HENGYUAN Part 7 (Q4 profit and Sustainability)

davidtslim

Publish date: Fri, 08 Dec 2017, 12:00 PM

Congratulation to all Hengyuan (HY) shareholders!

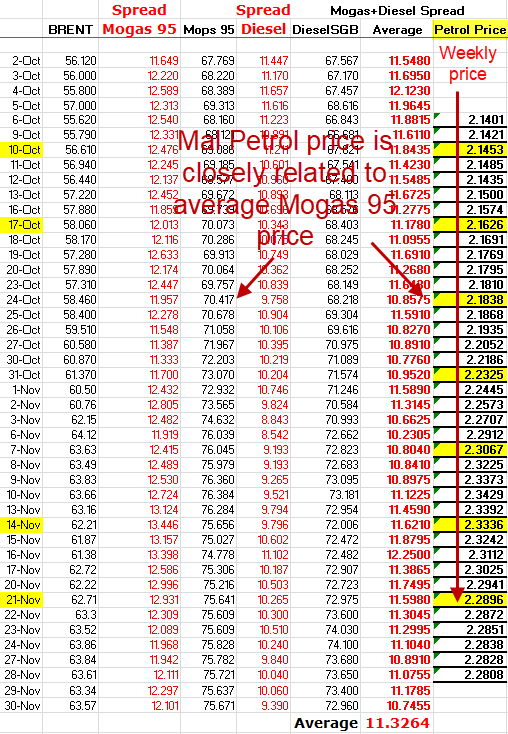

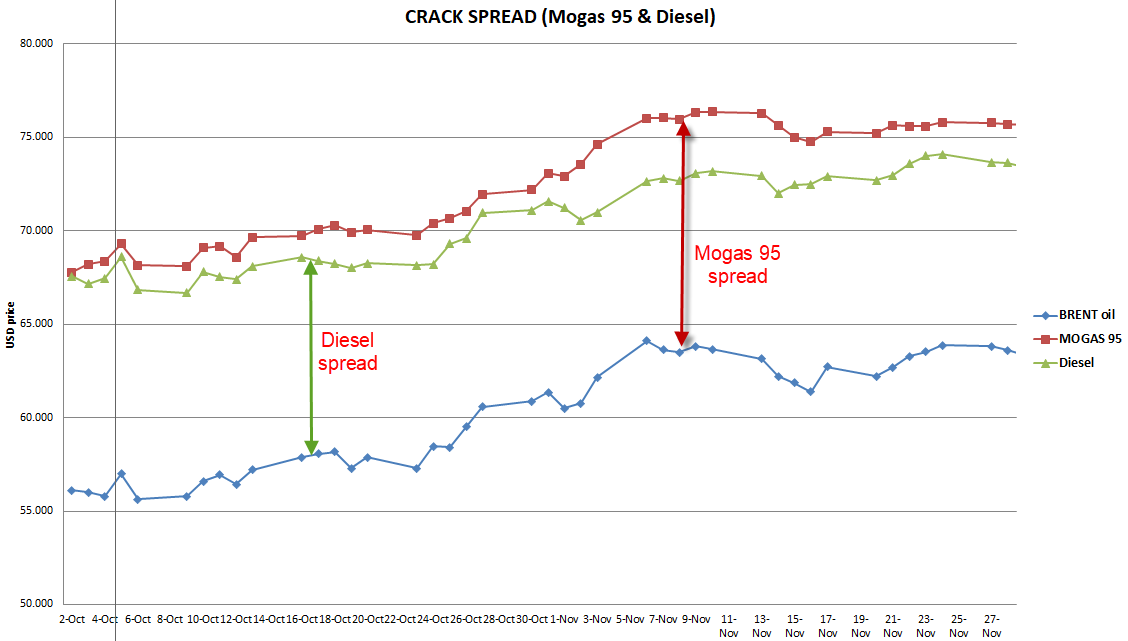

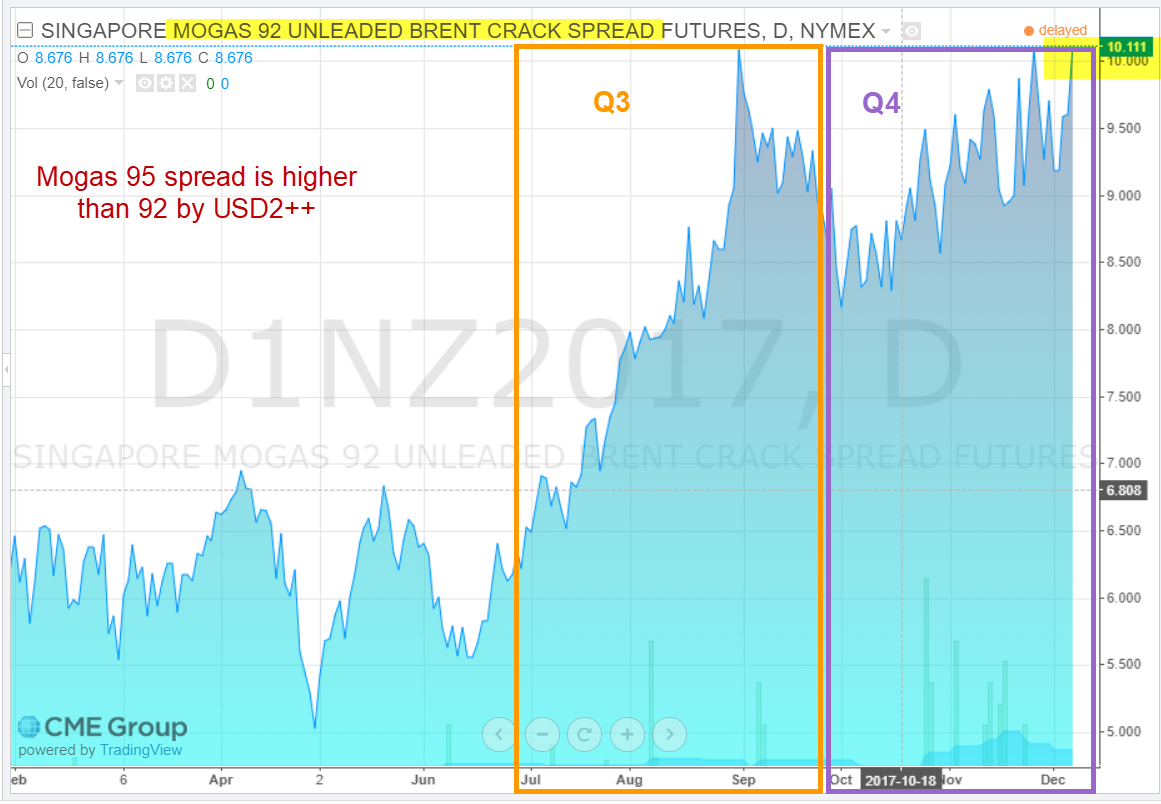

HY has reported strongest profitable quarter result in their history (RM361mil, EPS 120.6 sen). The question now is whether the profit of HY in Q3 is sustainable or not in Q4? To answer this question, let us go through a very important data in Q4 (Oct-Nov) that is closely related to HY’s profit margin – Crack Spread of Gasoline (Mogas 95, no more Mogas 92 product in Malaysia) and Diesel (Gasoil) as table and chart below:

Source: CME data (old spread data have been suppressed if you refer to latest Chart, Eg, if you use Mogas 95 chart of Dec to check Oct data, the value will be lower. Need to capture data daily or weekly)

I have calculated Malaysia weekly petrol price based on average 5-day Mogas 95 price and I found that they are quite well correlated (as shown in the above table). HY profit margin is closely related to the average spread (difference between brent oil and Mogas 95)

Source: CME data

From the table above, the average spread of Mogas 95 and diesel with reference to Brent oil is about USD11.3 for the period of 2 Oct to 30 Nov (CME data). In my previous articles, I use Mogas 92 chart (RON 92) to estimate HY’s profit margin which is actually has spread lower than Mogas 95. For Malaysia market, RON92 is no longer available and the main products of HY are actually RON95 (gasoline) and diesel. In fact, Mogas 95 spread is higher than Mogas 92 by about USD2+ over the past 6 months. USD11.3 is relatively higher than the spread in Q3 and average spread of 2017 (USD8) as per reported in HY’s Q3’17 report. However, due to other products (~2-3% products consist of heavy fuel oil, naphtha and propylene) and jet fuel (just slightly lower) may have lower spread or margin, my estimated effective average spread for products of HY may be in the range of USD9.5 – USD10.3.

