The MAGNIFICENT 7 of Bursa Malaysia - (KingKKK)

KingKKK

Publish date: Sun, 21 Jan 2024, 09:17 AM

Bursa Malaysia's Magnificent 7 are:

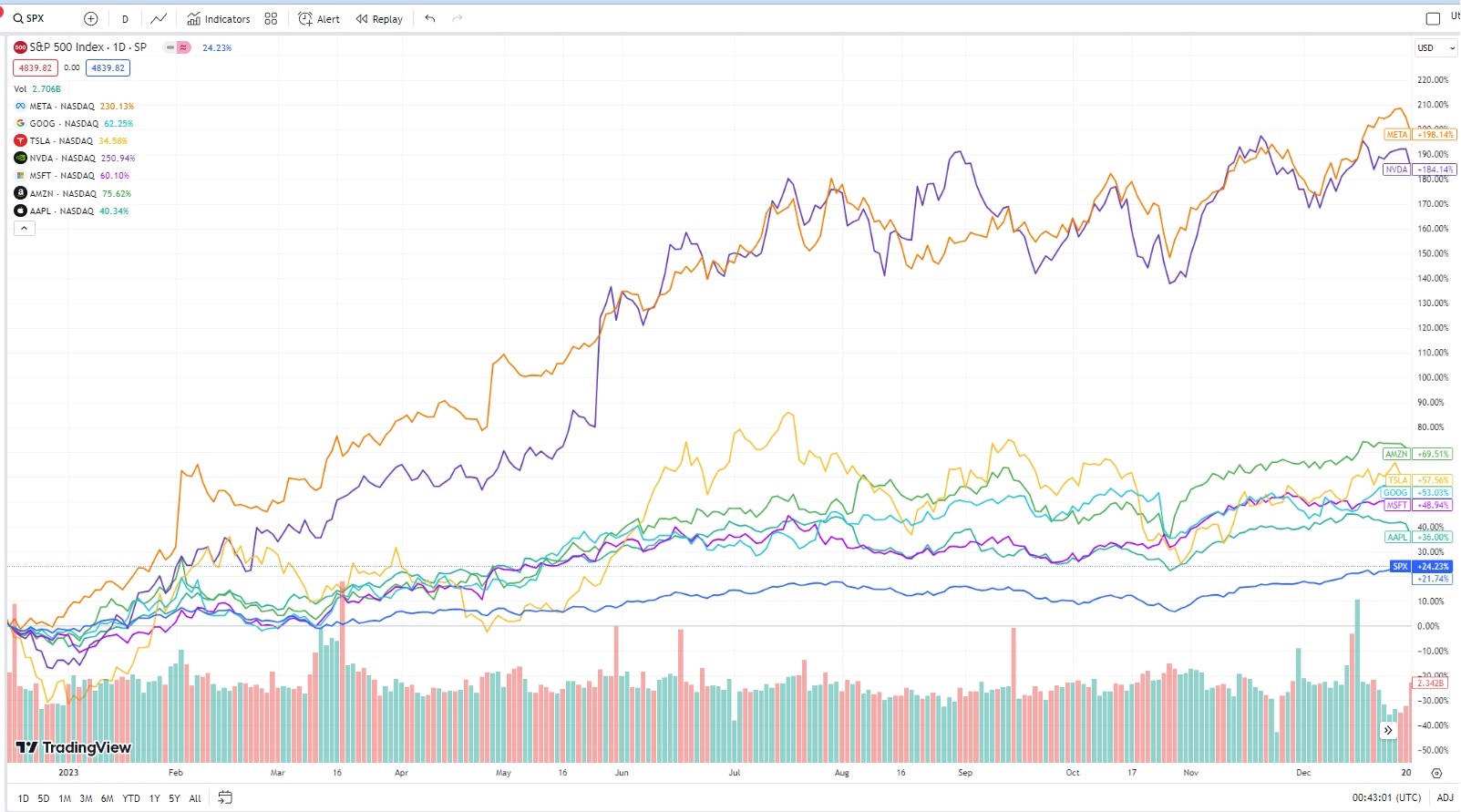

Background of US Magnificent 7

1. US Magnificent 7 outperformed S&P 500 in 2023

Magnificent 7 refers to a group of seven major technology companies that experienced exceptional performance in 2023:

- Nvidia (NVDA): Leader in graphic processing units (GPUs) and artificial intelligence (AI).

