(Icon) MBM Resources (1) - Earning At All Time High While Share Price At All Time Low

Icon8888

Publish date: Thu, 03 Jan 2019, 07:36 AM

1. Introduction

First of all, credit given to forum member commonsense. He was the one that gave us the idea for MBM Resources.

MBM Resources distributes Perodua cars, Volvo, Volkswagen, Hino, etc. It owns 22.6% stake in Perodua, which is its most valuable and profitable asset (the remaining 38%, 25%, 10% and 5% of Perdoua is owned by UMW, Daihatsu, PNB and Mitsui respectively).

MBM Resources also manufactures a portfolio of auto parts (airbags, safety belts, alloy wheels, etc). This division used to be quite profitable before 2015 but now merely breaks even.

MBM Resources used to trade as high as RM3.50 back in 2014. However, in the recent few years, it has not done well. So share price has come down to the current RM2.00 plus.

Based on 391 mil shares and RM2.20, market cap is approximately RM864 mil.

Auto stocks had been out of favour in past few years. So, even after MBM Resources has turned around in the recent few quarters, nobody notices it.

Another possible factor is the perception that recent strong quarter was due to the zero GST from 1 June until 31 August 2018, and hence is not sustainable (which is not the case, please refer to next section).

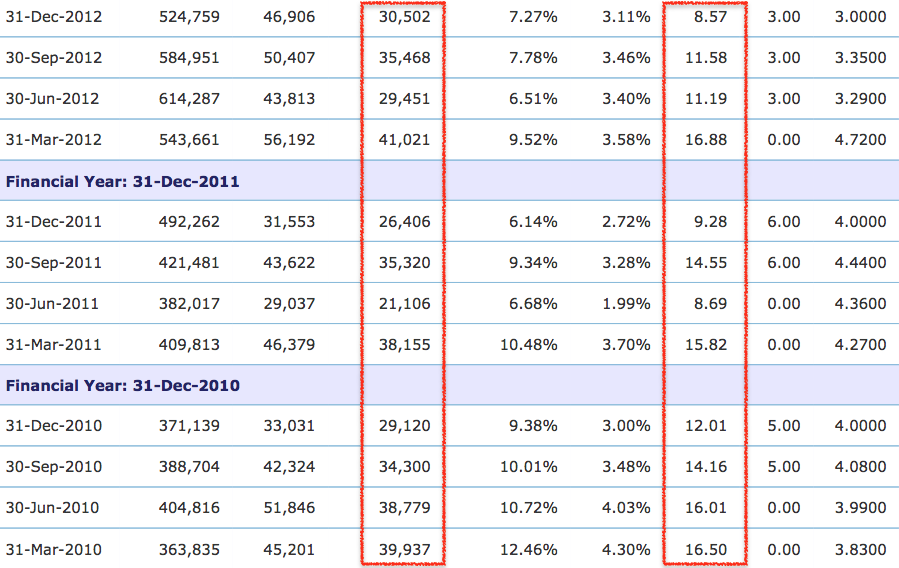

2. Historical Profitability

MBM Resources' financial year end is December.

Key observations :

(a) MBM Resources has not done well from Q1 to Q3 of FY2017.

In Q4 of FY2017, the group has turned around. Its 22.6% stake in Perodua reported a 50% jump in earning from RM25 mil to RM37 mil.

However, in that particular quarter, the group undertook kitchen sinking exercise involving RM177 mil impairment of its Hirotako stake (seat belt manufacturing) and RM62 mil impairment of certain plants and equipment. As a result, the group reported a loss of RM151 mil.

(b) In Q1 of FY2018, MBM Resources reported a 30% jump in gross profit from RM23 mil to RM30 mil. One contributor was auto parts manufacturing division which saw losses narrowed from approximately RM5 mil per quarter to RM3 mil per quarter.

Its 22.6% stake in Perodua continued its strong profitability of RM37 mil.

The group reported net profit of RM32 mil.

The last time MBM Resources has done so well was back in June 2015.

Market didn't notice.

(c) The Group continued to do well in Q2 of FY2018. 22.6% Perodua stake reported RM39 mil net profit.

Overall group profitability was RM34 mil.

Market still didn't notice.

(d) In Q3 of FY2018, the group continued its strong performance. 22.6% Perodua stake contributed RM39 mil. Overall group profitability was RM37 mil.

Market yawned. Everybody believed that "It must be due to the zero GST which pushed up sales. In coming Q4 of FY2018, you can expect the numbers to plummet".

Did the zero GST really cause Q3 earnings to spike ? Nope. Perodua encountered some production problems in the month of September 2018. As a result, its sales in Q3 actually dropped from 61,530 units in previous quarter to 51,105 units, despite the zero GST.

In other words, its strong Q3 has got nothing to do with the zero GST.