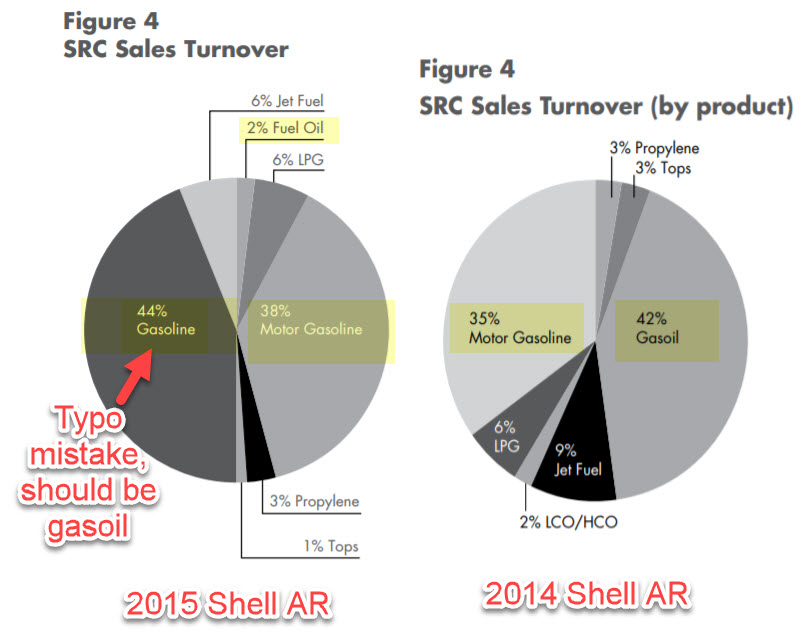

What I like HY is its complex refinery system which is flexible to adjust their product ratios which they tend to produce higher profit margin products like gasoline and diesel. Let see the products composition from Shell annual reports 2014 and 2015 as below.

Source: Shell Annual report of 2014 and 2015

From the pie charts, we can observe that HY main products are Gasoil (diesel) and gasoline which their profit margin is much higher than fuel oil (negative margin). Annual report 2015 shows that 82% of their products are gasoil (diesel) and gasoline, as well as 6% are from jet fuel (margin around USD10).

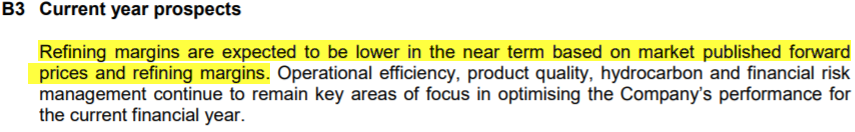

Let us go through the current year prospect of HY’s Q3’17 report as below:

Source: Q3’17 report

From the CME average crack spread data, the refining margin should be slightly higher in the near term based which is contradicted with the prospects reported by the HY quarter report. There is one possibility that I can think of for this pessimistic short term prospect in HY report.

- The Q4 report maybe compare Oct and Nov data with the peak spread data in early Sept as shown in the Mogas 92 spread (spike to USD17 and settle at 12) as shown in the chart below:

Source: CME data

My estimation of Q3 average spread is about USD10 which is slightly lower than the gasoline’s spread in Q4 (USD11-12 from my Mogas 95 table).

