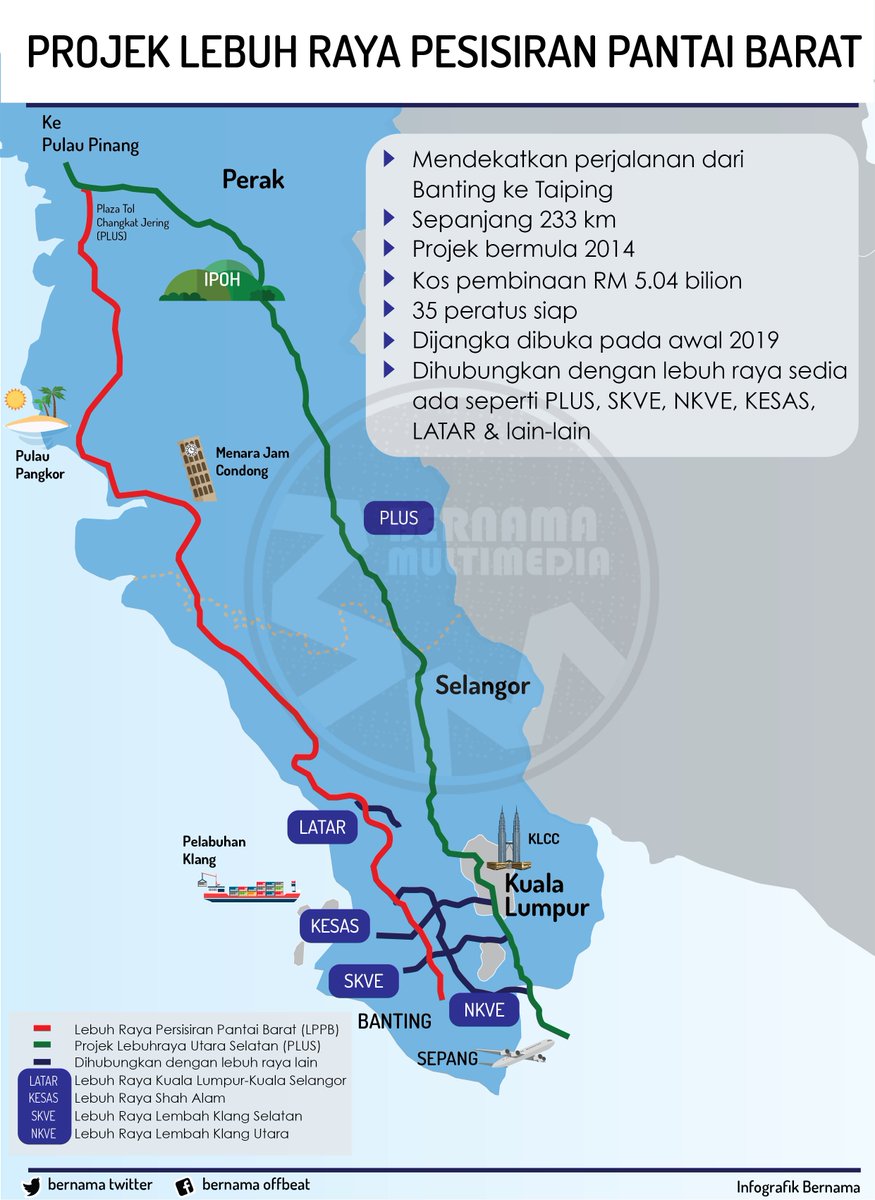

WCEHB is the 80% owner of West Coast Expressway Sdn Bhd, which is contracted to build and operate the 233km highway from Banting in Selangor to Taiping in Perak. Construction is expected to complete in early 2019. 20% is held by IJM.

