HENGYUAN Part 8: Valuation, Q4 profit and Q12018 Spread (Davidtslim)

davidtslim

Publish date: Fri, 19 Jan 2018, 11:03 PM

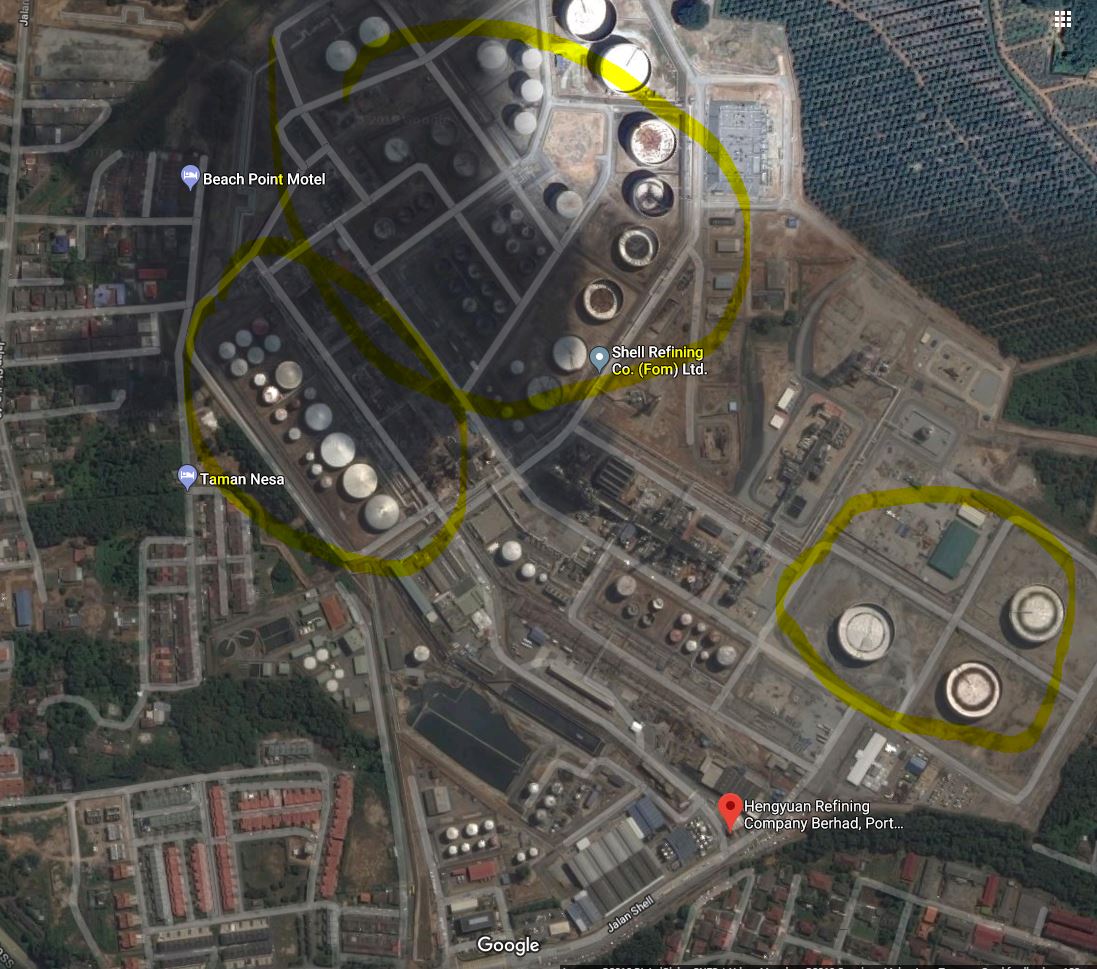

Inventory and Factory outlook

Since I am going to talk about oil Inventory, let us first have a look at this Google satellite image below which gives a good overview on the facilities or storage capacity of Hengyuan in Port Dickson, N. Sembilan.

Source: Google map

From the above image, we can see that HY plant has many storage tanks ranging from giants (having thousands of oil barrel storage capacity), medium tanks and smaller sizes of tanks (more than 100 units from my calculations).

These tanks are important for HY to store crude oils and refined product. Current inventory of HY is valued at RM 1.263 Billion consisting of their crude feed oil and refined products which are stored in these tanks. All these tanks and pipes (pipes too small to be seen from Google photo unless you zoom in to max) are super expensive to build nowadays not even bringing the cost of the Plant & Machinery, i.e the Refinery Complex consisting of Distillation Units and Catalytic Crackers (will share more on this on my next section on Petronm new upgrade project)

Why inventory and storage are important? Huge inventory (especially refined products) can serve as buffer when HY undergo shut down in Q3’2018 or make sure sales of their products to Shell Malaysia as sustained as usual during minor unplanned shut down. Actually we can observe that HY slowly raise their inventory level in the past 3 quarters.

