(Icon) Hibiscus Petroleum - The Potential Is There. Lets' See Whether It Can Deliver

Icon8888

Publish date: Tue, 19 Jun 2018, 12:00 PM

1. Introduction

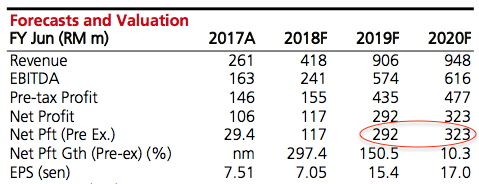

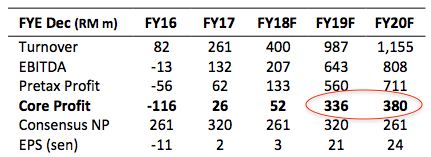

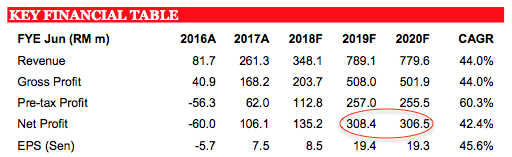

This stock attracted my attention because of analysts' extremely bullish earning projections. Not one analyst, at least three.

(Alliance DBS, 3 April 2018)

(BIMB Securities, 3 April 2018)

(Public Investment Bank, 30 May 2018)

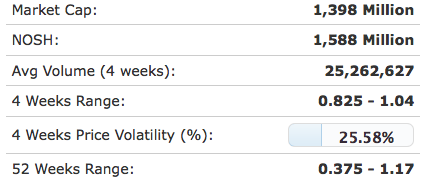

As shown above, analysts are expecting the company to report net profit of more than RM300 mil from FY2019 onwards. Since Hibiscus' financial year end is June, FY2019 is just a few months away. The company's existing market capitalisation is RM1.4 billion. As such, net profit of RM300 mil is a BIG DEAL. Let's find out more.

2. A Little Bit of Background

Hibiscus started out as a Special Purpose Acquistion Company (SPAC). It was listed as a cash company on Bursa. The company then made use of the cash to acquire profit generating assets. In the initial first few years since IPO, Hibiscus has not done well. It acquired a few assets, but they are mostly not very profitable.

The breakthrough came in 2015. Due to the depressed oil price, Hibiscus had opportunity to acquire 50% interest in Anasuria Clusters, an offshore oil field in UK. With daily production of about 3,000 barrels of oil, the 50% Anasuria generated net profit of approximately RM50 mil per annum.

In October 2016, Hibiscus announced that it was acquiring 50% equity interest in North Sabah Production Sharing Contract ("North Sabah PSC") for an extremely cheap price of RM200 mil. The vendor was Shell. Petronas holds the remaining 50% interest. The acquisition was completed recently on 31 March 2018.

This transcation is what gets analysts excited and make bullish earning projections for FY2019 onwards.

(As a matter of fact, the company's earning could spike as early as Q4 of FY2018, as North Sabah PSC will officially be part of the group effective 1 April 2018).

3. North Sabah PSC

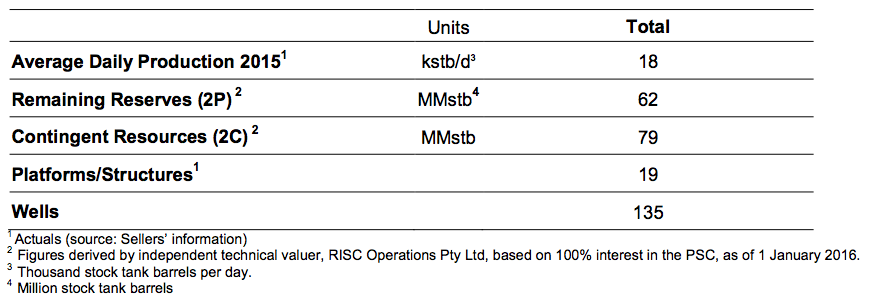

(Source : Company announcement dated 12 October 2016)

The North Sabah PSC is much bigger than Anasuria. Anasuria produced approximately 3,000 barrels per day (based on 50% interest). The North Sabah PSC produced around 7,000 barrels per day (based on 50% interest). Both assets will last for at least another 20 to 30 years.

4. Historical Profitability

Talk no use, show me the money. How has the company been performing in the past ?

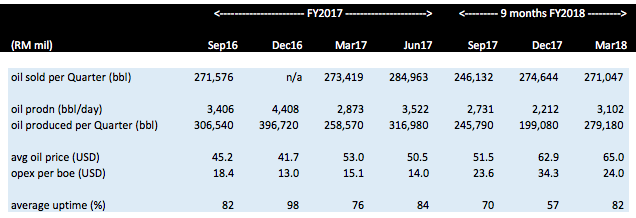

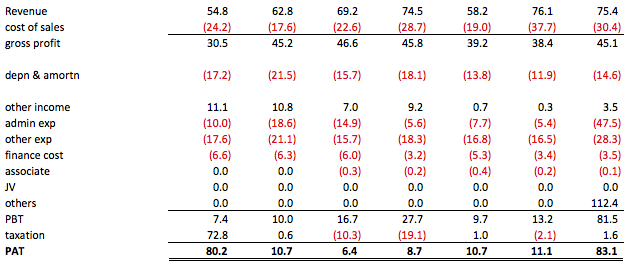

I have tabulated the past 7 quarters P&L in a systematic way. Please study the table to feel the figures. Key observations :-

(a) In FY2017, after excluding the exceptional items, the group reported total PBT of RM40.1 mil (being -3.3+3.1+11.9+31.5, near the bottom of table). Based on zero tax rate (which was the average in that year), PAT was RM40.1 mil.

