HENGYUAN Part 5 (Refinery Complexity: Why it matters for HY?)

davidtslim

Publish date: Tue, 24 Oct 2017, 09:34 AM

The importance of refinery industry

Crude oil cannot be used without refine. It must be refined to manufacture finished products as below:

1. LPG – (Liquefied Petroleum Gas) – For Household or restaurants fuel needs

2. Gasoline/Naphtha – For Transportation Industry, For Petrochemicals Industry

3. Aviation Turbine Fuel (ATF) or Kerosene – For transportation (aircraft)

4. Diesel/Gasoil – For Transportation- For Petrochemicals Industry, For Transportation Industry

5. Fuel Oil – For Power plants, For Fuel needs in any commercial facilities

6. Paraffin wax - For packaging of frozen foods / Coatings for waxed paper or cloth

7. Petroleum Coke –For Road making / For Electrochemical industries for certain type of electrodes (used in steel/rebar making) (https://en.wikipedia.org/wiki/Graphite)

If for some reasons (like disasters), Singapore and our country’s refineries damage and shut down for months. What will happen? First is our transportation will be heavily affected and petroleum related products (packaging materials) will be in shortage and price may increase (as supplies are limited). Of course, we still can depend on some refined products inventories but a lot of petroleum related industries will be affected (including our daily life as petrol/gasoline price may shoot up).

Before we start discussing the complex and simple refineries, let us go through a brief definition as below:

Definition of 3 types refineries

Simple Refinery : Crude Distillation, catalytic reforming and hydrotreating distillates.

Complex refinery : Simple refinery plus a vacuum flasher, catalytic cracker, alky plant and gas processing

Very Complex refinery : Complex refinery plus a coker, which eliminate residual fuel (low margin products) production.

Profit Margin – Complex and Simple Refineries

The complexity of a refinery refers to its ability to process crude oil into value-added products. A simple refinery is essentially limited to distilling crude oil. For example, simple refinery system mainly making crude oil for gasoline, LPG and heavy fuel oil. The ratio of gasoline produced by complex refiner (Eg. HengYuan) is much higher than simple refiner (Petronm). The profit margin of gasoline is also much higher than fuel oil which indicates that profit margin of complex refiner is higher than simpler refiner IF crack spread is sustained at high level (above USD5).

There are several measures of complexity for refineries. The most publicly used is the Nelson Complexity Index (NCI). The NCI is a pure cost-based index. It provides a relative measure of refinery construction costs based upon the distillation and upgrading capacity a refinery has. Simple refineries employ limited processing technology and produce a product slate similar to the component make-up of the crudes they run. Very complex refineries utilize extensive processing technology and produce more gasoline and diesel (middle distillates or called gasoil).

The index assigns a complexity factor to each major piece of refinery equipment based on its complexity and compared with simple crude distillation, which is assigned a complexity factor of 1.0. The higher the NCI number of a refinery, the more complex it is and costly to build. For example, the Phillips 66 company reports that its American refineries range from a NCI of 7.0 to 14.1. A complex refinery has expensive secondary upgrading units such as catalytic crackers, hydro-crackers and fluid cokers. They are configured to have a high capacity to crack and coke crude into high value products.

The actual profit margin of Hengyuan and Petronm is depending on their plant operation efficiency (simple or complex refinery), storage location, crude oil costing (sour crude is cheaper than sweeter crude), hedging contract price and transportation.

I cannot find any NCI number for Hengyuan (HY) from Google. Let us based on historical gross profit margin from its Q1’17 and Q2’17 reports to have a picture of how much HY’s gross profit margin (GPM) per barrel based on Singapore CME crack spread data.

|

|

GPM per barrel (USD) |

CME FUTURE crack spread data (average) |

|

2016 (under Shell) |

5.46 |

7.6 |

|

Q1’17 |

9.1 |

9.8 |

|

Q2’17 (3 weeks shut down, stock loss) |

6.46 |

10 |

Source: Annual report 2016 and Q1 and Q2 reports, CME & www.quandl.com

(GP of Hengyuan Q1’17 is RM395.6 mil, GP of Q2’17 is RM251.8 mil, divided by total sales barrels get the USD9.1 and USD5.46)

Let us have a look on simple refiner (Petronm) refined profit margin based on Jay i3’s article (What I learnt from Petron AGM) as below:

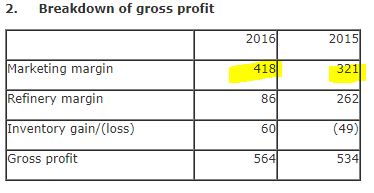

Source: http://klse.i3investor.com/blogs/purelysharing/125486.jsp

As we can observe that Petronm’s gross retail profit in 2016 and 2015 (AGM presentation slides) are RM418 mil and RM321 mil respectively. Due to Petronm retails profit is under a small growth in 2016 and 2017 (due to increasing new petrol station no), we can conservatively estimate gross profit from retail segment is about RM100 mil per quarter (418mil / 4). From recent Q1 and Q2 results, Petronm total gross profit is RM183.1 mil and RM123.9 mil respectively.

By assuming retail contributes around RM100mil gross profit, the gross profit for refinery for Q1 and Q2 should be around RM83.1 mil and RM23.9 mil respectively.

Based on the 2016 throughput of 47kbpd, assuming Petronm’s refinery working around 85 days, its refined or processed barrels in a quarter should be around 47k X 85 = 4 mil barrels.

Gross profit per barrel in Q1 = 81.1 / 4 / 4.2 = USD4.9

Gross profit per barrel in Q2 = 23.9 / 4 / 4.2 = USD1.4

|

|

GPM per barrel (USD) |

CME FUTURE crack spread data (average) |

|

2016 (estimate 15.5 mil barrels) |

2.3 (AGM data) |

7.6 |

|

Q1’17 |

4.9 |

9.8 |

|

Q2’17 (didnot mention whether got shut down or not) |

1.4 |

10 |

Source: Q1 and Q2 reports, CME & www.quandl.com

We can observe that Petronm main income is still come from retails due to their simple refinery plant finished products ratio are not optimize for high margin products (like gasoline, diesel). RHB recent report estimate Petronm NCI index is 3.

Both HY and Petronm Q1 and Q2 gross profit contains some unrealized inventory loss but I think the inventory loss of HY should be larger than Petronm due to HY traditionally keep 30 days crude oil stock vs Petronm 18-21 days of stock.

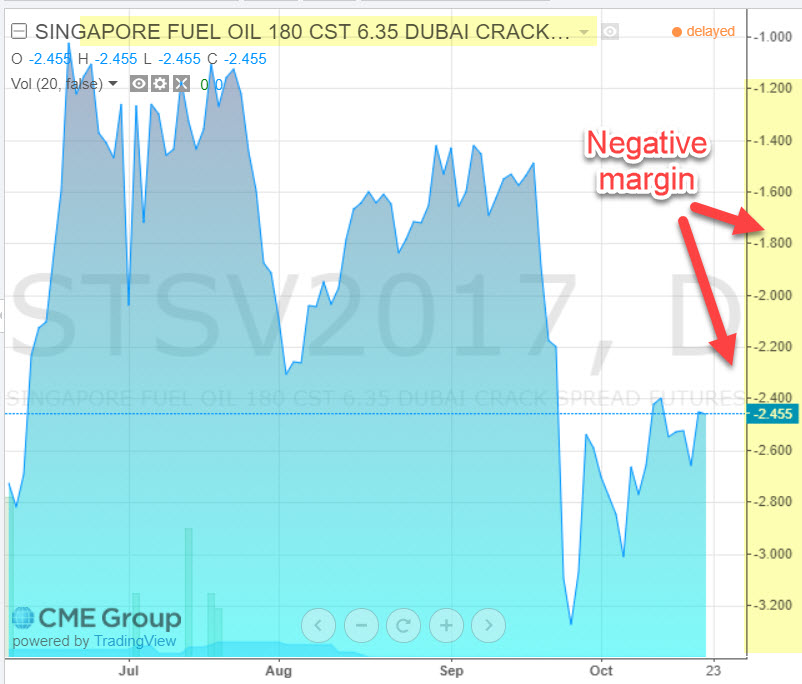

Typical simple refiner gasoline ratio is about 20% as compared to complex refiner ratio of 30-40%. Besides, their much higher ratio (up to 30%) of Fuel Oil (heavy gas or oil) which is a very low profit margin (spread close to zero or negative) product. That may explain low profit contribution from Petronm's refinery segment as compared to their retails segment. Anyway, under high crack spread period in 2017 (USD9-10), Petronm will be benefited also from their refinery segment but not as big as Hengyuan. Anyway, Petronm has retail segment which contribute stable income.

