(Icon) Air Asia (8) - Fantastic Result, RM3.00 Not Impossible

Icon8888

Publish date: Thu, 26 May 2016, 07:47 PM

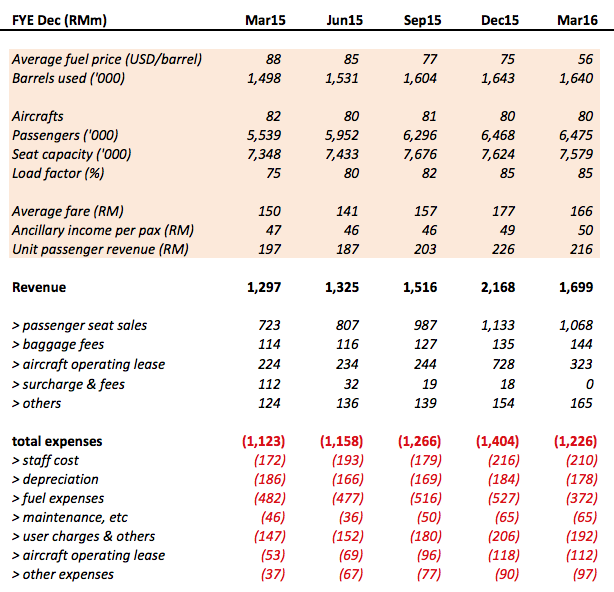

Air Asia released its March 2016 quarterly result today. I have put the latest figures in the table below, which is self explanatory.

Key observations :-

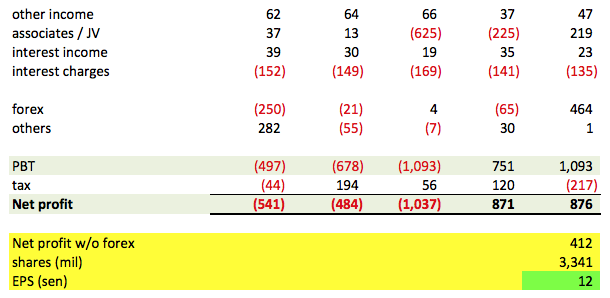

(a) Net profit came in at an astounding RM877 mil. After excluding the RM464 mil forex gain, core earnings is still a robust RM412 mil, translating into EPS of 12 sen (even after dilution pursuant to private placement)

(b) Operation wise, the latest quarter is actually not tremendously better than previous quarter.

> Total passengers carried almost the same as previous quarter;

> Load factor same as previous quarter; and

> Unit passenger revenue of RM216 is slightly lower than the previous quarter's RM226 (which is not surprising, as Q4 is usually the peak season when many people go for holidays).

(c) However, please don't let my sombre tone fools you. There is still plenty to be celebrated !!! Average fuel cost, as expected, dropped from USD75 to 56 per barrel, resulted in a whopping RM155 mil saving.

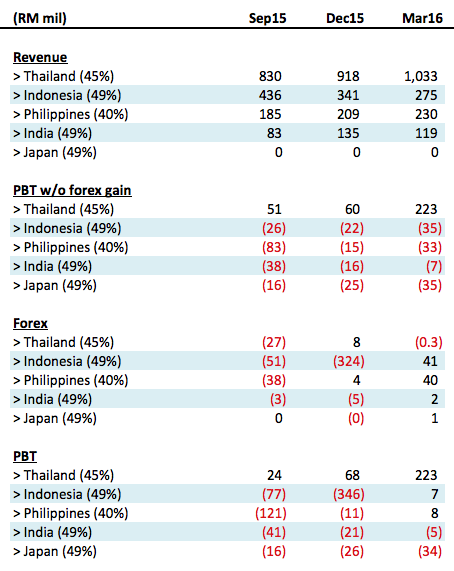

(d) Associate contribution also turned positive. From RM225 mil losses in previous quarter, it improved to RM219 mil profit, an improvement of RM444 mil.

> Thailand Air Asia performed extremly well with PBT of RM223 mil. It was achieved without forex gain.

> Indonesia Air Asia was still loss making. However, forex gain of RM41 mil turned its RM35 mil pre tax loss into a RM7 mil profit.

> Philippines Air Asia was also loss making. Similarly, forex gain of RM40 mil turned its RM33 mil pretax loss into a RM8 mil profit.

> India Air Asia almost broke even.

> Japan is making losses to the tune of RM35 mil.

Overall, I found the associates' performance acceptable. Indonesia, Phillippines, India and Japan were still making losses. But their magnitude is relatively small. It would be nice if they turn around in coming quarters. If they don't, I am ok. Their impact is not really that significant.