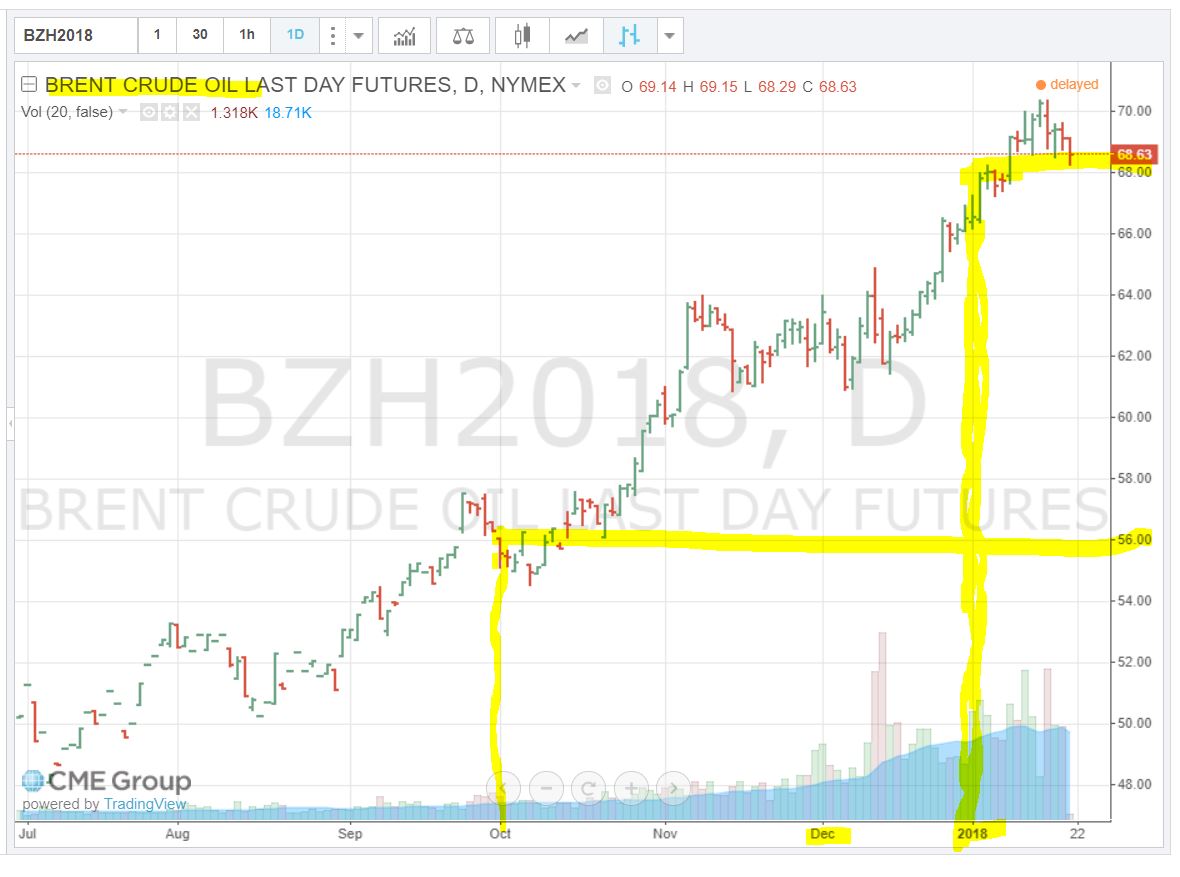

Another advantage of huge inventory during crude oil uptrend time is it can book considerable inventory gain. Let us go through recent Brent oil price, Mogas 95 and Diesel price charts as below to know the possible inventory gain and profit margin as below:

Chart 1 : Brent oil (Souce: CME website)

Chart 1 : Brent oil (Souce: CME website)

