HENGYUAN Part 6 (Valuation)

davidtslim

Publish date: Fri, 03 Nov 2017, 09:21 AM

Oil refinery is a capital-intensive business. Planning, designing, permitting and building a new medium-sized refinery is a 3-5 year process, and can costs USD3-7 billion (RM12.6-29.4 billion). The cost varies depending on the location (land cost) and country (local environmental regulations). Adding new capacity or complexity to an existing refinery is also expensive. The recent 45,000 bpd expansion of the Consumers Co-op refinery in Regina, SK cost CAD2.7 billion (1 CAD = 0.8 USD). The cost of the now shelved project by Irving Oil to build a second 300,000 bpd refinery in Saint John, Canada was estimated at CAD8+ billion. Petronm’s proposal for doubling its refinery capacity to 150kbpd from 88kbpd also cost USD1.5 to 2 billion or RM6.4 billion+.

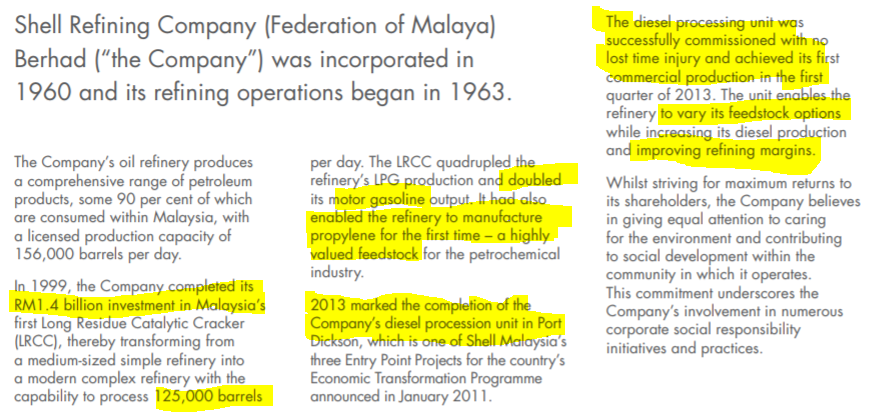

For Hengyuan, its predecessor (Shell) has completed a RM1.4 billion upgrade in 1999 and another upgrade in 2013 for LRCC and diesel processing unit respectively as shown in the snapshot below:

Source: Annual report 2014

Let summarize the cost for building new and upgrade exiting refineries in South East Asia as table below

|

|

Estimated Cost |

Remarks |

|

Petronas Rapid new refinery (300kbpd) |

RM60 billion

|

In progress, target to complete in 2019 |

|

Petron Corp Philippines (upgrade or top-up 100kbpd) |

USD5-10 billion (upgrade existing)

New 200 kbpd cost USD20 billion |

Final proposal stage |

|

Petronm Upgrade from 88kbpd to 150kbpd |

RM6.4 billion |

Proposal stage |

|

HengYuan |

RM1.4 billion upgrade in 1999 and another upgrade in 2013 |

Rated capacity is 125kbpd with license capacity of 156kbpd |

Rapid cost Sources: http://www.thestar.com.my/business/business-news/2017/03/04/whats-the-deal-in-rapid/

http://ww1.utusan.com.my/utusan/info.asp?y=2011&dt=0514&sec=Muka_Hadapan&pg=mh_01.htm

Petron & Petronm sources: http://www.malaya.com.ph/business-news/business/pnoc-offers-limay-land-petron%C2%A0expansion

https://www.rappler.com/business/170029-petron-new-petrochemical-plant-ang

Average cost for building new refinery in MALAYSIA (Petronas RAPID and Petron Corp Philippines)

= (60+84) billion / (300+ 200) kbpd

= RM0.288 billion or RM288 mil per 1kbpd

Average cost for upgrade existing refinery (Petronm, just upgrade 62 kpbd from 88 to 150)

= 6.4 billion / 62 kbpd

= RM0.103 billion or RM103 mil per 1kbpd

HY current market cap is around RM2.5 billion. If we calculate its valuation for its kilo barrel per day (kbpd):

Market Valuation of 1 kilo barrel capacity of HY (based on HY current whole market capital)

= 2500mil / 125 = RM20 mil for every 1kbpd.

