(Icon) Clash of The Titans (5) - Stockmanmy vs. KC Chong. Who Is Right ? Who Is Wrong ?

Icon8888

Publish date: Mon, 20 Jun 2016, 02:28 PM

1. Introduction

Stockmanmy has a lively debate with KCChong recently.

http://klse.i3investor.com/blogs/stockman/98587.jsp

http://klse.i3investor.com/blogs/kcchongnz/98599.jsp

If you filter out the noises and emotion, the debate is actually valid, matured and intellectual.

I don't mean to put words in people's mouth. But in order to write this article, I need to first sum up the respective party's view, so as to allow the readers to know exactly what the debate is about.

Stockmanmy has made it very clear how he picks stocks. The following are some of the salient points :-

(i) Net cash is not a good predictor of future share price;

(ii) The best predictor of share price is the business segment it is in; and

(iii) To be specific, the best predictor of share price is earnings growth.

In a nutshell, Stockmanmy said that you should not pay too much attention to balance sheet (of course, it is understood that we should avoid companies with excessive gearing and high bankruptcy risk) but should instead focus more on earnings growth.

As for KC, most forum members would have been very familiar with this gentleman's view as he is an active blogger. Just like everybody else, KC's stockpicking strategy involves many little little details. I must be careful not to misquote him or paint a misleadsing picture that does not reflect his actual stance. However, for the purpose of this article, I seek his indulgence to allow me to claim that "historical data plays an important role in KC's stock picking strategy".

I am not exactly shoving things down KC's throat. KC's style involved studying the PLC's Return On Invested Capital, Earnings Yield, etc. In order to do that, inevitably you need to look back to the past.

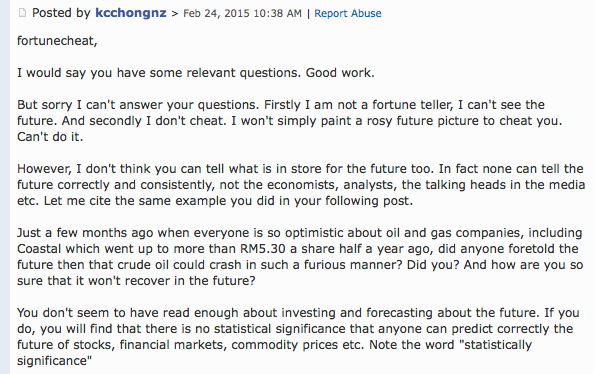

Not only that. If I am not wrong, KC is usually not very comfortable trying to make prediction about the future. If you do a search of "KCChong + statistical significance + future" in i3, the following will show up (not exhaustive) :-

Before I proceed further, let me clarify that the above examples should not be construed as stating that KC ignores the future when come to picking stocks. All we can say is that compared to Stockmanmy, KC does let the past plays a more important role.

So, Stockmanmy vs. KCChong, future vs. past. Who is right ? Who is wrong ?

2. Picking Stocks Based On The Future

I believe many people would have noticed that I am friendly towards KC. However, that is not relevant for this article. I am writing this article to discuss facts and truth, not to play politics.

With that in mind, I hereby declare that I am actually in similar school as Stockmanmy.

This is actually not surprising. Forum members who have been following my articles would have noticed that I rely heavily on future earnings to guide my investment decision.

My thought process and the way I operate is actually very similar to what Stockmanmy eloborated in his article. To deny that is simply lying.

Not only that, I have gone one step further to narrow down the timeframe for earnings forecast to the immediate next 12 months, as proposed by Uncle Koon in his now famous "Buy stocks that next year profit will be higher than this year".

The strategy has served me well. I achieved good return in 2015. In 2016, after an initial dip, my portfolio has rebounced and is doing reasonably well.

3. Picking Stocks Based On The Past

In the above section, I mentioned that the future is important for successful stock picking. How about the past ? Is referring to the past equivalent to "driving by looking at rearview window" as mentioned by forum member Fortunecheat ?

Is the past still relevant ? If the answer is Yes, how relevant ? And in what way it is relevant ?

To answer the above questions, I would like to refer you to the wisdom of one very famous investment Guru, Joel Greenblatt.

Joel Greenblatt is a very successful investor. Through his firm Gotham Capital, Greenblatt presided over an impressive annualised return of 40% during the period from 1985 to 2006.

How did he do it ? Greenblatt's investment strategy is explained in his book "The Little Book That Beats The Market". You can download it by clicking on the following link :

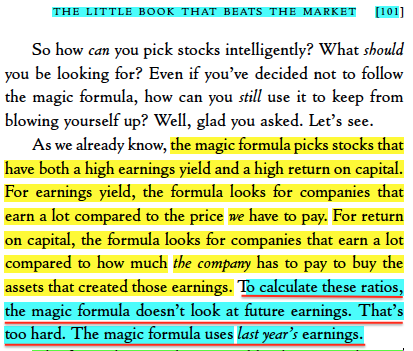

Bascially, Greenblatt picked stocks that fulfilled A COMBINATION OF the following :-

(a) High earnings yield (EY); and

(b) High Return On Invested Capital (ROIC).

whereby EY = EBIT / Enterprise Value; and

ROIC = EBIT / (Net fixed assets + working capital).

