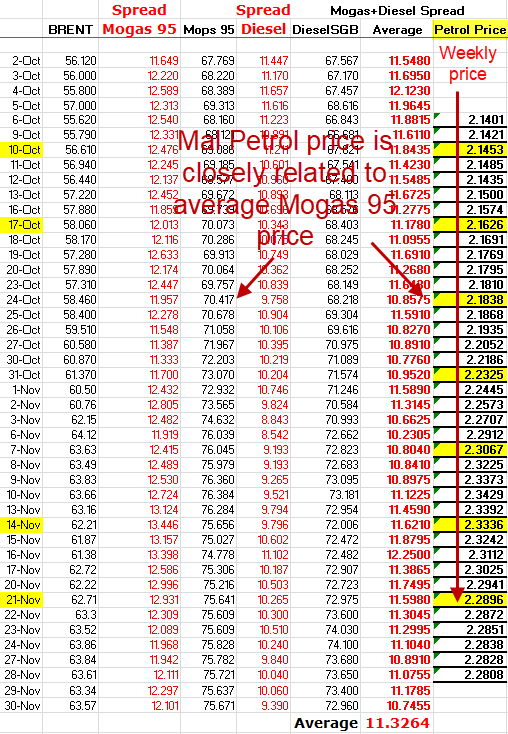

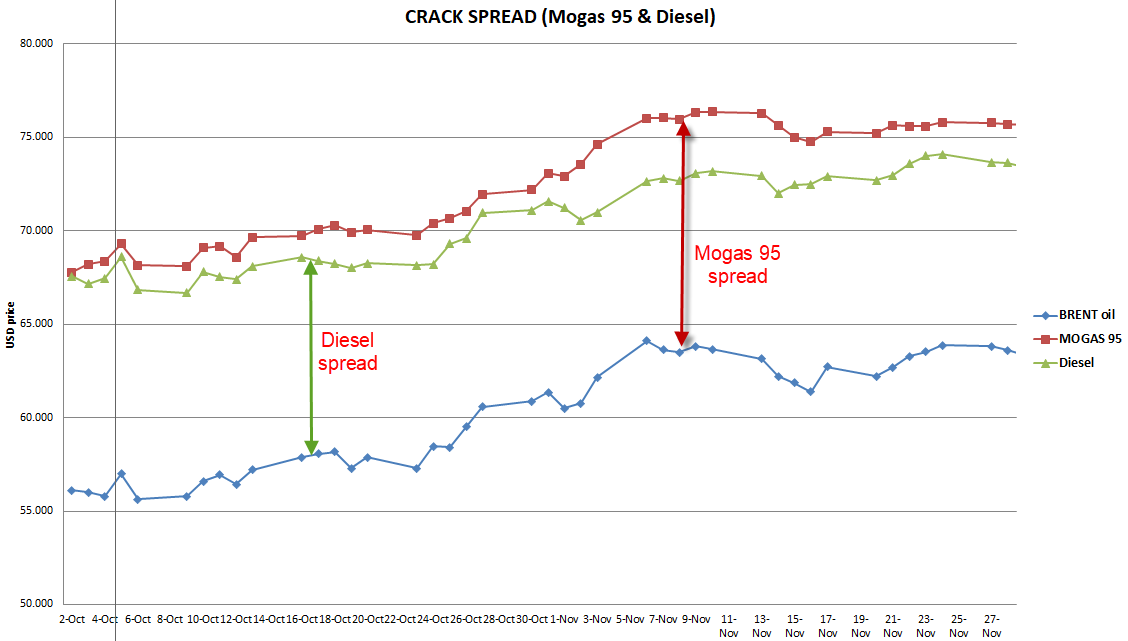

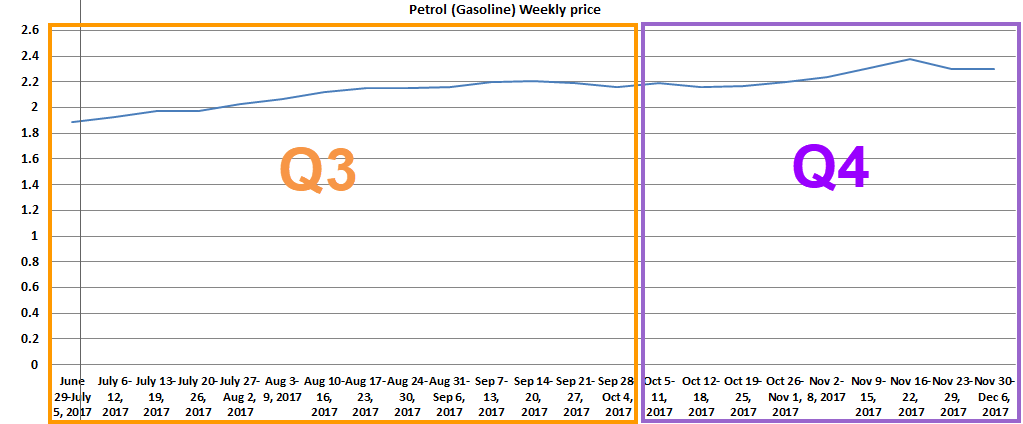

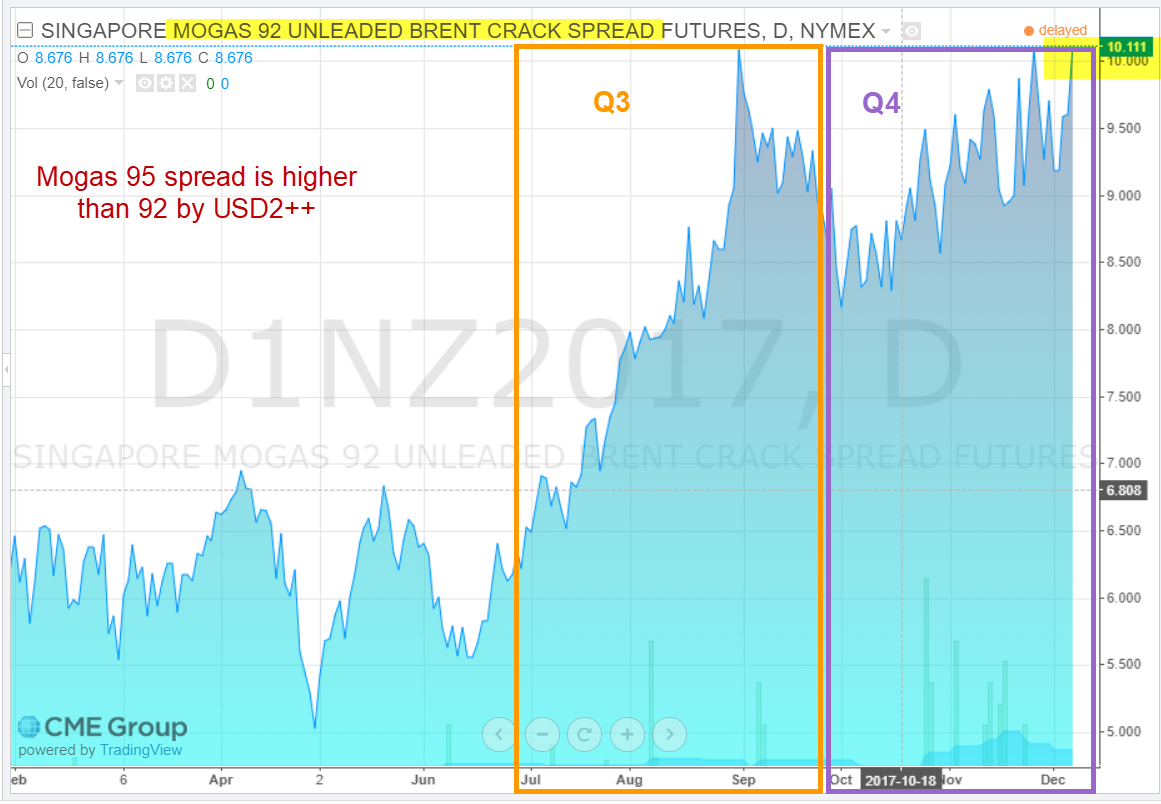

恒源(HY)公布有史以来最强的盈利季度业绩(3亿660万令吉,每股盈利120.6仙)。 现在的问题是,第三季度HY的利润是否可持续 ? 为了回答这个问题,让我们通过一个非常重要的数据 (汽油裂解价差). 恒源第四季度(10-11月)的利润率与汽油裂解价差有密切关系 - 让我们看看汽油裂解价差(Mogas 95汽油 ,马来西亚不再有Mogas 92产品)和柴油(Gasoil)如下表和图表所示:

