(Icon) Air Asia (11) - Asia Aviation Capital : Sale Or No Sale, Air Asia Is The Winner

Icon8888

Publish date: Wed, 21 Sep 2016, 07:25 AM

1. Introduction

Air Asia stock price has performed well. Since early 2016, it has gone up from approximately RM1.70 to as high as RM3.30 few weeks ago.

I believed many investors were tempted to take profit. However, Tony Fernandes pursuaded shareholders to hold on to their stocks. According to him, Air Asia is in the process of disposing its aircraft leasing unit, Asia Aviation Capital Limited, for closed to USD1 billion, and there is possibility of huge dividend payout.

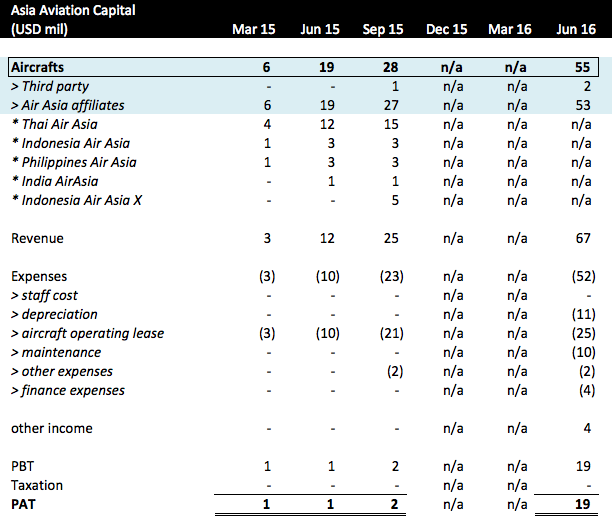

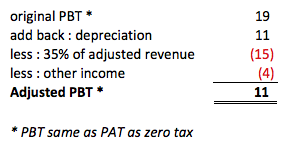

While excited about the potential windfall, I am sure deep in our heart many of us are quietly asking whether he is exaggerating the potential upside. Is Asia Aviation Capital really worth that much ? How has it been perfoming ? What is it doing ? Why are potential buyers willing to pay so much for it ?

To answer the above questions, I decided to do a little bit of research. The findings turn out to be quite interesting. Please read on.

2. BOC Aviation Limited

Asia Aviation Capital is a relatively new entity (incorporated in 2014). There is not much information available from public sources. To better understand the business of aircraft leasing, I decided to take a look at BOC Aviation.

BOC Aviation was listed in Hong Kong Stock Exchange in mid 2016. It is majority owned by Bank of China and is the largest aircraft leasing company in Asia.

Same as Asia Aviation Capital, BOC Aviation's business model is as follows :-

(a) Buys and owns aircrafts (through appropriate use of debt funding);

(b) Leases the aircrafts to airlines for rental income. Typically, lease period lasts for 5 to 7 years; and

(c) When opportunities arise, disposes aircrafts to lock in capital gain.

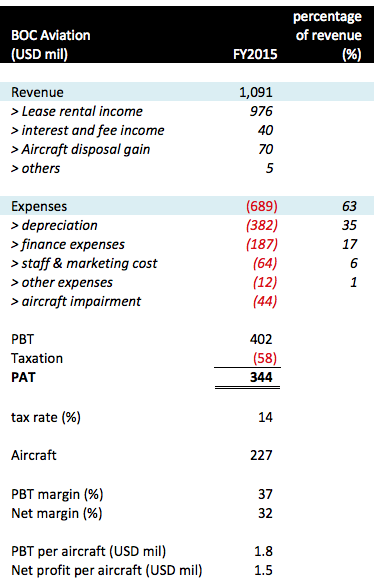

The following financial information is extracted from BOC Aviation's IPO Prospectus dated 19 May 2016. If you are interested, you can download it through the following link.

https://www.bocaviation.com/en/Investors/Prospectus.aspx

Key observations :-

(a) The business of aircraft leasing is surprisingly easy to understand. Basically, you let somebody make use of your aircrafts, and they pay you rental regularly. After deducting depreciation charges, interest expenses, staff cost, tax payment, etc, whatever left behind is your profit. Very straight forward.