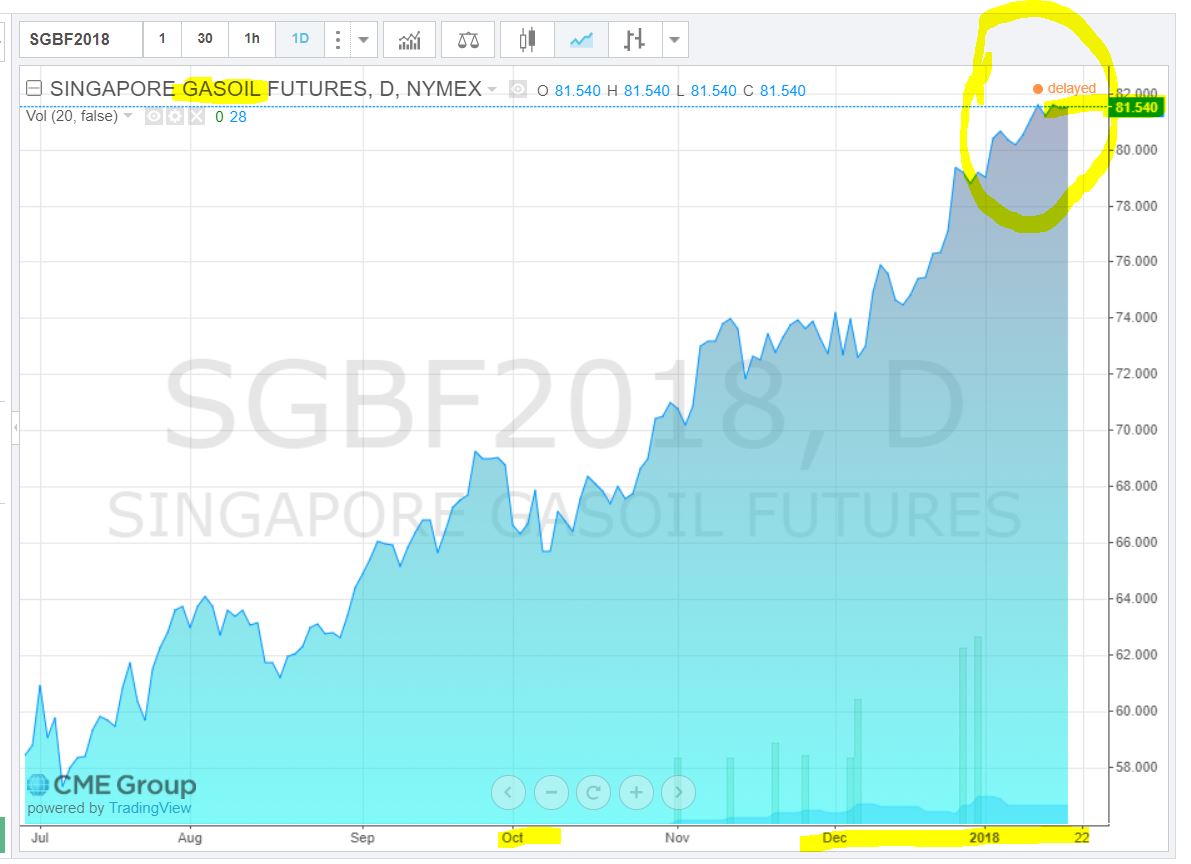

Chart 2 : Diesel = Gasoil (Souce: CME website)

Chart 2 : Diesel = Gasoil (Souce: CME website)

Chart 3 : Mogas 95 = petrol (Souce: CME website)

Crude oil theoretical Inventory Gain = [67 (30 Dec price) – 56 (30 Sept price) ] /3 = USD3.7 per barrel.

I divide inventory gain by 3 is based on backward calculation of past record of USD1.67 inventory gain as per Q3 report.

HY keeps around 3.5 million barrels crude oil (info from hrc.com.my).

Estimated inventory gain from Crude oil = 3.5M X 3.7 X 4 = RM51.8 mil

Their refined products inventory gain maybe included in the sales to its customer. For example, their old stock of inventory cost of refined products maybe USD65 (due to that time crude oil is cheaper), their selling price in Dec may reach USD78, as a result, HY may enjoy USD12 profit margin per barrel. This is called First-in-First out.

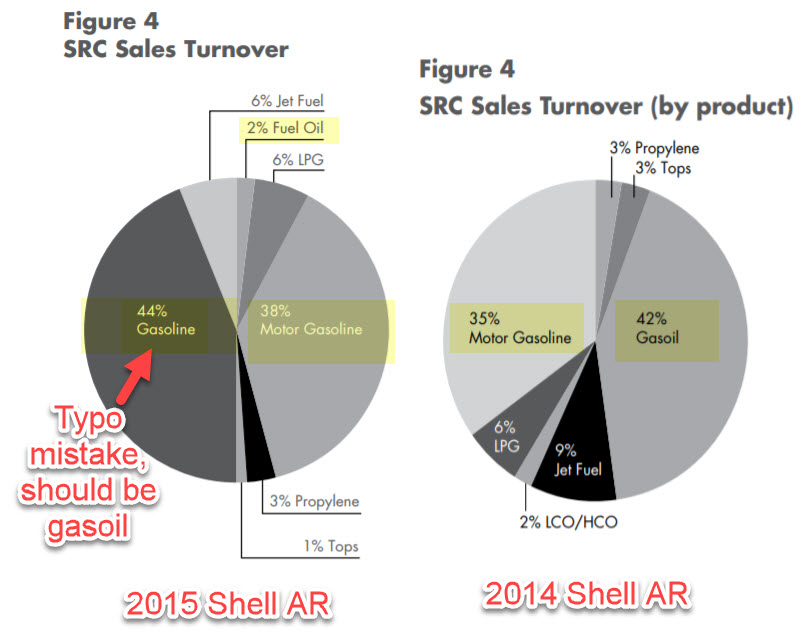

Q4’17 and Q1’18 profit margin

Two main products of HY are Diesel (Gasoil) and Gasoline (Mogas 95) which constitute about 80% of the revenue.