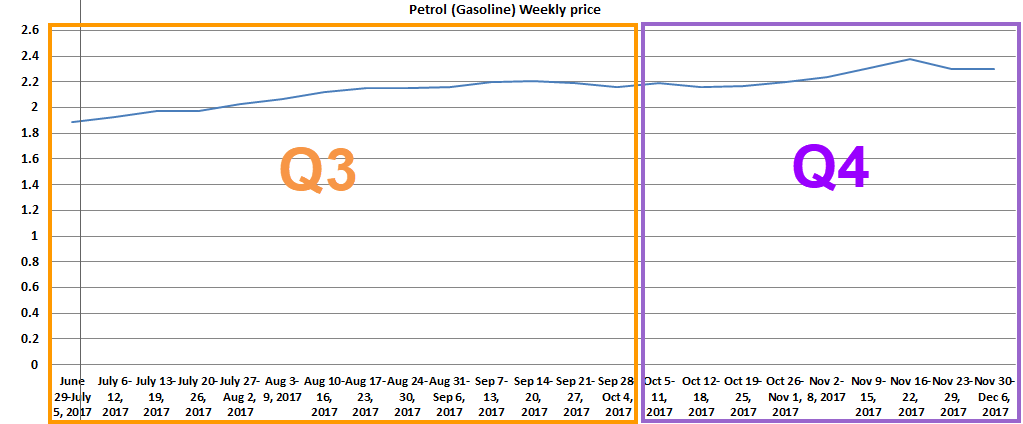

Another proof or supporting data that Q4 spread is higher than Q3 is by referring to Malaysia Petrol and diesel price which are calculated based on the Singapore Platts (average crack spread). Let us see the following chart for the Malaysia petrol weekly price:

Source: https://hargapetrol.my/malaysia-petrol-prices-list.html

Source: https://hargapetrol.my/malaysia-petrol-prices-list.html

In short, Malaysia petrol weekly price actually propotional to average (5 days) Mogas 95 price. HY profit margin is depending on average spread (difference between brent crude oil and Mogas 95)

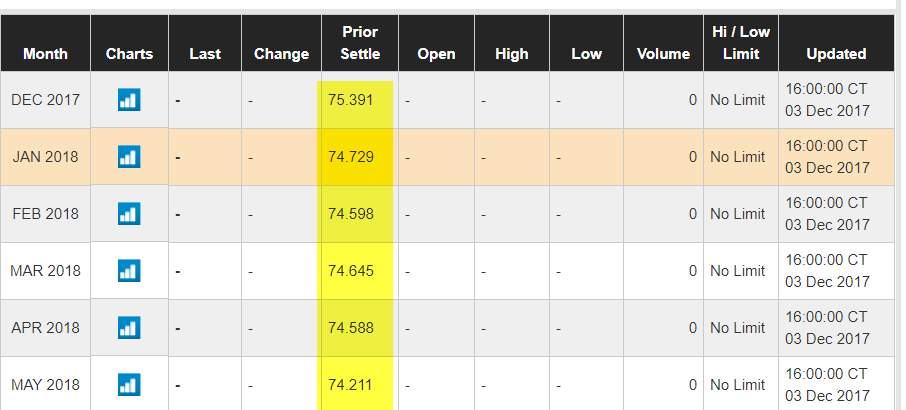

Even we monitor the future 6 month Mogas 95 data from CME (as chart below), the future contract price is in the range of USD74.2-75.4. As long as Brent oil price stabilize in the range of USD58-USD63, crack spread will be maintained at around USD10 (which is a lucrative margin for refiner like HY).

Source: CME future Mogas 95 data

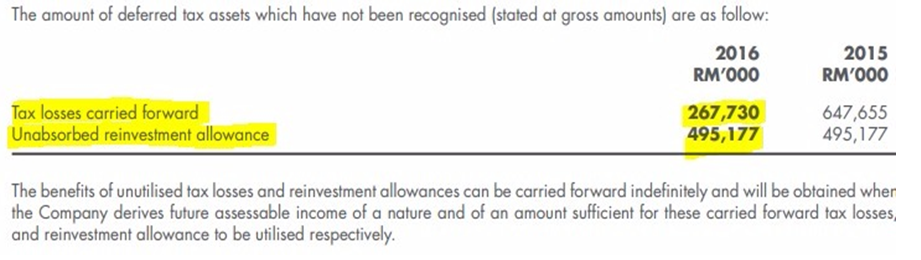

When Hengyuan needs to pay income tax?

