Part 4: HengYuan (Cash Generation Machine)

davidtslim

Publish date: Wed, 30 Aug 2017, 09:34 PM

Another perspective to view HY Q2 result

I believe most of the people invest in share market are to make money. How to know a company really makes money from business for us (shareholders) or just producing accounting profit? Many investors just see accounting profit as their buying/selling reference. I can give you two examples of listed companies which show high or positive accounting profit that do not make sense for me. First example is KNM and second example is EG Industries (NO OFFENCE for KNM and EG shareholders as I just want to give examples) which are quite often showing good accounting profit but negative free cash flow (FCF).

What will happen if a company has continuous negative FCF over long run? It may need to take loan from bank, right issue, private placement, issue loan stock (LA) etc. Please go to check how many time KNM (for acquisition) and EG (for expansion) proposed and exercised Right Issues in the past 5 years.

If a company reported a lower than expected accounting profit but generating high FCF, what will happen? This will drive cash in hand (banks) to increase and this would be more make sense for me. In fact, I believe positive FCF is important for sustainability of a business except for companies that are in big expansion and acquisitions. Big expansion or acquisition may have negative impact or risk if the projected earnings from expansion did not materialize.

From the latest HengYuan released result, it reported a net profit of RM84 mil (EPS of 29 sen) for second quarter (Q2) of 2017 (drop 21% YoY). Many investors should be quite disappointed with this result and think this is a poor result. But is it really a disappointed result? I don’t think so. Let me show you some of my justifications that the result is not so bad as what some of you may think.

First Justification:

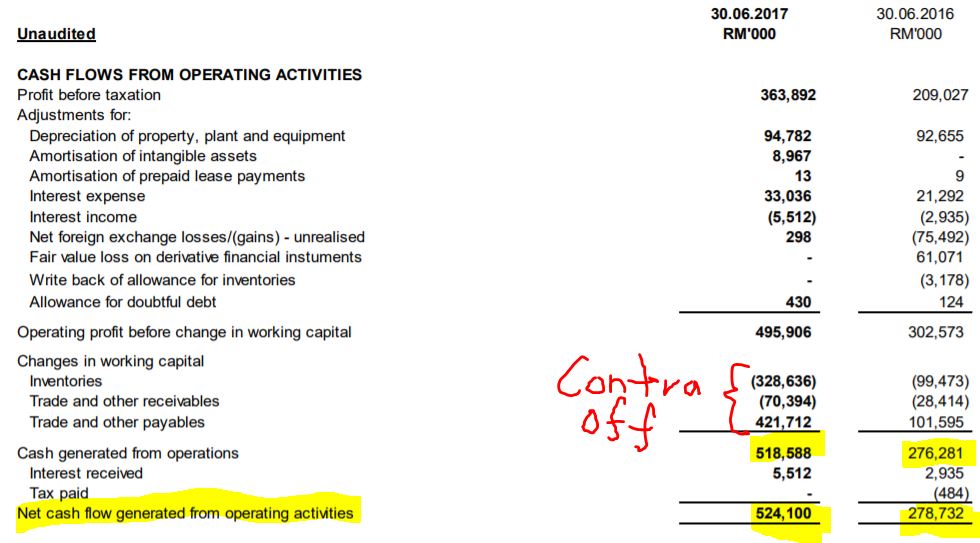

Lower accounting profit but much higher FCF from operation. Let see how much cash flow generated from operation in the past 6 months for HengYuan (HY) as below:

Source: Q2 report

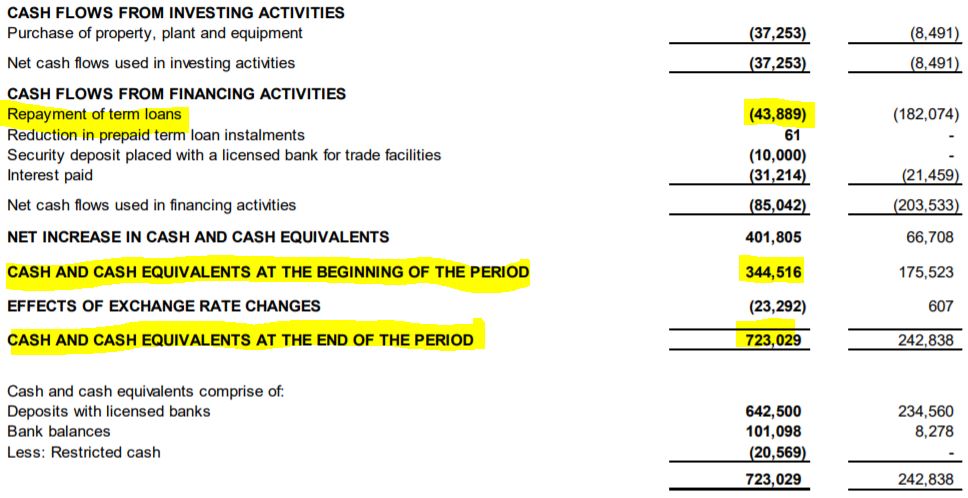

HY has generated RM524 mil cash from operation in a period of 6 months. This is achieved without any disposal gain. Let see how much cash has been used to pay loan in the past 6 months as below:

Source: Q2 report

From the table above, HY has paid RM43 mil of term loans (5% of USD200 mil loan) and has increased its cash in hand from RM344 mil to RM723 mil in the period of 6 months (cash in hand at the end of Q1 actually is RM285).

