VSTECS (5162) – New norm leads to better earnings

BuyCall

Publish date: Fri, 18 Dec 2020, 09:34 AM

For better reading experience, please visit original article:

VSTECS (5162) – New norm leads to better earnings

Nowadays Information and Communication Technologies (ICT), also known as your laptops, computers, internet, mobile phones and other technologies that we depend on to get things done in our daily life is so important to us that we can’t live without them.

Being one of the largest ICT distributors in Malaysia, Vstecs Berhad (Vstecs), a public listed company on the Main Market of our Bursa Malaysia, offers a comprehensive range of ICT products and enterprise systems originating from leading international ICT principals (global brands like HP, Apple, IJM and etc). These ICT products and enterprise systems are distributed to resellers comprising of retailers, system integrators and corporate dealers. According to its latest Annual Report 2019 , Vstecs is the authorised distributor for more than 40 world leading principals and with a nationwide channel network of more than 6,600 resellers (10 years ago they only have 2,500 resellers).

Principal Activities

Vstecs principal activities are categorised into 3 business segments:

1) ICT Distribution

Vstecs distributes a wide range of ICT products such as PCs, notebooks, printers, scanners, software and hardware from the industry’s leading brands to Vstecs’s resellers. Examples of the leading ICT principals represented by Vstecs are HP, Apple, Samsung, Microsoft, Adobe, Epson, Buffalo, Linksys, Canon, Autodesk, SonicWall, Symantec, Nortel, Philips, Extreme Networks and so on..

2) Enterprise Systems

Vstecs distributes value-added ICT products such as network and communication, server and software to their resellers comprise of mainly system integrators and corporate dealers. This includes design, install and implement ICT infrastructure systems and solutions by offering a complete range of enterprise servers, workgroup servers, operating systems, application software, system management tools and ICT security products. Leading ICT principals represented by Vstecs under this segment include Cisco, IMB, Juniper, Sun, Panduit, Red Hat, Printronix, Lexmark, Google, Blue Coat, Intermec and EMC.

3) ICT Services

Vstecs provides ICT services such as hardware support, maintenance and repair as part of their after-sale service. They also do consultation, designing of networks, installation of hardware and software and implementation and management of ICT systems for its clients.

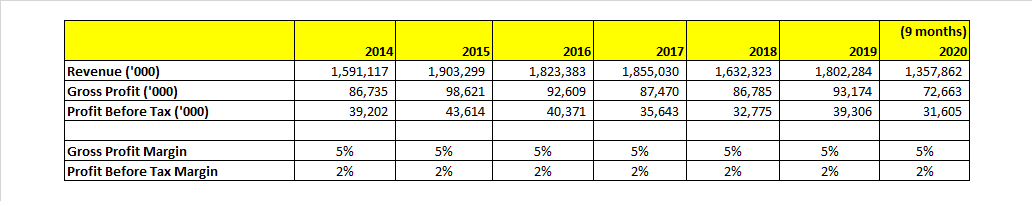

Past Performance

Since 2015, Vstecs’s revenue has been in the range of RM1.6bil to RM1.9bil. ICT Distribution business has always been a typical volume game, therefore its gross profit margins and profit before tax margins are thin and consistently at 5% and 2% respectively.

Well, you must be wondering how does Vstecs manage to perform fairly consistently throughout all these years with such thin profit margins to operate with.

This might be why:

a) Their long term partnership with leading major ICT principals

By working closely with their world leading principals, Vstecs will always be one step ahead of the game by knowing the latest direction and trends of the ICT industry. Therefore, they can make strategic decision and be one of the first in the market to obtain the latest ICT products that would be well-accepted in Malaysia.

b) Extensive network of resellers and end customers

After all these years, Vstecs have successfully established an extensive distribution network throughout Malaysia comprising more than 6,600 resellers who service end-customers in every category, from SMEs to large enterprises, government sector and consumers. Their large resellers network servicing a broad customer base will then provide Vstecs with a steady revenue stream for their products and services.

c) Better profit margins than competitors

By leveraging on their financial power and well established network of resellers, Vstecs is able to bargain for better margins when they order in bulk volume of ICT products from their principals. This is why even though their profit margins are low, Vstecs is still having a higher margins than other ICT players.