Concluding Remarks

Airasia's latest quarter result exceeded my wildest imagination. Based on annualised core EPS of 48 sen, the stock is currently trading at PER of 4.4 times. Barring a drastic spike in oil price (even though Air Asia has hedged most of its 2016 fuel requirement, a spike will still affect sentiment), it is not inconcievable that the stock can touch RM3.00 by year end.

If you have already sold your cars and houses, it is time to have a word with your cats, dogs, or even your girlfriend....

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Posted by calvintaneng > May 26, 2016 08:18 PM | Report Abuse X

All have missed AirAsia's Bloated Debt Bubble!

DEBT HAS NOW SURGE BY ANOTHER RM5 BILLIONS FROM RM81 BILLIONS TO RM85 BILLIONS

At earnings like now IT WILL TAKE AT LEAST 42 YEARS TO PAY OFF ALL AIRASIA'S DEBT.

Now the advantage of cheap oil might be lessen. Plus 8 Low Cost airlines are now in fierce competition with AirAsia & AAX

And according to AirAsia's report. Per passenger profit has decreased even though the number of passengers have increased.

This model of competing on lower and lower cost is unsustainable in the long run.

Shares will be passed from bullish hands to foolish hands now!

Tomorrow Calvin advise all to sell into strength. Many sorchai who are still ignorant will be buying

Now or Never!

2016-05-26 20:21

Only Calvin sochai never buy airasia keep shouting negative words on airasia..diu

2016-05-26 20:24

I don't think Calvin is Christian. Christianity don't teach jealousy or telling lies like what Calvin does.

2016-05-26 20:28

Posted by cheated > May 26, 2016 08:28 PM | Report Abuse

I don't think Calvin is Christian. Christianity don't teach jealousy or telling lies like what Calvin does.

Calvin replies,

You are correct that Calvin does not act from jealousy. You are definitely wrong to say Calvin tell lies.

Last time I should have warned my friends who risked their monies chasing shares at peak prices.

One Mr N from Batu Pahat lost Rm5 millions and gone into hiding

Mr Ho from SP Motor lost Rm3 millions and also gone into hiding

So my hope is to save some from future bankruptcy

I don't know whether you understand or not.

But time will tell

2016-05-26 20:33

Come on, if you don't agree, argue with facts, attacking personal faith is kind of moron act.

-------------------------------

cheated I don't think Calvin is Christian. Christianity don't teach jealousy or telling lies like what Calvin does.

26/05/2016 20:28

2016-05-26 20:39

someone only talked bout the past, can't see or don't acknowledge present, can he see future ? haha

2016-05-26 20:40

Calvin, you are the brave one, not too bad if we can have different views. Hope all get what you wish.

2016-05-26 20:45

Icon8888 really pros on putting an easy understood article like this for ikan biliz like me.

Investment Bank analysis won't present it that way.

Thanks again Icon8888.

2016-05-26 20:46

AA at peak? I read your post before that you bought Neoh Soon Kean SPG Sep'15 edition. What is AA peak price? I doubt you dare to tell the truth.

Posted by calvintaneng > May 26, 2016 08:33 PM | Report Abuse

Posted by cheated > May 26, 2016 08:28 PM | Report Abuse

I don't think Calvin is Christian. Christianity don't teach jealousy or telling lies like what Calvin does.

Calvin replies,

You are correct that Calvin does not act from jealousy. You are definitely wrong to say Calvin tell lies.

Last time I should have warned my friends who risked their monies chasing shares at peak prices.

One Mr N from Batu Pahat lost Rm5 millions and gone into hiding

Mr Ho from SP Motor lost Rm3 millions and also gone into hiding

So my hope is to save some from future bankruptcy

I don't know whether you understand or not.

But time will tell

2016-05-26 20:49

to be fair to Calvin, he see things differently. His investment must be backed by strong tangible assets such as land, property, cash and etc, even the company is not making money he may say it is under value.

2016-05-26 20:51

A words to Calvintaneng, there is no 100% counter that can fit every body .

Even wife oso can't satisfy all your fantasy things.

As long AA. Keep on making money, who care how long A.A.going to fully settle the Syndicate loan.

The longer the better.

2016-05-26 20:52

Posted by beso > May 26, 2016 08:55 PM | Report Abuse

airasia total debt 12.617b ringgit

NO!!

Creative accounting!

AIRASIA TOTAL DEBT COMMITMENT IS NOT RM12 BILLIONS

ACTUAL COMMITED DEBT IS A WHOPPING RM86 BILLIONS

EIGHT SIX THOUSAND MILLION IN DEBT NOW!

AAX DEBT HAS BALLOONED TO RM103 BILLIONS!

REALLY MIND BOGGLING

2016-05-26 21:02

I can just imagine the conversation tomorrow :

AA-01 Pilot: Ahem ... control tower this AA approaching runway 215 ready for take-off. Request permission .. over.