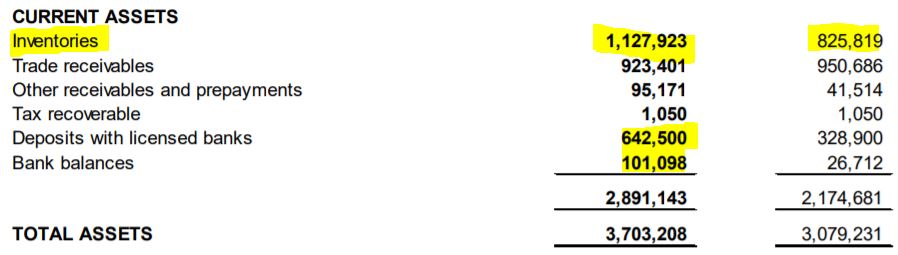

It is worth noting that the huge cash flow increment is achieved at the same time the inventory level is increased and repayment of term loan of RM43 mil. Let see how much the inventory level or value of HY as below:

Source: Q2 report

Normally when a company increases their inventory level, their cash flow should decreases but HY can achieve both at the same time which I believe is due to relatively good profit margin from operation and some unrealized stock loss.

How high this cash flow as compared to others?

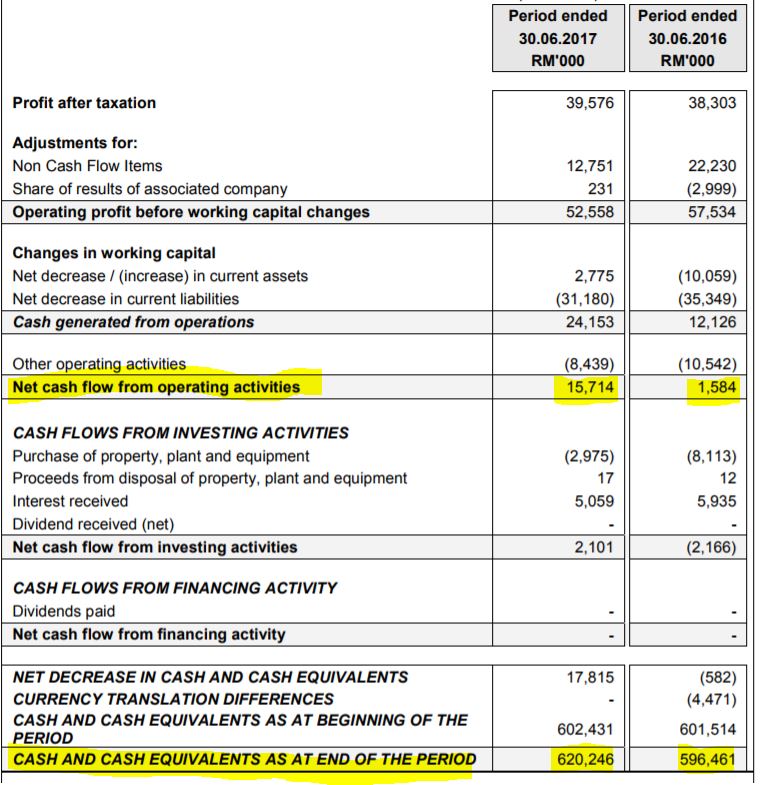

Let us compare with a company called Panany (Panasonic Manufacturing Malaysia Berhad) which is known for their high level of cash flow and high payout of dividend as below:

Source: Q2 Panamy report

Panamy has cash in hand of RM620 mil by end of Q2’17 and FCF from operation is about RM15 mil in the period of 6 months.

Let us compare cash per share and price/cash per share ratio for both HY and Panamy as below:

|

|

HengYuan |

Panamy |

|

Cash in Hand per share (cash/ total no of shares) |

2.41 |

10.21 |

|

Price/Cash per share ratio (based on RM7.43 for HY and RM38.5 for Panamy |

3.08 |

3.77 |

From the table, Hengyuan cash per share is RM2.41 while Panamy is RM10.21. However, if you compare Price/Cash per share ratio, Hengyuan produce a better value as the lower the ratio the better margin of safety.

It is worth noting that Hengyuan generated RM524 mil cash flow within 6 months while Panamy may take over 5 years to generate over RM200 mil free cash flow (can refer to Panamy’s Q3’12 report for cash in hand).

How strong this cash level as compared to Hengyuan market capital? If we assume Hengyuan can continue to generate another RM524 mil cash in second half of 2017 (which is likely in view of current margin), then total cash generated from operation per year is RM1048 mil. How long needed using this cash flow generation if majority shareholders intend to buy out the whole company?

The whole market capital for Hengyuan is just RM2.2 billion (based on RM7.43)

Time needed to buy out the whole company using Cash Flow from Operation

= 2200 mil / 1048 mil = 2.1 years

This means if someone manages to privatize this company, he can get back all his invested capital in 2.1 years using the cash flow from operation (with assumption of zero capex). It is worth noting that the company (HengYuan) that someone manages to privatize is a company with inventory value of RM1127 mil which can pare down up to 91% of its total borrowings of RM1232 mil. (Even with RM350 mil capex for upgrade/maintenance per year, someone still manage to buy out the whole company in 3 years time)

This is not to forget that Hengyuan actually owns a lot of super undervalue lands throughout Malaysia. Remember Petronm just disposed a land in Q2’17 which realized RM39 mil disposal gain (due to much lower land book value).

In short, the high quality of Hengyuan earning is supported by strong FCF from operation of RM524 mil as compared to accounting profit of RM363.8 mil (Q1 – 279.4 + Q2 – 81.4).

