第六篇:HENGYUAN恒源(估值)

davidtslim

Publish date: Sun, 26 Nov 2017, 06:52 PM

炼油厂是一个资本密集的企业。 规划,设计,获取执照和建设一个新的中型炼油厂是一个3 - 5年的过程,可能需要30-70亿美元成本(RM126亿-RM294亿)。 成本因地点(土地成本)和国家(当地环境法规)而异。 为现有的炼油厂增加新的产能或复杂性也是昂贵的。 SK Co refinery (加拿大)公司最近耗资27亿加元(1加元= 0.8美元)在炼油厂进行了4.5万桶日产量的扩张。 欧文石油公司(Irving oil)在加拿大圣约翰建造第二座30万桶/日炼油厂的项目的成本估计为80亿加元 (目前搁置)。 Petronm提出可能要将炼油厂产能从88k bpd(日产量)提高到150k bpd (日产量)的建议也估计花费RM64亿 。

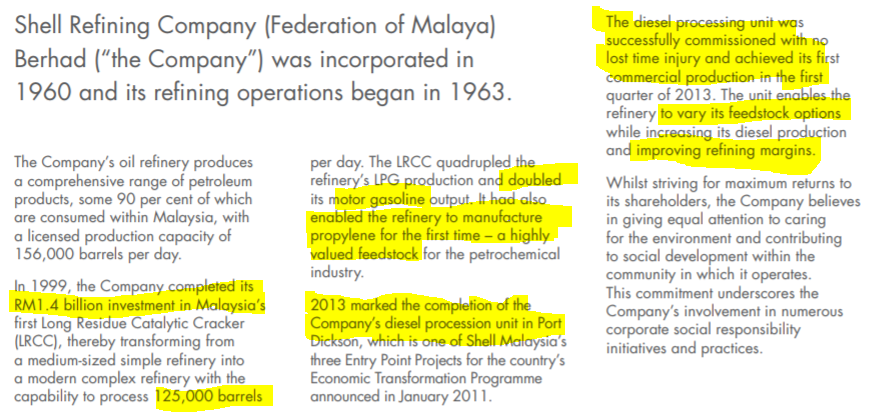

对于恒源而言,其前身(壳牌)已经完成了1999年的14 亿令吉的升级和2013年的LRCC和柴油处理单元升级,分别如下图所示:

资料来源:2014年年报

让我们来总结一下在东南亚新建和升级炼油厂的成本

|

|

估计成本 |

备注 |

|

国油RAPID新的炼油厂(300kbpd) |

600亿令吉

|

进行中,目标是在2019年完成 |

|

Petron Corp菲律宾(炼油厂升级)(100kbpd) |

50-10亿美元 升级)

新的200 kbpd成本估计花费200亿美元 |

最终提案阶段 |

|

Petronm (Malaysia) 从88kbpd升级到150kbpd |

64亿令吉 |

提案阶段 |

|

恒源 |

1999年升值14亿令吉 ,2013年升级 |

额定容量为125kbpd,许可证容量为156kbpd |

RAPID成本资料来源: http : //www.thestar.com.my/business/business-news/2017/03/04/whats-the-deal-in-rapid/

http://ww1.utusan.com.my/utusan/info.asp?y=2011&dt=0514&sec=Muka_Hadapan&pg=mh_01.htm

Petron&Petronm成本资料来源: http : //www.malaya.com.ph/business-news/business/pnoc-offers-limay-land-petron%C2%A0expansion

https://www.rappler.com/business/170029-petron-new-petrochemical-plant-ang

在马来西亚和菲律宾建设新炼油厂的平均成本 (Petronas RAPID和Petron Corp Philippines)

=(60 + 84)亿 /(300 + 200)kbpd

= 2亿8800万令吉每1kbpd

升级现有炼油厂的平均成本 (Petronm,将88kpbd升级到150kpbd, 只升级62 kbpd)

= 64亿/ 62 kbpd

= 1.03亿令吉 每1kbpd

恒源目前的市值约为25亿令吉(以恒源每股RM8.3)。 如果我们计算其每千桶日产量的估值(kbpd):

(以现价整体市值计算)

= 2500mil / 125 =每1kbpd 估值RM2000万。

(考虑到其现金和存货足以抵消其债务)