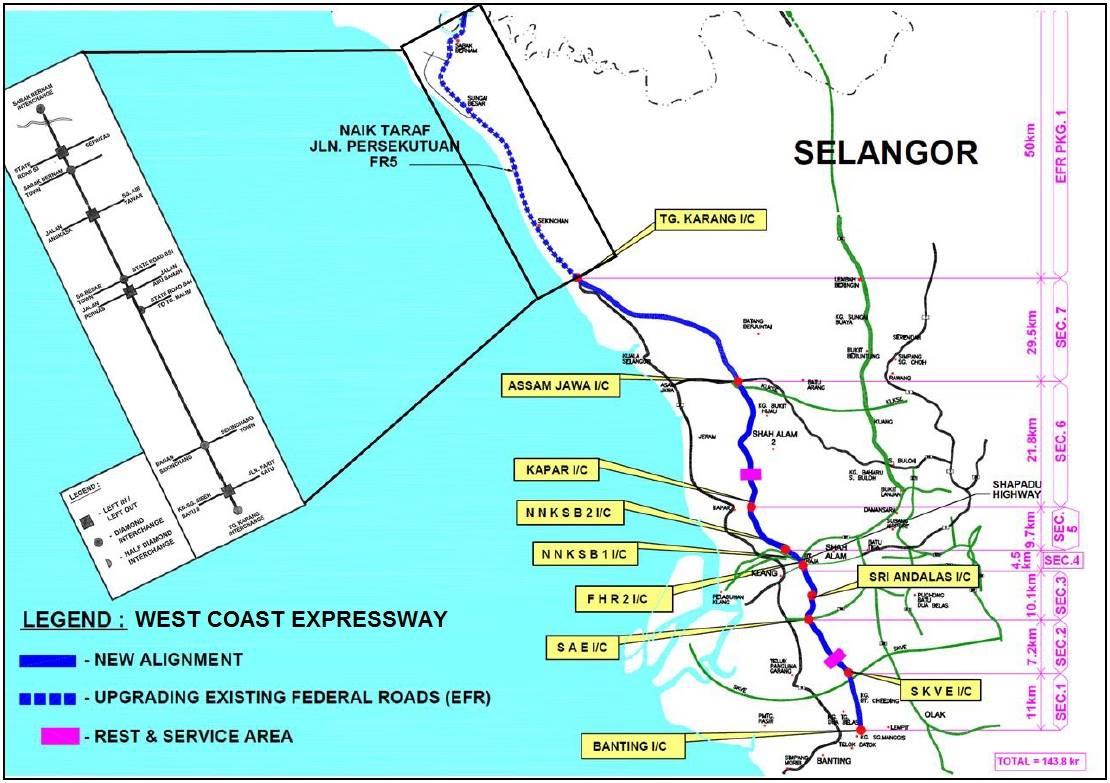

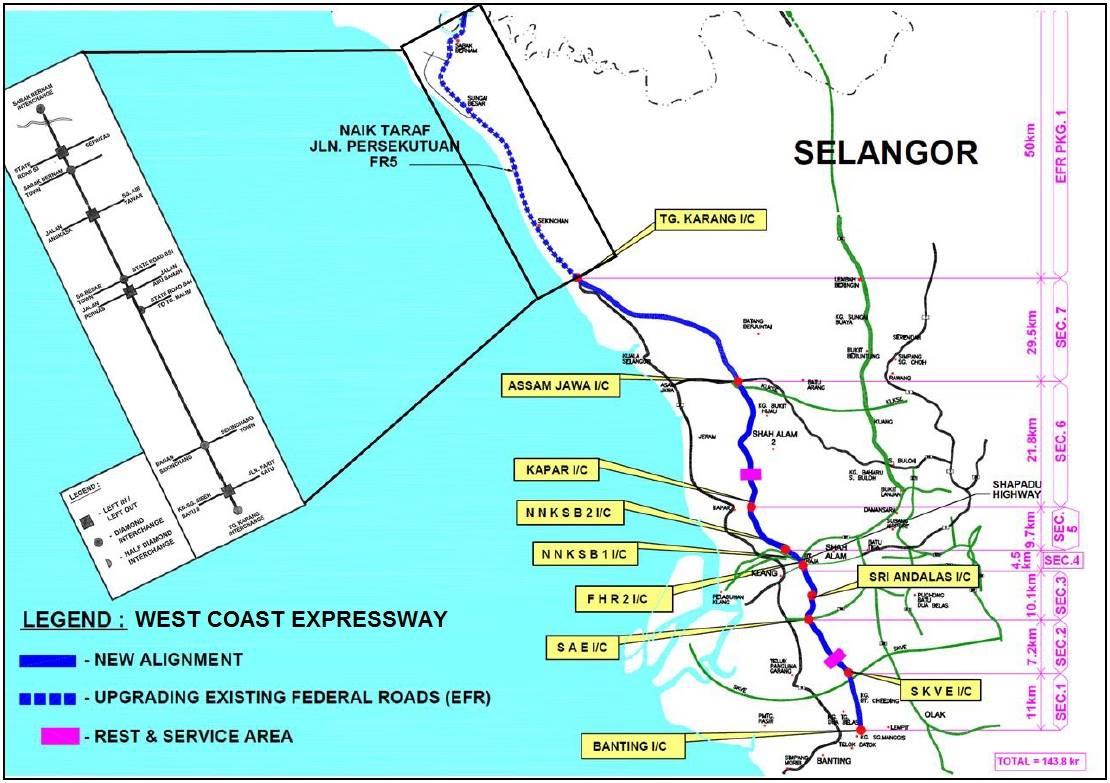

Here are some maps of the highway.