(b) The bulk of BOC Aviation's FY2015 PAT of USD344 mil was operating profit. Exceptional items were very small at USD26 mil, being the difference between gain on disposal of USD70 mil and aircraft impairment of USD44 mil.

(c) Depreciation charges accounted for 35% of revenue. (Note : this piece of information will be useful in subsequent section for Asia Aviation Capital's financial modelling)

(d) Very high profit margin - net margin of 32%.

For comparison purpose, Public Bank, Gamuda, KLK, Tenaga (representing various industries in Malaysia) has net margin of 27%, 30%, 7% and 14% respectively.

(e) Based on average net assets of USD2.3 billion, FY2015 ROE was approximately 15%.

For comparison purpose, Public Bank, Gamuda, KLK, Tenaga (representing various industries in Malaysia) has ROE of 16%, 11%, 9% and 13% respectively.

(f) Based on 227 aircrafts, BOC Aviation generated PBT of USD402 mil. This translates into PBT of USD1.8 mil (RM7.2 mil) per aircraft in FY2015.

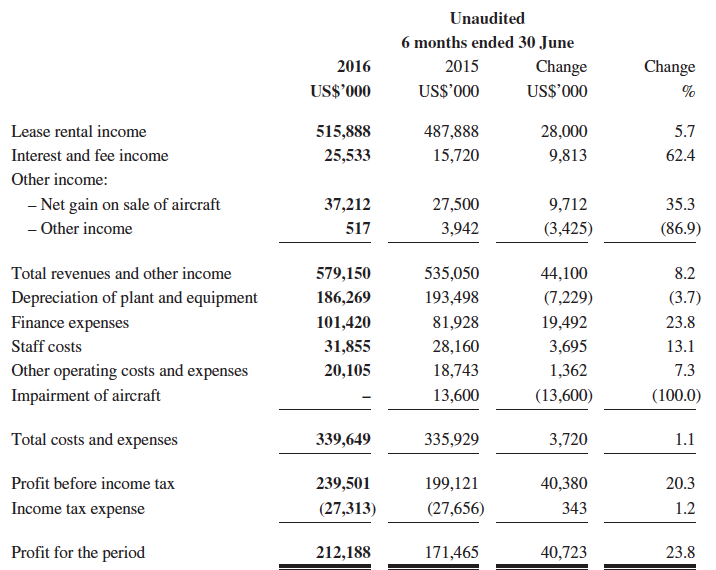

Note : BOC Aviation continued to do well post IPO. The company reccently announced 1H FY2016 net profit of USD212 mil, 23% higher than FY2015. Please refer to Appendix 1 for further details.

Summary Conclusion

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

sell AAC now, short term good, long term not good.

hold AAC now, short term we are not good, long term very very good. (^-^)

2016-09-21 08:53

Icon Sifu Thank you. I enjoy reading ur article and have a much understanding in AA

2016-09-21 10:00

Your assumptions for 'aircraft leased from other companies' Sep15 are wrong

2016-09-21 10:03

thx Icon, some extra info wish can help your analysis:

1. base on TA Report and info after investor roadshow, Airasia "might" target inject more aircraft to AAC from current 55 -68 units.

2. base on the Qtr report, AAC latest" total equity" is only 45.9m, With ttl assets 801m and total Debt 755m

3. New appointed CEO, Stéphane Daillencourt, with 30 years exp in GE, manage leasing arm 1700 aircraft portfolio.

base on above info, and the latest p&L and balance sheet, i believe the 1b is viable, how ever, to be realistic, there is 2 possibility:

1. buyer will take 755m debt out of airasia balance sheet with AAC, and paid extra usd 245m, in cash, which mean it will greatly reduce debt and boost AA BS to healthy zone.( jus like tony first bought AA at RM1 and take the 40m debt with it)

2. buyer pay 1b, and AA keep the 755m debt in AA balance sheet, with USD 1b cash, Tony will pay special dividend and cover the private placement of RM 1b.(which i thk with high possibility)

2016-09-21 10:26

Very well written. thank you Icon for the detailed analysis and comparison.