让我们来比较恒源的1kpbd估值和平均成本,根据当前的市场价格,在马来西亚建立一个新的炼油厂或升级现有炼油厂:

|

|

1kbpd 新炼油厂的平均成本 |

现有1kbpd 升级的成本 |

|

Petronas Rapid,Petronm |

每1kbpd RM2亿8800万令 |

每1kbpd RM1.03亿 |

|

恒源 |

1kbpd的市场估值为RM2000万令吉 |

恒远仍然有一些土地在波德申供未来升级。 |

根据当前9美元左右的裂解价差 (炼油厂利润率)(假设工厂的使用率为90%,没有大的维修),看看恒源炼油厂125KBd炼油厂一年能赚多少利润 。 2016年年报显示,2016年年产量为3750万桶 (112.5千X333日),过去5年平均运行炼油率可达91.9%

90%利用率= 0.9×125k = 112.5kbpd

根据平均9美元的裂缝价差,其毛利率(GPM)(Mogas 95现在已经超过10美元)

每年GPM = 112.5k X 9 X 4.2 X 333天= RM1416million (14亿1千六百万)

让我们假设恒源需要5.97亿令吉的运营,财务和管理成本(从Q1 + Q2和年度化),恒源可能的年度净利润约为8.37亿令吉 。

这个盈利预测是假设炼油利润率可以全年保持在9美元(2017年,只剩下2个月),没有意外的关闭。

对于25亿令吉的整体市场估值, 可能实现净利润8亿令吉, 我把它留给你来判断恒源估值是否便宜.

我们都知道,HY(恒源)需要相当高的资本支出来维护和遵守环境法规。 假设HY平均每年需要3亿令吉的资本支出(2017年没有重大资本支出,但2018年将有Euro 4的升值),这个资本支出可能会影响现金流(不是利润),但是记得HY 每季度有高达约RM5000万的折旧)。 所以我认为现金流量不会受到太大的影响,因为折旧将被加回现金流(折旧可以抵消资本支出在现金流里)。

也许我们可以给予20%的折扣 (为了可能的低使用率或意外的关闭),我的盈利预测恒源仍然可以以25亿令吉的市值创造RM6.7亿的净利润(不到4年就可以赚回整个市值) 。

值得注意的是,恒源在2017年6个月内已经产生了5.24亿令吉的自由现金流 (6个月会计利润RM3.368亿)。 从过去三季度的记录来看,HY有大约5000万令吉在厂房,物业和设备每季度折旧,可以帮助产生强劲的现金流(折旧也可以节省所得税开支)。

让我们看看恒源在ROIC方面更多的财务评估。

投资资本回报率(ROIC)是衡量可用资本的收益率。 ROIC告诉我们公司在把资本转化为利润方面的效率。

ROIC的方程式是:

ROIC =(净收入 - 股息)/(净债务+股权)

对于恒源ROIC可以计算如下(使用过去12个月的利润):

ROIC = 490 /(572 + 1,324)×100%

= 25.84%

ROIC每年15-20%的比率被认为是良好的比率,特别是炼油厂。 ROIC是投资大量资金的公司的有用指标,如炼油厂,石油和天然气公司,用以衡量其实现资本盈利的能力。 25.84%的 ROIC表明恒源将投资者的资本转化为利润是非常有效率的。

让我们看看恒源的一些重要财务数据如下表:

|

|

恒源(截至二季度业绩) |

恒源(即将到来的Q3成绩) |

|

ROIC |

25.84% |

? 期望改善 |

|

ROE |

33.27% |

? |

|

PE |

5.1 |

? 期望提高很多 |

|

EV / EBIT (<8很好) |

5.44 |

? 期望改善 |

|

现金 |

743.5百万 |

? |

|

债务总额 |

1316百万 |

应该保持 |

|

存货 |

1,127.9百万 |

? 价格已经增值基于9月30日油价和成品油价格上涨(Mogas 95价格现在是73美元) |

|

净债务 |

572.4百万 |

? |

ROIC是我对公司利用资本能力的评估方法之一。 它包括公司债务的计算,并提供公司获得总投资资本回报的能力的洞察。 如果ROIC太低(例如4%),公司可能无法偿还借款或银行贷款利息(通常为5%++)。 而ROE,净资产收益率的计算不包括公司的债务。

即将到来的第三季度利润

这篇文章我不想估计第三季度的利润,但更多的是绘制一个可能的利润估计供您设想。 你们中的一些人可能会注意到,恒源在2017年第三季度将会有库存增值和高产品差价的赚副。 我预计第三季度将会有强劲的表现。