Second Justification - Actual accounting profit could be much higher if we remove a few one-off items

One may notice Hengyuan operation profit is affected by Forex loss, inventory loss, extra factory expenses, amortization and loss due to 3 weeks planned maintenance. Let see from the table below how much the actual operation profit if we remove some of these one-off items (some are unrealized like inventory loss and forex loss).

|

|

Q2’17 (mil) |

|

Original accounting profit |

84 |

|

Forex loss |

24 |

|

Extra manufacturing expenses |

20 |

|

Inventory loss (unrealized) – Estimated by 2.8 mil barrels X 1.71 X 4.3 |

20.6 |

|

Loss due to distillers planned minor maintenance (sales drop by 300k barrels) – estimated by 300kXUSD8X4.3 |

10.3 |

|

Total profit if one-off item cost are removed |

158.9 mil |

That mean if we removed one-off expenses items the actual accounting profit will be RM158.9 mil which represents EPS of 53 sen (Q2’17). What is more valuable for me is its FCF from operation in Q2 (RM400 mil++) is much higher than the accounting profit. The strong FCF is mainly due to high depreciation and also some unrealized inventory loss (increase in payable if offset by increase in inventory).

Third Justification - High Inventory level from Q2 report

I particularly like Hengyuan’s high inventory level in the booming time of Crack spread (refinery margin). I believe only with high enough inventory then only you can make high enough profit under current crack spread level. This is not to mention that HY likely to record inventory gain if crude oil stays above USD48 in the end of September.

In fact, Hengyuan has increased their inventory value from RM825 mil to RM1127 mil within 6 months time (refer Q2’17 report). At the same time, their cash flow is still improved by RM525 mil even they have spent a lot of cash to increase their inventory. It is worth noting that they have suffered inventory loss in the previous two quarters but all these can be offset by high profit margin (high crack spread) in Q1 and Q2 of 2017.

Still not convincing enough that their profit margin is high in Q2 and Q1? Let see what are the review comments from their Q2 report as below:

Source: Q2’17 report

In short, their profit margin is highly depending on product crack spread. What can we expect for Q3 profit in view of current gasoline crack spread (refinery margin) reaches 5 years high in Aug 2017? It could be significant increment in HY gross profit margin if they can maintain similar throughput of 112kbpd (as per Q1).

From all my three justifications, I view HengYuan Q2 result (EPS of 29 sen - RM81 mil) is considerable good under many negative factors (planned 3 weeks shut down) which some of them are one-off items (stock loss, forex loss, extra factory maintenance expenses)

I may cover my view on possible dividend distribution in 2018, its debt structure and valuation analysis in my part 5 report.

Let us calculate how much gross profit (GP) per day for HY based on USD10 crack spread

GP = USD10X4.3 X 112k = RM4.82 mil

Even we assume they got shut down of 20 days in Q3, then GP = RM4.82 mil X 70 days = RM337.1 mil

Key Catalyst: High Product spread (Q3’17 vs Q2’17 vs Q3’16) which is main profit driver

Summary:

1. First strength: Hengyuan profit is closely related to gasoline and other products crack spread (refinery margin). Its gross profit is quite predictable just by monitoring the product future spread data.

2. Second strength: Hengyuan major customer is Shell and they got export 10% of their product to Singapore. Their business is very recursive and there is also possibility of export to china. In short, demand for their products is not an issue.

3. Third strength: Low risk of debt impairment as their customer is international oil giant (Shell)

4. Forth Strength: High profit visibility in Q3 from the fact of high average crack spread data and possible inventory gain

5. Fifth strength: High Free Cash Flow from operation which I would say it is like a CASH printing machine if refinery margin can be sustained at USD9 or above.

6. In my opinion, the possibility of another planned maintenance is low in Q3 as they just have it in Q2. Even we assume there are 22% of down time due to maintenance in Q3, the gross profit that I can calculate for HY is still very lucrative.

Before I end my report, let see some of the recent news on damages caused by US Harvey hurricane on its refinery facilites

https://www.cnbc.com/2017/08/27/hurricane-harvey-refineries-shutting-down.html

http://www.foxbusiness.com/features/2017/08/27/exxon-shutting-major-houston-area-refinery.html

If you interested on my analysis report, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Future Potential of HengYuan

Created by davidtslim | Jan 19, 2018

Discussions

Posted by Ooi Teik Bee > Sep 1, 2017 11:30 PM | Report Abuse

stockraider,

Your English is so poor, you talk cock here.

Thank you.

Ooi

"Mr Ooi Teik Bee’s recommendation:

If you are a subscriber, you should have received Mr Ooi Teik Bee’s recommendation of Hengyuan with a target price of Rm 15.93.

I am obliged to tell you that I have quite a lot of Hengyuan and I am not asking you to buy it. But if you decide to buy it, you are doing at your own risk.

As much as I am reluctant to post this piece on i3investor to avoid seeing some stupid commentaries, Mr Ooi Teik Bee asked me to post it to teach people how to make more money. "!!

FROM THE ABOVE U SEE MR OOI CAKAP TAK SERUPA LOH...!!

WHY SUDDENLY HE SAYS NO DIV LAH...CHINA PARTY BOUGHT IT CHEAP LOH..!1

LIKE NO FROG JUMPING AROUND LOH...!!

THIS IS BCOS MR OOI, SOLD OF HRC RM 7.00 TO RM 8.00 HOPING TO BUY BACK CHEAP LOH.....!!

GENERAL RAIDER SAYS MR OOI HIGHLY DISHONEST LOH...!!

WHY ??

IF HIS SHORT TERM HRC TP IS RM 9.00.

MID TERM TP IS RM 12.00

LONGER TERM TP IS RM 15.00

WOULD IT NOT BUYING & CHASING HRC AT RM 7.50 NOW, NO ISSUE LEH!!

WHY WOULD OTB AND GANG FEAR HRC RUN UP, BCOS OF RAIDER STRONG PROMOTION LEH....!!

2017-09-01 23:35

What is the problem?

Just buy back Ferrari HRC at higher price loh..hahahaha

2017-09-01 23:40

I recommend a buy at 5.95, I advise readers here not to chase high the price to buy. The record is very clear in this forum.