(I use market capital in the above calculation due to HengYuan’s Enterprise Value, EV works out about the same as its Market Capital considering its cash in hand and inventories are more than enough to offset its debt)

Let compare Hengyuan’s 1kpbd valuation with average cost to build a new refinery or upgrade existing refinery in Malaysia based on current market price in the table below:

|

|

Average cost for 1kbpd new refinery |

Cost for 1kbpd upgrade existing |

|

Petronas Rapid, Petronm |

RM288 mil per 1kbpd |

RM103 mil per 1kbpd |

|

HengYuan |

Market valuation for its 1kbpd is RM20mil based on RM8.3 per share |

HY still has some reserve lands for future upgrade in Port Dickson. |

Let see how much profit of the 125kbpd refinery capacity of Hengyuan can earn in a year based on current crack spread of about USD9 (assume 90% utilization rate and no major shut down). HY’s 2016 annual report shows that its annual production volume in 2016 is 37.5 mil barrels (112.5 kbpd X 333 days) (average operation availability of HY in past 5 years is 91.9%)

90% utilization rate = 0.9 X 125k = 112.5kbpd

Based on average of USD9 crack spread, its gross profit margin (GPM) (Mogas 95 crack now more than USD10)

GPM per year = 112.5k X 9 X 4.2 X 333 days = RM1416 mil

Let assume HY needs operation, finance and admin cost of RM579 mil (from Q1+Q2 and annualize), HY possible annual net profit is around RM837 mil.

This profit estimation is by assumption of USD9 spread can be maintained throughout the year of 2017 (just left 2 months) and no unplanned shut down.

I leave it to you to judge whether it is cheap or not for a possible net profit of RM800 mil++ for its whole market valuation of RM2500 mil (2.5 billion).

As we may aware, HY may need considerable high capital expenditure for maintenance and environmental compliance. Let assume HY average capex of RM300 mil per year (2017 no major capex but 2018 will has a Euro 4 upgrade), this capex may affect cash flow (not profit) but remember HY has high depreciation of about RM50 mil per quarter (RM200 mil per year). So I think cash flow will not be affected too much as deprecation will be added back to cash flow (depreciation can offset the capex).

Maybe we can give a 20% discount (for lower utilization rate or further shut down) for my profit estimation that HY still can generate RM670 mil net profit for a market capital of RM2500 mil (less than 4 years can earn back whole market cap).

It is worth noting that Hengyuan has generated RM524 mil free cash flow within 6 months of 2017 (accounting profit for 6 months of RM363.8 mi). From past 3 quarters records, HY has about RM50 mil+ depreciation per quarter from plant, property and equipment which can help to generate strong cash flow (depreciation also can save income tax expenses).

Let see a more financial valuation for Hengyuan in term ROIC.

Return on invested capital (ROIC) is a profitability ratio that measures the return generated from the available capital. ROIC tells us how good a company is at turning capital into profits.

The equation for ROIC is:

ROIC = (Net income - Dividends ) / (Net Debt + Equity )

For Hengyuan ROIC can be calculated as below (using trailing 12-month profit):

ROIC = 490 mil / (572 + 1,324) mil X 100%

= 25.84%

A rate of ROIC 15-20% per year is considered good ratio especially for refinery. ROIC is a useful indicator for company that invests a large amount of capital, like refinery, oil and gas companies to measure its strength of turning capital into profit. ROIC of 25.84% indicates Hengyuan is super efficient in turning investors’ capital into profits.