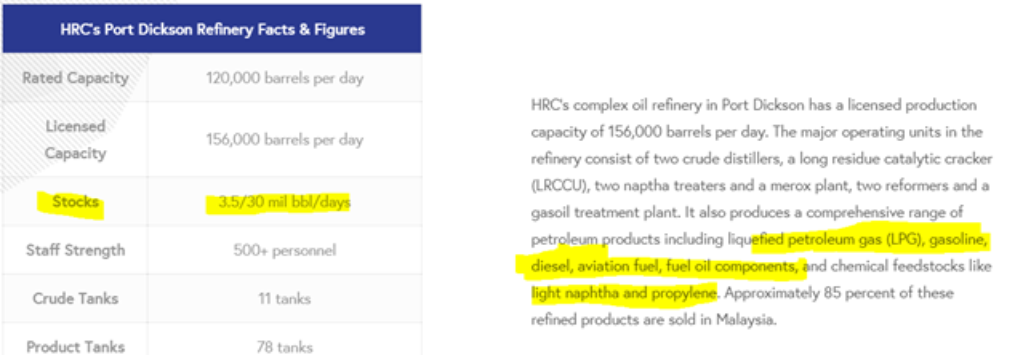

根据其网站(hrc.com.my)查看恒源炼油公司(HRC)可能的库存或库存收益,

资料来源:hrc.com.my

以上表格显示,恒源传统上保持原油350万桶或30天的原油(这是因为其库存价值为11.297亿)。9月30日布伦特原油收盘价约为57美元,3月30日收盘价为48.2美元。 通过直接扣减两个收盘价格(保守地可以取收盘价差异×350万之五十)

从下面的CME数据(直到9月份),看看Mogas 92裂解价差(产品利润率):

来源:CME网站

鉴于产品利润率和库存增值较高,我让您来估算第三季度可能的利润。

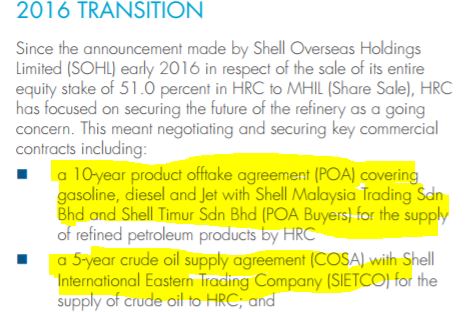

在2019年RAPID项目完成后,有些人可能会害怕HY(或HRC)可能面临更高的竞争,或者壳牌 可能不会从恒源购买 。 让我们来看看2016年年报摘录如下:

来源:2016年年报(第45页)

Shell Malaysia与恒源(HY)就其汽油,柴油和喷气燃料产品签订了为期10年的产品销售协议 (POA)。 这意味着恒源不用担心其产品的需求,而实际上壳牌的总销量大于恒源的总产量。

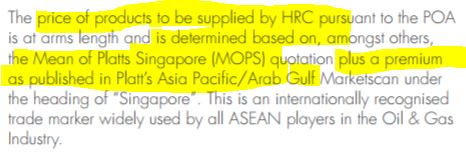

年报还提到,POA的销售价格是基于新加坡MOPS和Platt亚太地区发布的溢价。 这意味着壳牌没有得到特别的折扣, 销售价格是以市场价格为基础的。

来源:2016年年报(第45页)

此外,恒源和壳牌还签署了为期5年的COSA协议,确保壳牌向恒远供应原油的连续性的保障。 供应给恒远的原油价格是基于市场原油价格为基础的。

来源:2016年年报(第45页)

从这些摘录中我可以得出结论,只要原油价格稳定,裂解利差保持在6美元及以上,恒源(HY or HRC)将处于良好的盈利状态 。 如果裂缝价差保持在9美元及以上,则恒源应该享有超强的利润和现金流量 ( 这发生在2017的第一季度业绩,如果没有重大的意外关闭)。

库存价值

正如我在之前的第四部分提到的,恒源在二季度已经将存货增加到11亿令吉。 有些人可能知道,恒远有两期的定期贷款(总额3.5亿美元),5年内需要偿还的贷款。 引起我注意的是这些定期贷款的抵押品包括存货。 让我们来看看恒源四季报的摘录,看看这些定期贷款的抵押品是什么。

资料来源:第四季度报告

由此可见,库存,土地和建筑物之外的一种抵押品。 这意味着恒源的库存(高流动性)被视为银行的有价值的抵押品。

随着三季度原油价格上涨(48.2美元兑57美元)和第四季度(10月底60美元),未来四季度成品油库存将有相当大的未实现库存增长 。除此库存增长之外, 第三季度的平均裂解价差(利润率)大部分在10美元和第4 季度 (截止到10月底)大多维持在每桶9.5美元以上。 这对于恒源仍有一定的理论上的库存收益的情况下会获得较高的毛利率(就像是双重奖金) 。