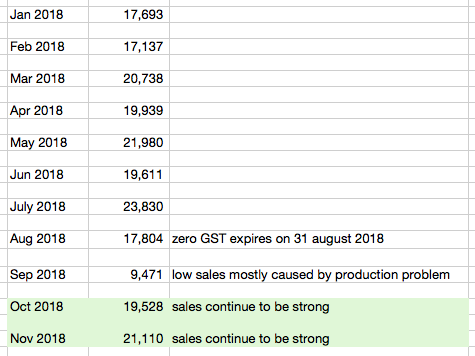

3. What To Expect For The Coming Quarters ?

The coming Q4 quarter is expected to be good because Perodua car sales had been strong (despite the introduction of SST). Pease refer to the green cells.

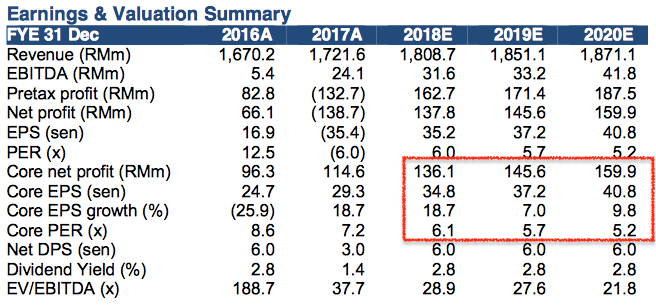

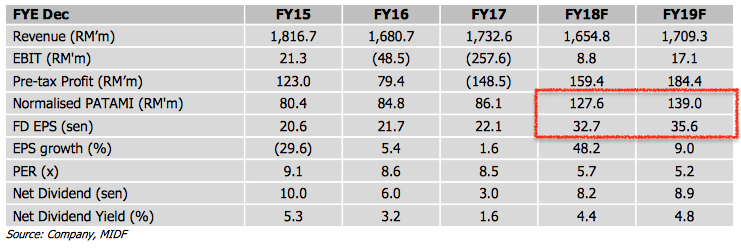

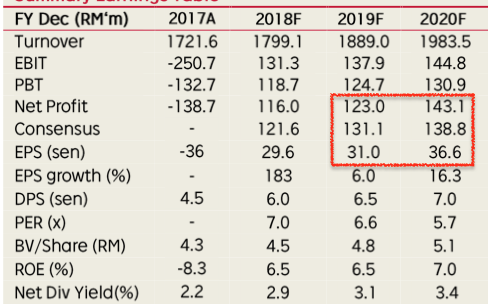

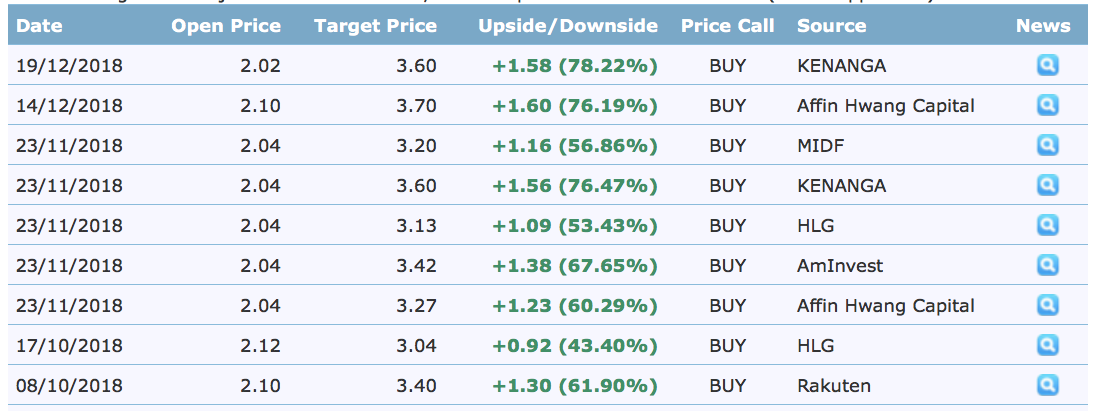

Almost all analysts expect the group to continue to do well in FY2019 and beyond. Please refer below.

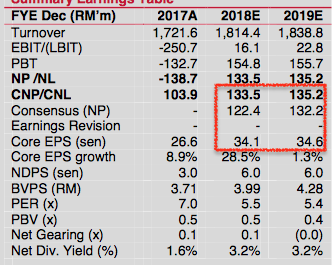

(Source : Affin Hwang report dated 14 December 2018)

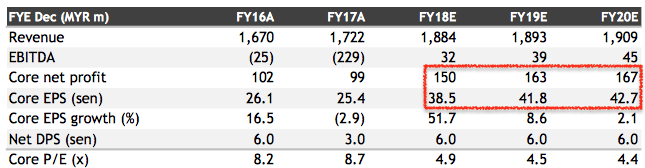

(Source : MIDF report dated 23 November 2018)

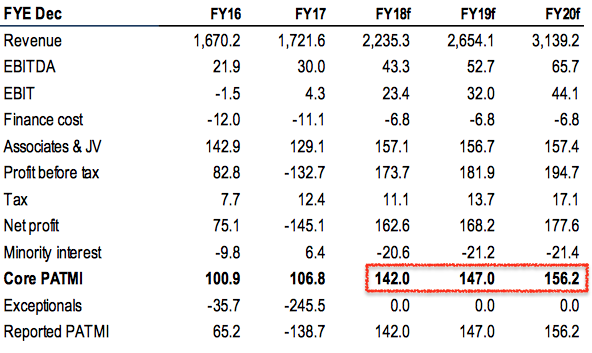

(Source : Kenanga report dated 23 November 2018)