Let see some key financial data of HY as table below:

|

|

Hengyuan (up to Q2 result) |

Hengyuan (upcoming Q3 result) |

|

ROIC |

25.84% |

? expect to improve |

|

ROE |

33.27% |

? |

|

PE |

5.1 |

? expect to improve a lot |

|

EV/EBIT (< 8 is good) |

5.44 |

? expect to improve |

|

Cash & Equivalents |

743.5 mil |

? |

|

Total debt |

1316 mil |

Should be maintained |

|

Inventories |

1,127.9mil |

?Value already increased based on 30 Sept oil price and refined products (Mogas 95 price at USD73 now) |

|

Net debt |

572.4 mil |

? |

One of my favourite measures of a company's ability to use capital efficiently is ROIC. It includes the company debt in the calculation and provides insight into a company's ability to generate returns of the total invested capital. If ROIC is too low (say at 4%), the company may not able to pay its borrowings or bank loan interest (normally 5%++). In contract, ROE calculation did not include the debt of the company.

Coming Q3 Profit

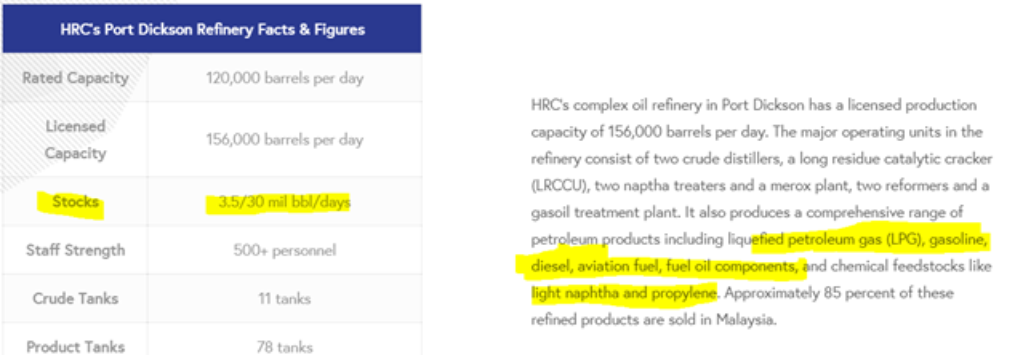

This article I do not want to estimate the profit for Q3’17 but more to paint a possible profit estimation picture for you to imagine. Some of you may aware that Hengyuan will has inventory gain and high product spread (margin) in Q3’17. I would expect a strong coming Q3 result. How strong the result will be? Let see the possible stock or inventory gain of Hengyuan refinery co (HRC) as per in their website (hrc.com.my)

Source: hrc.com.my

The table shows that Hengyuan traditionally keeps 3.5 mil barrels (mil bbl) or 30 days stock of crude oil (this is likely as its inventories value is RM1127.9 mil). Brent oil closing price on 30 Sept is about USD57 and closing price on 30 March is USD48.2. The actual inventory gain may not be so high by using direct subtraction of two closing prices (conservatively can take 50% of the difference of the closing prices X 3.5 mil).

Let see how much the Mogas 92 crack spread (product margin) future from CME data as below (up to Sept):

Source: CME website

I leave for you to estimate for the possible profit for Q3’17 in view of high product margin and inventory gain.

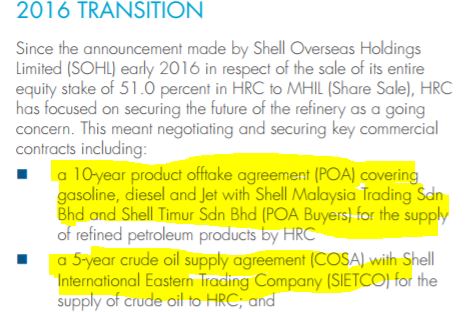

Some of you may afraid after RAPID project is completed in 2019, HY (or HRC) may face higher competition or Shell may not buy from HY (HRC). Let see the following excerpt from annual report 2016 as below:

Source: Annual report 2016 (page 45)

There is a 10-year product offtake agreement (POA) between Sheel Malaysia and HRC (HY) for their gasoline, diesel and Jet fuel products. That mean HRC no need to worry about demand of their product and in fact Shell total sales volume is larger than the total product throughput of HRC.