资料来源:CME数据(如果您参考最新的图表,旧的价差数据已被压制,例如,如果您使用12月份的Mogas 95图表检查Oct数据,价格会更低。您需要每天或每周采集数据)

我根据平均5天的Mogas 95价格计算马来西亚每周的汽油价格,我发现它们有密切的关系(如上表所示)。 HY的利润率与汽油裂解平均价差 (布伦特原油和Mogas 95之间的价差)密切相关,

来源:CME数据

从上表可以看出,10月2日至11月30日期间,Mogas 95和柴油与布伦特原油的平均价差约为11.3美元 (CME数据)。 在我之前的文章中,我用Mogas 92的图(RON 92)来估算HY的利润率。实际上Mogas 92汽油裂解价差低于Mogas 95的价差。对于马来西亚市场来说, RON92已经不在售卖了 。HY的主要产品实际上是RON95(汽油)和柴油。 事实上,过去6个月里,Mogas 95的价差比Mogas 92高出约2美元。 根据HY的2017年第三季度报告,11.3美元相对高于第三季度的差价和2017年的平均差价(8美元)。 然而,由于其他产品(〜2-3%的产品由燃料油,石脑油和丙烯组成)和喷气燃料具有较低的价差,我估计HY产品的有效平均价差 可能在9.5-10.3美元之间。

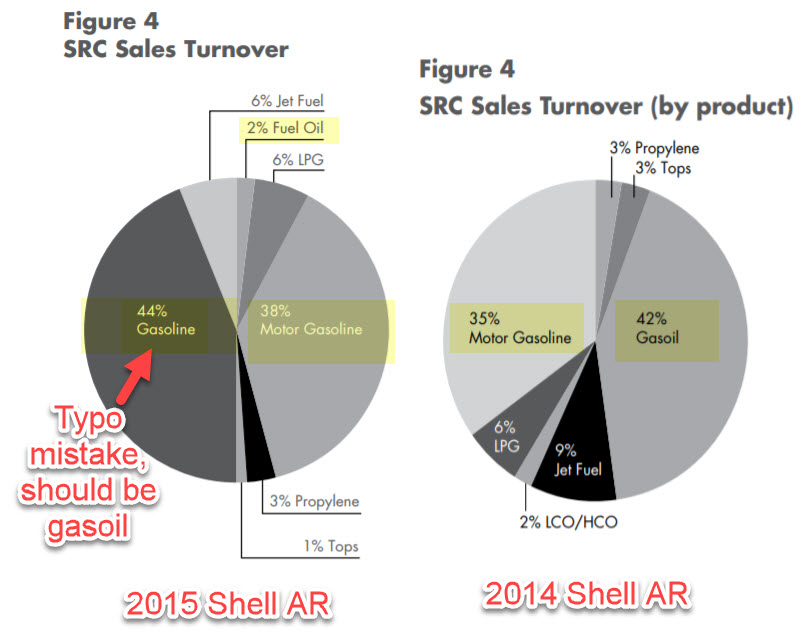

我喜欢HY是因其先进(复杂)的炼油系统,它可以灵活地调整产品比例,从而生产更高的利润率产品,如汽油和柴油。 请参阅壳牌2014和2015年度报告中的产品构成如下。

资料来源:壳牌2014年和2015年年度报告

从饼图中可以看出,HY主要产品是汽油和柴油,其利润率远高于燃料油(利润率)。 2015年年报显示,其中82%的产品是柴油和汽油,6%是来自航空燃料(10美元利润率左右)。