Aug 29, 2017 06:19 AM | Report Abuse

Is it true too that otb recommended Hengyuan with a target price of $15.93 too? Those who followed his target price, must be badly caught in this down draft in Hengyuan share price.

At 7.03 yesterday, the gains in Hengyuan since 31.7.2017 have been wiped away.

Ans :

3iii,

Please be careful with your words. Please do not cross the line.

I said short term target is 9.00, the highest price done was 8.68. I am not very far wrong.

I said 7 month target is 12.79. 1 year target is 15.93.

The statement here is very clear, I did not tell readers here to chase high. If they chase the price high to buy, it is not my fault.

Please be careful with your words and do not put words into my mouth. Please be fair and gentleman. Argue your point but not personal attack.

Thank you.

Ooi>>>>

Mr. otb

Thanks for highlighting my post.

Yes, this was what was written by me.

>>>>>>

3iii >>>>Stock: [HENGYUAN]: HENGYUAN REFINING CO BHD

Aug 10, 2017 11:14 AM

Mr Ooi Teik Bee’s recommendation:

If you are a subscriber, you should have received Mr Ooi Teik Bee’s recommendation of Hengyuan with a target price of Rm 15.93.

<<<<<

Alright, I think I have found the post you mentioned.

I think it is this post that you seem to be unhappy about.

If you are offended, please accept my apology.

More explanation later.

>>>

Stock: [HENGYUAN]: HENGYUAN REFINING CO BHD

Aug 28, 2017 11:54 AM | Report Abuse

Dear paperplane, raider, aseng and others,

No point for you to defend all accusation and attack on this stock, I know you want to help readers here sincerely.

Please note that 90% of investors lost money in stock market, only 10% make big money. Please follow the 10% but not 90%.

Please keep quiet and make money quietly, lesson learned. No point to share your hard work here, when they made money, they did not share with you. When they lost, they curse you. No worth your sincere effort.

It is a big bully here, did they do hard work to analyse the stock ? None.

They like to attack writers in I3 to show they are good. To me, they do not gain my respect unless they can show your good forecast here and talk with facts and figures.

I still respect you all despite you are wrong in your forecast. Try hard and make a good and correct forecast next time. You will do well in your investment.

It is my final posting in Hengyuan, I do not wish to share my information here. I would not bother to read any comment on me because I do not make any mistake here. I recommend a buy at 5.95, I advise readers here not to chase high the price to buy.

Thank you.

Ooi <<<<

Is it true too that otb recommended Hengyuan with a target price of $15.93 too? Those who followed his target price, must be badly caught in this down draft in Hengyuan share price.

At 7.03 yesterday, the gains in Hengyuan since 31.7.2017 have been wiped away.

29/08/2017 06:19<<<<<

FROM THE ABOVE U CAN SEE HOW MR OTB DISHONEST LOH...!!

CAKAP TAK SERUPA LOH...!!

NO STANDARD LOH...!!

"Mr Ooi Teik Bee’s recommendation:

If you are a subscriber, you should have received Mr Ooi Teik Bee’s recommendation of Hengyuan with a target price of Rm 15.93.

I am obliged to tell you that I have quite a lot of Hengyuan and I am not asking you to buy it. But if you decide to buy it, you are doing at your own risk.

As much as I am reluctant to post this piece on i3investor to avoid seeing some stupid commentaries, Mr Ooi Teik Bee asked me to post it to teach people how to make more money. "!!

FROM THE ABOVE U SEE MR OOI CAKAP TAK SERUPA LOH...!!

WHY SUDDENLY HE SAYS NO DIV LAH...CHINA PARTY BOUGHT IT CHEAP LOH..!1

LIKE NO FROG JUMPING AROUND LOH...!!

THIS IS BCOS MR OOI, SOLD OF HRC RM 7.00 TO RM 8.00 HOPING TO BUY BACK CHEAP LOH.....!!

GENERAL RAIDER SAYS MR OOI HIGHLY DISHONEST LOH...!!

WHY ??

IF HIS SHORT TERM HRC TP IS RM 9.00.

MID TERM TP IS RM 12.00

LONGER TERM TP IS RM 15.00

WOULD IT NOT BUYING & CHASING HRC AT RM 7.50 NOW, NO ISSUE LEH!!

WHY WOULD OTB AND GANG FEAR HRC RUN UP, BCOS OF RAIDER STRONG PROMOTION LEH....!!

2017-09-01 23:43

Posted by Ooi Teik Bee > Sep 1, 2017 11:48 PM | Report Abuse

Please learn up your English and understand what I say, then you are only qualified to talk to me.

Please do not let the readers here laugh at you.

Thank you.

Ooi

Please don divert u r really a dishonest chracter loh...!!

"Mr Ooi Teik Bee’s recommendation:

If you are a subscriber, you should have received Mr Ooi Teik Bee’s recommendation of Hengyuan with a target price of Rm 15.93.

I am obliged to tell you that I have quite a lot of Hengyuan and I am not asking you to buy it. But if you decide to buy it, you are doing at your own risk.

As much as I am reluctant to post this piece on i3investor to avoid seeing some stupid commentaries, Mr Ooi Teik Bee asked me to post it to teach people how to make more money. "!!

FROM THE ABOVE U SEE MR OOI CAKAP TAK SERUPA LOH...!!

WHY SUDDENLY HE SAYS NO DIV LAH...CHINA PARTY BOUGHT IT CHEAP LOH..!1

LIKE NO FROG JUMPING AROUND LOH...!!

THIS IS BCOS MR OOI, SOLD OF HRC RM 7.00 TO RM 8.00 HOPING TO BUY BACK CHEAP LOH.....!!

GENERAL RAIDER SAYS MR OOI HIGHLY DISHONEST LOH...!!