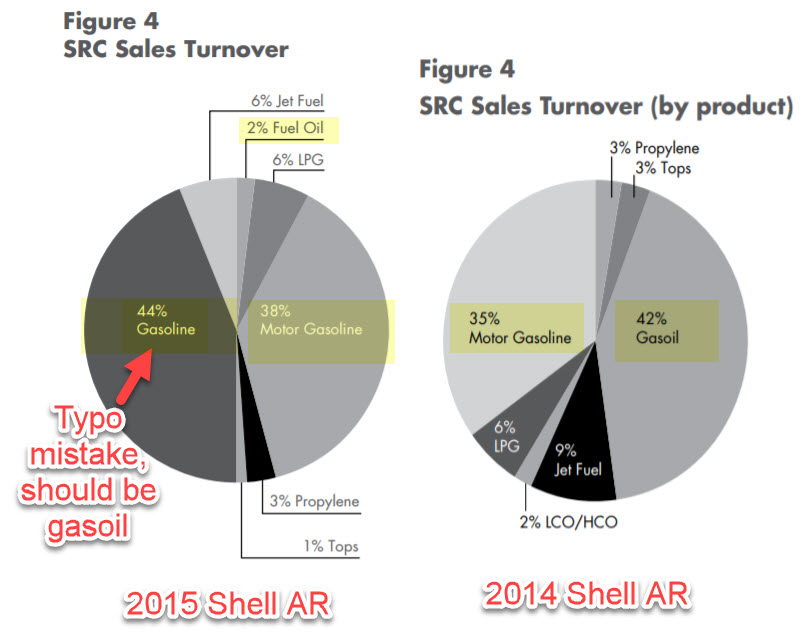

Let see the product ratio of HY (HRC) as per their 2014 and 2015 annual reports as below:

Source: Shell Annual report of 2014 and 2015

From the pie charts, we can observe that HRC main products are Gasoil (diesel) and gasoline which their profit margin is much higher than fuel oil (2%). Simple refiner produce higher ratio of Fuel oil (heavy or light) which their crack spread is very low (negative margin from CME).

In summary from the pie charts:

High profit margin products : 44% (gasoil) + 38% (gasoline) + 6% (Jet fuel) +6% (LPG)

Low profit margin products : 2% (fuel Oil) + 3% (propylene) +1% (TOP)

From these charts, HY (previously Shell) has almost 94% high margin products and lower ratio for low margin products. This ratio for a highly complex refiner clearly explains why HY can produce a super high profit in Q1’17 (RM279 mil, EPS of 93 sen). Q2 lower profit is due to 3 weeks shut down.