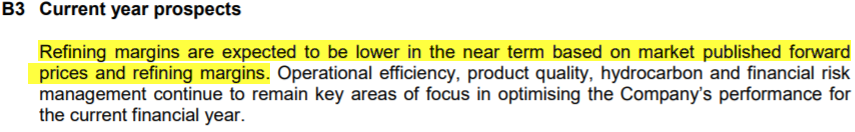

让我们来看看HY的2017年的第3季度报告的今年前景预期如下:

来源:Q317报告

从CME平均裂解价差数据来看,近期炼油毛利略高,与HY季度报告前景预期矛盾。 在HY的报告中,我认为会有这个悲观(保守)的短期前景是因为:

- 他们的管理层可能比较保守,他们可能将10月份和11月份的数据与9月初的高峰值价差数据进行比较,如下图所示:

来源:CME数据

我对三季度平均价差的估计约为10美元,略低于第四季度的汽油价差(我的Mogas 95表中为11-12美元)。

Q4价差高于Q3的另一个证据或支撑数据是马来西亚汽油和柴油价格,这些价格是根据新加坡PLATTS(平均裂缝价差)计算得出的。 让我们看下图的马来西亚汽油每周价格:

来源: https: //hargapetrol.my/malaysia-petrol-prices-list.html

来源: https: //hargapetrol.my/malaysia-petrol-prices-list.html

马来西亚汽油每周价格实际上和平均(5天)Mogas 95价格有密切关系。 HY利润率取决于平均价差(布伦特原油和Mogas 95之间的差异)

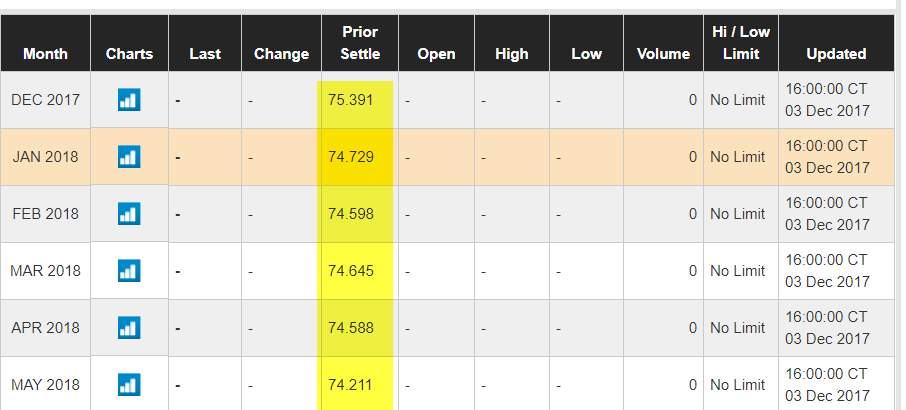

即使我们监测未来6个月来自CME的Mogas 95数据(如下图),未来Mogas 95合约价格在74.2-75.4美元之间。 只要布伦特原油价格稳定在58 美元至63美元的范围内,裂解价差将维持在10美元左右(这对HY这样的炼油企业来说是一个利润丰厚)。

来源:CME未来的Mogas 95数据

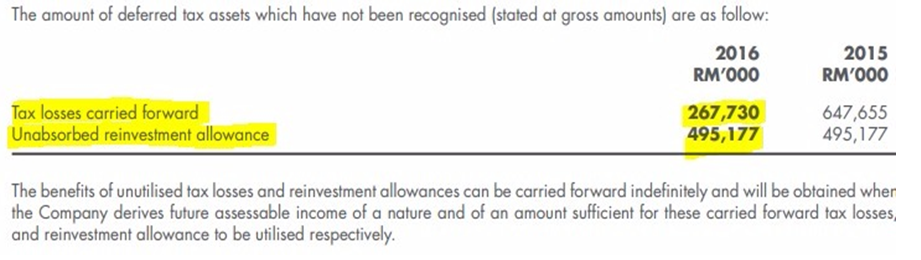

恒源何时需要缴纳所得税?