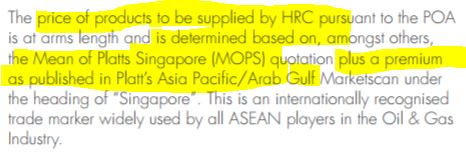

The annual report also mentioned that the price of selling of the POA is based on MOPS (Platts) of Singapore plus a premium as published in Platt’ Asia Pacific. That mean there is no special discount given to Shell and the selling price is based on Market Price.

Source: Annual report 2016 (page 45)

Besides, there is also a 5-year COSA agreement signed between HRC and Shell to ensure the continuity of supply of crude oil to HRC. The price of the crude oil supplied to HRC is based on the prevailing market crude oil price (based on Platts).

Source: Annual report 2016 (page 45)

From these excerpts, I can conclude that as long as crude oil price is stable and crack spread margin is maintained at USD6 and above, HY (HRC) will be in good profitable position. If crack spread maintained at USD9 and above, HY should enjoy super strong profit and cash flow generation (which was happened in Q1’17 and possible to happen in Q3’17 and Q4’17 IF no major unplanned shut down.

Inventory Value

As I mentioned in my part 4 article before, Hengyuan has increased its inventories to RM1.1 billion in Q2’17. As some of you may aware, Hengyuang has two term loans (total USD350 mil) to be paid in 5 years. What attracts my attention is the collaterals for these term loans include its inventories. Let see the excerpt below from Hengyuan quarter report to have a look on what are the collaterals for these term loan.

Source: Q4’16 report

From the above, inventories are one of the collaterals other than lands and buildings. That means Hengyuan’s inventories (highly liquidable) are treated as valuable collaterals for banks.

With crude oil price rally in Q3 (USD48.2 to USD57) and Q4 (USD60 end of Oct), there will be considerable big amount of unrealized inventory gain in coming quarter result. On top of this inventory gain, the average crack spread (profit margin) in Q3 mostly around USD10 and Q4 (up to end of Oct) mostly maintain above USD9.5 per barrel. This is like double bonuses for Hengyuan to reap high gross profit margin when still have some on-paper inventory gain.

Asia Refinery Outlook

Some of you may worry about electric vehicle may affect the demand of crude oil and its refined products in coming 10-20 years. Let us go through news from International Energy Agency for the future oil refined products demand (Thestar online)

The key excerpt from this news as below:

From this news, the demands for refined products are still strong in the next 10-20 years according to International Energy Agency.

Let see another news for Asia refinery company profit and its expected outlook.

Risk

1. Unplanned shut down due to unexpected machines or refinery system break down.

2. Fire or explosion due to accident.

3. High Capex expenditure for Euro 4 (RM580 mil) and maintenenace but all these expenses can be easily earned back by high profit margin in 2017. Refinery outlook in 2018 should be bright according to International Energy Agency.

Summary

1. Market Valuation of Hengyuan is relatively low based on cost to build a new or upgrading an existing refinery. Its 125 kpbd rated capacity is just valued at RM2.5 billion while Petronas RAPID project cost for 300 kbpd exceed RM60 billion and Petronm proposed upgrade cost estimation is RM6.4 billion for just 62 kbpd (from 88 kbpd to 156 kbpd). This new setup and upgrade costing are based on the Malaysia costing as both companies are running refineries in Malaysia.

2. Forward 6-month PE of Hengyuan could be very attractive based on current crack spread (profit margin). Even current trailing 12-monthPE of HY is just around 5 based on price of RM8.3.

3. The high quality of Hengyuan earning is supported by strong ROIC (25.8%), ROE (33.2%), low ratio of EV/EBIT (5.4) and strong cash flow generation from operation.

4. There is a 10-year product offtake agreement (POA) between Sheel Malaysia and HRC (HY) for their gasoline, diesel and Jet fuel products. That means HRC no need to worry about demand of their products in coming 9 years.

5. The outlook for refined products is still bright in the next 10-20 years according to International Energy Agency due to growing populations and vehicles in South East Asia countries.