As we can clearly see, it is likely to be a money maker. It has close links to existing highways and is also likely to eat quite a bit of traffic from PLUS for that particular section, as it’s shorter and have better access to ports.

The Toll Contract

1) Concession period is 50 years, with a 10 year extension if the agreed internal rate of return is (IRR) is received.

2) IRR agreed is not specified, but the figure is like to be around 10%, Give or take 1%. The IRR for Plus highway is about 10.5% by the way. The absolute bottom is probably something like 8% return.

3) Project is likely to cost RM6 billion with an additional RM930 million borne by the government for land acquisition cost.

4) Toll revenue in excess of an agreed traffic volume (Additional IRR above agreed rate) will be shared on the basis of 70:30 between the government and WCESB till full settlement of the GSL and subsequently 30:70 after the settlement of the GSL.

The DCF Valuation.

And here, is where everything gets very interesting. From what I’ve noticed, felicity never showed a completed DCF, and let me show you one that I’ve built, using very conservative assumptions.

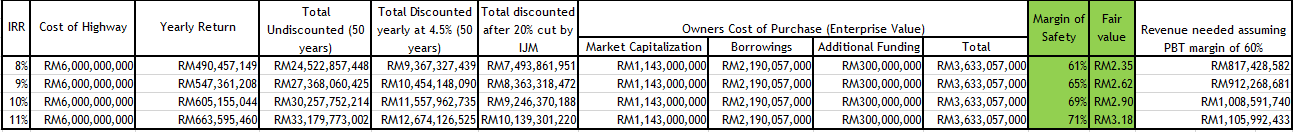

Assumptions:

-

Concession period: 50 years, no extensions.

-

IRR: 8%, 9%, 10% and 11%. Assume no sharing with gov as target IRR not hit.

-

Traffic Growth rate: Zero (Valautions get very very high once you at in 2% growth rate per annum for 50 years).

-

Discount rate: 4.5% (Risk Free Rate in Malaysia)

-

Cost of investment: Enterprise value with cash not being deducted, as they are likely to be used for the construction. An additional RM300 million is added, as fund raising may be required due to cost over-runs (calculated by felicity).

-

Cost of project: Rm6 billion.

-

IJM’s share: 20%

- PBT Margin: 60% as per Litrak and Ekovest

Depending on the IRR chosen. Fair Value is as follows.

IRR 8%: RM2.35

IRR 9%: RM2.62

IRR 10%: RM2.90

IRR 11%: RM3.18

As we can see, at the current price, there is a margin of safety of at least 61% for the worst case scenario. And this valuation assumes zero growth rate. For the record, PLUS growth rate is roughly 2.35% per annum in recent years. If you were to add this in, the valuation becomes obscene even with the profit sharing. But lets stay conservative.

For WCE to be able to generate the PBT indicated by the estimated IRR’s, assuming 60% margin, they will need to generate revenue of RM817 million to RM1.1 billlion. Margins may be a touch higher as the highway is new and lower maintenance is needed, but again, lets be conservative.

Is that revenue achievable? The revenue for PLUS in 2014 is RM3.3billion. Using the growth rate of 2.35%. Revenue in 2019 is likely to be around RM3.7 billion. WCEHB’s highway will need to take away 22% to 30% of Plus’s revenue. Definitely not unlikely. In addition, some traffic additional traffic is likely to be generated as well, since it the highway flows through the old roads, which consist of people who do not want to take PLUS.

Failure Points

As always, lets invert and find out the failure points for the company and our investment. As Munger always says, find out whats going to kill you and dont go there.

1) Cancellation of the tolls.

This is not really a problem as the government always pays the penalties as stated in the agreement. This can be seen in all current utilities or concession buy backs. As well as the compensation of RM2.2billion paid to PLUS for the cancellation of Kayu Hitam and Batu Tiga tolls.

2) Malaysia dying as a country, as it goes down the path of Venezuela if BN wins again.

Well, to be honest, I think that PH will win this round. If they dont, Najib will be dictator life.

