(CHOIVO CAPITAL) Something is weird in the State of Serba Dinamik Holdings Berhad (SERBADK: 5279)

Choivo Capital

Publish date: Sun, 22 Dec 2019, 12:32 AM

For a copy with better formatting, go here, its alot easier on the eyes.

Something is weird in the State of Serba Dinamik Holdings Berhad (SERBADK: 5279)

========================================================================

A few days ago, a friend of mine was quite excited about Serba Dinamik Holdings Berhad (“SERBADK”) and asked me to look. And having missed out on a few palm oil companies (despite doing research together, I might add. I am this untalented at trading. Thankfully, I held on and topped up my SOP at the bottom), I figured I better take a look.

Serba Dinamik was a company that I kept my eye on for some time. And I quite liked their annual report management explanations, as it seemed relatively clear by Malaysian standards, however, I never really did any analysis before.

The management spoke a lot about very nice sounding things and buzzwords such as, “Smart Maintenance Contracts”, “Project Development”, “IT Projects” etc, and even had a nice 7 part episode on the company on Astro Awani.

https://www.youtube.com/watch?v=aHLHI_EO-po

However, to be honest, it sounded a bit like the typical things that any CEO in the world would say, I mean, how long has it been since Tan Sri Shahril talked about SAPRNG making a profit?

And just after an RM8bil fund injection into it by PNB to save Maybank (they held a big chunk of SAPRNGS loan book), its now looking like it might still go down at any day again, with Current Liabilities again exceeding Current Assets.

And taking a quick look at the numbers of SERBADK, they sure raise some eyebrows.