The above formulars looked very complicated. However, there are equivalents that can help you to immediately understand them.

EY is actually the cousin of our well know PE Ratio (in reverse, namely 1/PER).

ROIC is the cousin of our well known Return on Equity (ROE).

Basically, Greenblatt picks stocks that have a combination of Low PER and High ROE.

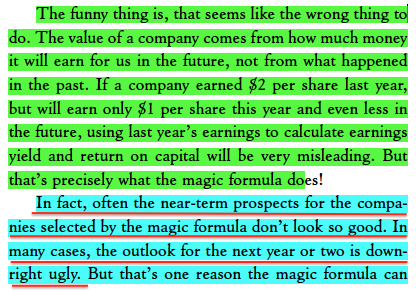

However, the above criterias is not important for this article (actually, what Greenblatt proposed is nothing groundbreaking. Most investors nowadays know that low PER and high ROE is good). What is important for this article is that Greenblatt relies heavily on the past when come to calculating EY and ROIC.

I did not cook this up. Greenblatt explicitly mentioned this in Chapter Eleven of the Book.

I have cut and paste quite a lot of information up there. What is the key lesson learned ?

4. Fallen Angels

What I am trying to highlight is not that you should use EY and ROIC to pick stokcs. They are useful tools, but not the purpose of this article.

I am also not trying to convince you that you should rely on past earnings to forecast future profit. Forecasting of profit is best done based on assumptions of the future, not the past. The past is over, many things that was previously there might have changed beyond recognition. It is risky to drive by looking at rearview window, just like what forum member Fortunecheat mentioned (actually Peter Lynch was the one that said it).

What I am trying to highlight is that while making fast money in the market based on Earnings Growth method, please don't forget to also pay attention to beaten down stocks that used to do well in the past but are now suffering due to unfavorable economic conditions.

One good example is MBM Resources. It used to generate EPS ranging from 40 sen to 50 sen. However, due to difficulty of securing car financing, weak consumer sentiment, weak Ringgit, etc, the group's EPS declined to approximately 20 sen. Its share price also declined from as high as RM4.00 to the current RM2.02 (down by 50%).

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY |

|---|---|---|---|---|---|---|

| TTM | 1,598,858 | 63,653 | 16.30 | 12.40 | 17.00 | 8.42 |

| 2015-12-31 | 1,816,663 | 80,398 | 20.58 | 11.67 | 7.00 | 2.92 |

| 2014-12-31 | 1,774,144 | 112,222 | 28.72 | 10.10 | 8.00 | 2.76 |

| 2013-12-31 | 1,959,689 | 138,480 | 35.45 | 9.06 | 6.00 | 1.87 |

| 2012-12-31 | 2,267,658 | 136,442 | 38.34 | 8.38 | 9.00 | 2.80 |

| 2011-12-31 | 1,705,573 | 121,237 | 42.60 | 5.76 | 6.00 | 2.45 |

| 2010-12-31 | 1,528,494 | 142,136 | 58.64 | 4.39 | 10.00 | 3.89 |

Companies like these are called "Fallen Angels". Their performance weakened substantially recently due to unfavorable market condition, but the business infrastructure (manufacturing capacity, distribution network, brand, etc) is very much intact. It is a matter of time (according to academic study, usually 5 years is the max) the operating environment will revert to the norm. When that happens, the stock will regain its mojo and deliver above average return to investors.

Please note that this is not the same as making a forecast of an untested company. I am not suggesting that we should forecast that for example, Asia Poly can make 10 sen EPS next year just because it reported 9 sen EPS in previous year. A Fallen Angel must be a company that has a strong track record in the past and has likelihood to recover when things normalised. Joel Greenblatt proved that for that kind of companies, if you invest BASED ON PAST DATA and with a bit of patience, it is possible to generate fantastic return over an extended period of time.

5. Concludng Remarks

(a) Based on real life experience, I advocate buying stocks based on future earnings. It is proven that most investors in Bursa love strong corporate profit. Stocks that display this characteristic will attract massive following and immediate outperformance.

(b) However, do not dismiss the useful role that historical earnings can play. It can be useful for picking Fallen Angels that have potential to shine again once things normalised. Those stocks usually trade at depressed valuation and hence offer good bargain. With some patience, they can generate impressive return at later stage.

(c) There is no need to dispute which method is more superior. One can give you fast money, the other gives you opportunity to bottom fish.