Refer chart below:

Typical yield as per below:

Typical yield as per below:

Diesel = 43%

Kerosene, LPG and others = 19%

Petrol (Mogas95) = 38%

Diesel product gross profit margin is obtained from subtraction of daily data of chart no 1 by chart no 2 as below:

Diesel Crack spread (margin) = Diesel selling price (chart 2) – Brent oil price (chart 1) [Eg. 81.56 – 69.3]

Mogas 95 product gross profit margin is obtained from subtraction of daily data of chart no 1 by chart no 3 as below:

Mogas 95 Crack spread (margin) = Mogas 95 selling price (chart 3) – Brent oil price (chart 1)

Average Mogas 95, jet fuel and diesel spread in Q4’2017 based on my previous article is around USD11.2. (https://klse.i3investor.com/blogs/davidtslim/143634.jsp). If we include LPG, Naphtha, propylene, fuel oil, average crack spread or profit margin per barrel maybe around USD9.5 - USD10

(Note: As per their respective yields, its average refining margin is higher. However, for conservative reasons I am not using these values.)

As far as I survey from online, most of the refinery plants running on 24 X 7 days (including holiday).

Let us calculate how much gross profit (GP) per day for HY based on USD9.5 average crack spread

GP = USD9.5 X 4 X 112k = RM4.26 mil per day

Q4 contain 92 days. Let assume 2 days down time in Q4, then

GP = RM4.26 mil X 90 days = RM383 mil

Total gross profit = 383 + 51.8 mil = RM435.2

Estimated admin cost, depreciation, manufacturing expenses and Finance cost = 127 mil (based on Q3 figure)

There is high possibility of forex gain and small amount of other income in Q4 (as per Q3 report)

Let assume similar forex gain as per Q3 forex gain (50 mil as RM actually strengthen in Q4 more than Q3), and same other income of 9 mil.

Estimated Net income before tax in Q4 = 435.2 – 127 +50 + 9 = 367 mil.

Profit before tax of RM367 mil translated to EPS of 122.6 sen in Q4.

Some of you may worry of Q1’18 Mogas 95 spread is dropping. But HY main product consist of Diesel which has relative higher spread (range from USD11 to 12++) in past 15 days of Jan 2018. This actually can compensate the drop in Mogas 95 spread which lead the average spread of these two products is still more than USD10 based on my data collected.

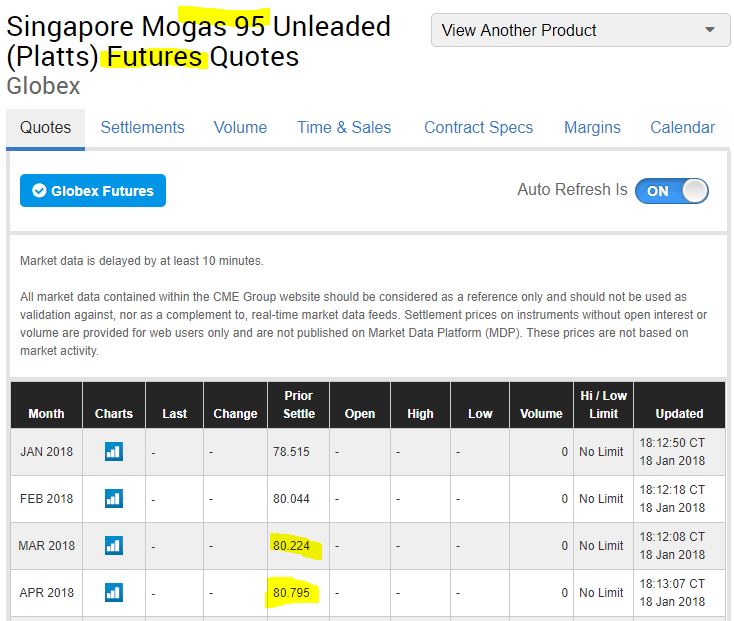

Still worry about Mogas 95 spread in Q1'18? Let us go through the future crack spread data of Mogas 95 in Feb, Mar and April as below:

Source: CME website

The future contract of Mogas 95 is trading at USD80.04 (feb) to 80.795 (April). The higher selling price of Mogas 95 may due to ending of winter season in March which the demands of gasoline is anticipated to be higher in Spring season (higher travelling). If you checked the future data of Brent oil in CME (Mar and April), brent oil is trading at USD69 – 68++ which indicate the Mogas 95 spread at that time may increase to a level of USD10++ (provided brent oil maintained at around USD69).