亚洲炼油展望

有些人可能担心电动车可能会影响未来10 - 20年的原油及其成品的需求。 让我们来看看国际能源署对未来石油精炼产品需求的消息(https://www.thestar.com.my/business/business-news/2017/10/24/iea-sees-southeast-asia-oil-demand-growing-until-at-least-2040/)

这个新闻的关键摘录如下:

根据国际能源署的消息,在未来10 - 20年,成品油需求依然强劲 。

再看看亚洲炼油公司盈利及其预期前景的消息。

资料来源: http : //www.dailymail.co.uk/wires/reuters/article-5030605/S-Koreas-S-Oil-expects-strong-refining-margins-2-yrs.html?ITO= 1490& ns_mchannel= rss& ns_campaign= 1490

风险

1. 由于意外机器或炼油厂系统故障而意外关闭。

2. 意外发生火灾或爆炸。

3. 高额资本支出(5.8亿令吉)和维持费用,但所有这些费用可以通过2017年的高利润率轻松收回。根据国际能源署的说法,2018年的炼油前景应该是光明的 。

概要

1. 市场根据新建或改造现有炼油厂的成本计算,恒源的估值 相对较低 。 Petronas RAPID的300 kbpd工程造价超过600亿令吉,而Petronm提出的升级成本估算估计为64亿令吉 (62 kbpd而已,从88 kbpd到156 kbpd)。 新的炼油厂设置和升级成本是基于马来西亚的成本,因为两家公司都在马来西亚经营炼油厂。

2. 根据目前的裂解价差(利润率),恒远未来6个月的PE可能非常具有吸引力 (根据目前恒源的价格RM8.3左右)。

3.恒源盈利的优质在于强劲的ROIC(25.8%),ROE(33.2%),EV / EBIT(5.4)的比率以及强劲的现金流。

4. Shell Malaysia与恒源(HY)之间就其汽油,柴油和喷气燃料产品签订了为期10年的产品承购协议 (POA)。 这意味着恒源不用担心未来9年的产品需求。

5.根据国际能源署的报告,由于东南亚国家人口和车辆的增加,未来10 - 20年成品油市场前景依然光明 。

6.从我所能收集的数据来看,过去3个月(Q3),未来3个月(Q4)盈利前景,2018年炼油业展望均为正面 。 恒源没有任何需求问题,坏账风险低(客户是壳牌国际巨头),让我们等待即将于11月底发布的Q3业绩。

对于份股票分析报告有兴趣的股友,可私下PM我 (davidlimtsi3@gmail.com)

风险提示:此文章乃我的分析及预测及选股策略, 不对用户构成任何股票买卖及投资建议,仅供学习及参考。

您可以在Telegram Channel ==> https://t.me/davidshare 获取我的最新更新分享分析

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Future Potential of HengYuan

Created by davidtslim | Jan 19, 2018

Discussions

Great effort. Mogas crack spread doesnt equal to hrc gross refinery margin correct?

2017-11-26 20:23

This is called homework. Publishing here means spoonfeed. Thank you for ur noble act in educating the community.

2017-11-26 23:53

Worth to really read and understand:

It forecast oil refining capacity would increase by 700,000 to 800,000 bpd in 2018, but would be outpaced by demand for oil products rising by 1.4 million bpd.

http://in.reuters.com/article/us-oil-refining-capacity/stormy-weather-...

SEPTEMBER 21, 2017

BRUSSELS/LONDON (Reuters) - Hurricane Harvey’s crippling impact on U.S. oil refinery operations this month and the challenge buyers faced in filling the gap in gasoline supplies has exposed a shortage of spare refining capacity around the globe.

Nearly a quarter of U.S. refining capacity was knocked out by the storm this month, driving U.S. gasoline prices to two-year highs above $2 a gallon. Many plants are still struggling to resume normal operations, prompting other refineries around the world to crank up output to fill the gap.

Global refining is considered to be running at its maximum when capacity utilisation is 85.5 percent, the highest level reached in the modern era, BP’s head of refining economics Richard de Caux said.

Today the utilisation level is 83 percent, he told the Platts Refining Summit in Brussels, suggesting a very slim buffer.

“The spare capacity is not really there,” said Dario Scaffardi, general manager of Italian refiner Saras. “In as much as consumption worldwide is growing, refinery capacity is not long at all.”