(d) In real life, I suggest putting the bulk of your money (let's say, 70%) in stocks that have strong earnings visibility while also nibble on beaten down stocks that have PROVEN HISTORICAL PERFORMANCE (let's say, 30% of your portoflio).

For beaten down stocks, you can build up your position more aggressively when there is indication of genuine turning around (be it based on FA or TA). By doing so, you can gain exposure at trough valuation while avoiding huge amout of capital being tied down in slow moving stocks.

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

In local context can aplly meh., local no such quality... seldom.

I only see jobst got previously, now sold.

And airasia now..... the others klci, ermmmm

2016-06-21 01:14

Those valuation method are heavily depend on past year figure to make future projection, it is even more subjective when comes to deciding what rate to use? After all these and you come out with your valuation but somehow it is Mr market who decides the price of the stock. Holding a stock which you deemed as undervalued but it seems like never achieving the target price appeared to be stubborn for me. I have gone through this and ever since i changed my strategies, the fruit bears (well maybe i am lucky). I am looking more on the business as i believed the value lies within the business, the competency of management, or even a windfall sometimes! Value might be something not everyone can see, if everyone can calculate that, can see that i dont think there is value anymore, market are more than efficient to close up this gap of opportunity(of course we all know valuation is not the only factor affect the prices). If the business model is so good that it is gaining more and more profits, isn't it a value that you found before it happened? If the management are capable to adapt on market competition or any policy change, isn't it a value too? I agreed that past year performance is important for us to judge a company as of today, but never buy a stock just depend on the past year figures. What i am trying to say is both methods are subjective, in fact investment is subjective, but neither one is foolproof. That's why a combination of both is vital, and i believed putting more effort on anything related to the business are rather important...and yes, figures can always be manipulated, that is what i learned thorough financial reporting. Cheers

2016-06-21 01:35

and i would like to recommend felicity, the blogger for serious investing is doing so well on these method. I love how he did the analyst. Logic with proven data.

2016-06-21 01:39

cheers

============

i believed putting more effort on anything related to the business are rather important...and yes, figures can always be manipulated, that is what i learned thorough financial reporting. Cheers

cheers

2016-06-21 02:19

So Ipomember, what do you proposed? Since you're against DCF valuation, yet all you have written are subjective i.e. good management, what valuation would you use then?

2016-06-21 06:05

I must admit Felicity is good. But take an example her analysis on Ecoworld, well all the reasons she stated aint anything new, but you will be bewildered how would she derive to value that Ecoworld should be worth more than 3 bil. She is good but the whole post is more like a good story telling. I can story tell and come up thinking Ecoworld is worth 10 bil. As Stockmanmy says, gut feelings mah. Why do so many valuation, just look at management, wah Datuk Liew, sure 10 bil.

2016-06-21 06:09

Stockmanmy

You could well be on to something good...

All you have to do now is... to harness... to simplify... to structure... to do the necessary... on how you identify growth companies... into a step by step approach..... that is simple yet reasonably reliable to use..

r°Moi is waiting for it

.

2016-06-21 08:33

Posted by leno > Jun 21, 2016 09:40 AM | Report Abuse

Stock manny ... name one wat-fak-growth stock and KC CHong to name one wat-fak-value stock TODAY ... and we see the result by end of june THIS year 2016 ... meaning about 10 days to go. See who win than can tok more kok.

What, is that what you understand about investing?

Tikam kah?

"tok kok is cheap ... any fakkers also can tok kok"

2016-06-21 09:55

relax man.. tomorrow is holiday! kikiki manny manny will choose penta as growth stock cheers

2016-06-21 10:10

KYY..next year sure no participate already...

already now he disable all comments

now very cheekily putting title 'car run on water'

2016-06-21 10:52

ohh...that real one and only unmatched guru - leno...everyone in i3 know la... any pussycat can challenge the throne?

though the time frame of 2016 is too short to conclude on any investment thesis....I am thinking the winners (especially with large portfolio) may truly deserve some credibility on their skills..

2016-06-21 11:09

at the end, it is not the method .. but result is the matter. And we mean REAL RESULT ... not main-main portfolio result hor ... HAHAHHAHAHA ... HAHAHAHAHAH ... leno the most panlai alredi give u all ONE good tip ... PMCORP CANTEEEEEEEEKKK AAAAAAAAAAAAAAA !!!

2016-06-21 11:23

will Thong Guan be the next Scientex?

well,

they are ambitious and they are capable.

This is the year expansion plans starts to bear fruits.

For genuine investors, don't even think of selling and nobody knows what is the top.

the only thing that one need to now is that packaging is an enormous growth industry due to E Commerce.

2016-06-21 11:24

aiyo...last time I used to a nice 'canteek' pussycat in Insas forum...don't where she is now..