Some investors may ask around when Hengyuan needs to pay income tax. HY can be exempted of paying income tax is due to utilization of tax losses (deferred tax assets). Let us see the amount tax losses carried forward which have not been utilized up to Dec 2016 as below:

Source: Annual report 2016

There is RM267.7 mil carried forward tax losses which can be utilized for income tax exemption. Let see how much has been utilized so far for Hengyuan in 2017 as below

|

Total 3 quarters profit (RM) |

25% tax losses utilization |

|

725.58mil |

181.39mil |

|

Balance of tax losses to be utilized |

86.305 mil |

If Hengyuan is able to generate profit of RM345mil in Q4, it will utilize its entire remaining carried forward tax losses asset (RM86.3 mil). I may explain more on unabsorbed reinvestment allowance (RM495 mil) in my next article in future.

Key Financial data of Hengyuan

After released strong Q3 result, HY has shown big improvement in their financial ratio. The ratios improving range from ROE, ROIC, FCFO (free cash flow from operations), PE and EV. Let us see some of the key financial data of HY as table below:

|

|

Hengyuan (up to Q2 result) |

Hengyuan (up to Q3 result) |

Hengyuan (upcoming Q4 result) |

|

ROIC |

25.84% |

48.1% |

? expected to improve |

|

ROE |

33.27% |

56.30% |

? expected to improve |

|

PE |

5.9 |

3.55 |

? expected to improve |

|

EPS (Trailing 12 month) |

147 sen |

311 sen (highest EPS in BURSA) |

? expected to improve |

|

FCFO |

524mil |

736mil |

? expected to improve |

|

FCF (minus out capex) |

487mil |

668mil |

? expected to improve |

|

EV/EBIT (< 8 is good) |

5.44 |

3.85 |

? expected to improve |

|

Cash & Equivalents |

743.5 mil |

897.7mil |

? expected to improve |

|

Total debt |

1316 mil |

1,310 mil |

? expected to reduce due to RM appreciate |

|

Inventories |

1,127.9 mil |

1263.3mil |

? expected to increase due to Brent oil increases |

|

Net debt |

572.4 mil |

412.3mil |

? expected to improve |

We can see significant improvement of all financial data after Q3 result was released. What is more important for me is future data or profit. I would expect future profit and financial ratio to be further improved in view of high refined product crack spread (margin) in Oct and Nov 2017.

To justify whether HY is still cheap or not at current price (RM11.00), let see the FCF vs market capital and cash in hand vs market capital ratios as below:

FCF / Market cap = 668 mil / 3300 mil = 20.2% (over 9 months only)

Cash in hand / Market cap = 897.7 mil / 3300 mil = 27.2% (over 9 months only)

Let compare FCF / market capital ratio among Hengyuan, Petronm and Petdag to see which company has strongest cash yield from their operations.

|

9 months (Q1-Q3) |

Hengyuan |

Petronm |

Petdag |

|

FCF / Market cap |

20.2% |

7.94% |

4.2% Note: there is a 430 mil gain on disposal of subsidiaries from statement of Cashflow |

We can see HY cash yield rate from operation is 2.5 times stronger than Petronm and 5 times stronger than Petdag. The ratio of 20.2% (9 months only) is much higher than bank’s fixed deposit rate (1 year 3.2%) and it is an excellent ratio. If current spread can be maintained till Q2 of 2018, this ratio will be further improved but will be affected by the shut down (one time maintenance shut down and upgrade) of Euro 4 upgrade in Q3’2018. In fact, if we consider its huge inventory value of RM1263.3 mil (can offset 95% of its borrowings), Hengyuan actually in a good net cash position of over RM850 mil cash. This cash level is equivalent to RM2.83 cash per share. Again, what I want to see is the future 6 months profit visibility which is closely related to crack spread.

Some may claim that refinery is a cyclic business from past data. I am not too interested on past crack spread data that are too long ago (due to the crude oil price big fluctuation in 2014) but more interested on past 11 months data of 2017 and future 6 months data.

Source: CME data

Do you think the above crack spread chart over past 11 months of 2017 indicates refinery is a cyclic business? I don’t think so and even future 6 months I think the spread may sustain at USD9 or above (Mogas 95). As long as Brent oil price is stable in the range of USD50-65, I believe the crack spread will be quite stable in 2018 (mainly supported by increasing demands and limited supply).

