(Icon) Air Asia (12) - Beli Beli Jangan Tak Beli

Icon8888

Publish date: Fri, 11 Nov 2016, 12:16 PM

1. Holding Our Breath

According to this article on The Star dated 6 October 2016, bidders will revert with offer for Asia Aviation Capital by mid November 2016.

At least four parties have been invited to bid for Asia Aviation Capital. Three are China based companies while one is from Japan. The relevant parties had been requested to revert with first round offers by mid November 2016.

The bidding process has been further comfirmed on 2 November 2016 by an Air Asia executive during a speech made in Hong Kong.

Today is 11 November. Mid November is only 4 days away. What should we do ? Should we trust the information being leaked to the press ? Is the disposal really going to happen ? Or is it just a rumour, created by syndicates to try to fool the retailers ?

In my opinion, the chance of the disposal happening is very high. Please read on.

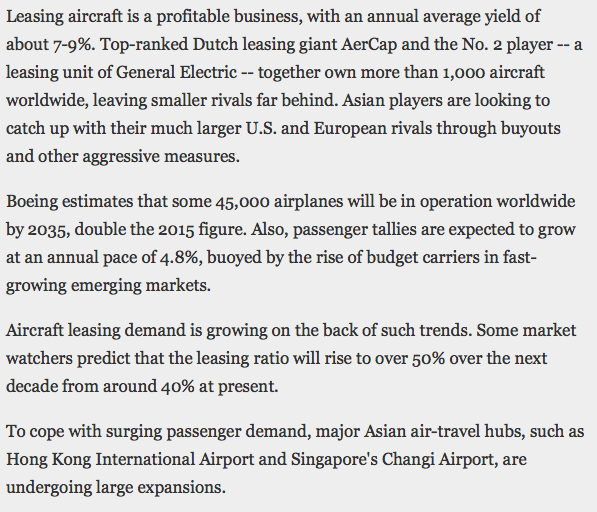

2. Eager Buyers

First of all, I am convinced that the bidders will enthusiastically pursue Asia Aviation Capital.

The recent decline of oil price has made many airline companies very profitable, creating strong demand for planes. As a result, the aircraft leasing industry is booming. Backed by abundant financial resources and buyont domestic demand, China based leasing companies in particular are in expansionary mood.

3. Eager Seller

Secondly, I am convinced that Tony Fernandes is very serious about selling Asia Aviation Capital.

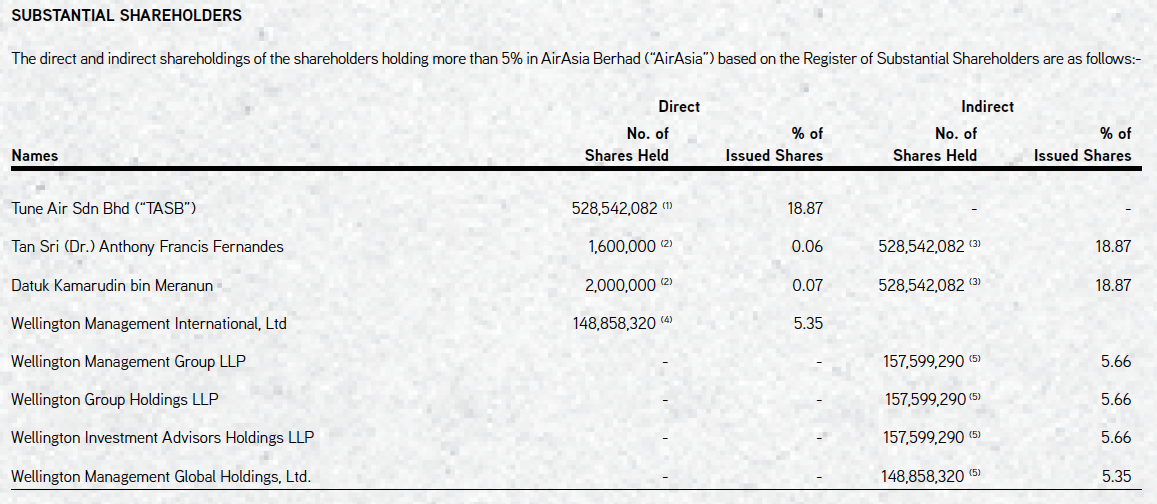

As at todate, Tony Fernandes only holds 18.87% equity interest in Air Asia.