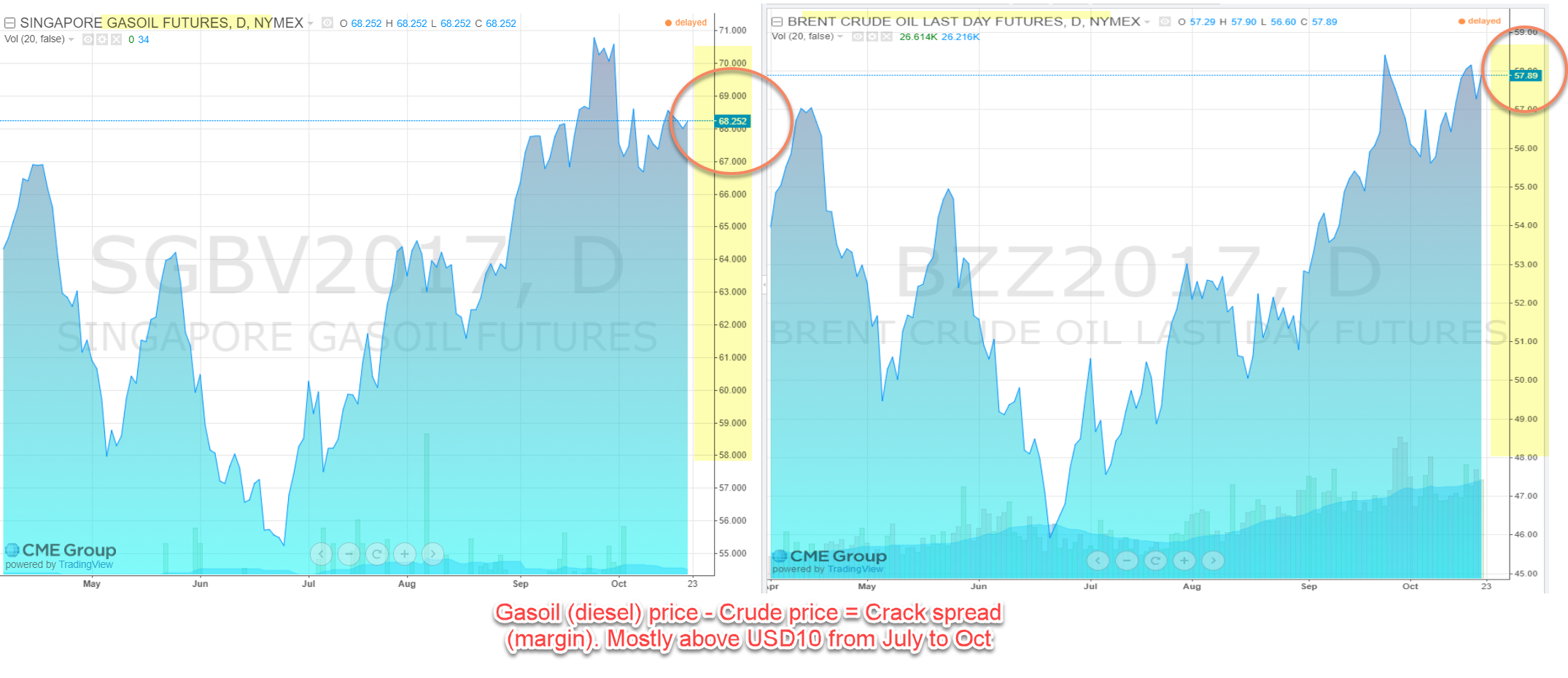

Let us see the graph below for the diesel (gasoil) crack spread from July to Oct as blow:

Most of the time from July to Oct, the spreads (difference between crude oil and Gasoil) are above USD10. Anyway, this is the future data where there might be some different with spot price data.

Let us have a look on fuel oil crack spread (one of the main products of simple refiner) as below:

Source: CME website

Source: CME website

The advantages of complex refinery are as below:

1. More value from the product slate: Better yields of high-value products, such as gasoline, and middle distillates (diesel fuel) and lower ratio of low-value product (heavy fuel oil)

2. Ability to process a wider range of crude oil types: Greater flexibility in the choice of crude means refiners can use cheaper heavy crude oils to produce products that are more in demand, and increase profit margins through higher sales volume and greater crack spreads.

3. Flexibility to adjust to changing markets which they can adjust production to changes in market demand (for example, the growing demand for diesel rather than gasoline).

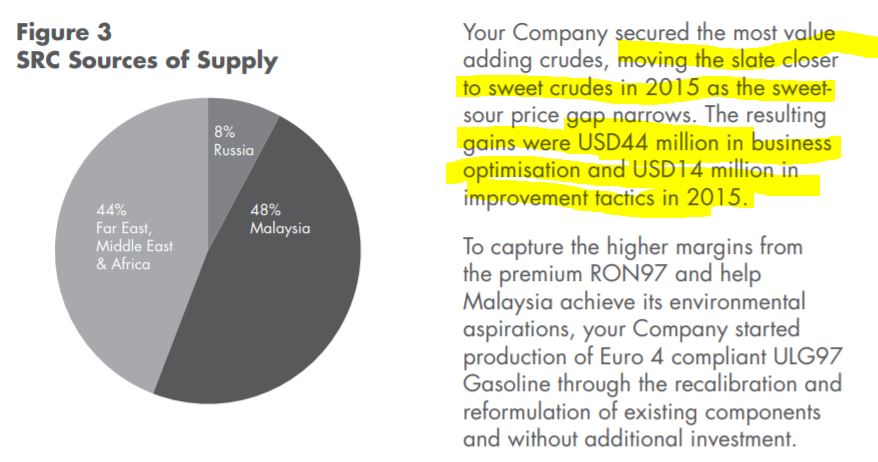

Let us see a pie chart provided in the 2015 Shell Annual report for its higher flexibility to adjust to choice crudes for cost optimization.

Source: Annual report 2015

In short, complex refiner enjoys higher profit margin than simple refiner when Singapore’s benchmark gasoline and Jet fuel spreads (margin) stay higher than USD5. Hengyuan achieved USD9.1 gross profit margin in Q1’17 and a lower USD6.46 gross profit margin in Q2’17 which is affected by 3 weeks shut down and inventory loss.