If you own a car(s), don’t you think petrol (gasoline) or diesel is essential for you? Is it we need to go to petrol station every week (or two weeks) if we own a car? Maybe some of you may argue that electric car may replace petrol car in 10-20 years’ time, but how about aircraft’s jet fuel consumption? How about big ship transportation and power generation which rely on fuel oil?

If petrol, diesel (mainly lorry, some machines), and jet fuel are essential for our current transportation system, it is NOT likely petroleum refined products is a cyclic business in future (unless there is a sudden increase in supply). This is something like consumer essential products (like milo, bread) is unlikely a cyclic business. Conventionally, Q4 (Oct-Dec) is peak season for Henyuan due year-end holidays which normally lead to higher land and air travelling. Let us have a look on refinery outlook in the next section.

In short, I believe crack spreads are suddenly so high in 2017 are due to refinery closures (tighter regulation require big investment) or insufficient increase in refining capacity, as demand continued to grow. Anyway, petrol was essential product in 2014 too, yet crack spreads were almost zero at that time may due excessive supply at that time.

Refinery Outlook

Let us go through two news related Asia refiners activities and Shell (international oil giant) for world refinery outlook as below:

Excerpt from the news as below:

Another news is from Shell which has started to focus on downstream businesses which they now view it can be a good profit contribution to their group’s profit.

https://www.thestar.com.my/business/business-news/2017/11/07/shell-to-secure-future-of-refining/

Excerpt from the news as below:

Based on current Asia’s vehicles population growth, I would expect the current refining margin (USD9) to be sustainable for a least 6 months in view of many refiners are scheduled to have maintenance shut down.

I maybe cover Hengyuan’s 2018 profit forecast, Euro 4m upgrade, diesel demands in 2020, SWOT, comparison with other companies etc in my future article.

Risk

1. Unplanned shut down due to unexpected machines or refinery system break down.

2. Fire or explosion due to accident.

3. Delay in Euro 4M project upgrade.

Summary

1. HY’s profit visibility in Q4 still good based on current spread data on gasoline and diesel.

2. Forward 3-month PE of Hengyuan could be very attractive (below PEX3.5) even based on current price of RM11.00.

3. The high quality of Hengyuan’s earning is supported by strong ROIC (48.1%), ROE (56.3%), and strong cash flow generation from operation.

4. There is possible inventory gain for HY in Q4 as current Brent oil price stay above USD57 (current pirce is USD61).

5. Recent RMUSD rate appreciation will further benefit HY as its material cost will be lower. Besides, it also may have forex gain as it has over RM1.3 billion of USD denominated loan.

6. The outlook for refined products is still bright in 2018 as in view of many refiners are scheduled to maintenance shut down, increasing demands from growing vehicle populations and limited refined product supply.

7. HY’s management has started to follow up closely for the Euro 4M equipment fabrication even from Q3’17 (1 year from 2018). They have anticipated possible delay in the fabrication of the equipment and now already started to look for alternative to minimize the delay. This indicates that they are well-prepared for possible challenge in this upgrade project (still has about 11 months of time and they may seek technical help from parent company as Hengyuan China is currently producing Euro 5 products).

8. Maintenance shut down/upgrade is one time event in every 3 years and this is normal for all refiners around the world. In fact, previous planned minor maintentence in Q2 increases the production volume by 0.6 mil barrels in Q3. I would focus more on the overall future 12 months profit and cash flow generation visibility in FY2018 for HY (短暂的休息是为了走更长远的路).

If you interested on my analysis report, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Future Potential of HengYuan

Created by davidtslim | Jan 19, 2018

Discussions

Got mandrin version?..i understand THIS article 80% only...i wanna understand 101%.....Davidlim.

HELP....

2017-12-08 13:05

The below article is one of the strongest argument why HY (a Complex refinery) future refining margin is bright:

https://www.platts.com/IM.Platts.Content/InsightAnalysis/IndustrySolutionPapers/SR-IMO-2020-Global-sulfur-cap-102016.pdf

IMPACT ON REFINING SECTOR

The more sulfur-constrained world of 2020 will have huge implications for the global refining sector, undermining margins for simple refineries that turn a significant share of their crude run into HSFO, but potentially boosting margins for complex refineries able to take advantage of it.