- Apple (AAPL): Tech giant renowned for its iPhones, Macs, and software ecosystem.

- Microsoft (MSFT): Software giant with dominant Cloud Computing and productivity software offerings.

- Amazon (AMZN): E-commerce powerhouse with growing cloud computing and streaming services.

- Alphabet (GOOG/GOOGL): Parent company of Google, dominating search engines and online advertising.

- Meta Platforms (META): Leading social media company with Facebook, Instagram, and WhatsApp.

- Tesla (TSLA): Electric vehicle pioneer driving innovation in automotive and clean energy.

Why are they called Malaysia Magnificent 7?

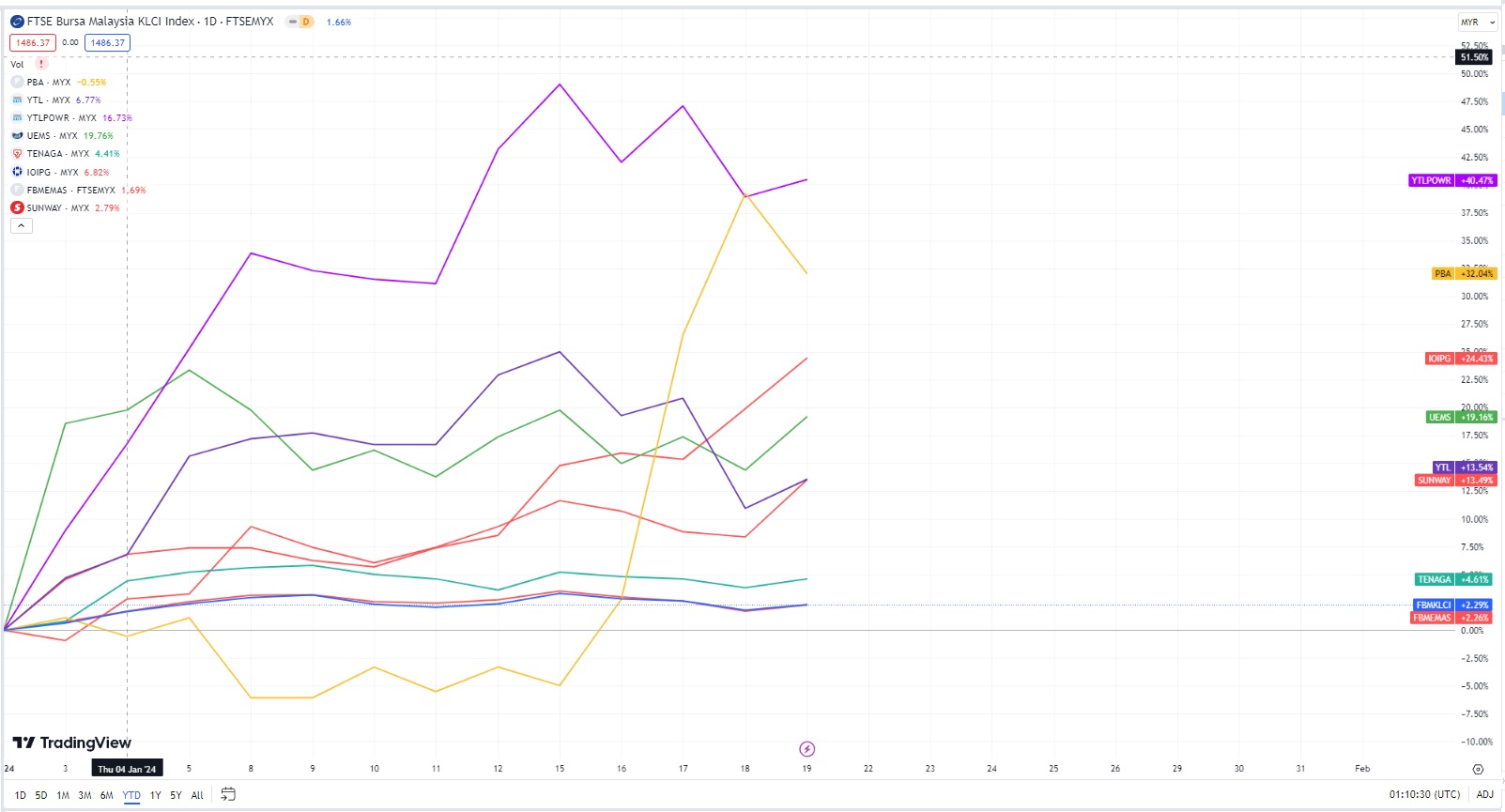

Malaysia Magnificient 7 are the counters that was not affected by the recent selldown. In mid-January, FBMKLCI declined due to negative sentiment from the some small-cap companies selldown. The details are in the news below. It has wiped off more than RM7 billion of market cap.