6. The past 3 months (Q3), the coming 3 month (Q4) profit outlook, 2018 refinery outlook all are positive from the data that I can gather. There is no demands issue for Hengyuan, low risk of bad debt (as customer is Shell international giant) and let wait for coming Q3 result to be released by end of Nov.

If you interested on my analysis report, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Future Potential of HengYuan

Created by davidtslim | Jan 19, 2018

Discussions

agree..this article is like an X-ray (or MRI scan) + Psychology analysis done by a doctor...on a beautiful young woman...

inside and outside all covered.

if only the doctor is 'man enough'.....he he

2017-11-03 10:31

the recent blessings from Harvey (temporary phenomenon) is that at the least its debts and capex requirement will be met....and that is a long term permanent effect on the health of HY.

Harvey was basically an immunization injection.

2017-11-03 11:06

Beside Shell Malaysia, any other customers? What are the percentages distribution among customers?

2017-11-03 11:11

Oil Traders Set Sights on Seas as Diesel Renaissance Is Born (1)

Heesu Lee and Debjit ChakrabortyNov 02, 2017 2:40 am ET

(Bloomberg) -- It was only two years ago that the world’s biggest oil market was awash with diesel and profits from making the fuel cratered. Now the refined product is getting a new lease of life, and more demand is poised to emerge from the sea.

With crude’s bull market being underpinned by diesel consumption, Asian refiners could soon be scrambling to meet further appetite as a maritime rule in 2020 seeks to replace dirtier fuel that runs tankers. While shippers could add technology that’ll clean up their traditional power source, it’ll mean investing millions of dollars in each vessel -- an expense they may not be prepared to bear. Their other option is to use diesel.

“By 2020 is too short a time to find an alternative other than to shift to marine gasoil,” said Rakesh Mehra, Dubai-based strategic advisor at Gulf Petrochem Group, a company that runs a refinery in the Middle East as well as trades fuels and operates storage terminals. “This will drive diesel demand and that’s going to stay.”

The renaissance in diesel, also known as gasoil, has contributed to the surge in global benchmark Brent crude to the highest level in more than two years. It’s a far cry from 2015 when a flood of exports from China swamped the Asian market, dragging profits from making the fuel in the region to below $8 a barrel and the lowest level in at least five years.

After the average annual diesel margin in Asia declined for the past three years, it has rebounded in 2017 to more than $12 a barrel as industrial activity picks up in the region. Unexpected refinery outages at plants from Europe to the U.S. due to fires and hurricanes have also contributed to a slump in stockpiles of the fuel. China’s exports, meanwhile, dropped in September to the lowest since January as domestic demand increased.

More good news is coming in the form of the fight against pollution. The International Maritime Organization, a global shipping regulator, will cap the limit on sulfur content in fuel oil -- a residue from the refining process that’s used to power ships -- to 0.5 percent in 2020 from 3.5 percent now. One way of meeting the new emissions standards is to use an exhaust gas cleaning system, or scrubbers, that removes pollutants before they’re released into the atmosphere.

Shipping Uncertainty

Vessel owners may be skeptical about whether this technology, still in its infancy, will be economical in the long term. The uncertainty over how the rules will be implemented, as well as concerns the IMO could one day impose stricter regulations that render newly installed scrubbers obsolete, is keeping shippers on the sidelines, said Rahul Kapoor, an analyst at Bloomberg Intelligence.

“The easiest option, therefore, is to switch over to gasoil,” Gulf Petrochem’s Mehra said. “Gasoil with 0.1 percent sulfur is easily available.”

Most shippers will use less sulfurous diesel than spend $4 million to $10 million per ship to add scrubbers, Kapoor estimates. Just one out of every five ships that have come to the market in the last five years will install the cleaning system by 2020, said Suresh Sivanandam, a senior research manager for Asia refining at Wood Mackenzie Ltd.