But even if BN wins, there is too many capitalistic Chinese in and around this country for that to happen. China is also there to keep Malaysia in check and protect their investment, so it should be ok. Malaysia has a really good geographical potential to be the ecommerce hub for SEA. Eitherway if BN wins, ill likely pull out some of my investments and move it to Singapore.

3) WCEHB bosses cannot be trusted.

IJM is the biggest shareholder of WCEHB. Should not be a problem.

4) Can it be completed in time? (ie early 2019)

This one, im actually not too sure. Because if it took them 3-4 years to complete 47%, im not sure if they can complete 53% or so 1 year from now. Unless thne 47% consist of the hard to build portions, and the 53% is the easy to build ones. We'll see.

5) Can the revenue targets be hit?

This is actually really really hard to know. Unless you have the traffic report, there is no way of knowing with a high level of certainty.

On this one, i have to do what i really dislike.

Rely on the fact the Pang's and IJM are not retarded. Mamee after being privatized is being fantastically run with a new lease on life. The brand is massively improved, needless to say revenue and profit have also increased massively since the privatization.

I dont think people like them will put so much money in for 5% IRR or less.

Conclusion:

Personally, I quite like this company as a business, and the large margin of safety is also a big plus. Its currently 3% of my portfolio, but I’m definitely seriously considering making it a 10%.

Let me know if you feel i missed out on anything.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

Yeah, i have a feeling, that's why i added that RM300m as per flicity calculation at Jan 2017.

RAMS report stated likely to be 4 months behind schedule. That is nothing really. Id be worried if it was like 1 year or so. Hopefully it does not come to that, IJM knows how to build their highways.

Posted by Flintstones > Mar 11, 2018 04:06 PM | Report Abuse

Construction is behind schedule and likely cost over run.

2018-03-11 16:10

The only thing cheaper than trucks for transportation of goods is trains.

2018-03-11 18:41

WCE has a flatter terrain advantage as well. Development of ports on the West Coast and ECRL will be a booster.

2018-03-11 19:26

My concern is that they may neeed to do more fund raising, as felicity has pointed out.

2018-03-11 19:26

Imo you're under discounting in this dcf analysis. Why are you not using WACC or atleast klci average return but a 1 percent premium above risk free rate, I would have used an higher rate even for reits.

I didn't read their annual report but imho you should be more conservative especially if your words might influence others that are not that as well versed in finance compared to you.

2018-03-11 19:33

Well, thanks everyone for your constructive criticism, let me respond and let’s try and find what is right.

On DCF. Let me be clear about one thing. If you need to do a DCF to justify your investment, you are fucking up. It needs to scream at you saying its bargain.

WCEHB screamed at me (ish), but I just couldn’t really see why I felt it was cheap. So I did a DCF since I think it might show me better. Now that I have a sense of the DCF, the next time I see a highway investment, I can just do it in my head.

Make no mistake, DCF is like a Hubble Telescope, adjust by just a millimetre and you’re looking at a completely different galaxy. The worst investments in the world is supported by very detailed DCF’s saying why it would work.

Why not WACC? Because i think CAPM and thus the Cost of Equity is nonsense. It is simply a theoretical construct based on assumptions and therefore by definition, does not adhere to reality.

I use the risk free rate, which I consider to be FD rates in Malaysia for a few reasons. This is likely going to infuriate a lot of finance or IB people.

1) You cannot compensate higher risk with higher interest rates.

Interest rates/yield is mainly used by banks and bond investing. And the one thing I’ve learnt, is that you cannot compensate higher risk with higher interest rates.

First and foremost, you must be certain that you get your capital back. No ifs or buts. What’s the point of a higher interest rate if the company is not good for it and is going to lose you your capital?

So I do my best to find things that are quite certain.

Compensating higher risk only works in certain scenarios and up to a point. You need, a very large amount of loans that are immaterial to you individually, that you are fairly certain is good for your capital. And then because of the sheer size (there is bound to impairment), you can build and use an actuarial table to estimate the additional cost on an interest basis, and charge quadruple that. That’s personal loans for you. Haha.

2) RM1 in the future is the same amount of money regardless if it’s from Company A or Company B.

As my first focus is company who can give the money I expect with a high certainty, it is redundant for me to use a higher interest rate to discount that.

3) There is something called margin of safety.

It’s redundant to both have a margin of safety and adjust interest rates. Its far simpler to just have a higher margin of safety than to go and calculate a DCF based on various discount rates.

4) Ease of comparison.