Small-cap selldown wipes off over RM7b market cap from 13 worst-hit counters (theedgemalaysia.com)

Against KLCI's 2%, these 7 are not affected and in fact still show positive return YTD. The return YTD are:

YTLPOWER - 40%

PBA - 32%

IOIPG - 24%

UEMS - 19%

YTL - 14%

SUNWAY - 13%

TENAGA - 5%

Why are these companies performed better and better and did not experience SELLDOWN? These are reasons these companies share price generated positive return YTD:

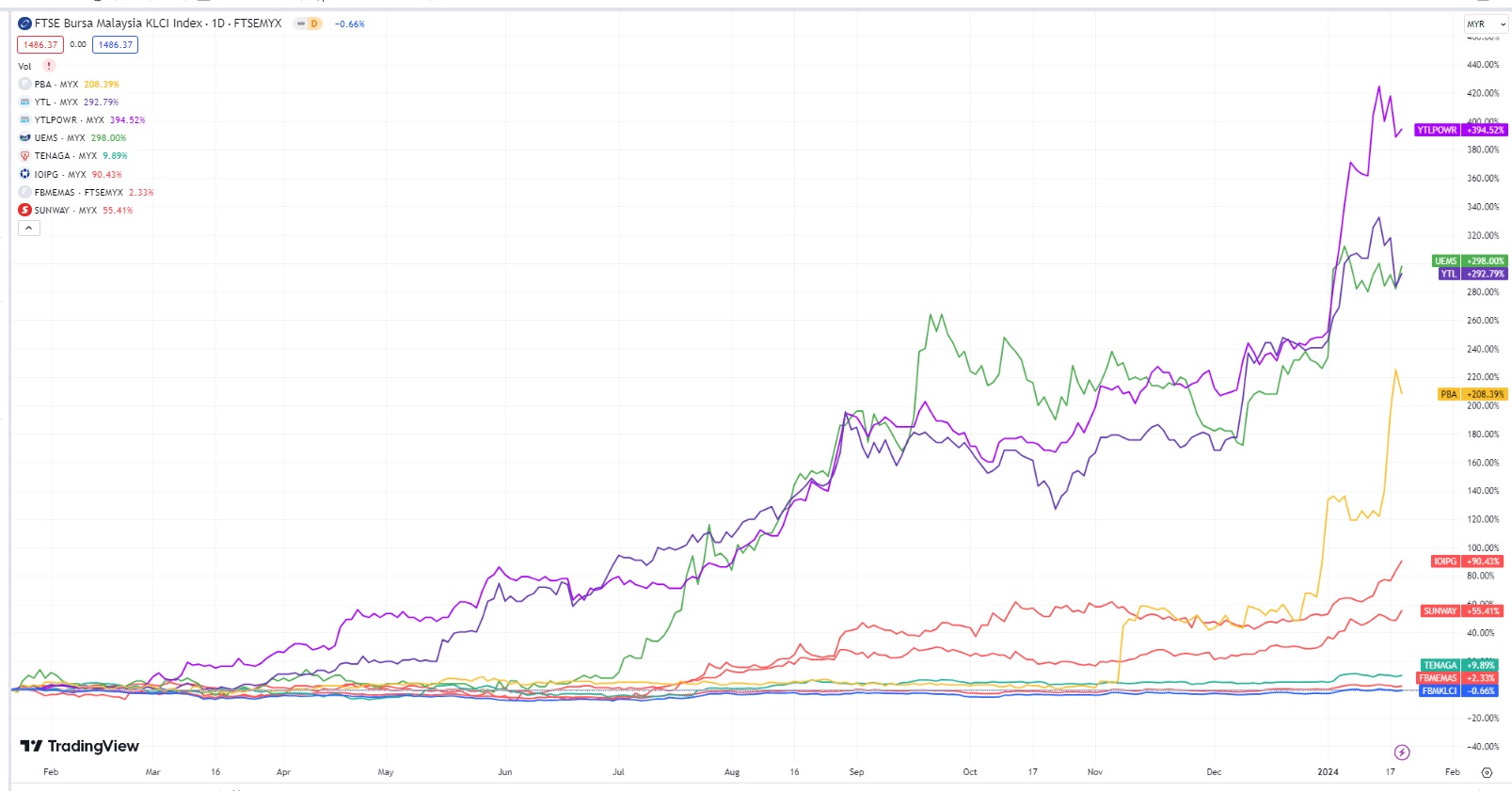

Strong Fundamentals: These companies generally possess strong financial fundamentals, such as consistent profitability, manageable debt levels, and healthy dividend payouts. This financial stability fosters investor confidence and attracts long-term investment, potentially driving their share prices higher than the broader market (especially weak fundamental company that are prone to sell off).

Growth Potential: The Magnificent 7 are actively pursuing promising growth opportunities. YTL Power's focus on renewable energy, UEMS's expansion plans, and IOIPG's land bank and sustainability initiatives are just a few examples. This potential for future growth can attract investors seeking higher returns, potentially propelling their share prices ahead.

Balance Sheet Bulwarks: While some listed companies has excessively high debt levels, the Magnificent 7 generally boasted sturdy balance sheets. Low debt-to-equity ratios and ample cash reserves provide them with resilience against economic downturns and flexibility for future investments. This stability attracts risk-averse investors seeking reliable long-term growth, potentially pushing their share prices ahead of the market. For example, PBA has net cash of RM193 million. Just the net cash only already 58 sen per share (close to 25% of its market price of RM2.39 now!)