According to the UK Petroleum Industry Association (UKPIA), a change to 0.50% mass sulfur marine fuels “would have a massive impact on refinery configuration and operations,” and would require some combination of the following four main approaches, each with its own drawbacks.

1) Substantial investment in upgrading fuel oil residues to gasoil grades (i.e. building secondary units such as crackers, visbreakers and cokers). But as many refiners are global companies they will only make such investments in locations with good returns (leaving the prospect of patchy availability).

2) Reduction of residue production through changes to a sweeter crude slate. The downside here is of course that such crude grades trade at higher differential, reducing refining margins, and will be in even more demand, and thus more expensive, in 2020.

3) Residue destruction, stopping the production of fuel oil. This also requires huge investment.

4) Desulfurization of residual fuel oil and blend with low sulfur gasoils. Similarly this requires huge investment. According to the IEA, these units are more expensive than upgrading units, and presently there is little demand for fuel oil desulfurisation units, with global capacity estimated to be less than 0.1 mb/d.” (Source: Medium-Term Oil Market Report, February 2016)

2017-12-08 14:00

Hope the above article gives the message to all once and for all why PetronM is going for 6.4 Billion investment.

By the way its not like an upgrading you do for HY where you can still run the 45 kbpd plant of PetronM till new refinery is completed (unless it is placed in a completely new location).

2017-12-08 14:15

sell all my other non performing counter.. all in hengyuan.

pls read with an open mind. and tell yourself, where got company like this in bursa. Joke on you if miss this one even after all the sifu help/explanation/articles

special thanks to davidslim/ICON/probability/OTB/stock raider

not to forget all those remain loyal to HY from rm 5 till now. you guys really did your homework..

2017-12-08 15:59

Good analysis. But bear in mind the unused tax losses carried forward in the AR already stated in gross amount, mean you shall offset the gross profit, i.e. before X24%(current statutory tax rate in Malaysia)

2017-12-08 17:37

Bear in mind that when you buy a Musangking at RM5 per kilo...there is Tupai bite on its skin..

2017-12-08 17:51

Thank you very much for your in-depth and consistent effort for the benefits of all... Very kind of you..Keep it up. Shall wait for your next analysis

2017-12-08 18:05

Important thoughts to think:

(1) what would happen when all the sea ships switch to gasoil (diesel) from Fuel oil in 2020?

(2) what would happen when these simple refiners decide to close down their refinery and refuse to invest heavily on scrubber or new system for higher conversion from fuel oil to Diesel?

(3) what would happen when even if they decide to invest like PetronM is contemplating...and it takes 4 years to commercially produce their products?

(4) what happens to the gasoline margin due to its reduced production as complex refiners selectively produce more and more diesel to cater the sudden surge in its demand due to:

i) ships needing them in replace of Fuel oil, and

ii) decrease in existing supply from simple refiners who had been forced to shutdown for upgrade or new investment as their Fuel oil has no value.

What are their effects on Gasoline and Diesel crack spread?

2017-12-08 21:20

Refining capacity might fall short of demand after 2020 -Varo CEO

https://www.reuters.com/article/refineries-oil/refining-capacity-might-fall-short-of-demand-after-2020-varo-ceo-idUSL8N1MU4J9

LONDON, Oct 19 (Reuters) - Global oil refining capacity might not meet demand for oil products after 2020 as consumption continues to grow, boosting profit margins, Roger Brown, chief executive of European refiner Varo Energy, said on Thursday.

Refining margins are expected to remain strong in the long term due to strong demand for gasoline and diesel as well as a switch to higher-grade bunker fuels after 2020, Brown said at the Oil & Money conference.

“We see very good long-term refining margins at the moment.”

Refining capacity set to come on line in the coming years, including large plants in Kuwait, China and India, might not be enough to meet growing demand, he said.

“At the pace demand is growing… You’ve got to see supply and demand in refining between 2020 and 2025 remaining balanced and maybe a little short,” Brown said.