Cost of new refinery upgrade and Simple Valuation

As highlighted in my HY part 6 article, oil refinery is a capital-intensive business. Planning, designing, permitting and building a new medium-sized refinery is a 2-5 year process.

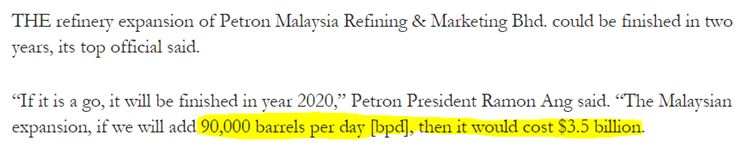

Let see how much the budget for coming Petronm refinery upgrade as per news below:

https://businessmirror.com.ph/petron-refinery-expansion-seen-completed-by-2020/

Let me summarize the cost for building new and upgrade exiting refineries in Asia and South East Asia as table below

|

|

Estimated Cost |

Remarks |

|

Petron Corp Philippines

|

USD3.5billion (upgrade existing to 270k from 180kbpd)

|

Going to start in Q1’18 |

|

Petronm Upgrade from 88kbpd to 180 kbpd |

RM14 billion (USD3.5 B) |

Final proposal stage |

|

HengYuan |

4.29 billion for license capacity of 156k but rated capacity of 125k bpd |

Euro 4M upgrade maybe further increase HY capacity |

Average cost for building new refinery (Petron Corp Philippines)

= (8+14 billion / (90) kbpd

= RM0.16 billion or RM160 mil per 1kbpd

Average cost for upgrade existing refinery (Petronm)

= 14 billion / 90 kbpd

= RM0.16 billion or RM160 mil per 1kbpd

HY current market cap is RM4.29 billion. If we calculate its valuation for its kilo barrel per day (kbpd):

Market Valuation of 1 kilo barrel capacity of HY (based on HY current whole market capital on 19 Jan, RM14.30 per share price)

= 4290mil / 125 = RM34.32 mil for every 1kbpd.

Let see another news on Saudi Arabia possible investment in China refinery plant as below:

Aramco (one of the world biggest oil companies) willing to pay USD2 billion for 30% stake of 260 kbpd refinery plant in china (normally can be built at lower cost than other countries using China technology).

30% of 260 kbpd is 78kbpd. USD2 billion = RM8 billion for a new refinery plant in China.

Hengyuan current market capital is RM4.29 billion (based on current price of RM14.30) for a rated capacity of 125k bpd.

The beauty of HY refinery is it is a complex refinery with possible earning capability of RM1 billion per year (base on 2017 spread, HY has earned 752 mil in 3 quarters of 2017).

Free cash flow also strong in 2017 (predicted can be maintained in Q1 and Q2 of 2018) which currently they has level of cash in hand of RM898 mil as per 30 Sept 2017. Total share base of HY is just 300 mil. To pay 50 sen dividend, HY just need to come out of RM150 mil. Hengyuan may become NET CASH company after Q4'2017 or Q1'2018 if their cash pile can further increase to more than 1.2 billion (supported by strong earning).

Actually current market capital of Petronm is just RM3.56 billion but they need to invest RM14 billion for just 90 kpbd upgrade.

If we compare Petronm big 14 billion upgrade with HY RM580 mil upgrade cost, (this excluding the 2-3 year times cost for Petronm), considerable long shut down time, new inventory cost (for additional 90k bpd), then we will find HY Euro 4M upgrade is way cheaper and just needs 2.5 months shut down (include maintenence time).

Petronm would needs to proceed with this big investment is due to their current refinery plant is too old (simple refinery) which their Diesel and Gasoline yields are relatively low. One of the simple refinery main products is heavy Fuel oil which actually has Negative spread or margin (based on CME data). Refer to the below news for dropping of fuel oil margin.

If RM14 billion investment cost is obtained through borrowing, the interest cost based on 5% rate will lead to RM700mil per year. Anyway, based on current high crack spread data, the yield estimated by Petron President is relative high at USD600 mil (but that is to assume current high spread need to be maintained in 2020-2021 as the new plant only ready in 2020).

If Petronm proceed with the upgrade, there will be Big deprecation per year from the RM14 billion upgrade which will greatly affect their future accounting profit.

It is like if you bought a Toyota Camry under a company asset, first 3 years will have relatively high depreciation in accounting. After 3 years, the vehicle value may close to zero in term of asset value but the vehicle (Toyota camry) still can work fine for company activities (sales or delivery of goods).