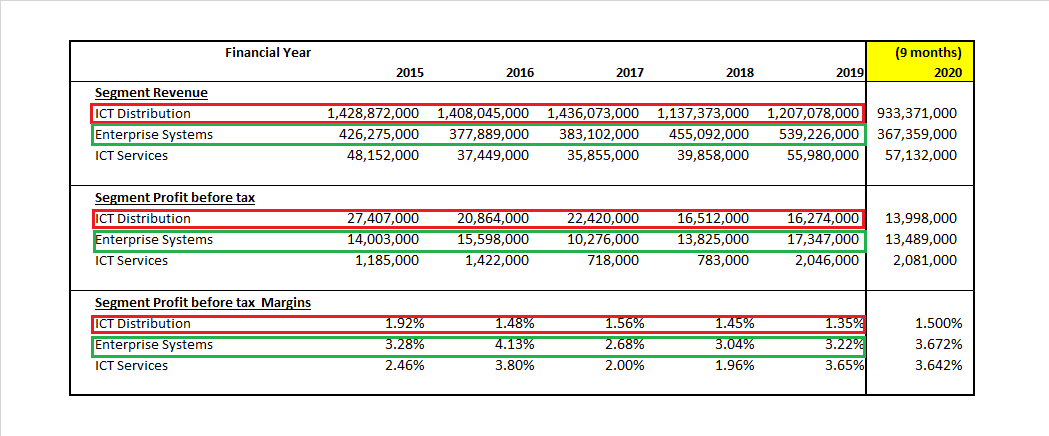

To have a better picture of how its revenue and profit are spread out, lets take a look into its segmental information:

It seems that Vstecs’s ICT Distribution segment is not doing as well as they did in the past. This is witnessed by the average decline in its revenue from 2015 to 2019 which led its profit before tax (PBT) to decline as well. Please take note, the percentage drop in PBT is far greater than its revenue, which means that profit margin of its ICT Distribution segment is dropping too (from 1.831% in 2015 to 1.349% in 2019), which represents a 26.3% drop in PBT margin! This is not apparent on the surface due to the improvement in its Enterprise Systems segment which mitigated the reduction in profit from ICT Distribution segment towards its bottom line.

The decline in its ICT Distribution business segment might be due to the fragmented market that Vstecs is currently operating in. The rise of e-commerce has also threatened the business of its resellers as their end-customers are able to purchase directly and conveniently through e-commerce platform from other ICT sellers. To overcome this issue, Vstecs started to sell their products directly to end-customers through e-commerce platforms too to reduce their dependence on resellers. Currently, they have close to 15 self-managing authorized online stores on platforms like Lazada and Shoppee. This has proven to be effective as its revenue and PBT margin have slightly improved in 2020.

Well this is not the end of the story, as its ICT Distribution is not the area that interest me. What really caught my attention is its Enterprise Systems segment. As you can see, the PBT margin for Enterprise Systems business is more than double of its ICT Distribution business. Over the last four years, the group has been putting their focus on Enterprise Systems which yields a higher profit margin. This is witnessed by the gradual increase in the revenue and profit before tax under their Enterprise Systems segment.

According to Vstecs’s CEO, despite the Covid-19 outbreak, the demand for enterprise systems remains strong as banks, telecommunication operators and hospitals see the need to upgrade their infrastructure, namely servers, network equipment, security products and storage devices. He seems pretty confident that the enterprise segment will continue to grow going forward.

Covid19’s effect – New Norm

Due to the Covid19 pandemic, many companies have implemented the work from home policy to prevent the Covid19 virus from spreading. Lately, although our government has implemented a much relaxed movement control order SOPs, many companies are still encouraging their staff to work from home on alternative day. During times like this, IT infrastructure of a company is crucially important in order for businesses to run smoothly, safely, and efficiently. This is why corporates, government agencies, and other businesses are spending on IT stuff like servers, network infrastructure, video conferencing equipment, cloud computing, cyber security software and many other things. Besides ensuring a smooth daily operation, in long run their investments on IT infrastructure will yield them a better return due to the increased work efficiency (which means increased production rate and lower operational cost).

Even after the pandemic is over, I believe this new norm will remain. This is because most businesses had to change their business model in order to adapt to the pandemic. And it happened that a better and faster IT infrastructure is the perfect solution for them to increase productivity and efficiency. A lot of businesses had to switch their traditional door business to online in order to survive. All these events will benefit Vstecs as they are the market leader in this industry. Post-pandemic, old traditioned businesses that do not leverage on latest ICT technologies will then slowly be eliminated.

