第四篇:HENGYUAN恒源(现金机器)

davidtslim

Publish date: Tue, 21 Nov 2017, 12:23 AM

HengYuan第二季度月绩报告的另一个观点

我相信大部分投资股市的人都是为了赚钱。 如何知道一个公司真正从业务中在帮我们(股东)赚钱,还是仅仅产生会计利润? 许多投资者只是将会计利润视为他们的买入/卖出参考。 我可以给你两个上市公司的例子,第一个例子是KNM,第二个例子是EG工业公司(对于KNM和EG股东而言 ,我只是想举个例子),这些例子往往表现出良好的会计利润,但是自由现金流量是经常负数的 (negative free cash flow)。

如果公司长期持续负现金流量将会发生什么呢? 它可能需要从银行贷款,附加股的发行,私募,发行贷款股票(LA)等。比如KNM(收购用途)。请去检查KNM过去5年提出的附加股。

如果一家公司业绩报告的会计利润低于预期,但产生高的自由现金流量会产生什么效果? 这将推动手中的现金增加 ,这对我来说更为有意义。 事实上,我认为正数的自由现金流对于企业的可持续发展至关重要,除了那些正在进行大规模扩张和收购的公司。 如果预计的扩张收益没有实现,那大规模扩张或收购可能会产生负面影响或风险。

从恒源最新公布的业绩来看,2017年二季度(Q2)同比下降21%,实现净利润8400万令吉(每股盈利29仙 )。 许多投资者对此结果相当失望,认为这是一个糟糕的结果。 但这真的是一个失望的结果? 我不这么认为。 让我告诉你一些我的理由,即结果不像你们有些人可能想像的那样糟糕 。

第一个理由:

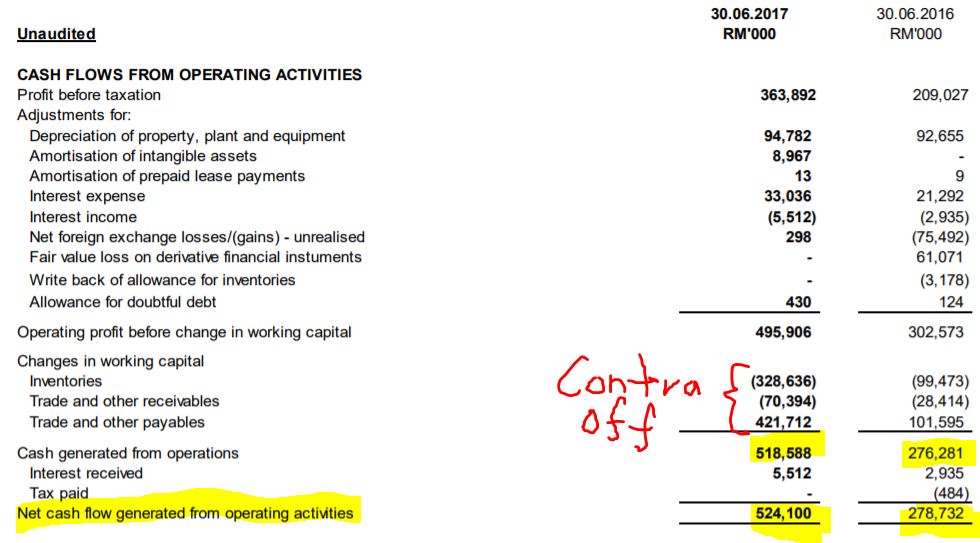

普通或低的会计利润,但从运营中获得更高的自由现金流。 让我们来看看恒源(HY)过去6个月运营产生的现金流量如下:

来源:第二季度报告

HY在6个月内已经产生了5.24亿令吉的现金 。 这是没有任何产业出售收益的。 让我们来看看过去6个月里有多少现金用于支付贷款:

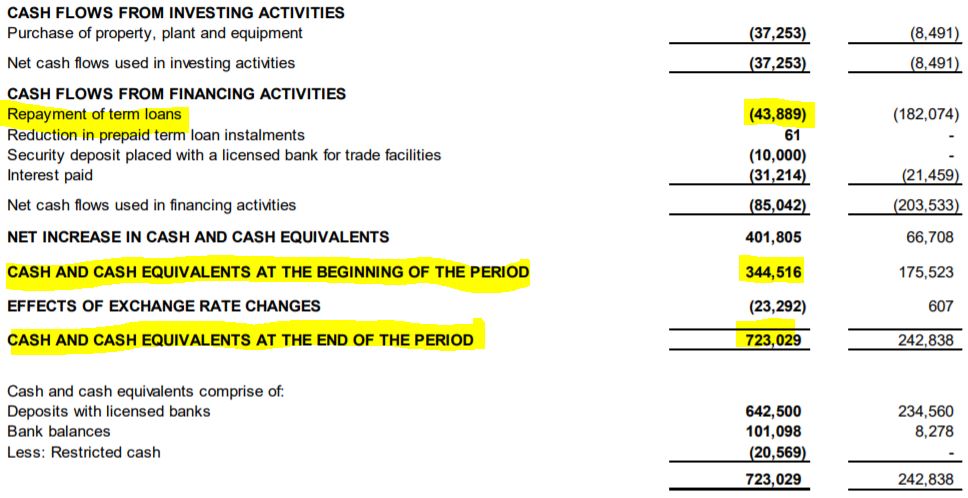

来源:第二季度报告

从上表可以看出,HY已经支付了4 千3百万令吉的定期贷款(2亿美元贷款的5%),并且在6个月期间将现金从3亿4千4百万令吉增加到7.23亿令吉 )。

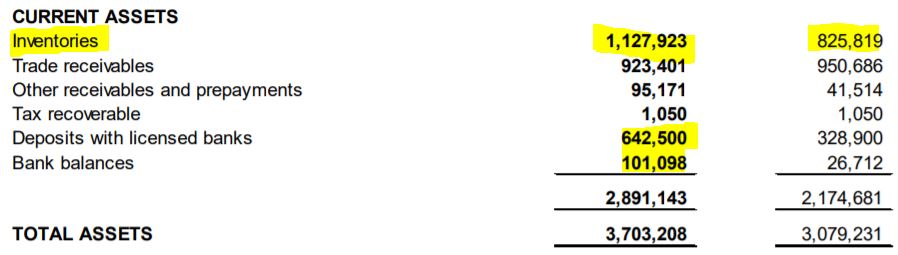

值得注意的是,在库存水平提高的同时, 实现了现金流量增量 ,同时偿还了4300万令吉的定期贷款。 让我们来看看HY的库存水平的价值如下:

来源:第二季度报告

通常当公司增加库存水平时,他们的现金流量应该减少,但是HY可以同时达到这两点 ,我相信这是因为相当高的经营利润率和一些未实现的库存损失。

与其他人相比,这个现金流量有多高?

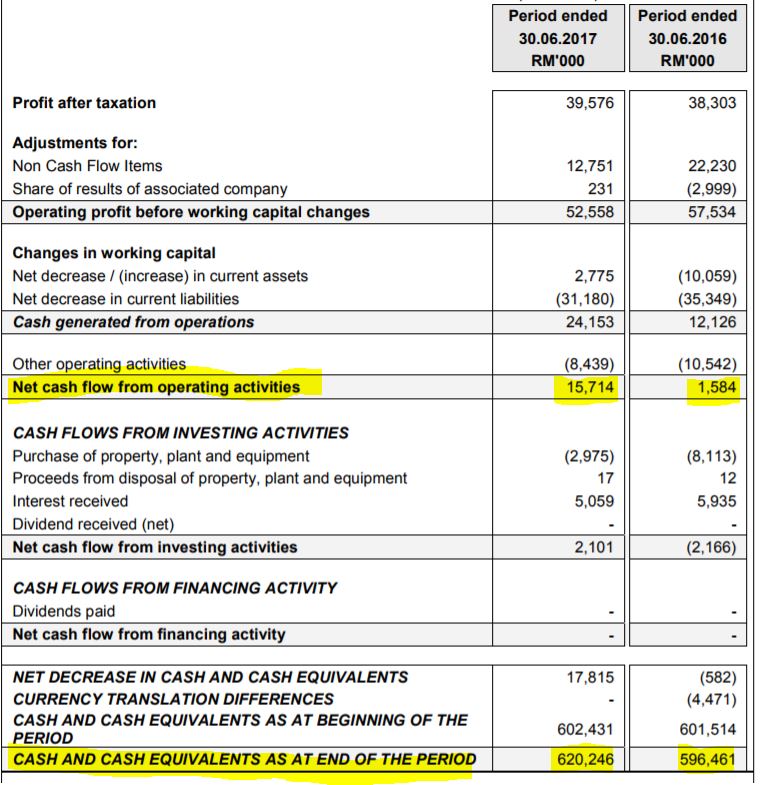

让我们来比较一个名叫Panany(松下制造马来西亚有限公司)的公司,它以高水平的现金流和高股息而闻名如下:

来源:第二季度Panamy报告

Panamy在第二季度末拥有6.2亿令吉的现金,而在6个月期间,经营获得的自由现金流约为RM1500万。

让我们比较HY和Panamy的每股现金和每股价格对比每股现金如下:

|

|

恒源 |

Panamy |

|

每股现金(现金/股份总数) |

2.41 |

10.21 |

|

价格对比每股现金(越低越好)(根据HY为7.43令吉,Panamy为38.5令吉) |

3.08 |

3.77 |

从表中可以看出,恒源每股现金为2.41令吉,而Panamy则为10.21令吉。 但是,如果您比较每股价格对比每股现金,恒源产生更好的价值,因为比率越低安全越好。

值得注意的是,恒源在6个月内产生了5.24亿令吉的现金流,而Panamy需要5年才能产生超过2亿令吉的自由现金流量(可参考Panamy的Q3'12报告现金)。

这个现金水平与恒源市值相比有多强? 如果我们假设恒源能够在2017年下半年继续创造5.24亿令吉的现金(这可是鉴于当前高的经营利润率),那么每年运营产生的现金总额为10.48亿令吉。如果大股东打算收购整个公司,需要多长时间?

恒源整体市值仅为22亿令吉 (按7.43 令吉计算)

使用“现金流量购买整个公司的时间

= 2200万/1048万= 2.1年

这意味着,如果有人设法将这家公司私有化,他可以使用运营现金流量(假设零资本开支 )在2.1年内收回所有的投资资本。 值得注意的是,私有化的公司(恒源)是一家存货价值 为11.27亿 马币的公司,存货价值可以削减总额为13.2亿令吉的总借款的91%。 (即使每年有3.5亿令吉的资本支出用于升级/维护,收购整个公司 只需要3年的时间 )

恒源在马来西亚其实拥有很多超低价土地 。 请记住,Petronm刚刚在Q217出售了一块土地,实现了RM3900万的产业出售收益收益(由于土地账面价值大大低于市场价值)。

总而言之, 恒源高质量盈利可以从5.24亿运营现金流来体现(会计盈利3.638亿令吉)。

第二个理由 - 如果删除一些一次性项目,实际会计利润可能会更高

有人可能会注意到恒源的经营利润受到外汇损失,库存损失,额外的工厂费用,3周的维修计划摊销损失影响。 让我们从下面的表格中看看,如果我们删除一些这样的一次性项目(有些是未实现的,如库存损失和外汇损失),那么实际会计利润是多少。

|

|

Q2'17(万) |

|

原来的会计利润 |

8400 |

|

外汇损失 |

2400 |

|

额外的制造费用 |

2000 |

|

库存损失(未实现) - 估计为280万桶X 1.71 X 4.3 |

2060 |

|

由于工厂的维护造成的损失(销售额下降了30万桶) - 估计为300kXUSD8X4.3 |

1030 |

|

一次性项目的成本被清除后的总利润 |

1.589亿 |

这意味着如果我们清除一次性支出项目,实际会计利润将达1.589亿马币,代表每股收益53仙 (Q2‘17)。然而对我来说更有价值的是它在第二季度运营的现金流(4亿令吉)远高于会计利润。 强有力的现金流主要是由于高折旧以及一些未实现的库存损失.

第三个理由 - Q2报告中的高库存水平

我特别喜欢恒源在高格的裂缝价差(炼油厂利润率)时期存有高库存。 我相信只有足够高的库存,那么在当前的高格的炼油利润率下你才能够获得足够高的利润 。 如果原油在9月底停留在48美元以上 ,那么恒源很可能会录得库存增长 。

事实上,恒源在6个月的时间内将库存价值从8.25亿令吉增加到了11.27亿令吉(参见Q2'17报告)。 与此同时,即使花费了大量现金来增加库存,他们的现金流仍然提高了5.25亿令吉。 值得注意的是,他们前两个季度遭受了库存损失,但这一切都可以被 2017年第一季度和第二季度的高利润率 (高裂解价差) 所抵消 。