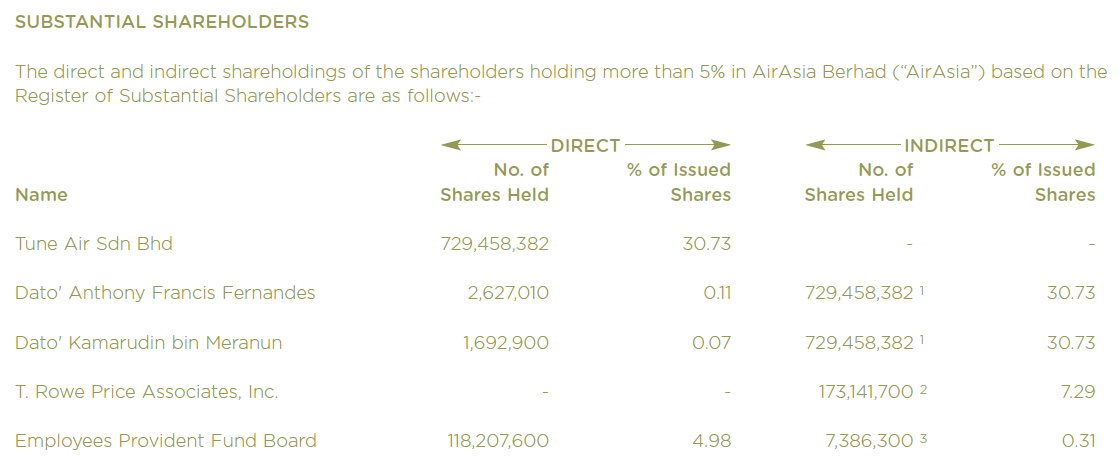

It was not always like that. For example, back in 2007, Tony Fernandes held more than 30% equity interest in Air Asia.

The reason his equity interest has declined by so much was because he has been selling down in the open market. In the past few years, oil price was as high as USD100 per barrel. Airline business was difficult and high risk. He can hold on to only 19% without having to worry about losing control.

But now things are different. The decline of oil price has resulted in huge jump in profitability. If Tony Fernandes does not increase his shareholding, somebody will launch a hostile take over to assume control of Air Asia.

Hostile take over was very rare in Malaysia, but it has happened before. In 2001, Sime Darby launched a hostile bid for IOI Corp's oleochemical business, Palmco Holdings Bhd. IOI Corp eventually managed to fend it off. But it was a painful and expensive exercise, requiring IOI Corp to counter offer at a higher price.

If the above happens to Air Asia, Tony Fernandes will not be in a position to fight back. He is no IOI.

Things had been made worse by Tony Fernandes going around telling people about Asia Aviation Capital. Now that everybody has known how valuable it is, if Tony Fernandes fails to increase his shareholding through the private placement, I am willing to bet a bag of gold for a potato that risk capital will step in to wrest Air Asia away from him, dispose of Asia Aviation Capital to pare down borrowings (taken up to fund the hostile bid) and end with free Air Asia shares.

In other words, if Tony Fernandes does not dispose of Asia Aviation Capital, somebody else will do it for him. It could be anybody - MAS backed by government funding, Hedge Funds, Private Equity Investors. Plenty of people will be very intrerested to do it.

4. Not All Margin Financing Are Equal

It is safe to assume that Tony Fernandes will rely on margin financing to pick up his placement shares. He has in numerous occasions cited Bank Negara Malaysia approval as the main reason for delay in implementation of the private placement.