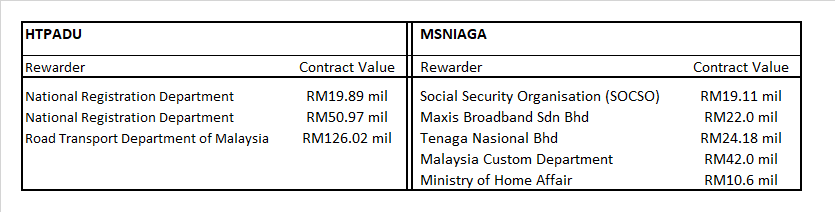

Indirect beneficiary of Government and Large Organization Contracts

Under Vstecs’ Enterprise Systems and ICT services division, their resellers comprise mainly system integrators and corporate dealers. As disclosed by the CEO Mr. Soong, among their system integrator resellers are two locally listed companies, namely Heitech Padu Bhd (Htpadu) and Mesiniaga Bhd (Msniaga). Htpadu and Msniaga are both IT-related service companies that sell complete IT solutions to government and other large organizations.

In the year 2020 alone, Htpadu and Msniaga both have been rewarded by numerous contracts from the government and other large organizations. The followings are the contract rewarder and the contract value:

and Htpadu and Msniaga are just 2 companies out of the 6,600 resellers that are under Vstecs’s resellers network.

VSTECS’s Future Prospect moving forward

Vstecs is in the perfect position to take advantage of the industry trend which is much inclined to the adoption of advanced ICT technologies and solutions.

These are the few out of many points which I believe the current and near future market environment will benefit Vstecs a whole lot:

- The change in companies’ business model, many have switched their traditional door business to online business

- In order to compete among each other, businesses require digital transformation such as better and faster IT solutions to stay on top of the game

- Servers and cloud computing have been so crucial during the pandemic period due to the increase bandwitdth usage and data transfer, this trend will continue

- 5G infrastructure is coming. To accommodate 5G network, all ICT products (especially smart phones) are to be renewed in order to support 5G network (this might be the catalyst to move Vstecs)

- The increase adoption of online purchase behavior by end-customers will further complement Vstecs business and profit margins

- The implementation of Industrial 4.0 in businesses for automation work flow

- Government’s vision for Digital Transformation across the country with different initiatives taking place

To further improve its business, Vstecs had acquired 40% stake in ISATEC Sdn Bhd which specializes in digital process automation, mobile & software engineering, system consulting, and digital performance management. The new synergy through its association with ISATEC could further improve business growth and better profit margin in near future.

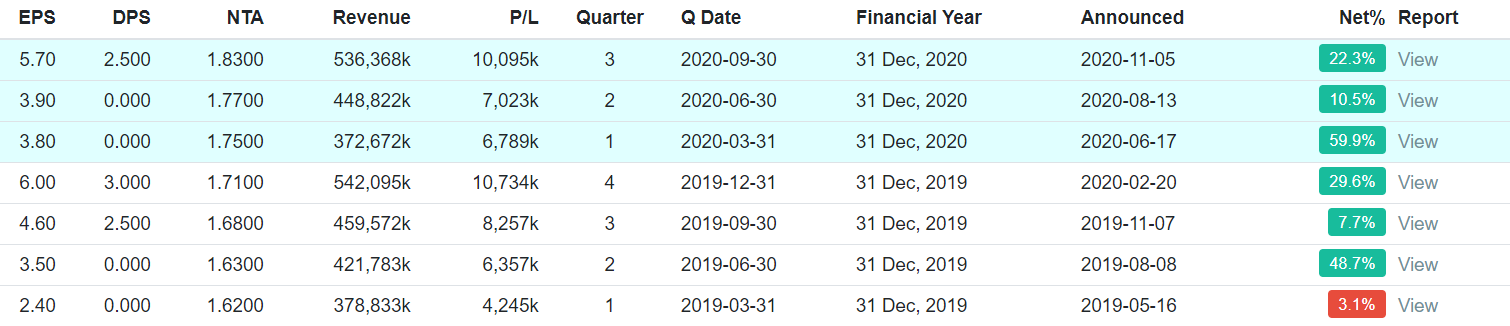

Simple PE Valuation

Vstecs is currently trading at the PE of 11, which I think is reasonable. Historically, the stock was trading on an average low PE of 8 times. Some claim that Vstecs is a technology company and should be trading at a PE of above 25. Although Vstecs is selling ICT technologies devices and services, their nature of business is mainly import and distribute technology items from suppliers. Hence, the company is more of a consumer product than a technology company (personal opinion).