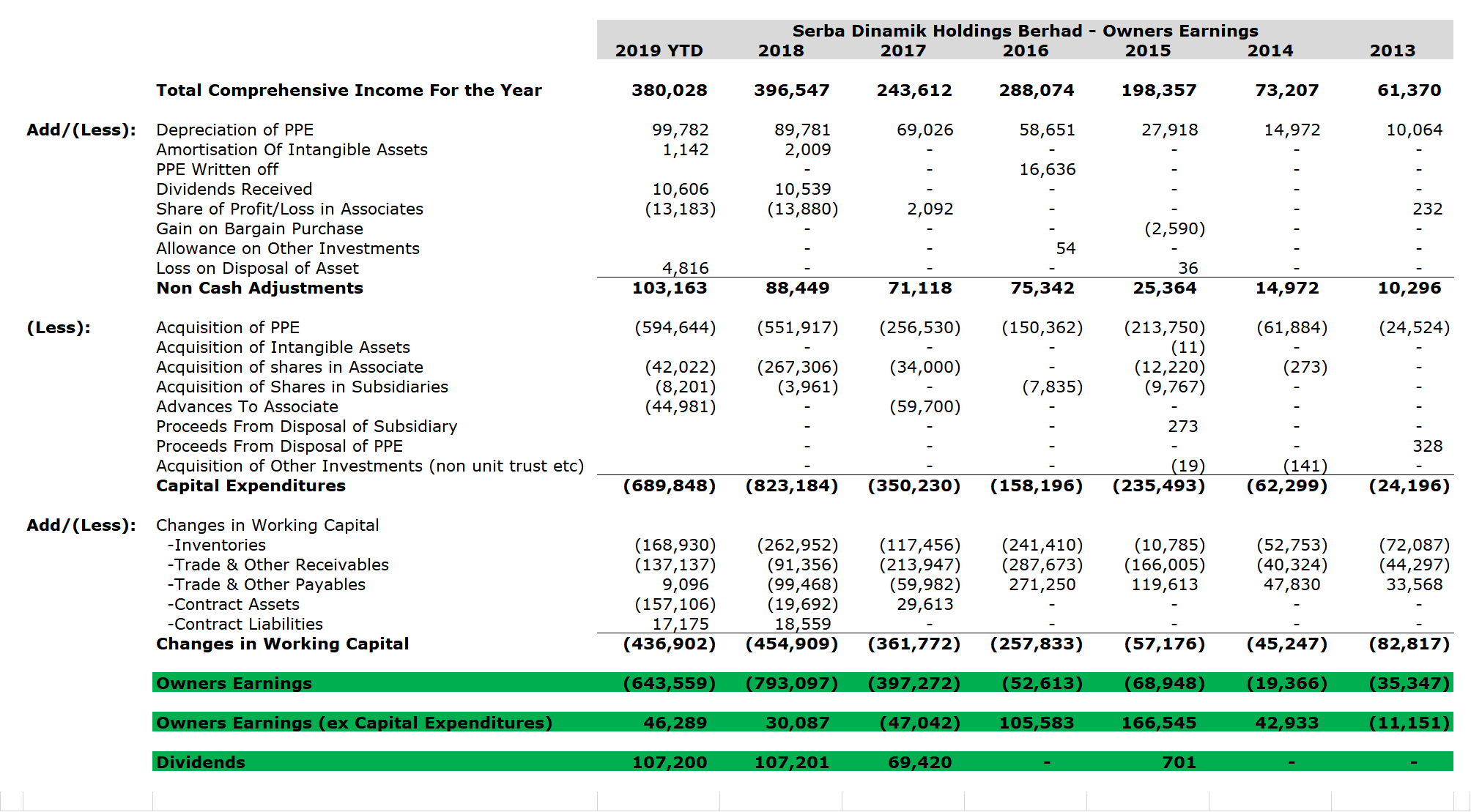

Owners Earnings

Now the tool that we are going to use in our analysis is called “Owners Earnings”. It is a valuation method detailed by Warren Buffet in Berkshire Hathaways 1986 annual report. Warren Buffet stated that the value of a company is simply the total of the net cash flows (owner earnings) expected to occur over the life of the business, minus any reinvestment of earnings.

It is defined by him as such,

"These represent (a) reported earnings plus (b) depreciation, depletion, amortization, and certain other non-cash charges, less (c) the average annual amount of capitalized expenditures for plant and equipment, etc. that the business requires to fully maintain its long-term competitive position and its unit volume.

Our owner-earnings equation does not yield the deceptively precise figures provided by GAAP, since (c) must be a guess - and one sometimes very difficult to make. Despite this problem, we consider the owner earnings figure, not the GAAP figure, to be the relevant item for valuation purposes.

All of this points up the absurdity of the 'cash flow' numbers that are often set forth in Wall Street reports. These numbers routinely include (a) plus (b) - but do not subtract (c)."

In essence, it means,

Owners Earnings =

(a) Reported Earnings

Add: (b) Depreciation and Amortization

Add/Less: (c) Other Non Cash Items

Less: (d) Average Annual Maintenance Capex

Add/Less: (e) Changes in Working capital.

For the sake of simplicity, we are going to use “Total Comprehensive Income” for “Reported Earnings” and “Capital Expenditure & Acquisitions of Companies” as “Average Annual Maintenance Capital Expenditure”.

For the second, the main reason we use the total expenditure instead of calculating the average annual maintenance capex is due to how difficult it is to get a meaningful number for “Maintenance Capex”.

In addition, the amount they spend on capital expenditures is not the main point, as in terms of accounting profit, they very clearly seem to be putting all that Capex to good use.

Now why owner’s earnings?

Because the P/L can show whatever numbers they want, but at the end of the day, the number that really matters is how much of it goes back into the owner’s pockets, as we have very clearly seen with London Biscuits recent PN17 status.

So, what does it look like for SERBADK?

As you can see, its quite incredible how since 2013 this Company have recorded huge negative Owners Earnings.

Having said that, if we were to exclude Capital Expenditures, on a net basis RM333.2 million in cash have been generated, out of which, dividends totaling RM284.5 million have been paid since 2014.

Having said that the cash generated (on a owners earnings basis) is a far cry from the profit reported, and this is from the incredible increase in working capital requirements each year.