2016-06-21 11:25

wat insas ? NEver heard of insas in my life.

i onli has PMCORP niah ....

i believe it must be that bugger calvin tan use my name to promote insas liaw ...

2016-06-21 11:26

.

Stockmanmy

If cannot do what r°Moi asked for.. then just stop la

Imagine following you... IB analyst coming up with FV like this....

A one liner...

Based on gut feeling CIMB is going to be 3.50 one of these days Period

Bbbbbblllllaaaaaaaaaaahhhhhh

r°Moi Stockmanmy

You could well be on to something good...

All you have to do now is... to harness... to simplify... to structure... to do the necessary... on how you identify growth companies... into a step by step approach..... that is simple yet reasonably reliable to use..

r°Moi is waiting for it

.

21/06/2016 08:33

2016-06-21 11:31

well

I am not IB analyst.

so far not a single IB analyst catch my attention.

2016-06-21 11:33

actual stockman...is one the smartest people around...he does not need to do any calculations...he just need to know who are the established investors...poke them...challenge them...gain insights...still not confident..poke their opponent more..and then buy...saves a lot of time right? he he he...

2016-06-21 11:37

Liihen bla bla... all almost done till dead...and it is not like you have noticed before... before they flew off...

Challenge is to look for a sure winner ler... like AirAsia at below RM 1 and oil prices were falling off the cliff...

Come up with a new one la... leave liihen alone

2016-06-21 11:39

to summarise everi thing here is as below

1. kcchong all tok .. angin onli

2. stockmanni all tok .. also angin onli

3. all must follow leno the most panlai .. less tok, action onli

PMCORP CANTEEEEEEEEEKKK !!!

2016-06-21 12:08

Posted by telengoh > Jun 21, 2016 05:10 PM | Report Abuse

LESSON LEARNT - DO NOT TRUST BLOGGERS

(Icon) Comcorp (4) - Excellent, Excellent Results

2016-06-21 17:15

Posted by singkalan > Jun 21, 2016 05:27 PM | Report Abuse

Calvin was damm right about it. Bravo to bro Calvin! Congratulations to die hard fans and supporters of king of pump and dump icon8888

2016-06-21 17:29

only stupids listen stupids..............tht....means con con, koon bee, leno.etc

2016-06-21 18:36

If arguing can become rich, please continue. It's just purely wasting of time.

2016-06-21 23:07

Getting too details is rediculous, stupid, it's BUSINESS, not SCHOOL STUDY.

2016-06-21 23:08

Don't trust anyone, trust yourself. Especially those bloggers: icon, kcc, bla bla bla chicks, , whatever they recommend, be careful on it, don't simply go in, avoid those stocks or dump it.

Anyone unhappy made big lost, can hirE sniper to kill those bloggers also. One die then all will goNE forever. LOL

2016-06-21 23:20

You better be careful don't simply joke like that. Your joke can be misconstrued as a threat. There will be consequences if somebody or police decided to take action against you. I have been in i3 for so long, "kill" is a word I stay far far away from

You are taking it too lightly

Ryan88

Anyone unhappy made big lost, can hirE sniper to kill those bloggers also. One die then all will goNE forever. LOL

21/06/2016 23:20

2016-06-22 12:43

it doesn't matter whether police or anybody will take action against you. But your use of "kill" word sets a very bad example for others to follow. We are all members of this forum, let's try to at least preserve its integrity. If everybody starts following you and starts incorporating the Kill word in their discussions, can you imagine what i3 will become ?

For that reason, I appeal to everybody here to never ever use that word

2016-06-22 12:52

answer me, Mr KC

You have showed me some examples of your work

Spread sheets of some sort of financial analysis.........

Don't you ever do any analysis of business risks, and analysis of business operations and business analysis. ?

The warning on all on your works is Final decision is yours as if washing your hands of all liabilities and claiming credit for when you are right....and all these based on an incomplete analysis.

Yes, that is right. Incomplete analysis.

I see you and sifus in i3 keep talk about FA and TA......as if that is the end of it....but where is the BA? the business analysis.

the real warning should be worded as....This is a FA and TA without a BA.

2016-06-22 21:34

tomorrow I am coming up with another article featuring you and KC. Stay tuned...

2016-06-22 21:39

hi stockmanmy,could you let us know some of few companies that meet your growth criteria......been curious to know your way of investing.will not follow blindly but will study them first.hope u dont mind......

2016-06-22 21:53

stockmanmy

wrong, plane.

It is not dividend even, it is about what the Company do with what it has.

That is why shares like Tesla ( or Berkshire) with no dividends can be so high, or Alibaba or Google that we all like what they do with what they have.

paperplane2016 > Jun 21, 2016 01:03 AM | Report Abuse

Thts why the forMula shld be, value, plus high div yield all these years. At least higher than fd.

2016-06-21 01:11