(Icon) Eco World International - Raining Durians Soon ?

Icon8888

Publish date: Wed, 11 Jul 2018, 02:53 PM

Eco World International is 27% owned by Eco World Berhad. Tan Sri Quek Leng Chan and Tan Sri Liew Kee Sin holds another 27% and 12% respectively.

(Blue Blood Shareholders)

Eco World International was listed on Bursa in March 2017.

Eco World International does not have any property projects in Malaysia. It is the overseas development arm of Eco World Berhad.

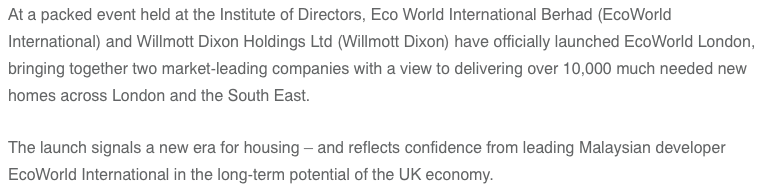

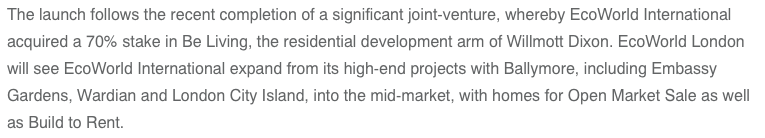

Eco World International's major projects are in London :

(a) Embassy Gardens on Elms Street;

(b) London City Island; and

(c) Wardian at Canary Wharf (financial district).

All of the above are HIGH END residential projects.

Total UK GDV is approximately RM12 billion. As Eco World International owns 75% equity interest, its effective GDV is approximately RM9 billion.

Eco World International also has two projects in Australia :

(a) Yarra One in Melbourne; and

(b) West Village in Paramatta, Sydney.

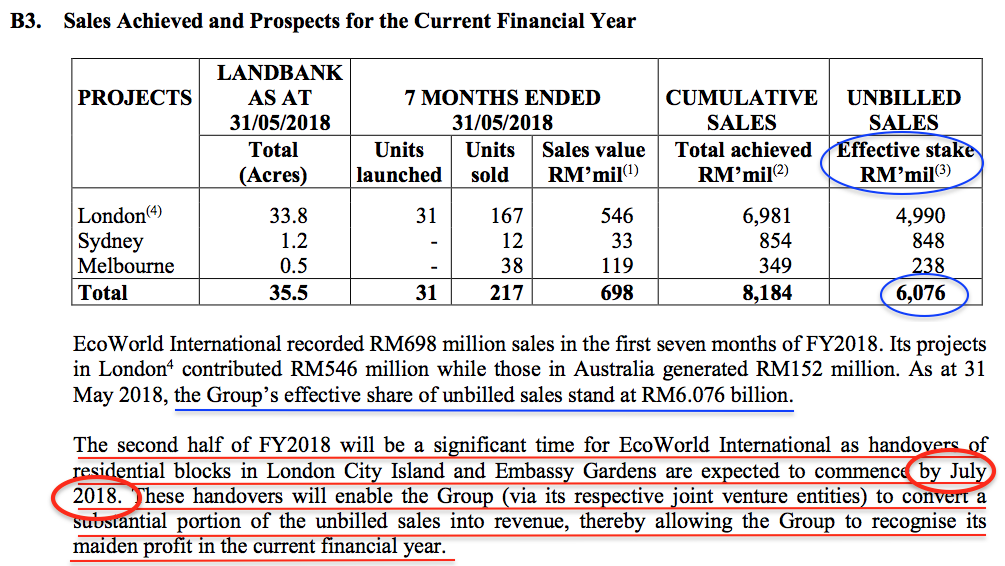

So far, the group has locked in sales of RM6.1 billion (based on effective stake).

Unlike in Malaysia, accounting standard in UK and Australia only allows recognition of revenue and profit upon completion of the properties.

Eco World International started construction works on the London projects approximately 2 years ago. In July 2018, it will complete construction and start handing over keys to buyers (what month are we in now ?).