I believe many readers have experience with margin financing - you pledge your shares and the bank provides you with the funding. You don't need to repay the facility. As long as you keep the ratio below certain level, you can roll over indefinitely.

But that is for ordinary people like you and me. It will be different for Tony Fernandes. When a bank provides margin facility (RM1 billion !!!) to somebody to subscribe for new shares in a single PLC, the bank will want to know how the loan will be paid back. There is no such thing as ROLL OVER. The bank wants an exit strategy.

There is only one way Tony Fernandes can pay back the loan - dispose of Asia Aviation Capital and distributes the cash proceeds. There is no other way to do it.

5. Concluding Remarks

Everytime people tells me they can predict the market, I will yawn. Stock market is a very huge and complicated system, nobody can predict its direction.

However, based on my experience, in certain rare instances, a window will open and provide us with opportunity to see things with certain degree of clarity. I believe Air Asia at current stage is one of such cases. Bits and pieces of information put together points to high possibility of sale of Asia Aviation Capital happening in the not too distant future.

Nobody can guarantee you that you can make money by buying Air Asia now. But the risk reward ratio seem to be quite favorable.

In my opinion, it is worth taking a bet.

p/s : Strengthening of USD today alarmed many investors (risk of capital flight). But I would like to point out that this will benefit Air Asia's sale of Asia Aviation Capital as the deal will be denominated in USD

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Long time no see Bro Icon8888's posting here...though I dont like AAsia at all at this level I still give a big LIKE

2016-11-11 12:21

long time no see, bro icon888, i still hold half air asia. (^-^)

this few day use last patch of fund buying into plantation stock. no money to add AA liao. (>-<)

2016-11-11 12:47

Thanks and I like your comments with supporting data. Unlike many, just posting nonsense by talking empty only.

2016-11-11 12:48

Oh come on icon, no bank's going to provide margin financing based on fat man tony's aa shares certainly not now with their USD borrowings and looming forex losses (not to mention oil prices are rising....) Selling their leasing arm and distributing the cash isn't going to change that

2016-11-11 13:53

High USD Debt, is end of Airasia and AAX? Bro Icon, please give your Guide.

2016-11-11 13:56

pinjaman bank perlu dibayar...asia aviation capital, adalah jalan penyelesaian yang bagus untuk tony and airasia....tapi asia aviation capital macam ayam yang bertelur emas...nak jual tapi siapa dapat bagi tawaran yang paling tinggi? syarikat china, jepun atau institusi kewangan global? tunggu dan lihat....

2016-11-11 18:22

Becareful !!!

When article come out

Sign to sell !

Faster dispose all ur stocks in this counter before bug sharks take advantages to dispose their big volume of shi*

2016-11-11 20:50

Why Airasia surged from below RM1.50 up to RM3.00 early this year? Icon knew it very well. With RM depreciated from 4 to 4.40, what will be the impact to Airasia?

Anyway, thank you for pasting all newspapers here, though it is not easy to read.

2016-11-12 00:57

beli salah.. tak beli pun salah...beli kalau betul-betul yakin terhadap saham airasia...kalau tak, ibarat sudah jatuh ditimpa tangga ...nasib baik aku beli tahun lepas masa harga masih rendah dan tak begitu pening kepala....kesan dari dasar perdagangan Trump pasti memberi impak kepada pasaran saham di malaysia terutamanya nasib matawang ringgit...meskipun begitu airasia adalah jenama yang boleh bangkit semula dan berkembang maju....

2016-11-13 12:32

sure govt dislikes airasia. it has to protect the dysfunctioning MAS from competition!

2016-11-14 08:24

Thanks Icon8888. Once again, an intelligent and insightful analysis.

2016-11-14 12:12

baca tulisan icon888 memang seronok dan meyakinkan.. gabungan ilmu dan pengalaman orang lama..memang mantap bro..thanks icon8888

2016-11-14 23:26

VenFx

Interesting...

2016-11-11 12:19