有些投资者可能会问,恒源何时需要缴纳所得税。 恒源可以免交所得税是由于利用税务亏损(递延所得税资产)所致。 让我们来看看2016年12月以前未使用的税额损失资产如下:

来源:2016年年报

恒源有2.677亿马币的税收损失资产可以用于免除所得税。 让我们来看看到2017年恒源的税收损失资产的利用率:

|

总计3个季度的利润(RM) |

25%的税收损失资产利用率 |

|

7亿2558万 |

1亿8139万 |

|

税收损失资产的余额 |

8,350万 |

如果恒源能够在第四季度获得3.445亿令吉的利润,它将用完其剩余的税收损失资产(8,630万令吉)。 未来我可能会在下一篇文章中详细解释未使用的再投资补贴(4.95亿令吉)。

恒源的主要财务数据

在公布了强劲的三季度业绩后,HY的财务比率大幅提升。 从ROE,ROIC,FCFO(经营自由现金流量),PE和EV的比率都显着改善。 让我们看看HY的一些重要财务数据如下表:

|

|

恒源(截至第二季度业绩) |

恒源( 截至第三季度业绩) |

恒源( 第四季度业绩) |

|

ROIC |

25.84% |

48.1% |

? 预计会有所改善 |

|

鱼子 |

33.27% |

56.30% |

? 预计会有所改善 |

|

PE |

5.9 |

3.55 |

? 预计会有所改善 |

|

EPS(连续12个月) |

147仙 |

311仙(BURSA中最高的EPS) |

? 预计会有所改善 |

|

FCFO |

524mil |

736mil |

? 预计会有所改善 |

|

FCF(减去资本支出) |

487mil |

668mil |

? 预计会有所改善 |

|

EV / EBIT (<8很好) |

5.44 |

3.85 |

? 预计会有所改善 |

|

现金 |

743.5百万 |

897.7mil |

? 预计会有所改善 |

|

债务总额 |

1316密耳 |

1310密耳 |

? 预计由于RM升值而减少 |

|

存货 |

1,127.9 mil |

1263.3mil |

? 预计由于布伦特原油增加而增加 |

|

净债务 |

572.4百万 |

412.3mil |

? 预计会有所改善 |

第三季度业绩公布后,各项财务数据均有明显改善。 对我来说更重要的是未来的数据或利润。 考虑到2017年10月和11月的精炼产品裂解价差(利润),我预计恒源未来的利润和财务比率将进一步提高。

为了证明现在的价格(11.00令吉)恒源HY是否还价便宜,让我们看看FCF对比市场资本,现金对比市场资本比率如下:

FCF / 市值 = 6亿6800亿/ 33亿= 20.2%(仅9个月)

手头现金 / 市值= 8.977亿/33亿= 27.2%(仅9个月)

让我们比较恒源,Petronm和Petdag之间的FCF /市值比,看看哪家公司经营现金收益最强。

|

9个月(Q1-Q3) |

恒源 |

Petronm |

Petdag |

|

FCF /市值 |

20.2% |

7.94% |

4.2% 注:从现金流量表中有脱售附属公司的4.30亿的收益 |

我们可以看到,HY运营现金收益率是Petronm的2.5倍,比Petdag强5倍。 20.2%( 仅9个月 )的比率远远高于银行的定期存款利率(1年3.2%) ,这是一个很好的比例 。 如果目前的价差能够维持到2018年第二季度,这个比例将会进一步改善,但会受到2018年第三季度Euro4升级( 一次维护关闭和升级)的影响。 事实上,如果我们考虑到其巨大的库存价值12.63亿令吉 (可以抵消95%的借款),恒远实际上拥有超过8.5亿令吉的净现金。 这个现金水平相当于每股2.83令吉的现金。 再次,我看到的是未来6个月的利润可见度与裂解价差有密切关系。

有些人可能会声称,炼油厂从过去的数据是有周期的业务。 我对过去的裂解价差数据(由于2014年原油价格大幅波动)不太感兴趣,而对过去11个月的数据和未来6个月的数据更感兴趣。