WHY ??

IF HIS SHORT TERM HRC TP IS RM 9.00.

MID TERM TP IS RM 12.00

LONGER TERM TP IS RM 15.00

WOULD IT NOT BUYING & CHASING HRC AT RM 7.50 NOW, NO ISSUE LEH!!

WHY WOULD OTB AND GANG FEAR HRC RUN UP, BCOS OF RAIDER STRONG PROMOTION LEH....!!

2017-09-01 23:53

must explain lah...if not dishonest mah...!!

simply say people english...poor for what ??

give lah...reason why not dishonest...!!

Say which area raider simply accuse u loh...!!

2017-09-01 23:57

Wah..I wanna learn new TA concept of dead cat bounce in uptrend stock like Ferrari HRC

When can open class leh ..when ah??

2017-09-01 23:58

A dishonest character say this & that loh....!!

no wonder so many people accuse him dishonest...must be true loh..!!

raider no simply accuse him mah...!!

2017-09-02 00:00

Hiyah..make money already, can afford buy back mah

Buy back Ferrari HRC at much higher price loh

Buy back higher price, still cheaper than 15 mah..hahahaha

2017-09-02 00:14

osted by Tomato Juice > Sep 2, 2017 12:12 AM | Report Abuse

Posted by Ooi Teik Bee > Sep 1, 2017 11:48 PM | Report Abuse

Please learn up your English and understand what I say, then you are only qualified to talk to me.

Please do not let the readers here laugh at you.

Thank you.

Ooi

Answer : Totally agree! Using too much loh, mah, meh is insult to our intelligence! Blasting every 10 minutes is a sign of immaturity! It's enough to promote few times and let others share their views! A free forum must be a healthy exchange not to be monopolize by one single person!

NO POINT TOMATO LAH...U IS ANOTHER SAD SOUL...WHO SOLD OFF HRC LOH..!!

If sold already ...refuse to chase...go and buy another stock better than...HRC no need squat here loh...!!

2017-09-02 00:14

Posted by Ooi Teik Bee > Sep 2, 2017 12:15 AM | Report Abuse

Go to ask paperplane and probability, what I said is the same meaning as

"I challenge all people who bad mouth Hengyuan to sell so that strong believers of Hengyuan can buy it on cheap sale basis.

Everyone can bad mouth Hengyuan easily like what I show them."

Please do not put words in my mouth.

Thank you.

Ooi

U GO AND SHOW U BUM MY FOOT LOH...!!

WHAT U CAN SHOW LEH ??

ASK UR SUPPORTER SELL LOH....!!

BETTER SELL LOH....ALREADY SOLD ALOT MAH...!!

PEOPLE HERE MAKE ALOT ALREADY LOH....!!

RAIDER HAPPY LOH...!!

2017-09-02 00:17

Hengyuan is such a good stock, no need to promote everyday.

Those bad mouth Hengyuan, please sell it.

I prefer to make money quietly.

Thank you.

Ooi

2017-09-02 00:21

General Raider Special Advice loh !!

If u know HRC can go up to Rm 9.00 by end nov 2017.

U also know HRC can go up to Rm 12.00 by april 2018.

U know HRC can go up to Rm 15.00 by Aug 2018.

Then ask yourself HRC..now Rm 7.50...u think and got news it can drop to rm 7.26 next wk...u want to sell now at Rm 7.50 and buy back Rm 7.26 ah ??

So little potential profit worth it meh ??

What happen after u sell HRC Rm 7.50....it keep going up and never come down to rm 7.26 would u chase rm 8.80 leh ??

If a stock worth Rm 15.00 like HRC, if selling it at Rm 7.50 and hope to buy back at Rm 7.26 very dangerous loh...!!

Always fight on the side, that give u the greatest value and profit {raider says this is taichi flow} loh..!!

Yes Hrc has all the potential to give u all the great return u never dream of loh...!!

Strong growth in EPS of more than 100%.

High ROE exceeding 37%.

Superb cashflow half yr exceeding rm 1.44 per share.

strong growth potential crack margin now usd 17 per barrel.

most importantly it is the cheapest stock in klse with pe less than 5x loh.....!!

it is expected it will achieve eps exceeding rm 2.20 pa a great historical record for hrc mah...!!

HRC The most wonderful investment loh....!!

REMEMBER LOH...DON ACT & FOLLOW DISHONEST OTB...SELL ALREADY HOPING TO BUY BACK CHEAP CHEAP LOH...!!

MKT IS NOT THAT STUPID MAH...!!

THEY ALSO KNOW HOW TO CALCULATE MAH...!!

IF SELL HRC A WONDERFUL SHARE, IT IS VERY DIFFICULT TO BUY BACK CHEAP LOH..!!

2017-09-02 00:23

No problem leh ...already made money mah

Buy back much higher price n sell higher loh

2017-09-02 00:30

U GO AND F..CK UR GRANDFATHER LOH...!!

WHY PEOPLE WANT TO SELLDOWN TO PLS U LEH ??

GET UR PEOPLE TO SELL MORE LOH...!!

RAIDER LIKE MAH...!!

2017-09-02 00:38

If I did not promote Hengyuan, you think Hengyuan can move up north so powerful.

Result showed. You can talk a lot, you definitely not up to my standard.

Everyone here acknowledge the above statement.

Tin kosong makes the most noise.

Thank you.

Ooi

2017-09-02 00:41

The bottom line...be a gentlemen loh...if u have sell off...and still like...go and quietly buy back hrc loh...!!

If u cannot buyback...refuse to chase...then f..ck off...no one owe anything for u loh...!!

Look for another good stock loh...!!

Don try to manipulate & bad mouth to buy cheap..bcos people also know HRC is good too mah....!!