Perception of China controlled companies (different with China red chip companies)

Hengyuan Shandong (China) has invested RM300 mil for its 51% of share in Shell refinery co (Malaysia).

One thing I would like to highlight that Hengyuan Shandong (China) acquired Shell refinery co with cash from pocket and become guarantor for loan of USD350 mil. This is TOTALLY different with other China red chip companies that they conducted IPO in Malaysia (mean they will receive cash from Malaysia’s investors). IPO mean owners of the companies sold their shares for cash (for expansion etc) but Hengyuan Shandong (China) is totally different with IPO which they brought over Shell refinery co for their 51% shares and need to settle all the banks loan owed by Shell refinery co. That why Hengyuan Shandong needs to secure an oversea USD350 mil term loan to settle all debts owed by Shell to local banks before the acquisition can be completed in Dec 2016 (acquisition needs approval from bankers).

Imagine if Hengyuan refinery Malaysia is not doing well and unable to pay the term loan (USD350 mil) debt after 5 years, who will suffer the most? It is HY Shandong China who becomes the guarantor for USD350 mil debt. I believe Hengyuan ShangDong (China) will has much higher motivation than any minority shareholders to make sure the company can generate good cash flow and profit to pay their USD350 mil term loan and also possible future dividend to direct reward themselves.

One of the reasons Shell want to sell Malaysia refinery plant is because they are not willing to invest in Euro 4 compliance. So it is not ONLY RM300 mil for its 51% share but a commitment for Hengyuan Shandong to invest for Euro 4 and 5 compliances. Hence it is in their interest to ensure that the refinery is run efficiently to ensure that margin is further improved and all loans payment is timely settled (but that is after 5 years actually).

Even with a RM580 mil capex for Euro 4 upgrade in 2018, the good news so far for minority shareholders is there is no cash call (no right issue), no company warrant (no dilution) issued and management announced that the RM580 mil will be generated through internal fund and loans. I believe the whole 2017 cash flow from operation is sufficient to fund this Euro 4 upgrade (even with surplus) in view of high spread (margin) from Q1 to Q4 (spread maintained at USD9.5 to 10 in Q3 and Oct).

I leave to you to think whether Hengyuan Shandong is a good management or not from their actions that they go to take loan for Euro 4 upgrade without cash call through right issue and continue to generate strong cash flow from operation in the Q1 and Q2 of 2017 (RM524 mil free cash flow generated in 6 months).

Prospect of Refinery Industry in 2018

Harvey hurricane knocked out almost 20% of US refining capacity in late August and sending gasoline and diesel prices to new high in 2017. To reap high profit during this period, some of the refinery companies delayed their plant maintenance for weeks or months. Consequently, there will be more maintenance shut down during 1H of 2018 and supply at that time should be limited. Let see the news from the following link http://www.hellenicshippingnews.com/far-from-the-texas-coast-hurricane-harvey-hits-oil-refiners/

The excerpt from the news is as below:

Let see another news on Europe’s largest refinery to shut down two months for maintenance.

I will address valuation of Hengyuan in my part 6 article (try to publish in a few days later)

Let see the crack spread future from CME data as below (up to Oct) for Q4 profit outlook:

Risk

1. Inventory/stock loss in Q4 from crude oil price dropping.

2. Big drop in refinery margin which I think is not likely to happen in short term based on my monitoring on Singapore Future crack spread of refined finished products (Mogas 92).

Summary:

1. High profit margin as Hengyuan plant is a complex type refinery which they can generate higher ratio of gasoline which has good crack spread (refined margin). Its gross profit is quite predictable just by monitoring the product future spread data.

2. The high quality of Hengyuan’s earning is supported by strong positive cash flow (RM524 mil generated in 6 months) from operation which they can use it for future Euro 4 upgrade project without any cash call from shareholders.

3. Perception for Hengyuan is as a red chip China company is not true. In fact, Hengyuan has invested not only cash but their technology, experience from their China refinery plant and they should have strong motivation to generate enough cash flow to pay company USD350mil loan where they serve as guarantor. Once this debt is settled, Hengyuan will be a debt free company with high inventories value of RM1.1 billion and annual earning visibility of RM600-800 mil per year (if spread maintain at USD9 and above).