Control Tower : AA-01 Permission denied. Please proceed to runway 220 for takeoff ETA 0900 .. Over

AA Pilot : Roger Control Tower. TQ

AA Co-Pilot : Cabin crew please arm exit doors. Some comedians are currently trying to hijack our plane and asking us to take runway 200.

Stewardess : Roger ... crew please assemble for seat belt buckle briefing to our valued investors ... ahem customers.

2016-05-26 21:05

calvin, in this case ,i am not agree with u, Air Asia is nothing like IFca & sumatech, Air asia already became one of famous Brand name in malaysia. Nowadays, many youth are using AA travel outside malaysia every year(they very like travel,sometime twice a year),i can foresee the trend still continue in many years.Further more, oil price will continue remain low in 2 -3 years. if the business still going well ,the debt are doesn't big matter . that's why Tony are inject 1 Billion into Air Asia. sometime ,we should use the businessman or entrepreneur perspective instead of accountant.

2016-05-26 21:48

haha, i talk to lizard in my house 1st, i thk they dont have any objection if i sell them

2016-05-26 21:52

check with lizard ? haha ... the most creative one, got some sifu check feng shui like metal, wood, some sifu check weather like El Niño, some sifu watch movie to check if market crash and etc etc haha

2016-05-26 22:05

Posted by Ricky Kiat > May 26, 2016 09:48 PM | Report Abuse

calvin, in this case ,i am not agree with u, Air Asia is nothing like IFca & sumatech, Air asia already became one of famous Brand name in malaysia. Nowadays, many youth are using AA travel outside malaysia every year(they very like travel,sometime twice a year),i can foresee the trend still continue in many years.Further more, oil price will continue remain low in 2 -3 years. if the business still going well ,the debt are doesn't big matter . that's why Tony are inject 1 Billion into Air Asia. sometime ,we should use the businessman or entrepreneur perspective instead of accountant.

Ricky? Rickety?

Last time when I warned those fellas to sell Sunatech at 60 cents they say Sumatech is different. Different from delisted Patimas?

All who didn't sell got caught in SudaTrap

Then I warned IFCA people like Orionpacific, Cyborg, NancyTang, Crischan, Taka, Russian & others in IFCA when it was around Rm1.30 to Rm1.80

All in unison said that IFCA is different. Different from SudaTrap? And how can Calvin a nobody lone ranger be correct if CIMB Research confidently predicted that IFCA will reach Rm2.20?

I don't know how far MR MARKET & His Sorchai will push rickety AirAsia up tomorrow. But this I know for certainty - those who failed to sell into strength at peak prices will suffer the same fate of SudaTrap & IFCA.

"THIS TIME IS DIFFERENT" Or "THIS ONE IS DIFFERENT" is the Most Expensive and Costly Phrase I know.

2016-05-26 22:19

Sorry ... the flight fully booked tomorrow morning. You can buy into Jaya Tiasa airline. That one flights all on fire-sale tomorrow ... Better yet buy in the evening ... it will really be on fire .... hehehehehe

2016-05-26 22:24

for stock market , short term like vote machine , long term like weight machine. time will tell . let see how air asia perform in year end...cheers...

2016-05-26 22:43

Nice show between Icon8888 vs Calvin. See neutral IBs' side who tomorrow? Will Macquerie(IB with highest TP RM 3.50) revise TP even higher?

2016-05-26 23:00

World chocolate failure calvintaneng has become world champion liar. Well, within my expectation calvintaneng will be no1 liar

Maybe I'm God favourite son because I keep on winning. I really don't know why. Calvintaneng, don't angry with me on why I have all the good luck. And don't lose sleep because you're too angry. It's bad for your health. I play with you when I have time next time

2016-05-26 23:00

$ 11 billion bank borrowings

$ 1 billion investments in associates.....they gave you all the profits.

2016-05-27 01:16

buy in or sell out??? for me is buy in...later sure got people ask "still can buy" or "so how"?

2016-05-27 08:51

31cents EPS for a quarter LOL

imagine they remain it for 4 quarters!!!!!

124sens with P/E 5 the share price will be 6.2!!!!!

2016-05-27 08:52

Total shares currently:2,783,000,000

Total injection from Tony Fernandes: 559,000,000

Total shares after injection:3,342,000,000

If Airasia RM3, the market cap will be RM10 billion, which surplus skpetro and umw.

So will Airasia become KLSE index top 30 shares again?

2016-05-27 13:02

Why you sold all you AA yesterday kah ? Today throwing tantrum. Go and queue buy order lah and join the fun

2016-05-27 13:11

stockmanmy is one of those low self-esteem fellas...rather than focusing their energy to earn a few bucks they'd rather make themselves feel good by doing this. GFO la!

2016-05-28 11:06

buddyinvest

Luckily, Icon8888 "kiu" lim peh

2016-05-26 20:19