They also want to buy cheap mah...!!

For seller...u think they are stupid to sell cheap cheap leh ??

If they panic....they would have selloff few days ago mah...!!

those who hold on would want higher & higher price loh...!!

2017-09-02 00:45

osted by Ooi Teik Bee > Sep 2, 2017 12:53 AM | Report Abuse

Posted by Tomato Juice > Sep 2, 2017 12:47 AM | Report Abuse

This loud mouth has been talking nonsense alot! He has promoted so many losers! I think out of 100, only 4 make money! You don't have to believe me, you can check his past record!

Ans : He does not understand what I wrote, simply bark like a mad dog.

A sad case.

Let time tells who make the most money. I am very poor, I do not have any Hengyuan. He is the one who can afford to buy Hengyuan.

Thank you.

Ooi

IT IS NO WONDER THIS OTB SO MANY PEOPLE ACCUSE HIM DISHONEST LOH...!!

IT MUST BE TRUE LOH....!!

INITIALLY RAIDER DISAGREE BUT NOW RAIDER BELIEVE LOH...!!

FROM THE WAY HE TALK...U ALREADY FOUND MANY DISHONEST ACTION LOH..!!

2017-09-02 00:57

Bro Stockrider..

Omg I think u didnt understand what OTB is writing.

Please print out and read again and again overnight until u understand.

OTB is just being sarcastic to non believer..

Cheers bro..

NOT THAT RAIDER DO NOT UNDERSTAND OTB WRITING LOH...!!

IT JUST THAT OTB....WRITING 2 SIDED.. LIKE 1 SIDE APPEAR SIDED WITH THE HRC INVESTORS..INTIALLY, THEN 2ND SIDE BEHIND OUR BACK HE WANT TO WHACK HRC SHAREHOLDERS MAH...!!

IF HE REALLY MEANT TO BE GOOD FOR HRC, WHY HE TARGET THE EXISTING SHAREHOLDERS { WITH FEAR & NEGATIVE POINTS WHICH RAIDER HAD COUNTER MANY TIME.}...WHO HAVE JUST WEATHER THE STORM OF HRC SELLDOWN...NOW ENJOYING THE FRUITS OF HRC RUN UP RECENTLY LEH ??

CLEARLY FROM HIS WRITING HE WANTS THE EXISTING HOLDERS OF HRC TO SELLDOWN, SO THAT HIS GANG CAN PICK UP CHEAP LOH...!!

IF HE REALLY SUPPORT HRC PRICE RISE, WHY HE TARGET LOYAL HRC INVESTORS TO SELL LOH!!....IF HE WANTS HRC REFLECT FAIR VALUE OF RM 15.00 RIGHTFULLY HE SHOULD JUST TARGET NEW INVESTORS TO BUY AND ENCOURAGING THE EXISTING INVESTORS TO JUST HOLD ON FOR FAIR VALUE RISE OF RM 15.00 AS PER HIS TARGET LOH...!!

THE WAY HE DID IT, WITH VERY BAD INTENTION LOH...!!

FURTHERMORE HE WANTS RAIDER TO COOPERATE TO GET OUT OF HIS WAY, WHICH RAIDER DISAGREE LOH....!!

GENERAL RAIDER WILL NOT ABANDONED LOYAL HRC INVESTORS, JUST TO GIVE FAVORS JUST FOR A FEW BANDITS, TO GET CHEAP HRC SHARE BCOS THEY SOLD OF NOW WANT TO BUY BACK CHEAP MEH ??

CONSISTENT INTEGRITY GENERAL RAIDER THINK VERY IMPORTANT, WE CANNOT TODAY ASK PEOPLE TO BUY AND ANOTHER DAY ASK PEOPLE TO SELL, WHEN MISSION NOT ACCOMPLISHED AND OBJECTIVE NOT MET MAH...!!

BTW OBJECTIVE RM 15.00 LOH...!!

THOSE WHO SALE OFF & TAKE PROFIT ON HRC, HOPING IT WILL FALL AND BUY BACK CHEAPER, RAIDER NO OBJECTION.....!! BUT DON GO AND SPREAD FALSE & FEAR NEWS, TO MISLEAD THE LOYAL INVESTORS TO SELL CHEAP LOH..!!

RAIDER ADVICE THE FOLLOWING LOH;

The bottom line...be a gentlemen loh...if u have sell off...and still like...go and quietly buy back hrc loh...!!

If u cannot buyback...refuse to chase...then f..ck off...no one owe anything for u loh...!!

Look for another good stock loh...!!

Don try to manipulate & bad mouth to buy cheap..bcos people also know HRC is good too mah....!!

They also want to buy cheap mah...!!

For seller...u think they are stupid to sell cheap cheap leh ??

If they panic....they would have selloff few days ago mah...!!

those who hold on would want higher & higher price loh...!!

2017-09-02 11:37

Shell’s history more or less demonstrated the extreme pessimism (in fact, a valid one) at one point in time. While its turnaround is also very valid and justified, we must not forget the fact that the underlying fundamentals of the energy market is forever volatile. Crack spreads won’t stay high or low for long. So called mean reversions are also ever changing because too many circumstances are involved. Oil refiners are always in a very vulnerable position of getting squeezed from either side or even both sides of the value chain they are operating in.

To assign a maximum PE (whether on a relative or absolute basis) to current earnings is to assume that current events will unrealistically stay constant for a very long time. Incorporating a margin of safety is never about paying a cheaper price than fair value. It is about paying a price that takes into account the unsustainability of optimistic and pessimistic performances. So fair value is supposed to incorporate this margin of safety. Looking at long-term is not about forecasting how much a business can earn in the next 10 years or so, but it is all about understanding what we are certain to encounter in the long-term.