来源:CME数据

您是否认为2017年过去11个月的上述裂解价差显示炼油厂是一个周期性的业务? 我不这么认为,甚至未来6个月,我认为价差可能维持在9美元或更高(Mogas 95)。 只要布伦特原油价格稳定在50-65美元之间,我相信2018年的裂解价差将会相当稳定(主要是受需求增加和供应有限的支撑)。

如果你拥有一辆汽车,你不觉得汽油或柴油对你来说是必需品吗? 如果我们拥有一辆汽车,我们是否需要每周(或两周)要去加油站? 也许有些人可能会争辩说,电动汽车可能会在10 - 20年的时间内取代汽油车,但是飞机的燃料消耗呢? 大型船舶运输和依赖燃料油的发电又如何呢?

如果汽油,柴油(主要是货车,机器)和喷气燃料对我们现有的运输系统来说是必不可少的,那么石油提炼产品在未来就不应是一个周期性的业务(除非供应突然增加)。 这就像消费者必需品(如milo,面包)不太可能是一个周期性的业务。 传统上,第四季(十至十二月)是HY的旺季 ,第四季通常会空中旅行和陆上旅行会增加。

总之,由于需求持续增长,我认为2017年裂解价差突然如此之高是由于炼油厂关闭(需要大规模投资和更严格的监控)或炼油能力不足。无论如何,2014年汽油也是必不可少的产品,但当时裂解价差几乎为零,可能是当时供应过剩。

炼油展望

让我们来看看两个有关亚洲炼油企业的消息 - 壳牌(国际石油巨头)和中国炼油业如下:

摘录如下:

另一个消息是,壳牌已经开始关注下游企业,他们现在认为下游对他们集团的利润有很好的利润贡献。

https://www.thestar.com.my/business/business-news/2017/11/07/shell-to-secure-future-of-refining/

摘录如下:

根据目前亚洲车辆的增长情况,鉴于许多炼油厂计划关闭维护,我预计目前的炼油利润率(9美元)将持续至少6个月。

在未来的文章中,我可能会讨论恒远的2018年盈利预测,Euro 4的升级,2020年的柴油需求,SWOT,与其他公司的比较等。

风险

1. 由于意外机器或炼油厂系统故障而意外关闭。

2.意外发生火灾或爆炸。

3. Euro 4项目升级延迟

概要

1.根据目前汽油和柴油的裂解价差数据,HY在第四季度的盈利能见度依然不错。

2.即使以现价11.00令吉计,恒源未来3个月的PE仍然非常有吸引力(低于PEX3.5) 。

3.恒源有高质量的ROI(48.1%),ROE(56.3%),已经非常强劲的运营现金流 。

4.由于目前布伦特原油价格保持在57美元以上(当前价格为63美元),第四季度恒源有可能获得库存收益 。

5.近期RMUSD 升值将进一步惠及HY,因为其材料成本(原油)将较低。 另外还有外汇收益,因为它有RM13亿的美元贷款。

6. 2018年炼油产品前景依然光明 ,鉴于许多炼油企业计划关闭维护,车辆增长会增加需求以及炼油产品供应有限。

7. HY的管理层已经开始密切关注Euro 4的设备制造,甚至从2017年第三季度(1年之前)开始关注。 他们预计设备可能会延迟制造,现在已经开始寻找替代方案,以尽量减少延迟。 这表明他们已经准备好迎接这个升级项目的可能挑战(还有大约11个月的时间,他们可能会寻求母公司的技术帮助,因为恒源中国拥有生产Euro 5产品的技术)。

8.维护关闭/升级是炼油厂每三年一次的事件 ,这对世界各地的炼油厂来说是正常的。 事实上,第二季度小维护提高第三季度产量60万桶。我会比较关注2018财年整体12个月的盈利和现金流量来衡量恒源。(短暂的休息是为了走更长远的路).

如果您对我未来的分析报告感兴趣,请与我联系 davidlimtsi3@gmail.com

风险提示:此文章乃我的分析及预测及选股策略, 不对用户构成任何股票买卖及投资建议,仅供学习及参考。

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Ricky Kiat

david, u are great .

2017-12-13 20:41