Malaysia Magnificent 7 1-year performance

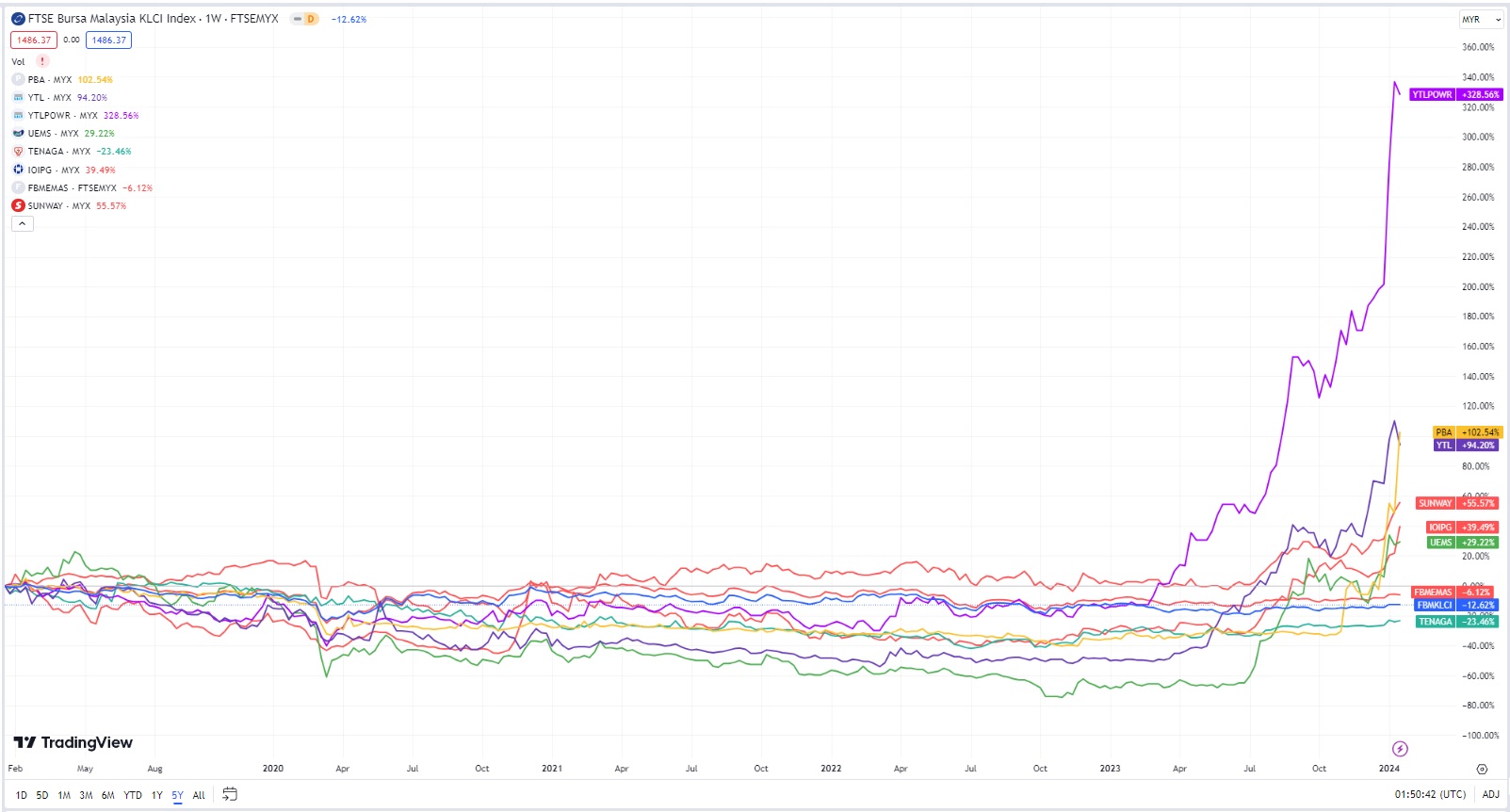

5-years performance

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-12-21

SUNWAY2024-12-21

TENAGA2024-12-21

TENAGA2024-12-21

YTL2024-12-21

YTL2024-12-21

YTLPOWR2024-12-21

YTLPOWR2024-12-20

SUNWAY2024-12-20

SUNWAY2024-12-20

TENAGA2024-12-20

TENAGA2024-12-20

UEMS2024-12-20

UEMS2024-12-20

UEMS2024-12-20

YTL2024-12-20

YTL2024-12-20

YTL2024-12-20

YTLPOWR2024-12-20

YTLPOWR2024-12-20

YTLPOWR2024-12-20

YTLPOWR2024-12-19

SUNWAY2024-12-19

SUNWAY2024-12-19

SUNWAY2024-12-19

TENAGA2024-12-19

TENAGA2024-12-19

TENAGA2024-12-19

TENAGA2024-12-19

TENAGA2024-12-19

YTL2024-12-19

YTLPOWR2024-12-19

YTLPOWR2024-12-19

YTLPOWR2024-12-19

YTLPOWR2024-12-19

YTLPOWR2024-12-18

IOIPG2024-12-18

SUNWAY2024-12-18

SUNWAY2024-12-18

SUNWAY2024-12-18

TENAGA2024-12-18

TENAGA2024-12-18

UEMS2024-12-18

UEMS2024-12-18

YTLPOWR2024-12-17

IOIPG2024-12-17

SUNWAY2024-12-17

SUNWAY2024-12-17

SUNWAY2024-12-17

TENAGA2024-12-17

YTL2024-12-17

YTLPOWR2024-12-17

YTLPOWR2024-12-16

IOIPG2024-12-16