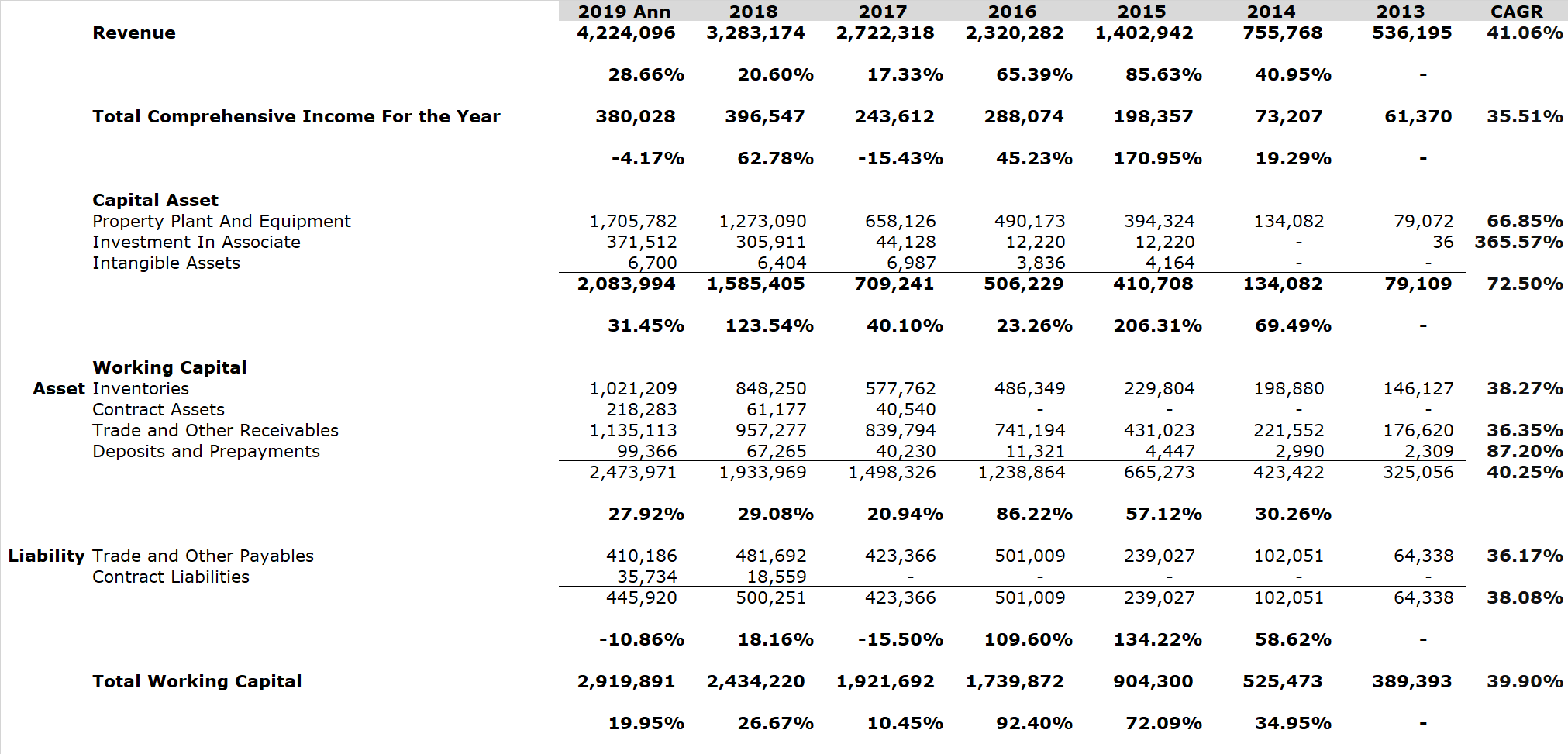

When compared against their Revenue and Comprehensive Income,

Its interesting to note, that the growth in Capital Assets, far exceed that of the growth in Income and Revenue. And considering that these assets are the kind that relies on new projects (which can be very lumpy and irregular) in order to be utilized, It does not seem to bode well.

Look at Sapura Energy etc.

In addition, the increase in Working Capital on the Asset end of the balance sheet have far exceeded the growth in revenue. However, on the liability end, we are looking at a strong drop in working capital.

This indicates that the credit period they obtained from creditors seem to be shortening, while the credit they give to debtors seem to be holding steady or increase.

Easy to pay money to creditors, but collecting money seems to take quite a bit longer. Which is interesting

Conclusion

I may very well be extremely wrong, and this may very well just be initial capex cost in their path of world domination, however I digress.