4. Some of the refinery companies delayed their plant maintenance for weeks or months in 2nd half of 2017 to 1st half of 2018 to reap high refinery profit in Q3 and Q4 of 2017 (especially after Harvey hurricane). There will be more refineries maintenance shut down during 1st half of 2018 and supply at that time should be limited. Asia refined product demands in Q4 (Oct to Dec) still strong (from Singapore gasoline future spread reference price) which paint a positive outlook for complex refiner like Hengyuan.

If you interested on my analysis report, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Future Potential of HengYuan

Created by davidtslim | Jan 19, 2018

Discussions

Good article. Just to highlight a few things

1. I think Petronm capacity not sufficient to support the volume they sell so they have to source some from 3rd parties, which will reduce their margin

2. there may be some transfer pricing between refinery and marketing. sometimes it's also quite hard to distinguish between these two when both are under the same roof

3. Hengyuan is sourcing crude oil from shell for 5 years and its products are also mainly sold to shell malaysia for 10 years. the management team is also mainly from the shell days. so I think you are right to point out hengyuan is different from typical red chip

both petronm and hengyuan are good companies to ride this refinery upcycle

2017-10-24 10:18

Nobody has obligation and he is not paid for this write-up. I see this as an analysis and learning rather than a promoting.

2017-10-24 10:34

Great effort, give a like. Of all positives, can pls comment a bit on hrc hedging and any possible accelerated impairment & major shutdown as the plant is at age tail end?

2017-10-24 11:03

this cannot be be promoted earlier because crack spread was below USD 6....

now I see that price is ONLY RM8.40... very cheap

2017-10-24 11:12

superb explanations... on why margin of HY refinery is greater than Petronm

thanks David!

2017-10-24 11:42

Fuel Oil crack spread was negative, and only recently from end of last year it went to break even level, the moment it reverts it will erode PetronM profits unlike HY which only produces less than 3% Fuel oil...

Simple Refiners produce more than 30% fuel oil.....just like leverage which acts as a double edged sword, the moment fuel crack spread becomes negative, its earnings will return to about its previous level..

2017-10-24 11:49

High profit margain is good, but high growth of profit margin is more important and convincing.

2017-10-24 13:33

Fantastic sharing, everything is a new knowledge for me .. Keep it up

2017-10-24 20:24

osted by deMusangking > Oct 24, 2017 08:45 PM | Report Abuse

aiyoh, why cant the big players go n ask the CEO of Heng and find out whether the earnings good or not!!!!!! why keep on guessing!!!!!????

LIKE THAT INSIDER TRADING MAH...ILLEGAL LOH...!!

2017-10-24 20:47

They hush hush ask...then guess the profit loh...!!

Then set the TP mah....!!

2017-10-24 20:54

https://www.energyinst.org/_uploads/documents/session-4-refining-notes-2012.pdf

View Bar chart on Page 6 of the pdf article above.

PetronM is a Hydroskimmer, whereas HY is more like the Deep conversion bar at the far right.

Basically there is almost nil 'Heavy products + Residue" from a Deep Conversion refinery...all of them are converted to lighter products such as Diesel and Petrol.

2017-10-25 01:01

The more promotion will cause more profit taking and Fund will not support and retail was interested with this kind of promotion.

TRAP...............

2017-10-25 17:15

Oil Traders Set Sights on Seas as Diesel Renaissance Is Born (1):

http://washpost.bloomberg.com/Story?docId=1376-OYDB596KLVS001-1E9I04O9...

With crude’s bull market being underpinned by diesel consumption, Asian refiners could soon be scrambling to meet further appetite as a maritime rule in 2020 seeks to replace DIRTIER FUEL OIL that runs tankers.

While shippers could add technology that’ll clean up their traditional power source, it’ll mean investing millions of dollars in each vessel -- an expense they may not be prepared to bear. Their other option is to use DIESEL.

NOW THIS WHERE HY'S EDGE is OVER PETRONM.

2017-11-03 14:25

Profits in Asia from turning benchmark Dubai crude into diesel, known as the crack spread, more than doubled to $15.37 a barrel in September versus a record low in April 2016,

2017-11-03 14:42

Alex Foo

thank you David for your hard work in analyzing hengyuan and your generosity to share with us.

Can I ask something?

The chart you attached for fuel oil (shows negative margin). Is it a bad thing? I saw that you also mentioned 2% profit margin for fuel oil.

2017-10-24 10:04