Let me have a SWOT analysis on HengYuan as below:

SWOT analysis (S-strengths, W-weaknesses, O-opportunities, and T-threats)

|

Strengths |

Weaknesses |

|

1.High profit margin (high spread from 2017 to 2018) 2.Strong cash flow generation 3.Their refinery system has depreciation of RM200 mil per year for many years which the value already closed to fair value. Their system still works fine and after upgrade may has higher efficiency – mean accounting profit will not affected too much by depreciation 4. High inventory level 5. Highest ROE and ROIC, ROA 6.Flexibility of their refinery system to tweak for different crude oil and different refined product slate (may tweak to higher profit margin products like diesel) and it has only 2% of low margin feul oil product.

|

1. Big capital expenditure for upgrade (but 580 mil is far or way cheaper than its peer petronm 14 Billion upgrade) 2. Fluctuation of crack spread or refined margin may affect profit margin. (Many refinery plants scheduled shut down in 2018 should lead to stable crack spread based on my estimation) 3. High debt of 1.3 billion but the strong earnings in 1.2 year OR high inventory (highly liquidable) can pay off 95% of the debt.

|

|

Opportunities |

Threats |

|

1.ASEAN and Asia vehicle population growth will provide support for the stable crack spread or margin

2. 2020 IMO global bunker fuel regulation will be a opportunity for complex refiner like Hengyuan (Refining capacity might fall short of demand after 2020 - https://www.reuters.com/article/refineries-oil/refining-capacity-might... Refer to https://stillwaterassociates.com/imo-2020-part-3-refiners-perspective/

High sulfur fuel oil demand may drop in 2020 which maybe one of the reasons of Petronm upgrade. |

1.High crude oil price increase the material cost (but will have inventory gain)

|

Risk

1. Unplanned shut down due to unexpected machines or refinery system break down.

2. Fire or explosion due to accident.

3. Delay in Euro 4 project upgrade.

Summary

1. HY’s profit visibility in Q4 still good based on current spread data on Diesel and Gasoline.

2. Forward 3-month PE of Hengyuan could be very attractive (below PEX4.5) even based on current price of RM14.30.

3. The high quality of Hengyuan’s earning is supported by strong ROIC (48.1%), ROE (56.3%), and strong cash flow generation from operation.

4. There is inventory gain for HY in Q4 as current Brent oil price stay above USD67 on 30 Dec 2017.

5. Recent RMUSD rate appreciation will further benefit HY as its material cost will be lower. Besides, it also may have forex gain as it has over RM1.3 billion of USD denominated loan.

6. The outlook for refined products is still bright in 2018 as in view of many refiners are scheduled to maintenance shut down, increasing demands from growing vehicle populations

If you interested on my analysis report, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Future Potential of HengYuan

Discussions

Excellent article to dispel all hearsay about crack spread going down. Fair estimate of after tax eps for year is around 3.40 rgt.

Using very conservative PE of 5, Price is RM17.00, 6x, price is RM 20.00

About CW, still believe value for money, with reasonable premium is CWs - CD, CE and CF. CB is really undervalued !!

Monday, for sure gap up !! Hoping HRC will go beyond RM 19.00, so that most of us will recover our losses, especially for those too stunned to cut loss !!!

2018-01-19 23:32

Davidtslim, many thanks for the writeup. Also I think you should take the below cost into considerationwhen caculating the net profit.

Name of Related Party Nature of RPT Amount of RPT

(USD)

Shell International

Petroleum Company

Limited

Payment for the provision of

Information Technology (IT)

transition and separation

services by SIPC to HRC

USD8,712,574

(Equivalent to

RM35,547,302

based on the

exchange rate of

USD1 = RM4.08

as at 14 December

2017)

2018-01-19 23:37

Any cost for Services incurred where the expected Benefit is not recognized immediately has to fall in to capital (investment) and accounted via D&A over its beneficial lifespan of the service.

Posted by ooihk899 > Jan 19, 2018 11:37 PM | Report Abuse

Davidtslim, many thanks for the writeup. Also I think you should take the below cost into considerationwhen caculating the net profit.

Name of Related Party Nature of RPT Amount of RPT

(USD)

Shell International

Petroleum Company

Limited

Payment for the provision of

Information Technology (IT)

transition and separation

services by SIPC to HRC

USD8,712,574

(Equivalent to

RM35,547,302

based on the

exchange rate of

USD1 = RM4.08

as at 14 December

2017)

2018-01-19 23:47

Coupled with the detailed explaination by probability, there is no reason for the stock price to dip further despite heavy manipulation

Luckily i held to my shares despite the recent selldown and extreme pessimism

2018-01-20 00:20

THE MANIPULATOR BULLETS HAVE BEEN ALL EXHAUSTED, MAJORITY OF THEIR SELLING HAD BEEN ABSORBED BY CHINA FUNDS LOH...!!