(Source : Quarterly report for the three months ended April 2018)

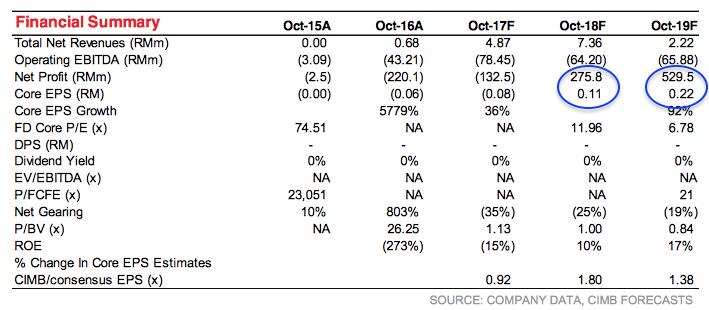

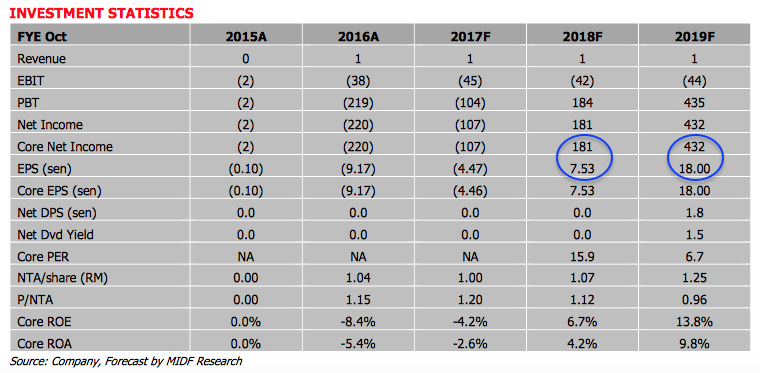

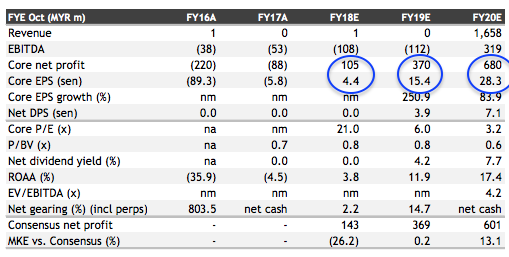

According to analysts, Eco World International will recognize maiden profit in FY2018 (ending October 2018) and report HUGE earnings in FY2019.

(Source : CIMB May 2017)

(Source : MIDF Research March 2017)

(Source : Maybank IB 29 June 2018)

NOTE 1 : The above analyst reports were obtained by me through Google. Some of them are dated back to March 2017. Please share with us if you managed to get hold of more updated information.

NOTE 2 : Eco World International owns 75% equity interest in its London projects. However, the projects are treated as Joint Ventures as its local partner has equal voting rights despite only holding 25% equity interest. Because of that, Eco World International will not be booking in revenue, expenses, etc. Instead, the projects will show up like associate stakes in the P&L, albeit based on 75% equity interest.

London is facing chronic shortage of housing. Please refer to article below (and Google to find out more when you are free).

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

中国.北京11日讯)美国周二晚间就2000亿美元(约8055亿令吉)加征关税的建议产品清单征求公众意见,周三中国金融市场反映强烈:中国股市沪综指开盘大幅低开1.7%;汇率方面,人民币兑美元即期盘初大跌创7月3日以来新低。

2018-07-11 19:47

Market people already knew EWINT's overseas property development will only see the revenue and profit upon the completion of the properties. In other words, it is known that the profit will come only in later part of 2018 and 2019. Otherwise, how can a property company which made loss in past 6 quarters consecutively can still sell at 0.93 P/BV.

2018-07-12 18:34

Comparing with Tambun which made profit in past several years and sellig at merely 0.63 P/BV and ~PE5, EWINT is not cheap relatively.

Even when EWInt registers good profit in subsequent quarters from its completed overseas project, that only justify its current price at 0.93 P/BV..I don't think there will be a huge jump in its stock price when people see EWInt turns from loss to gain in subsequent quarters bcos that is within expectation.

2018-07-12 18:38

Why one off, u think they will not expand their business?

More and more project ahead.

2018-07-14 09:23

Come on guys. Icon is writing this on a short/mid term trading perspective. Nobody is asking you to hold this counter long term. Heck, nobody in i3 holds long term. One off or not, people will be flocking into this counter when they see explosive profit. Timing is key in this play.

2018-07-14 09:39

Ecoworld has one of the best management around. No doubt about that. They should grow. But the runway is longer than most think.

In property development, the way to make money is to buy land from a long time ago, and when the land prices appreciate, you develope, making money on both the house and the land.

I don't think ecoworld really has that land earnings for now.

If you look at their roe for ecoworld. It's barely above fd. But over time, they should grow to be pretty good.

2018-07-14 10:02

EWI can do or not with all the negative news about London and Australia property market........?

or is it icon don't know what to do with his EWI?

2018-09-22 10:32

its a contrarian play.....but I would not choose property counter for contrarian play....

2018-09-22 10:44

Fabien Extraordinaire

I would prefer to gain exposure to EWI by owning Eco World Berhad

2018-07-11 17:34