If you were to do an owners earnings analysis of SAPRNG from 2008 to 2019, it looks surprisingly similar. Having said that, so do most extremely ambitious companies planning to expand via aggressive debt and fund raising programmes.

I hope I’m wrong, as i have no skin in game, it matters not to me if im right.

As usual, feel free to let me know if you think differently or if you feel I’m wrong.

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

The formula you used fails to capture the essence of WB's "owners earnings". Quoted "..simply the total of the net cash flows (owner earnings) expected to occur over the life of the business".. Equating Capital Expenditure & Acquisitions of Companies as similar to Average Annual Maintenance Capital Expenditure is comparing an orange with an apple. A new acquisition or new capex will generate new flow of revenue and cash flow while maintenance capital is simply to preserve existing revenue and cash flow. Just look at the jump in revenue and profits for the last three years... Similarly, SAPNGR and SERBADK are dissimilar as one invested at the peak while the other at the crest of oil price. Of course, you could be right if oil price drops to $30 per bbls and STAYS there....

2019-12-22 23:35

Got a bit of time year end

Digging out choivo articles to read one by one

Young punk got some useful concepts that I can learn

2019-12-23 07:53

i enjoyed reading Choivo articles too..

n i went through all 7 episodes of Serbadk Astro Awani last night.. feeling very good:)

2019-12-23 08:11

Choivo is not bad

But too academic, just like professor Ricky Yeo

Can be a good writer, not a good investor

2019-12-23 09:23

funny lo

how come he can said audit partner will not know anything about the biz

this show that this CHOIVO is totally not understand how audit firm works

he thinks audit partner just blindly sign off audit report only

laugh die me

2019-12-23 10:51

Why Choivo Capital’s credibility is so low:

- First posted on Friday saying SDK is rotten. Plucked numbers from the sky and said maliciously claim that SDK is rotten. Remove the post and claim is excel formula error and change title from rotten to ‘weird’

- Write about owner earnings as if he is warren buffet, but ends up 58 in stock picking.

- Says that audit partner of SPNRG does not know anything about the business.

- Failed miserably in his RM5,000 paper on RCECAP.

- Operating a ‘capital’ without license

2019-12-23 11:39

Shhhh, now, dont talk so much, action?!! Go goreng dsonic, to make back. Kaka

2019-12-23 12:24

Dear Choivo Capital,

May the Year of the Metal Rat bring you Good Luck, Good Health, Good Fortune, Plentiful of Laughter, Happiness, Success and at Peace with Oneself and Others. Happy Chinese New Year 2020

Thank you

P/S: https://klse.i3investor.com/blogs/Sslee_blog/2020-01-22-story-h1482896892-Let_s_celebrate_the_coming_CNY_2020_together_with_well_wishing_of_Unity.jsp

2020-01-22 21:06

Dear Choivo Capital, your prediction came true today. Serbak is having trust problems now. Please comment, Sir.

2021-05-30 12:03

Lu Tau Boh ?

Posted by stockraider > May 30, 2021 10:34 AM | Report Abuse X

If u look at KPMG concern ......there are 2 major areas of concern

a. Potential Fictious suppliers & debtors that cannot be verified or yet to be verified. ( Potential for fraud & misstatement of Accounts loh}

b. Small small companies less than Rn 200k doing Rm 300m to Rm 400m worth of business in normal course people will not approve the contracts mah....if these companies goes bankrupt or runaway..Serba cannot recover their monies loh ( potential of risk management & money laundering mah}

As we talking about hundred of millions of transactions & exposures the Risk are very high loh...!!

2021-05-30 12:15

Sporting mah...joke only mah!

Posted by scenery > May 30, 2021 2:01 PM | Report Abuse

Don't listen to this Rascal Con liar stockraider, he not only denied his conning ppl in Netx for 2 MYvi, which were witness by Mike n 3iii, he also changed my post of 'stop buying Lambo since Sept' into I ask ppl to buy by deleting the "stop" in my posts.

2021-05-30 14:04

BE VERY CAUTIOUS WHEN U BUY INTO SHIT SERBA, KPOWER & SCIB LOH!