SUNWAY2024-12-16

SUNWAY2024-12-16

SUNWAY2024-12-16

SUNWAY2024-12-16

SUNWAY2024-12-16

TENAGA2024-12-16

YTLPOWR2024-12-16

YTLPOWR2024-12-14

TENAGA2024-12-13

IOIPG2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

SUNWAY2024-12-13

TENAGA2024-12-13

TENAGA2024-12-13

TENAGA2024-12-13

YTLPOWR2024-12-12

IOIPG2024-12-12

SUNWAY2024-12-12

SUNWAY2024-12-12

SUNWAY2024-12-12

SUNWAY2024-12-12

TENAGA2024-12-11

IOIPG2024-12-11

SUNWAY2024-12-11

SUNWAY2024-12-11

SUNWAY2024-12-11

SUNWAY2024-12-11

SUNWAY2024-12-11

SUNWAY2024-12-11

SUNWAY2024-12-11

TENAGA2024-12-11

TENAGA2024-12-11

TENAGA2024-12-11

TENAGA2024-12-10

IOIPG2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

SUNWAY2024-12-10

TENAGA2024-12-10

TENAGA2024-12-10

TENAGA2024-12-10

TENAGA2024-12-10

UEMS2024-12-10

UEMS2024-12-10

YTL2024-12-10

YTLPOWRMore articles on Stock Market Enthusiast

Created by KingKKK | Dec 21, 2024

Created by KingKKK | Dec 13, 2024

Created by KingKKK | Dec 10, 2024

Created by KingKKK | Dec 07, 2024

wendy76

well-written article. Thank you KingKKK.

2024-01-21 15:59