Diesel consumption in Asia, home to nine of the 10 largest container ports in the world, will rise by an annual average rate of 5 percent from 2020 through 2026, according to BMI Research. That compares with growth of 1.6 percent a year from 2017 to 2019.

Profits in Asia from turning benchmark Dubai crude into diesel, known as the crack spread, more than doubled to $15.37 a barrel in September versus a record low in April 2016, according to data compiled by Bloomberg going back to 2010. It was at $12.35 as of 3:26 p.m. Seoul time on Thursday. Inventories in Asia are also tightening, with onshore middle distillate stockpiles in Singapore shrinking to 11.5 million barrels, down 22 percent from their peak in 2015, the year China began significantly increasing its overseas diesel shipments.

“These regulations are definitely good for refiners, especially in Asia,” said Arun Kumar Sharma, finance director of Indian Oil Corp., the nation’s biggest refiner. “Opening up of a new market for gasoil will further improve diesel cracks.”

Demand is likely to gain by as much as 300,000 barrels a day for gasoil in 2020, while fuel oil consumption may drop by 350,000 barrels daily, according to Ehsan Ul-Haq, a London-based director of crude oil and refined products at Resource Economist.

“By around 2020, the diesel market even looks tight unless refiners do something about it,” said Ul-Haq. “And there’s not much time left.”

2017-11-03 14:35

Even if we assume the latest qtr earnings (~ 30 cents per qtr) is how we can expect for long term, considering its depreciation of 50M, its generating an average cash flow of 150M per qtr.

That is Cash per share of RM2 per annum. At ~ RM 8 share price, it gives a cash yield of 25%

With Cash yield of 25% + enough Cash reserve and inventory, risk is very minimal.

Doubling the current price with 50% payout still gives a dividend yield of 7.5%.

Perception and impression will change when the Cash reserve offsets its Debt.

If the crude price sustains at this level, huge inventory gain for qtr ending Sept 17 will be translated as cash by end of Dec 17.

2017-11-04 14:24

with a 10 year product off-take agreement with Shell at MOPS crack spread, basically HY had ensured that it will generate RM 20 cash per share in 10 years using EPS of of just 30 Cents per qtr.

Note that at an average crack spread of just 6 USD/barrel, it will generate EPS of 45 cents per qtr.

so, people worried about demand..can forget worrying on that for next 10 years.

Well argued by David!

2017-11-04 15:01

Great effort. Pls factor in hedging and actual gross refinery margin not just mogas Crack spread. It mislead retailers resulting buy or a sell at current price le

2017-11-04 15:06

aiyoh...hedging is a neutral issue mah, how to factor in leh ??

Crack spread and refining margin is quite similiar loh, the higher the crack spread the higher the refining margin and vice versa loh...!!

2017-11-04 15:55

The cost of investment of a new refinery dictates the expected return and thus the crack spread going forward.

One can work back from the Investment figures presented by David above, where the crack spread work out to be minimum 6 USD/brl to justify the investment, considering cost of capital of 10%.

Since the projected demand growth is higher than the new refinery investment capacity taking place....there is a natural force to sustain the margin above this level.

2017-11-04 16:02

Raider think david lim has missed out the investment of Rm 700m that HRC going to do loh....!!

But even after the xtra investment, HRC is still the cheapest refinery available loh....!!

After the investment of Rm 700m, HRC refinery useful life is extended to 2050 loh...!!

2017-11-04 16:05

UPDATE 1-Repsol profit leaps on refining and crude price gains

Reuters Staff

2 Min Read

(Adds details, opening share price)

MADRID, Nov 3 (Reuters) - Spanish oil major Repsol posted close to a 90 percent jump in third-quarter adjusted net profit after higher oil prices boosted its production division while its refining arm remained highly profitable.

Repsol’s performance echoed that of European competitors Shell, Total and BP, which all reported stronger quarterly profit on the back of the recovery in crude prices.

Average recurring net profit adjusted for one-off gains and inventory effects (CCS net profit) came in at 576 million euros ($671 million) in the July-September period, compared with a 553 million euro consensus in a Reuters poll of analysts.