Varo Energy, a joint venture between the world’s top oil trader Vitol and private equity giant Carlyle Group, operates two refineries in Europe. (Reporting by Ron Bousso; editing by Jason Neely)

2017-12-09 01:03

IMO 2020 Part 3: Refiners’ Perspective

November 16, 2017

https://stillwaterassociates.com/imo-2020-part-3-refiners-perspective/

(1) Refineries currently producing HSFO will be the most threatened by this rule.

(2) Refineries that currently produce minimal HSFO due to vacuum resid processing (e.g. coking, hydrocracking) will likely see IMO 2020 as an opportunity rather than a threat.

(3) Time is the enemy of refineries currently producing HSFO. Unless refinery modifications to reduce HSFO production are already well underway, those modifications will not be onstream until well after 2020.

(4) Key price differentials for refiners will likely change markedly in 2020, producing significant changes in processing strategy for many refiners:

(i) Distillate prices will increase markedly relative to high sulfur residual fuel products. Distillate prices (particularly in coastal markets) may also increase relative to gasoline. This will create product mix optimization opportunities for refiners and bunker blenders/suppliers. Intermediate streams that historically might have been processed on catalytic cracking or hydrocracking units may alternatively be routed to IMO-compliant fuel oil blending.

(ii) Vacuum residue yield and sulfur content will cause crude price differentials to widen between grades (e.g. high resid content sour crudes versus low resid content sweet crudes). This will create crude slate optimization opportunities for almost all refineries.

(5) Expectation of a wide price differential between IMO 2020-compliant fuel and traditional HSFO will create an incentive for shipowners to install onboard scrubbers and for refiners to install (or expand) resid upgrading facilities. Investment decisions by either of these industry sectors, driven by a wide price differential expectation, will directionally reduce the magnitude of the above market price changes.

2017-12-09 13:02

Preparing for a Sea Change in Global Refining

JUNE 14, 2017

https://www.bcg.com/publications/2017/downstream-oil-gas-petrochemicals-energy-environment-preparing-for-sea-change-in-global-refining.aspx

A shift in HSFO pricing from its higher value to its lower value could have a significant knock-on effect on the price differential between light and heavy refined products. Specifically, we expect a spike in the differential. Which refineries are profitable and emerge as leaders will depend on their capabilities and product mix.

"Complex refineries with hydrocracking and residue desulfurization units that enable maximizing LSFO and distillates production will be able to navigate the disruption. Asia and the Middle East are home to such refiners."

- HENGYUAN REFINERY PERFECTLY FITS IN HERE!

Additionally, refiners with coker units, such as those on the US Gulf Coast, will fare well, as will refiners with access to crude with very low sulfur.

2017-12-09 18:03

Referring to page 6 of the below article and from the gasoline, diesel and fuel oil yield < 5% presented on Davidtslim charts above for HY, one can see HY refinery falls under 'deep conversion' category.

https://www.energyinst.org/_uploads/documents/session-4-refining-notes-2012.pdf

On the other hand, PetronM which does not have a catalytic cracker...falls into Simple Refiner category yielding a significant portion of their products as Fuel Oil.

2017-12-09 20:57

2020 IMO global bunker fuel regulations: A challenge too far for European refiners?

https://www.cornhilleconomics.com/single-post/2017/01/17/2020-IMO-global-bunker-fuel-regulations-A-challenge-too-far-for-European-refiners

The IMO global maritime sulphur limits regulations are likely to have an adverse effect on European refiners unable to make the necessary investments in refinery upgrading triggering further refinery shut downs.

2017-12-10 21:44

MEPC 71: 2020 deadline reaffirmed as IMO agrees to promote consistent implementation:

11/07/2017

https://ibia.net/mepc-71-2020-deadline-reaffirmed-as-imo-agrees-to-promote-consistent-implementation/

Any suggestion that there may be any form of delay to the 1 January 2020 implementation of the 0.50% sulphur limit in 2020 was ruled out at the 71st session of the Marine Environment Protection Committee last week, as a majority of member states rejected a proposal to collect data to allow the International Maritime Organization to take stock of the availability situation ahead of 2020.

2017-12-11 00:13

HENGYUAN @RM21 CONFIRM COMING

WOW! VERY INFORMATIVE, all way bullish till next quarter result out!

2017-12-08 12:25