Forecasting that the market price will hit a certain amount within the year is neither right nor wrong. However, we need to understand that such a short term forecast without taking into account the long-term aspect of valuation is pretty much forecasting on how many more people are out there who are willing to pay an ever increasing price before realising that they have become the Greater Fools.

2017-09-02 16:52

impact: crackspread will collapse to 4.16...and price will follow to 4.16 also

2017-09-02 17:18

by crackspread collapsed to 16.4 > Sep 2, 2017 05:18 PM | Report Abuse

impact: crackspread will collapse to 4.16...and price will follow to 4.16 also

LA777

1101 posts

Posted by LA777 > Sep 2, 2017 05:32 PM | Report Abuse

crackspred collapsed to 16.4, sudah gila?

crackspread collapsed to 16.4

5315 posts

Posted by crackspread collapsed to 16.4 > Sep 2, 2017 05:33 PM | Report Abuse

infected by raider syndrome

GENERAL RAIDER SPECIAL ADVICE;

U NEED TO HAVE PROPER PERSPECTIVE ON CRACK SPREAD LOH....!!

WHEN CRACK SPREAD WAS ONLY USD 5.00 TO 6.00 IN 2015 TO 2016 HRC MAKE EPS RM 1.10 TO RM 1.20 LOH...!!

IF U LOOK INTO TP 1ST HALF OF 2017 THE CRACK SPREAD WAS USD 8.00 TO 9.50 HRC MAKE EPS RM 1.21 PER SHARE LOH...!!

THEN THE CRACK SPREAD SUDDENLY, SHOOT UP ABOVE USD 10.00, 11.00, 13.00 AND 17.00....NOW STILL USD 16.00 PER BARREL WITHIN 2 MTHS PERIOD LOH...!!

ASK YOURSELF WHAT SUSTAINABLE CRACK SPREAD U REALLY NEED IN ORDER TO GIVE REALLY VERY GOOD EARNINGS TO HRC LEH ??

THE ANSWER IS ANYTHING BETWEEN USD 9.00 TO 11.00 CRACK SPREAD HRC WILL MAKE EPS OF RM 3.00 AND ABOVE LOH...!!

NO NEED TO BE VERY GREEDY MAH....!!

ANY CRACK SPREAD ABOVE USD 12.00 IS NOT SUSTAINABLE MAH...!!

SO JUST DON BE GREEDY, WORK YOUR FIGURE AT A SUSTAINABLE USD 10.00 CRACK SPREAD IS GOOD ENOUGH LOH...!!

THE CURRENT CRACK SPREAD USD 16.00 IS TOO HIGH LOH....!!

2017-09-02 17:59

General Raider,

HRC wants to be greedy...so that it can wipe out its debt and internally finance its coming capex without debts..

i see many people greedy and impatient for dividends ma..

2017-09-02 18:10

Posted by stockraider > Sep 2, 2017 06:22 PM | Report Abuse X

Posted by crackspread collapsed to 16.4 > Sep 2, 2017 06:09 PM | Report Abuse

General Raider,

HRC wants to be greedy...so that it can wipe out its debt and internally finance its coming capex from internally generated cash.

i see many people greedy and impatient for dividends ma..

JUST LOOK AT DAVID CASHFLOW ANALYSIS JUST IN 3 MTHS....APR TO JUNE RM 500 MILLION NETT OF BORROWING IS WIPE OFF FROM HRC BALANCE SHEET MAH..!!

HRC NOW NET BORROWING REDUCE FROM RM 1.074 BILLION TO RM 572 MILLION WITHIN 3 MONTHS IN 30TH JUNE, AT THAT TIME THE CRACK SPREAD WAS ONLY AVERAGE ABOUT USD 7 TO 8 PER BARREL MAH...!!

THERE WILL BE RM 700 MILLION CAPEX PLUS EXISTING BORROWING OF RM 572 MILLION WILL AMOUNT TO RM 1.272 BILLION BUT GIVEN THE CASH GENERATION CAPACITY OF THE REFINERY, OF RM 700 TO 800 MILLION SUSTAINABLE PA, IT IS EXPECTED HRC WILL BE NET CASH IN 2019 ONWARDS.

THIS IS ACHIEVEABLE BCOS PETRON HAD SHOWN THIS ABILITY TO BE ABLE TO FULLY REPAID ITS DEBT WITHIN 3 YRS, DESPITE MORE DIFFICULT MKT ENVIRONMENT THAN NOW...WHEN THE CRACK SPREAD WAS BELOW USD 5 PER BARREL LOH....!!

TODAY CRACK SPREAD EASILY SUSTAINED AT ABOVE USD 7.00 BPD LOH...!!

Posted by crackspread collapsed to 16.4 > Sep 2, 2017 06:29 PM | Report Abuse

they doubt China man company will pay dividend.

GENERAL RAIDER;

WHY CHINAMAN NEED TO AND WANT TO PAY DIV ?

ALTHOUGH HRC IS BOUGHT FOR A SONG AT RM 1.93 PER SHARE, BUT SHPC THE PARENT IS NOT BIG, IN FACT SMALLER THAN HRC LOH...!!

THE PARENT WILL NEED DIV, BCOS THEY NEED TO SERVICE THEIR TAKEOVER LOAN MAH....!!

THUS DIV IS ESSENTIAL FOR SHPC LOH...!!

THIS IS BCOS THERE ARE NOT MUCH TRANSFER PRICING BETWEEN SHPC & HRC BCOS HRC PURCHASE ALL ITS CRUDE FROM SHELL THRU A 6 YRS PROCUREMENT AGREEMENT MAH...!!

2017-09-02 19:07

Posted by crackspread collapsed to 16.4 > Sep 2, 2017 06:27 PM | Report Abuse

some greedy investors cant wait for 2019 raider...they say (not me) will only invest when HRC declare they are paying dividend...

just wish their wishes come true earlier..