Spare capacity is needed to meet demand when refineries undergo maintenance or face unexpected outages. Too much in reserve is costly for refiners. But Hurricane Harvey has shown the world may not have enough.

Consultant JBC Energy said refiners could process 83 million bpd of crude by the end of 2017. In 2016, BP data showed processing at roughly 80.6 million bpd.

Energy consultancy FGE estimates spare global refining capacity, based on official or nameplate numbers, stands at 14 million bpd, down from 18 million bpd earlier this decade.

But nameplate figures can be misleading, as they are based on capacity of a refinery when built or refurbished. Many cannot match those levels due to years of underinvestment. So actual spare capacity may only be a fraction of that 14 million bpd.

For example, Venezuela’s four refineries have run at record lows this year as they lack spare parts. Plants in Mexico, Brazil and Nigeria have also suffered poor investment for years.

At the same time, demand for oil and its products is climbing, led by China and India, and more developed economies.

“SILVER AGE”

“What we have is good demand growth and, ... whilst there are long lists of refinery projects, not many of them are coming through,” said Steve Sawyer, FGE’s head of refining.

Throw Hurricane Harvey into the mix and the shortage in spare capacity becomes increasingly apparent.

“Are we going to assume Venezuelan refinery utilisation rates will suddenly jump?” Energy Aspects said. “Or are we going to rely on Nigeria’s dilapidated refineries to fill the gap? None of this capacity is available to the current market.”

“The only country with truly spare refining capacity is China, where environmental restrictions have capped runs,” the consultancy said in a note.

As a result, Morgan Stanley predicts a “silver age” of profits to the end of the decade for refiners as margins rise.

“Refining cycles are historically short and volatile, but there is more visibility than usual, and we expect this strength to continue,” the bank said in a note.

It forecast oil refining capacity would increase by 700,000 to 800,000 bpd in 2018, but would be outpaced by demand for oil products rising by 1.4 million bpd.

“Refinery crude intake probably needs to increase by (roughly) 1.1 million bpd. Hence, global refining utilisation is set to stay high in 2018, which will underpin margins again next year,” the bank said.

It forecast BP’s Refining Marker Margin, a benchmark proxy for profits, would rise from $12.8 a barrel in 2017 to $16 a barrel in 2020.

A move to make shippers to use fuel with less sulphur from 2020 will offer further opportunities for refiners to boost margins by supplying more low-sulphur distillates.

“With product demand and refining margins this strong, the world needs more refining capacity not less,” said Nevyn Nah, oil products analyst at Energy Aspects in Singapore.

2017-11-27 00:07

It forecast oil refining capacity would increase by 700,000 to 800,000 bpd in 2018, but would be outpaced by demand for oil products rising by 1.4 million bpd.

“Refinery crude intake probably needs to increase by (roughly) 1.1 million bpd. Hence, global refining utilisation is set to stay high in 2018, which will underpin margins again next year,” the bank said.

It forecast BP’s Refining Marker Margin, a benchmark proxy for profits, would rise from $12.8 a barrel in 2017 to $16 a barrel in 2020.

2017-11-27 00:11

https://www.rappler.com/business/170029-petron-new-petrochemical-plant-ang

He said Petron plans to spend at least $1.5 billion (P74.57 billion) to expand the capacity of its oil refinery in Malaysia to 150,000 barrels a day from 88,000 barrels a day.

2017-11-27 10:08

Annual world refining outlook 2017:

https://www.fgenergy.com/media/420733/fge-annual-refining-outlook-2017-brochure.pdf

Our conclusions will continue to challenge the conventional wisdom of gasoline length and distillate shortage (at least to 2020!). It will also raise new concerns about how the refining/shipping industries will react to the 2020 IMO regulation changes; all set within an internally consistent framework of refinery capacity, estimated refinery margins and products prices. We review how surplus refining capacity may change, challenging the traditional call for further reductions in capacity. Indeed, we may well be experiencing the beginning of a new “Golden Age of Refining” which will see new capacity being required and added throughout the 2020s.

2017-11-27 10:17

If you read the second article on the Bunker Fuel ( Fuel Oil produced by Simple Refiners), it precisely gives the reason why PetronM has to do the 1.5B investment.

When all these simple refiners are forced to closed down, Gasoline and Diesel demand in future will exceed the supply significant pushing their margins higher.

Hengyuan made the most prudent investment of 1.4Billion (RM 5 per sghare) in 2013 on Catalytic cracking unit to convert the fuel oil to Diesel.

2017-11-27 10:31

FutureEyes

Priceless information. Well done!

2017-11-26 19:18