These are some dangerous signs now appearing in Serba

1) Auditors are Flagging Red Flags

A Post investigation reveals a perfect storm in China’s manufacturing industry, with consultants helping factories receive a passing grade from auditors by covering up malfeasance. Illustration: Henry Wong

Above refers to Corrupt Auditors which money can buy

Thank God, KPMG PLT the whistle blowing Auditors Is Upright & Righteous

THUMBS UP TO KPMG!

WELL DONE!!!

So Now We See Lots of Hidden Worms Coming out of the Cans.

2) See Some Fellow i3 Forum Comments

Blog: Serba Dinamik: In search of total solutions to address KPMG’s red flags

Posted by sense maker > May 31, 2021 3:35 PM | Report Abuse

The solution is dissolution of the company. When figures are so materially inflated or fake, the company is worth nothing. We are gonna see RM0.15-0.30 a share for all 3 companies of serba, kpower and scib.

A check with Sense Maker i3 forum history shows that he 1st joined i3 forum in January 2013 (9 months before i joined)

To have survived the shark and crocs infested stock market these 8 years show that he has been very careful & watchful of his investments while so many have fallen prey and perished. Many other Careless & Heedless Punters & Traders No longer in i3 after having lost everything & gone bankrupt

Let us do a breakdown of when Sense Maker posted

Posted by sense maker > May 31, 2021 3:35 PM | Report Abuse

The solution is dissolution of the company. When figures are so materially inflated or fake, the company is worth nothing. We are gonna see RM0.15-0.30 a share for all 3 companies of serba, kpower and scib.

1) When figures are so materially inflated or fake, the company is worth nothing.

He said Serba accounts are inflated & fake & the company is worth nothing

2) We are gonna see RM0.15-0.30 a share for all 3 companies of serba, kpower and scib.

He said Serba, Kpower and Scib are worth only 15 sen to 30 sen?

WoW! That is a great judgement

Stock: [SERBADK]: SERBA DINAMIK HOLDINGS BHD

May 31, 2021 9:40 AM | Report Abuse

First limit down, two more to come.

Stock: [KPOWER]: KUMPULAN POWERNET BHD

May 30, 2021 1:27 PM | Report Abuse

Triple limit downs are expected.

WOW! Sense Maker expects Kpower to limit down 3 times!!

Stock: [SERBADK]: SERBA DINAMIK HOLDINGS BHD

May 29, 2021 2:15 PM | Report Abuse

Same tactic is used in kpower and Serba. Bloated Receivables and huge bank borrowings. Fair value of this kind of companies is minimal. RM0.20-0.30, max.

Stock: [KPOWER]: KUMPULAN POWERNET BHD

May 29, 2021 12:22 PM | Report Abuse

Profits have been possibly or probably inflated and chucked into its huge receivable. It has net cash but still needs cash via private placement. That is the second big red flag. This company operates without much fixed assets. Possibly it’s serving mainly as a billing platform only, a third red flag. This kind of company should be valued at book value, at most. We are looking at RM0.15 fair value, ie 50% discount, to be judging the veracity of its book reasonably. A strong sell.

So his comments piqued my interest

That Triggered Calvin's own Investigations into the Accounts of Serba, Kpower & Scib

All three smelled of the same rat sting

That will be in another Upcoming Post

2021-06-05 09:02

By that time too late mah!

Posted by Jokers2020 > Jun 5, 2021 9:59 AM | Report Abuse

normal la Institution sell.EPF n PNB still holding so no worry yet.Once this 2 start sell than can say bye2

2021-06-05 10:26

@JensenChin didn't you bring up the above claim by Choivo to the legal counsel or MCMC?

2021-06-07 14:25

@RainT I think you didn't know Choivo was one of big audit firms' ex-employees. He's kind enough to share what he knew and experienced in the audit industry. You're actually a frog in the well…

2021-06-07 14:30

The very source of numbers provided by Serba itself is in doubt as the earlier audits were weak. Auditors ought to look at accounts with a cynical eye ( as called out by the select committee on Carillion fiasco in the UK). Some companies pull wool over our eyes often enough the world over.