仍然没有足够的说服力,第二季度和第一季度的利润率相当高? 让我们来看看第二季度报告中的评论意见如下:

资料来源:二季度报告

总之,他们的利润率很大程度上取决于产品的裂解价差(炼油利润率)。 考虑到目前(8月)的汽油炼油利润率,我可以预期第三季度利润将达到5年高点。 如果他们能够保持112kbpd的吞吐量(按第一季度),则可能会显着增加恒源的毛利率。

从我所提到的三个理由来看,我认为恒源第二季度业绩(每股盈利29仙)在很多负面因素(计划3周关闭)下是相当不错的 ,其中有些是一次性项目(库存亏损,外汇亏损,额外的工厂维护费用)

让我们根据10美元的裂缝价差计算恒源每天的毛利(GP)

GP(毛利)= USD10X4.3 X 112k = 482万令吉

即使我们假设他们在第三季度关闭了20天,那么GP = 482万令吉×70天= RM3.371亿万

主要催化剂:高炼油利润率(Q3'17对Q2'17对Q'16)是主要利润驱动因素

概要:

1.第一利好:恒源盈利与汽油裂解价差息息相关(炼油利润率)。仅通过监测产品未来的价差数据,其毛利率是相当可预测的。

2.第二利好:恒源的主要客户是壳牌(Shell),她的产品10%出口到新加坡。 他们的业务高度递归(顾客回访率高),也有出口到中国的可能性。 总之,他们产品的需求不是问题。

3.第三利好:由于客户是国际石油巨头(壳牌),应收债务减值风险低,

4.第四利好:由于高平均汽油裂解和可能的库存收益,第三季度的盈利能见度非常高。

5.第五利好:运营的自由现金流量高,如果炼油毛利可以维持在9美元以上,那么我认为它就像现金印刷机 。

6.我认为,第三季度另一个计划维护的可能性很低,因为她在第二季度已经维护了。 即使我们假设由于第三季度有维护而有22%的停机时间,我可以为HY计算的毛利仍然非常有利可图。

在结束我的报告之前,让我们看看最近有关美国哈维飓风对炼油设施造成损害的新闻

https://www.cnbc.com/2017/08/27/hurricane-harvey-refineries-shutting-down.html

http://www.foxbusiness.com/features/2017/08/27/exxon-shutting-major-houston-area-refinery.html

对于份股票分析报告有兴趣的股友,可私下PM我 (davidlimtsi3@gmail.com)

风险提示:此文章乃我的分析及预测及选股策略, 不对用户构成任何股票买卖及投资建议,仅供学习及参考。

有兴趣的读者可加入我的 Telegram 频道 : https://t.me/davidshare

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Future Potential of HengYuan

Created by davidtslim | Jan 19, 2018

Discussions

omg davidtslim.. hope that u have luck this time..

not like the blog u wrote for hiaptek.. totally different from what you predict

2017-11-21 10:06

next yr EPS might not be so high, as need to strt paying tax, conservatively still RM15-18 first lah.

2017-11-21 17:11

David... ppl bought at 4 and below d, u copycat buy late and keep pushing and sweet talk

2017-11-22 11:54

younginvestor92: Copy others pick? I publish my first Hengyuan article on 21 July. Pls check Hengyuan price at that time and see anyone cover or write about HY?

HY part 1 : https://klse.i3investor.com/blogs/davidtslim/128328.jsp

I cover Petronm even earlier (7 articles)

2017-11-22 17:17

younginvestor92 : Show proof that I copy others. This article is my translation from my Hengyuan's part 4 article that I published in Aug.

2017-11-22 17:26

ACCORDING TO GENERAL RAIDER INTELLIGENCE REPORT, WE BELIEVE DAVID LIM, AND HE SHOULD ALSO BE GIVEN A MEDAL OF EXTREME HONOR FOR HIS CONTRIBUTION TO HENGYUAN WAR SUCCESS LOH...!!

Posted by davidtslim > Nov 22, 2017 05:17 PM | Report Abuse

younginvestor92: Copy others pick? I publish my first Hengyuan article on 21 July. Pls check Hengyuan price at that time and see anyone cover or write about HY?

HY part 1 : https://klse.i3investor.com/blogs/davidtslim/128328.jsp

I cover Petronm even earlier (7 articles)

davidtslim

115 posts

Posted by davidtslim > Nov 22, 2017 05:26 PM | Report Abuse

younginvestor92 : Show proof that I copy others. This article is my translation from my Hengyuan's part 4 article that I published in Aug.