Traditionally, Vstecs always record their best quarter result on the 4th quarter of their financial year due to the year end spending from personal users, corporates and government. Given the favorable market environment Vstecs is in now, I believe it is reasonable to assume that next quarter Vstecs could register a 15% growth in EPS as compared to its previous quarter. This will amount to an EPS of 6.56 sen.

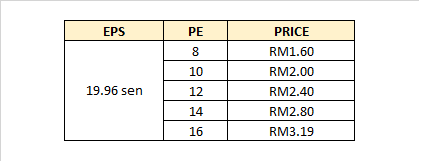

The new annualized EPS will then be 19.96 sen (6.56+5.70+3.90+3.80). Simple calculation to illustrate the possible future price for Vstecs:

Personally, I think Vstecs deserve a PE range of 12-14 which is slightly more than their current PE due to the potential growth of its Enterprise Systems segment. A growing company deserves to have a higher PE as investors are willing to pay a higher price for a growing company. IF you were to assume additional growth for its future quarters year-on-year, the company could be even more undervalue.

Risks

Besides the usual business risks that have been covered in their annual report every year, there are a few risks that could happen:

- I might be wrong on the capex spending by companies. It could turn out that most companies actually prefer to save cost and preserve cash post pandemic

- Due to the instability of the government and politics, contracts for new projects might be on hold

- Another round of MCO lockdowns which might disrupt its supplies

Technical Analysis

Based on Vstecs’s daily chart, the stock is still consolidating between the price range RM1.80 to RM2.275 at low volume. While consolidating, the stock is forming higher lows and higher highs with RSI crossing above 20. We have an immediate support at RM2.020 and immediate resistance at RM2.275.

Few things to take note:

- Price is trading below 20-days moving average

- MACD – blue line has crossed below red line and moving below zero (down trending)

- The stock is trading below its trend line

For those who are not willing to take a lot of risk, you can wait for the following signals to appear before entry:

- The price to cross its 20-days moving average

- MACD – Blue line crosses red line above zero

- The price to cross above its trend line, and stay above the trend line

Immediate Support 1: RM2.02

Immediate Support 2: RM1.82

Immediate Resistance 1: RM2.275

Immediate Resistance 2: RM2.495

My Opinion

To be honest, I was not interested in Vstecs before, not until its last quarter result that caught my attention, which got me to research a tad bit of the company.

Due to the pandemic, the market environment has changed. It has changed in favor of Vstecs in the sense that for the very first time the importance of the need for better ICT infrastructures and devices are felt by everyone, including students, employees, corporates, and government agencies. The management’s decision to shift their focus to Enterprise Systems segment for better margins yield was wise and timely.

Even before the pandemic, Vstecs was a fine company. Despite their thin profit margin, they have never incurred any losses before for the past 10 years (I only checked 2010-2020). Vstecs is also a net cash company since 2010 with generous dividend payout (again, I only checked 2010-2020). Back then, the stock was more of a dividend play stock rather than a capital gain stock.

At its current PE 11, the stock is not expensive either. It is very likely that Vstecs will record a better year-on-year result for its next two quarters, which will eventually bring its PE down to less than 10. Due to its ultra-thin margin business, Vstecs’s average PE has always been below 10. Going forward, investors might be willing to give Vstecs a higher PE valuation when its Enterprise Systems segment is growing with better margin.

With the future trend inclining towards digital transformation such as 5G ecosystem and Industrial 4.0, coupled with Government’s initiatives such as the National Fiberisation and Connectivity Plan (NFCP) to build a high-quality digital infrastructure across the country, I believe Vstecs is well positioned to benefit from it.

Based on my assumptions and analysis, the stock is worth at least RM2.80, but this should not be treated as a target price because target price changes all the time in accordance to the performance of the company. Well, my whole story on the company and its future trend are rely on the assumptions that I have made, and only time can tell whether it is going to realise. This is why it is really important to practice your technical analysis as well. In case I am wrong on the fundamental aspect, I have my technical analysis to protect my capital moving forward.

Read and invest at your own risk.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

DISCLAIMER

This post is completely for education and discussion purpose only. The author of this post does not have the required licenses to provide any investment advice or induce any trade for the readers here. Therefore, it should not to be taken as investment advice or inducement to trade and the Author take no responsibility for any gains or losses as a result of reading the contents herein. Please invest at your own risk.

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Buy Call - Stock Analysis & Insight

Created by BuyCall | Feb 01, 2021

Created by BuyCall | Jan 26, 2021

failfish

very details analysis thanks

2021-01-14 23:27