(b) In Q3 of FY2018, admin and other expenses spiked from the average of RM30 mil per quarter to RM75.8 mil (very bad). By excluding exceptional items and applying the normalised RM30 mil expenses (please refer yellow highlighted), FY2018 Q4 PBT will be RM32.1 mil. This will lead to FY2018 nine months PBT of RM59.3 mil. As mentioned above, Q4 could get a big boost from incorporation of North Sabah PSC contribution. However to be conservative, lets' assume Q4 PBT of RM16.1 mil (same as Q2 FY2018), FY2018 PBT could be about RM75.4 mil. Based on assumed zero tax rate (as per the FY2018 nine months average), PAT works out to be RM75.4 mil as well.

5. Concluding Remarks

According to the analysis above, the group's earning capacity before North Sabah PSC contribution is approximately RM40 mil to RM60 mil. In the coming quarter, North Sabah PSC will be reflected in the accounts. Can earning grow as analysts expected ? We can only find out when the result is released by end August 2018.

Recently the market is bad. Many people are in bad mood. They came out to attack each other. This is so childish. Grow up and behave like an adult. There is no sure win in stock market. Everybody is guessing (albeit educated guesses). No matter how good your analysis is or how accurate your insider information is, there is always a chance that something will happen in the future to adversely affect your investment. If you cannot handle the stress of losing money (actually paper loss) during bad time, put your money in FD. Nobody owes you a living.

Have a nice day.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

(吉隆坡18日讯)贸易战烧到大马!中国商务部宣布,将对大马、沙地阿拉伯、泰国和美国的乙醇胺(Ethanolamine)产品祭出暂时性反倾销惩罚。

同时,中国商务部指出,初步认定日本和美国输华的盐酸(Hydrochloric acid)产品出现倾销行为,已经损害中国盐酸领域利益,因此将对两国的盐酸产品祭出暂时性反倾销措施。

2018-06-19 13:24

Hibiscus most likely can make some money if they don't have to amortise their $ 1 billion intangible assets.......

in the post 1 MDB world......these are dinosaurs from the 1 mdb era.

its all up to their accountants now......

2018-06-19 16:32

Tis intangible assets is actually cost of oil plant n equipment transfer to d states in exchange for d rights to extract oil Can b recovered as part of cost recovery under cost recovery

2018-06-19 16:40

All oil assets left behind by oil majors running smoothly now why can't deliver?

2018-06-19 17:17

@ OrlandoOIL

The TP are only applicable if crude oil remains above USD60 in the next half year.

Else the IB and analyst will always do re-rating, downgrade.

I personally don't like them as they don't have a "backbone".

They can't give a TP that is for 10 years without changing any variables in between that period.

2018-06-19 17:17

Knn no nid worry abt oil price falling la cos it wil not fall no surplus mah

Saudi is back to being d one calling d shot d kingpin d price maker now all oil excess gone

Putin stil remember one of d reasons oil crash was to mess up his country finances now he ask Trump to fly kite

2018-06-19 17:34

ICON8888, your introduction, it should be FY2018 and not FY2019.

As shown by the 3 analysts, FY2019 would be very good as it will be a full year with both Anasuria and North Sabah productions together, rather, than now 9 months only Anasuria plus final 4th quarter 2018 that will include both Anasuria and North Sabah.

2018-06-20 16:19

Need to monitor Sarawak's lead over the O&G state administration right development that likely to have a spill over effect to Sabah.

Since , hibiscus's has its PSC in North Sabah.

2018-06-20 23:30

question now when can this stock back to RM1.00 its already long time never up..loor

2018-06-21 00:02

This is just estimates provided when the crude oil trades above USD65 per barrel or when this number was computed. Let's see the numbers and comment again.

2018-06-21 17:13

砂拉越胜利 国油申请被驳回

2018年6月22日

(古晋22日讯)砂拉越胜利!联邦法院今日驳回国油公司的申请。

国油公司(Petronas)昨日入稟法院,要求联邦法院宣判,1974年石油发展法令適用於全马的石油工业,因此国油公司是全马石油资源的专属拥有者和监管者。

首席法官丹斯里威拉阿末昨日听取国油和砂政府双方意见后,今早驳回国油的申请,并喻令国油支付5万堂费给砂拉越.

在这宗官司中,国油公司挑战砂拉越政府之石油和天然气监管权。国油认为根据1974年石油发展法令,国油掌管国内石油资源,有权在国内开采石油,包括砂拉越地区。

但是砂拉越政府认为,在国会未通过1974年石油发展法令之前,砂拉越早在未合组马来西亚之前,便已有了1958年石油开采条例(OMO),此条例迄今仍然有效,并管制砂拉越陆上及海外油田,因而,国油也须遵守砂拉越法律。

砂政府是由律政司拿督达拉马末、砂法律顾问拿督斯里冯裕中等人为代表。

诗华日报 版权所有 Copyright © 2009 - 2018 See Hua Daily News

http://news.seehua.com/?p=372305

2018-06-22 15:45

icon, i think your view is correct here....I want to add more before next Quarter result come

2018-07-27 16:31

Tee Tom

Icon, hibicus with the expected higher yield bbl and selling price (Sabah enjoy a little premium price than brent oil price due to good quality oil; and better brent oil price agaist last qtr usd 65 avg), both this strong elements expected to boost earning. Just little unknown thing is how management to manipulate the accounting rules.

2018-06-19 13:16