Third-quarter production reached 695,000 barrels per day (bpd), versus 671,000 bpd in the same period of 2016 while the refining margin was $7 a barrel, up from $5.10 a year ago.

Net debt fell to 6.97 billion euros at Sept. 30, from 7.48 billion euros three months earlier, and is on track for the year-end target of less than 7 billion euros.

At the market open, Repsol shares edged up by 0.4 percent to 16.21 euros. ($1 = 0.8580 euros) (Reporting by Jose Elias Rodriguez; Editing by David Goodman)

2017-11-04 16:07

https://www.reuters.com/article/column-russell-refineries-asia/column-asian-oil-refiners-lose-profit-bump-from-harvey-but-may-get-china-boost-russell-idUSL4N1ML1UK

CHINA THE X-FACTOR

The peak winter demand season is coming, which usually boosts consumption of middle distillates such as heating oil.

Several refineries across Asia are also scheduling maintenance during October and November, which should tighten supply somewhat in the lead up to winter.

But perhaps the biggest potential upside for Asian refiners is the prospect of sharply lower product exports from China, which has emerged in recent years as a major supplier of gasoline and middle distillates such as diesel and jet fuel.

Refiners in China are required to have quotas in order to export surplus products and the authorities in Beijing have lowered the amount it will allow to be exported this year.

The quota awards for 2017 total 37.4 million tonnes of oil product exports, down some 19 percent from last year, according to a Ministry of Commerce document seen by Reuters.

Given that total product exports from China for the first eight months of the year were 32.8 million tonnes, this implies that only 4.6 million tonnes can be shipped in the last four months of the year.

That would represent a dramatic slowdown from the monthly rate of around 4.1 million tonnes in the January-August period.

Even if product exports don’t fall by as much as the quota awards suggest they should, it’s still likely that China won’t be exporting as much refined fuel in the last quarter of 2017.

China may export 1.0-1.2 million tonnes of gasoil in October, down from the year-to-date average of 1.3-1.4 million, according to Thomson Reuters Oil Research and Forecasts, which monitors shipments of crude and products.

If Chinese product exports are constrained by a lack of quotas, this will boost the fortunes of the rest of Asia’s refiners that supply export markets.

2017-11-04 16:25

Aramco talcock so long with Petronas of more than 1 yr, still not finalised the 49% investment in the Pengerang refinery ah ??

Saudi Aramco's RAPID US$7bil investment deal to be finalised soon - Rahman Dahlan

BANGKOK: Saudi Arabian Oil Company (Saudi Aramco) is expected to finalise soon its agreed investment of US$7 billion in the Petronas Refinery & Petrochemical Integrated Development (RAPID) project in Pengerang soon.

Minister in the Prime Minister’s Department, Datuk Abdul Rahman Dahlan said the government was giving both Petronas and Saudi Aramco an opportunity to resolve several technical issues regarding the investment deal.

“There are several terms and conditions that the parties have to meet and it is an ongoing process.

“I expect that it would not be long before they (Saudi Aramco) begin channelling their funds for the RAPID project,” he told Bernama in a recent interview.

Abdul Rahman was in Bangkok to attend the 7th Asian Ministerial Energy Roundtable which ended yesterday.

He took the opportunity to meet with Saudi Arabia’s Energy, Industry and Mineral Resources Minister, Khalid Abdulaziz Al-Falih, who also attended the one-day conference.

“We discussed the latest developments with regards to Saudi Aramco’s investment in RAPID. I find that there are no major issues to deal with, so it should be happening soon,” he said.

In February this year, Petronas and Saudi Aramco signed a Share Purchase Agreement, which enabled the Saudi Arabian oil and gas company to purchase a 50 per cent stake in the RAPID project.

The agreement saw both parties having an equal equity stake in selected ventures and assets of the venture.

The deal was made during Saudi Arabian Ruler, Raja Salman bin Abdulaziz Al-Saud’s visit to Malaysia.