With Serba, just the appearance at the strike rate of its aggressive procurement itself seems a bit daunting. I might as well believe pigs fly.

2021-06-07 18:08

1. Please don't write long stories. We got to wait whether fraud is involved or not !

2. If all the hype leads only to accounting issues then there is nothing to worry ie. difference in opinion and not fraud.

3. WE JUST GOT TO WAIT !

4. Why didn't KPMG highlight these in the past? Perhaps all these happened only in 2020? Otherwise KPMG should not be allowed to go scott free !

5. Things that happened in FGV, Boustead, etc were all cheatings and fraud of the first degree. Don't forget that !

2021-06-08 12:13

By the time u wait long for the result out, it will be too late for u to run mah!

2021-06-08 12:15

riader bro, ignore this loser. Loss so much in LAMBO until become sorhem lial

2021-06-08 12:34

REMEMBER THE BOND HOLDERS RANKED AHEAD OF SHAREHOLDERS, IF BOND SUFFERED 70% LOSSES, THAT MEANS HIGH CHANCE SERBA COMPANY GOING TO BANKRUPT LOH!

Trading at -70% below par, have Serba Dinamik’s bonds hit rock bottom?

SHARES of Serba Dinamik Holdings Bhd have plummeted by more than half following the resumption of trading.

The bonds of Serba Dinamik suffered a similar fate with bid quotes for their USD bonds SDHMK 6.300% 09May2022 Corp (USD) and SDHMK 6.997% 12Mar2025 Corp (USD) reaching as low as 30 cents to the US dollar (70% below par).

On May 25, Serba Dinamik announced that its external auditors have flagged concerns about matters relating to its statutory audit. The company informed that it will soon appoint an independent firm to verify the audit matters. On May 28, a company response was provided to the queries raised by Bursa Malaysia which we will be examine in this article.

Examining KPMG’s raised issues

Referring to Serba Dinamik’s unaudited results for financial year ended Dec 31, 2020, we noted that the RM608.94 mil increase in trade receivables during 2020 is nearly equal to the RM652 mil of receivables flagged by KPMG.

Furthermore, COVID-19 exacted turmoil in the energy industry last year where oil prices plunged and countries were cutting production.

However, Serba Dinamik grew its gross profits for its operations & maintenance (O&M) segment by 26.5% year-on-year (yoy).

Yet Table 1 shows that other similar energy companies listed in Malaysia have seen a decline in annual revenue. During 2020, Serba Dinamik reportedly increased its revenue by 32.8% yoy.

Source: Bloomberg Finance LP, iFAST compilations

Additionally, in December 2018, Serba Dinamik made a 30% acquisition in eNOAH iSolution India Pvt Ltd for RM 15 mil to improve its IT solutions segment. In 2019, its share of total comprehensive income from eNOAH was RM 1.14 mil. However, with this acquisition, its 2019 audited gross profits from the information, communication, and technology (ICT) segment multiplied by about 10 times to RM21.23 mil.

Subsequently in 2020, gross profit for this segment increased by 206.79% to RM65.13 mil in what seems to be amazingly quick growth.

While we have the company’s balance sheet and credit ratios in Table 2 and 3 respectively, there is a chance that the some of the numbers may be subjected to change due to the company’s fluid and developing situation as well as the questions brought up by KPMG.

This makes analysis more difficult but we will rather be safe than sorry in this situation due to the below reasons.

The group is required to maintain a maximum gearing ratio of 2.00 times debt-to-equity, failing which this could trigger an event of default from lenders.

There is a possibility that the equity value of the company would fall after the balance sheet has been finalised by auditors.

In addition, we believe that the company’s ability to access capital markets has been materially constrained and its cloudy liquidity position could make it hard to justify the bid prices for the SDHMK 6.300% 09May2022 Corp (USD) and SDHMK 6.997% 12Mar2025 Corp (USD).

In other words, we believe that the recovery value could be even lower than current depressed pricing of around 30-40s. As such, we advise investors to exit from the bonds. – June 9, 2021

2021-06-10 20:08

chshzhd

n how he fool around with top 30 institution investors :)

2019-12-22 22:53