All my investments are generally quite certain, so if I do a DCF (which I have not other than this one) it needs to be easily comparable. I will just adjust on the margin of safety depending on the quality of the business.

brisk Imo you're under discounting in this dcf analysis. Why are you not using WACC or atleast klci average return but a 1 percent premium above risk free rate, I would have used an higher rate even for reits.

I didn't read their annual report but imho you should be more conservative especially if your words might influence others that are not that as well versed in finance compared to you.

11/03/2018 19:33

hpcp Discount rate too low

11/03/2018 22:46

2018-03-12 02:10

This is my only concern really. If they can hit the revenue needed for those IRR's.

If the IRR is PAT. We are looking at at least 1.09 bil for 8% IRR. and 1.35bil if they can get Plus's 10.5.

Not easy at all.

Fabien Extraordinaire Competition for traffic may come from MRT.

11/03/2018 19:40

2018-03-12 02:13

Posted by Jon Choivo > Mar 12, 2018 05:37 PM | Report Abuse

You have to be a fool to value banking stocks based on NTA and Net Margin only.

By that same NTA metric, i can think of so many companies cheaper than TA enterprise. Plenitude, L&G, Mahsing, KSL, Orient etc etc.

PLease don't go around playing the Walter Schloss of malaysia but sell your stock like you're KYY.

I dont remember walter schloss everyday tell people to buy this buy that. In fact, he prefers not to tell people what he buy, cause if they knew, they would not invest in him.

John Choivo,

If you had not commented I would have kept silent on your WCE

I bought KEuro (WCE) at 27 Sen when its NTA was almost Rm1.00

That time its sister company Talam went into PN17 & Brisdale was delisted.

Many were afraid to buy KEuro then at 27 Sen

Then I saw KEuro bought into Talam. And IJM bought into Keuro

IJM being Govt owned will save Keuro, I thought?

And I was correct!

Keuro jumped 200% to over 81 Sen because of West Coastal Highway News

I made Very GOOD MONEY FROM KEURO (WCE)

I am surprised that you only now go gaga over this WCE.

I don't it a wise decision to put more than 3% of your clients' capital into WCE

These are my reasons

1) My Johor Sifu bought LITRAK because SS@ to Puchong are jammed with affluent travellers. So it is doing well

2) We bought MTD Infrar which owned THE MONOPOLY TOLL OF GOMBAK TO KUANTAN. It was so profitable as many go Genting punting. But MTD took MDT Infrar private to our loss

3) SILK Highway is not doing well so SILK sold it away

4) Even EDL TOLL OF JOHOR CAUSEWAY ALSO NOT DOING WELL. SO GOVT HELPED MRCB TO SCRAP IT FOR COMPENSATION

5) PLUS I BOUGHT ABOUT RM2.50. ALAS! PLUS WAS TAKEN PRIVATE BY UEM

6) LATTAR HIGHWAY BY BPURI is still under utilised & struggling

7) I don't see how WCE going to generate much profit as there is a recession currently due to GST & high inflation.

Coming back to your constant accusation

YES!

IF GOOD STOCKS ARE NOT RECOMMENDED BAD STOCKS WILL BE

AND SO IF YOU THINK YOU HAVE GOOD STOCKS BY ALL MEANS RECOMMEND TO i3 MEMBERS

ALL CAN DECIDE FOR THEMSELVES

As for WCE I respect felicity's views

IF ONLY YOU GUYS DARE TO BUY IT AT 27 SEN

So sorry you missed>

And don't be another too "clever" expert calling for a buy on Perak Corp at Rm3.60

2018-03-12 22:00

Jon,

Your analysis supported with logical deduction and it is a reading pleasure. Looking forward to more good analysis from you. Please ignore low life Calvin who is not qualified to even scratch your leg. Your time is too valuable to be wasted on dirt.

Thank you

Your reader

2018-03-12 22:18

Calvin, how to buy at 27 sen? That was 2010. Contract also not yet announce or tender then. Unless you're stuck for a long time, or the founder, or part of a goreng crew just frying up any thinly trader stock nobody look at.

Please.

2018-03-12 22:49

Calvintaneng.

Here is where you are making an error.

I can't give half a damn about what you say about my picks. Whether you want to praise or condemn.

If my research is unraveled by the likes of you commenting on my picks. I have clearly made a mistake. You're actions were just incidental.

You cannot affect the intrinsic value of the company. Only the price (Maybe, i doubt even 5% of your post affect the price. Most are just luck.)

If the price go down, i can buy more.

If it goes up above fair value. I'll sell.

Very simple.