NOW EVERYONE SCRAMBLING TO GET BACK IN AS Q4 RESULT IS VERY STRONG, THEY ARE AFRAID MAY MISS THE OPPORTUNITY LOH...!!

Posted by longkanginvestor > Jan 20, 2018 12:20 AM | Report Abuse

Coupled with the detailed explaination by probability, there is no reason for the stock price to dip further despite heavy manipulation

Luckily i held to my shares despite the recent selldown and extreme pessimism

2018-01-20 00:30

Posted by stockraider > Jan 20, 2018 12:30 AM | Report Abuse

THE MANIPULATOR BULLETS HAVE BEEN ALL EXHAUSTED, MAJORITY OF THEIR SELLING HAD BEEN ABSORBED BY CHINA FUNDS LOH...!!

NOW EVERYONE SCRAMBLING TO GET BACK IN AS Q4 RESULT IS VERY STRONG, THEY ARE AFRAID MAY MISS THE OPPORTUNITY LOH...

Yes they are desperate because there is not much time left before the announcement of the explosive q4 result. They need to push it down fast because after this there is no more chance to collect low

2018-01-20 00:38

This is one of the best, if not the best analysis I have seen in i3 so far. None of Malaysia analyst can write so well ,I mean those investment bank analyst also can't write so well like David! My salute to him. He is the real sifu we all should learn from!

2018-01-20 01:34

slts,

Please let us know which particular item David is bullshitting. We will verify and David can correct it if it is as you said.. Unfortunately you make general statement which no one can help you. David spend hours and hours to prepare this report. Don't you think you are so irresponsible?

2018-01-20 06:30

from the charts, difference between both gasoil & mogas 95 and brent crude, we can seen 4th qtr is better than 3rd qtr, but one IB analys said that 4th Q crack spread is 20% less than 3rd Q, is he saying is true? Or is he lie?

2018-01-20 07:07

This kinda information no Investment Bank analyst will ever provide you.

Note Fuel Oil crack spread can go to negative level, whereas Diesel is at 11 USD/brl.

Meaning Hengyuan has a special ability to convert Fuel Oil to Diesel which sells at at a differential of 12 USD/brl compared to PetronM's Fuel Oil.

When you discount 30% yield of a 45 k bpd of current throughput of PetronM (as Fuel Oil does not generate income), the effective capacity of PetronM is just 30k bpd.

Thus, Hengyuan at 120 kbpd is at the least 4 x times more valuable than PetronM refinery.

If Investment Bank can cover PetronM which produces 30% Fuel Oil with a target price > 16, hope they know what to do with HY soon...

2018-01-20 11:28

The Fuel Oil yield of 30% is precisely the reason why PetronM is going ahead with a RM 14 Billion investment for an upgrade.

2018-01-20 11:31

This i3 got a lot of hidden tiger crouching dragon people. DAVID IS DEFINITELY one of them besides many other sifus like OTB,Icon,KYY., Probability and so forth.

2018-01-20 12:08

This i3 got a lot of hidden tiger crouching dragon people. DAVID IS DEFINITELY one of them besides many other sifus like OTB,Icon,KYY., Probability and so forth.

2018-01-20 12:09

Jan 20, 2018 02:17 PM | Report Abuse

Lets not forget one has 14 Billion to depreciate in their accounting in 20 years and the other had 0.5 Billion where at current depreciation wont last more than 3 yrs.

By the way...for those purely from Accounting background who understand depreciation very well....stainless steel vessel and pipes has oxidation resistance for a few 100 years

2018-01-20 16:00

Jan 20, 2018 02:21 PM | Report Abuse

Meaning..a new plant (refinery) or an old plant has basically no difference...except that the new plant will face a lot of hiccups (downtime) after commissioning the first few years till all technical issues are resolved and fine tuned.

2018-01-20 16:02

Actually if you pay attention to November quarterly report Section B3 Current year prospects, the management already hints us about the drop in refining margin.

Refining margins are expected to be lower in the near term based on market published forward

prices and refining margins. Operational efficiency, product quality, hydrocarbon and financial risk

management continue to remain key areas of focus in optimising the Company’s performance for

the current financial year.

Therefore, the recent fall in share price must have something behind. Better exercise cautions and buy after Q4 out to play safe. Buying nothing is better than buying the wrong stock. Just a faithful advice.

2018-01-20 16:53

people have done thorough research spending hours going through their annual reports and presenting the mechanics of its margin derivation with data collected tediously from beginning of the year till 31 dec, and you think they dont know about Section B3 drafted by the management on last qtr report sometime early october?

use your common sense my friend

2018-01-20 21:14

Why so noisy about Hengyuan? Expecting RM21 = 47% upside?