THOSE CANNOT WAIT FOR 2019, CAN FUCK OFF LOH....HRC IS NOT FOR THEM LOH...!!

HRC SHAREHOLDER ARE PEOPLE WHO ARE WILLING TO INVEST FOR AT LEAST 2 YRS MAH...!!

THE EPS OF EXCEEDING RM 2.00 TO 3.00 GIVE PE OF 4X TO 2.5X IF BASED ON RM 7.50 SHARE PRICE LOH...!!

U R GETTING RETURN ON INVESTMENT EXCEEDING 25% TO SOMETHING LIKE 40% PA LOH....!! VERY ATTRACTIVE FOR LONG TERM STEADY GROWTH RETURN MAH...!!

THIS TYPE OF EARNINGS ARE MUCH SUPERIOR THAN MOST COMPANY IN KLSE LOH..!

IN FACT IT IS UNHEARD OF LOH...!!

BTW WE ARE TALKING OF EARNINGS ON YOUR SHARE...NOT CAPITAL GAIN LOH..!!

ONCE EARNINGS SUSTAINED KICK IN.. U SEE STRONG RERATING AND CAPITAL GAIN ON SHARE PRICE LOH....!!

stockraider

4649 posts

Posted by stockraider > Sep 2, 2017 07:03 PM | Report Abuse X

REVISIT OLD SHELL DIV PAYMENT;

YEAR DIV PER SHARE

2005 .. RM O.55

2006.. RM 0.79

2007.. RM 0.42

2008.. RM 0.51

2009.. RM 0.37

2010.. RM 0.37

2011.. RM 0.37

2012.., RM 0.19

2013... RM 0.11

THE DIV RANGE FROM SHELL IS AT SUSTAINED AT RM O.11 TO RM 0.79 PER SHARE FOR MANY MANY YEARS UNTIL IT WAS STOPPED IN 2014.

RAIDER SEE 1ST DIV COME IN 2019, STRONG DIV CAN BE SUSTAINED DUE TO STRONG CASH GENERATION ABILITY OF HRC LOH...!!

SUSTAINED DIV OF RM 0.50 PER SHARE WOULD NOT BE FAR WRONG LOH...!!

2017-09-02 19:08

crackbomb explode to 16.4 richter scale

lets not belief this joke...it cant be true:

"Time needed to buy out the whole company using Cash Flow from Operation

= 2200 mil / 1048 mil = 2.1 years"

2017-09-04 22:39

General Raider says;

Q3 is surewin big gain for HRC loh....!!

1. Strong Crack Spread for q3, in fact record crack spread loh..!!

2. Big inventory gain for HRC both refine petroleum plus crude oil raw material stock gain...raider think exceeding rm 100 million compare to inventory losses of rm 19 million in q2 loh...!!

3. Strong improvement in free cashflow in q3, in fact raider think, it is the historical best for hrc loh...!!

4. Less operating expenses compare to q2, in fact no more exceptional maintenance cost and forex losses. Raider see positive forex gain possibility about rm 15 million reversal in q3 loh...!!

Basing on the above scenario, and with q3 losses of eps rm 0.27 in 2016, the comparative strong q3 eps in 2017, it is the expected the rolling eps of hrc to shoot up alot beyond imagination loh..!!

So hang tighth your valuable and rare HRC loh...!!

2017-09-06 22:31

crackbomb explode to 16.4 richter scale

you know another thing i am hoping may come true....

last 5 years or more...its inventory in barrels were only equivalent to 800M with current oil price.

Imagine if it reduces back the inventory from from current 1.2B back to 800M...

almost 400M free cash flow on top of those generated in Q3!!...

2017-09-06 22:39

crackbomb explode to 16.4 richter scale

that will be basically a 'shell shock' to those who questions its cash level in its balance sheet!

2017-09-06 22:41

stockraider

Posted by Ooi Teik Bee > Sep 1, 2017 11:27 PM | Report Abuse

stockraider,

Your English is so poor, please do not attack me that I am dishonest.

Please sell if you think that Hengyuan is not good.

Thank you.

MY ENGLISH IS POOR SO WHAT ??

AT LEAST I M NOT DISHONEST LIKE U LOH...!!

"Mr Ooi Teik Bee’s recommendation:

If you are a subscriber, you should have received Mr Ooi Teik Bee’s recommendation of Hengyuan with a target price of Rm 15.93.

I am obliged to tell you that I have quite a lot of Hengyuan and I am not asking you to buy it. But if you decide to buy it, you are doing at your own risk.

As much as I am reluctant to post this piece on i3investor to avoid seeing some stupid commentaries, Mr Ooi Teik Bee asked me to post it to teach people how to make more money. "!!

FROM THE ABOVE U SEE MR OOI CAKAP TAK SERUPA LOH...!!

WHY SUDDENLY HE SAYS NO DIV LAH...CHINA PARTY BOUGHT IT CHEAP LOH..!1

LIKE NO FROG JUMPING AROUND LOH...!!

THIS IS BCOS MR OOI, SOLD OF HRC RM 7.00 TO RM 8.00 HOPING TO BUY BACK CHEAP LOH.....!!

GENERAL RAIDER SAYS MR OOI HIGHLY DISHONEST LOH...!!

WHY ??

IF HIS SHORT TERM HRC TP IS RM 9.00.

MID TERM TP IS RM 12.00

LONGER TERM TP IS RM 15.00

WOULD IT NOT BUYING & CHASING HRC AT RM 7.50 NOW, NO ISSUE LEH!!

WHY WOULD OTB AND GANG FEAR HRC RUN UP, BCOS OF RAIDER STRONG PROMOTION LEH....!!

2017-09-01 23:30