2016-09-21 10:29

sifu koohaiwuyah, I believe Asia Aviation Capital's net asset is USD45.9 mil + USD185 mil (amount owing to holding company) = USD230.9 mil

2016-09-21 10:39

Nice one Icon. Great analysis and straightforward presentation for a clueless layman like myself.

2016-09-21 10:40

feel even more confident with AA after reading Icon article, yesterday i sailang in Airasia, thanks Icon for this timely article.

2016-09-21 10:47

ya, icon sifu, i thk u r right, i overlook this part(amt due to holding company) =D

2016-09-21 12:05

Great post. We all are alway waiting for your post and learn from you on how to do a good analysis.

2016-09-21 12:41

Thanks for your great effort in preparing the analysis. It's data based and give opinion with well stated assumption.

2016-09-21 13:15

I'll add my compliments, Icon8888.

What's your view of a report I read that there won't be US$1.4 bil for distribution after sale of Asia Aviation Capital as it has huge borrowings?

Anyway, I'm in AirAsia for its operating profit, not AAC. That latter's just a bonus.

2016-09-21 16:01

I will be happy if Air Asia pay me 50 sen dividend. Anything more than that is a bonus.

2016-09-21 20:21

1. May i know what's pass-through revenue?

2. Why do you say lost earnings contribution is not significant? AAC contributed USD19m or RM80 last quarter (ignoring inter-company), Airasia made RM342m in 2Q, RM412m in 1Q excluding forex. but one-off cash boost also good and may bring down interest cost

3. I think technically net assets should still be RM45.9m. Amount owing to holding is debt, not equity. In disposals, this amount should be settled. other than amount owing to holding of RM185m, there's also an amount owing from related parties RM68. so net for AirAsia group AAC owe RM117m. but it's more likely than this amount would have been factored in the USD1b valuation (if it's true)

4. What do you think about its valuation right now? especially considering the new shares to be issued will dilute the eps

Thanks a lot for sharing

2016-09-22 11:17

Icon, just assume that Airasia sold the AAC. The item under revenue "Aircraft Operating Lease" (On June16 Qtr 328m), and the item under expenses "Aircraft Operating Lease" (On June16 Qtr -121m) both will disappear, right? That mean quarterly Airasia will lost net income on this item around 200m/qtr right? correct me if mistaken.

2016-09-22 20:09

dear Jay and Tee Tom, I think your questions are valid. My argument that disposal of AAC will not affect Air Asia profitability in a big way was based on AAC figures. However, upon taking a closer look at Air Asia's financial figures, the lease income and lease expense is much higher than that of AAC. One possibility is that only part of Air Asia's leasing activities are housed under AAC. Due to lack of information, I think it is best that I don't take a stance when come to this issue. I have added a paragraph in item (d) of Concluding Remarks to say that I no more comfortable with my original view.

2016-09-22 20:31

Icon, I have no mean to question on your hard effort piece of work. Haha, I think you spent a lot of time & effort to produce this top class analysis. Anyway, no discuss, no debate, it wont has spark. This is just a normal processes we are going. The more important is the ending, right? You are my top example I want to learn on; Your analysis ability, your fugures sensitivity, your top class sense of investing, and your ability to put your thought on the paper. I always enjoy your writing. Thank god you are always by our side. Thanks.

2016-09-22 21:49

Oh no offence taken. You guys gave your comments in a professional way, I have no complain

By the way, I finished that article at almost 1am at night. So the last few items were not as well thought out and written as I wish (sleepy...). So I welcome you guys comments to point out any inadequacy.

2016-09-22 22:02

Talk so much for what?

AirAsia sudah 100%, buy others, kesm, gkent, rcecap, bornoil,choobee,etc

2016-09-23 22:19

RCECap buy call by Maybank TP 1.60 , Airasia TP 3.33 Buy call by Maybank, TP

3.85 Buy call by HLG.

2016-09-23 23:03

RainT

Thanks Icon

2016-09-21 08:17