2018-03-12 22:54

Posted by Jon Choivo > Mar 12, 2018 10:49 PM | Report Abuse

Calvin, how to buy at 27 sen? That was 2010. Contract also not yet announce or tender then. Unless you're stuck for a long time, or the founder, or part of a goreng crew just frying up any thinly trader stock nobody look at.

Please.

How to buy?

IJM was buying & buying like no tomorrow.

That is why you must see the cloud formed before the rain arrives

When the rain finally arrive price in no longer cheap

Prestar was 46 sen when Insiders were buying. Govt building 8 Highways including WCE. So by Rm1.30 many were chasing Prestar. By then too late.

Same goes for RceCap at 27.5 sen when Datuk Hashim was buying

After corp exercise Rcecap doubled from 80 Sen to Rm1.60. Omly then people were going gaga and chasing. Too late

Masteel was 66 sen when Insiiders took up ESOS by the millions

Too late when Others Chased it over Rm1.70

Time to buy is when you MUST SEE FURTHER & DIG DEEPER

WHEN EVERYTHING IS OUT IN THE OPEN SUNSHINE LIKE NESTLE OR PUBLIC BANK? Too late loh!

2018-03-12 22:55

but clown calvintaneng, of the 7 buy calls u made ytd, 6 r in the red of which 3 r in deep red.

so do u think u r in a position to give stock recommendations????

lol............

2018-03-12 22:57

Thanks! This explains alot. Ill update this post another day.

Felicity For IRR,

https://feasibility.pro/shareholder-loan-and-equity-irr/

read example 3.

Also, with example 3, this is why the management and directors of WCE did this

http://www.intellecpoint.com/2017/07/wces-new-equity-raising.html

very smart.

IRR for equity holders much much higher.

12/03/2018 23:26

2018-03-12 23:52

I find that many people in this forum like to anyhow show off their "past records".

This is very laughable! Haha.

2018-03-13 00:10

Hey man keep it up. I wholeheartedly agree on the part where you say DCF is not a justification to invest but rather a supplement valuation tool. Although there's a few thing I disagree ( who doesn't though ) but at least you seems like someone who is not trying to mislead others into financial ruin.

2018-03-16 22:30

WCE Holdings makes cash call to fund additional cost of West Coast Expressway

http://www.theedgemarkets.com/article/wce-holdings-makes-cash-call-fund-additional-cost-west-coast-expressway

2018-03-27 01:51

Hi Jon Choivo

This might come a bit a late

Can I ask how you calculate the

-'total discounted yearly at 4.5% (50 years)'?

-margin safety

-fair value

I try several calculation , could not get your amount

very appreciate if you could help....

(hope miracle do happen)

2018-09-05 19:40

1) Take yearly return, first year discount by 4.5%, second year 4.5%^2 etc etc

2) "Less IJM" Less total owner cost

3) "Less IJM" Prorate to per share.

2018-09-05 20:18

Calvin talked old grandmother's stories again? I have to admit that no one can fight with him when come to talking one's old grandmother's stories.

I can only remember my grandmother gave me sweets whenever she came to our house, that's all. Nothing more than that. I surrender, OK?

2018-09-05 20:27

My conservative estimate of the value of the expressway base on

1. traffic data 150k cars/day from the road transport ministry(KL-ipoh only, assuming 50% of the users will choose WCE, just google and you can find the data)

2. average revenue per km of highways in malaysia, also googled it.

3. 60% EBIT margin

4. 5.5% discount rate

The resulting PV of the EBIT is about 12B, after tax value will be about 9B,which is what i think the expressway is worth now. WCE berhad 80% portion will be 7.2B.

Now the tricky part is how will the capitalization of WCE berhad at the end of the construction period. They have loan facility of 4.74B, which if assume they will utilize 100%, will leave about 2.46B value for the equity.

The market cap of 510M now seems like a bargain, and correct me if I am wrong, they intend to raise about 500M by issuing almost 2.5B shares base on the recent fund raising circular. So total outstanding shares in the future will be 3.5B. Add in the 500M fund raised to the expressway value and we will get about 3B of value.

3B divide by 3.5B, and a fair value price will be 0.85 a share. Of course the property development portion is an icing on the cake, which I currently ignore. In my view, the proposed rights issue activity is very dilutive.

2019-09-09 22:49

Meant if you had stopped at the 2.46B PV b4 the rights issue, the number of shares now is 1.002B, the PV is well exceed rm2. Correct?

2019-10-05 18:01

Flintstones

Construction is behind schedule and likely cost over run.

2018-03-11 16:06