Better switch to this stock, upside more than 80%, follow link here...

https://klse.i3investor.com/blogs/superprofitstock/144840.jsp

2018-01-21 08:36

Probability and other refinery sifus ,

I have more than 30 years of manufacturing experience in semicon industries and I am trying to use some logical thinking and common sense on Hengyuan 's expenditure on upgrades versus the others . The sifus has been telling us that Hengyuan need to spend only RM 700 million to upgrade its old refinery to become the state of the art refinery meeting new standards plus making higher premium products . Why others are so stupid and do not know how to copy Hengyuan 's cheaper methods ( one fifth or one tenth the cost ) rather than spending multibillions . Does Hengyuan has its trade secret in upgrading the cheaper ways which no other refineries can do ? Are such upgrade patented by Hengyuan that others cannot copy? If ten others need to do the expensive ways and Hengyuan is the only one who can do the much cheaper way , who do you think will be doing the "right " way. Is my common sense common ?

2018-01-21 08:37

In any tender process , if I receive 5 tender quotations for an upgrade , 4 of them have +/ 10 to 20 % price differences and there is one with 50 % or 90 % lower than the other 4 , I will not award the project to such vendor even though it is the cheapest but is ridiculously lower . Chances are this vendor will lose money , run away and unable to complete the project because his quote does not make sense .

Common sense tell me to believe the 4 ( price differential is acceptable ) than the one with ridiculously lower price .

2018-01-21 08:48

Pjseow: Actually I think petronm upgrade is not merely an upgrade. Due to its equipment is too old, maybe most the old equipment and piping may not able to be reused. So the upgrade may need to change a lot of old equipment and may include new construction of buildings (look like building a new refinery). While for Hengyuan upgrade, it is mainly on Euro 4M upgrade where the main purpose of this upgrade is to reduce the sulfur content etc to make the fuel cleaner. I think one of the main equipment is filter for HY upgrade. HY ever perform two major upgrade in 1999 and 2013 and I believe most of their equipment still can be reused. This explain the big different between HY and Petronm upgrade cost. HY upgrade may not add directly the processing throughput HY but after the upgrade and major maintenance, machine efficiency should be higher that may leader to higher output efficiency.

2018-01-21 12:13

Pjseow: If u compare China Yunnan refinery setup cost and Petronas RAPID cost, their difference also big where China refinery system can be built at much lower cost and still running well. I think there are a lot of made-in-china products which they have decent quality but with much lower price as compared to many other countries. With technology breakthrough, it is possible to produce things that are cheaper and with decent quality.

2018-01-21 12:20

David ,thanks so much for your clarification . I would like to say that I benefited a lot from your numerous write ups on Hengyuan . The big disparity on the cost for upgrades between HY and other refineries had puzzled me in the last few weeks . Based on what I read in Stock Performance Guide by Dynaquest , Shell spent RM 1 billion in 1999 to transform from a simple refinery of 105kbpd into a 156kbpd complex refinery . In Feb 2013, Shell also spent another 810 million for the additional 6000 tons per day diesel processing unit . Petronm or previously Esso had also transformed from a 75kbpd capacity into a 88kbpd refinery producing a range of products such as motor gasoline, diesel , LPG.jet fuel ,kerosene etc. Based on my logical thinking ,with today's easy accessible information technology and know how ,PEtron should be able to spend similar and proportionate amount to upgrade its 88kpd capacity into similar state of the art refinery meeting the new Euro 4 and 5 standards .

2018-01-21 13:29

Average cost for building new refinery (Petron Corp Philippines)

= (8+14 billion / (90) kbpd

= RM0.16 billion or RM160 mil per 1kbpd

Average cost for upgrade existing refinery (Petronm)

= 14 billion / 90 kbpd

= RM0.16 billion or RM160 mil per 1kbpd

Can't be the same lah.

2018-01-29 04:09

>>>>Total gross profit = 383 + 51.8 mil = RM435.2

Estimated admin cost, depreciation, manufacturing expenses and Finance cost = 127 mil (based on Q3 figure)

There is high possibility of forex gain and small amount of other income in Q4 (as per Q3 report)

Let assume similar forex gain as per Q3 forex gain (50 mil as RM actually strengthen in Q4 more than Q3), and same other income of 9 mil.

Estimated Net income before tax in Q4 = 435.2 – 127 +50 + 9 = 367 mil.

Profit before tax of RM367 mil translated to EPS of 122.6 sen in Q4.<<<<<

Actual Q4 2017 results

Profit before tax 247.296 million

Net Profit 183.553 million.

EPS 61.18

The actual EPS for this quarter Q4 2017 was about 1/2 of that estimated by the author of the above article.

2018-03-03 15:18

John Lu 《 HIBISCUS 》 TP RM2

Well said!! Awesome!! China style goreng!! 1 day can drop 20% and up 20%...40% swing!! Stock king 2017/18 towards rm30

2018-01-19 23:17