2017-11-22 17:30

Vimediac: I didnot owe anyone for anything. I share my articles without any return and with clear disclaimer. My Hiaptek's contents technically nothing wrong and I found nothing misleading (Show me if got anything misleading or technically wrong). It is my freedom (in fact any author in i3) to delete or share their writing.

2017-11-22 23:37

cocky now la..

tq for sharing.. dont worry to be worng, no one always right..

2017-11-22 23:40

People willing to share, we should appreciate instead of talk 3 talk 4 here. Buy or sell at your own risk, you have to fully responsible to your investment decision.

2017-11-23 00:44

Good Article, Thank you very much to Mr. David Lim.

Looking forward for more articles in future.

2017-11-23 16:02

NOVEMBER 23, 2017 / 6:11 PM / UPDATED AN HOUR AGO:

Traders mop up fuel cargoes before refinery repair crunch:

https://uk.reuters.com/article/oil-refining-fuel/traders-mop-up-fuel-c...

LONDON, Nov 23 (Reuters) - Traders are chasing gasoline and diesel cargoes and drawing volumes away from Europe to prepare for a particularly heavy round of refinery works around the world.

The buying spree has soaked up fuel even as many refineries have been running flat out, while the surge in demand has sent tankers on unusually erratic routes.

This has underpinned a bullish oil market that has pushed crude prices to two-year highs.

Buyers from Venezuela to Singapore, still recovering from the loss of millions of barrels in U.S. refining in the autumn due to Hurricane Harvey, are now grappling with upcoming refinery closures for repairs in the Middle East.

With Latin America’s own refineries running at a fraction of capacity due to lack of maintenance, the region has been taking much of the diesel coming from the U.S. Gulf Coast.

To compensate, U.S. East Coast buyers have pulled in diesel cargoes that had been destined for Europe, including one siphoned from a 2-million-barrel vessel that was built to carry crude from Asia.

“Demand has come in stronger than people anticipated,” said Robert Campbell, head of oil products research with Energy Aspects, adding that the increase in demand for products stocks in advance of early-year maintenance came faster than expected.

In the past, diesel cargoes rarely left Europe, a region that imports nearly 20 percent of its needs and which traders till recently termed a “dumping ground” for the fuel. But exports have surged from Europe since Hurricane Harvey.

Gasoil stocks in independent storage in Europe’s Amsterdam-Rotterdam-Antwerp hub plummeted to three-year lows last week, falling below 2 million tonnes even as winter demand for heating fuel looms. At that level, stocks are 42 percent lower than the 2017 high hit in May and about half the record hit last year.

Gasoline is also heading out of Europe. Data from industry monitor Genscape shows 3.6 million barrels of gasoline and reformate, a component used to make the motor fuel, left Europe for China, Singapore and the Middle East in the past two months.

By some estimates shipments are at least 20 percent above the same period last year. Several traders said roughly 1 million barrels per day loaded in the past week alone, bound for the Middle East and Far East.

“That’s a ridiculous volume of exports,” one trader said.

Iranian gasoline production shortages forced Iran to import more cargoes. But buying is mainly being driven by refinery maintenance work planned for first quarter of 2018, particularly in Saudi Arabia, said Campbell and several traders.

“We’re talking about a very large amount of crude capacity that’s coming off,” Campbell said, adding it would lead the Middle East region to continue importing into early next year.

Demand for gasoline cargoes is keeping stocks from building significantly, even though refineries worldwide are running at more than 96 percent of capacity, their highest in more than three years, according to estimates by analysts JBC.

“Inventories for gasoline and diesel have fallen significantly, and we see the market as having rebalanced from this perspective,” JBC said.

“Together with little spare capacity and still-strong demand, we expect relatively erratic movements in cracks to keep market participants on their toes,” the firm added.

2017-11-23 23:50

skyjet

If Q317 net profit 400Mils or EPS 1.33, assume continue coming 4 quarters also with net profit 400Mils, total net profit for 4 quarters will be 1.6B or EPS 5.32. Apply with PE 10, Heng Yuan target price is 53.2. Current price just around 10. Another 500% gain. WOW, worth to buy now.

HengYuan target price 53.2. @@ HengYuan so SEXY....................

2017-11-21 07:42