According to Abdul Rahman, if the deal goes smoothly and becomes profitable, there was a chance that Saudi Aramco would increase its investments in Malaysia.

Malaysia’s strategic location in the Southeast Asian region has attracted interest, not only from Saudi Aramco, but also other global oil and gas companies, he said.

Asked to comment on whether the stronger bilateral ties between Malaysia and Saudi Arabia might lead to Petronas or Khazanah Nasional becoming an investor in Saudi Aramco’s public listing proposal, he said it was unlikely.

“I don’t think there are any special talks on Petronas or Khazanah Nasional becoming a cornerstone investor in Saudi Aramco’s initial public offering (IPO),” he said, but noted, that the companies may purchase the shares, once listed.

The plan to list five per cent of Saudi Aramco’s shares next year, valued at U$100 billion, would make it the world’s biggest IPO listing, and put the company’s value at US$2 trillion.

Abdul Rahman said although Bursa Malaysia was initially considered as one of the bourses to be involved in Saudi Aramco’s IPO listing, the plan did not materialise, as the company targeted the London Stock Exchange and New York Stock Exchange instead.

However, he did not rule out the possibility of Bursa Malaysia becoming involved should Saudi Aramco choose to list its subsidiaries in the future.--BERNAMA © New Straits Times Press (M) Bhd

2017-11-04 16:28

If future of refining is so uncertain, market would not have given PE exceeding 15:

http://marketrealist.com/2017/09/ranking-7-refining-stocks-based-on-their-dividend-yields/

At Cash yield of 25% for HY, it only needs a payout of 15% to get a dividend yield of the above listed 7 refining stocks.

And since these a refineries....the location whether U.S or India or Singapore does not matter...the future perception should remain the same.

2017-11-04 20:05

JP54 - D6 - JET A1 - D2 AVAILABLE ON CI DIP AND PAY FOB ROTTERDAM

WE HAVE AVAILABLE PETROLEUM PRODUCTS FROM RELIABLE REFINERY IN RUSSIAN FEDERATION WITH BEST AND QUALITY PRICE.

BELOW PRODUCT ARE AVAILABLE WITH BEST OFFERS - FOB CI DIP AND PAY ROTTERDAM

JP54: Quantity: 500,000-2,000,000 Barrels

JetA1: Quantity: 500,000-2,000,000 Barrels

D2: Quantity: 50,000-150,000 Metric Tons

D6 Virgin: Quantity: 400,000,000-800,000,000 Gallon

SERIOUS BUYERS PLEASE CONTACT US FOR MORE DETAILS WITH YOUR REQUIRED

Maksim Yaroslav (Mr.)

EMAIL: neftegazconsultant@yandex.ru

EMAIL: neftegazconsultant@mail.ru

Skype: neftegazconsultant

TEL: +7 9265036551

2018-05-20 04:25

JP54 - D6 - JET A1 - D2 AVAILABLE ON CI DIP AND PAY FOB ROTTERDAM

WE HAVE AVAILABLE PETROLEUM PRODUCTS FROM RELIABLE REFINERY IN RUSSIAN FEDERATION WITH BEST AND QUALITY PRICE.

BELOW PRODUCT ARE AVAILABLE WITH BEST OFFERS - FOB CI DIP AND PAY ROTTERDAM

JP54: Quantity: 500,000-2,000,000 Barrels

JetA1: Quantity: 500,000-2,000,000 Barrels

D2: Quantity: 50,000-150,000 Metric Tons

D6 Virgin: Quantity: 400,000,000-800,000,000 Gallon

SERIOUS BUYERS PLEASE CONTACT US FOR MORE DETAILS WITH YOUR REQUIRED

Maksim Yaroslav (Mr.)

EMAIL: neftegazconsultant@yandex.ru

EMAIL: neftegazconsultant@mail.ru

Skype: neftegazconsultant

TEL: +7 9265036551

2018-06-03 23:21

Source:

Source:

abang_misai

very good article. This allows Amanahraya to get out at decent price.

2017-11-03 09:29