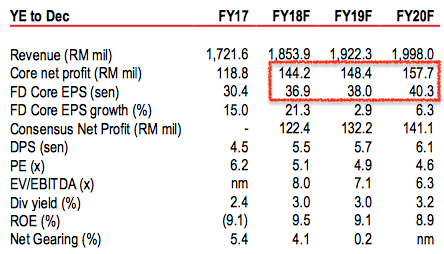

(Source : Maybank report dated 23 November 2018)

(Source : HLIB report dated 23 November 2018)

(Source : AmInvestment Bank report dated 23 November 2018)

(Source : Rakuten report dated 8 October 2018)

The above analyst reports are available in i3's MBM Resources webpage.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

4.5 cents annual div lah. In time like this (bearish), if you get stock with RM2.21, ou loss. Better put into fixed deposit. So you bet lah!

2019-01-03 08:20

MBM is another forever undervalued company. Sometimes you got to think why the undervaluation persists. Is it because of its business? Is it because of its holding company status? Is it because of the illiquidity discount? Plenty of factors to ponder at. CCB who one time had a 49% stake in mercedes benz malaysia was completely ignored by the market too. My theory is that fund managers tend to discount associate stake in car manufacturers and prefer to value companies with car manufacturing/dealership as their core business. That is why BAuto, Sime are valued at a premium

2019-01-03 08:40

most of the points you mentioned above sound correct but are indeed text book theory

but I lazy to argue as it will anger you (somebody who has high regard for himself)

2019-01-03 08:57

Seriously, newbies might be awed by your arguments above

But seasoned investors will immediately spot the weaknesses

2019-01-03 12:07

Icon8888, only u and i pick mbmr in tkw competition, u max it at 30% while i only 20% hehe

2019-01-03 12:15

Of course you already know why I pick Jaks . I wrote so many articles already

2019-01-03 12:36

u should know better than me since u the 1 that pick it?

mmm.. yes4g is a failed venture , singapore utilities business can't earn money , malaysia 2 power plant already expired , only wess3x water is profitable , jordan and indonesia power plant i dono, din't follow up

there better investment i can make else where, ytlp i don't like

2019-01-03 12:40

not interested in automobile industry. feel like it will get disrupted very easily . especially component manufacturing company. The only real money making machine is their stake in perodua.

2019-01-03 12:50

This lazycat not really lazy

Did a lot of homework

Most of he points correct also

As for why I bought, because I think no deal brexit unlikely happens. So I bought a bit. It has come down quite a lot afterall

u should know better than me since u the 1 that pick it?

mmm.. yes4g is a failed venture , singapore utilities business can't earn money , malaysia 2 power plant already expired , only wess3x water is profitable , jordan and indonesia power plant i dono, din't follow up

there better investment i can make else where, ytlp i don't like

2019-01-03 13:13

Yes. It is entirely a Perodua story

Posted by godhand > Jan 3, 2019 12:50 PM | Report Abuse

not interested in automobile industry. feel like it will get disrupted very easily . especially component manufacturing company. The only real money making machine is their stake in perodua.

2019-01-03 13:14

y Flintstones > Jan 3, 2019 08:40 AM | Report Abuse

MBM is another forever undervalued company. Sometimes you got to think why the undervaluation persists. Is it because of its business? Is it because of its holding company status? Is it because of the illiquidity discount? Plenty of factors to ponder at. CCB who one time had a 49% stake in mercedes benz malaysia was completely ignored by the market too. My theory is that fund managers tend to discount associate stake in car manufacturers and prefer to value companies with car manufacturing/dealership as their core business. That is why BAuto, Sime are valued at a premium

=========

that goes to the core of the issue....

associate businesses...got earnings....(accounting profits only) but no control and no cash flows.....nevermind...MBM got takeover play......

2019-01-03 13:14

Same as flinstone, qqq3's above arguments are full of holes also

But being the one that nominate qqq3 as one of the most argumentative person in i3, I better keep my opinion to myself

Not interested in engaging in endless debates and spoil our budding friendship

2019-01-03 13:28

MBMR - 20% stake in Perodua new Aruz Deras and Myvi

UMW - new Toyota godcar

Pecca - new Perodua, new Toyota, Nissan (who knows when Proton X70 CKD's in Tanjung Malim...) comes with free 100 mil net cash and 7% dividend yield

2019-01-03 15:30

Icon8888 > Jan 3, 2019 01:28 PM | Report Abuse

Same as flinstone, qqq3's above arguments are full of holes also

=====

own operations really do get premiums compared to associate company operations......

2019-01-03 15:39

Icon8888, I did not rebut your remarks here because I respect you as a long time i3 contributor as opposed to the random commenter. What I want to share is look beyond the numbers and understand why the market undervalue MBMR. Even the recent acquirer made a lowball offer on MBMR which was rejected. There are plenty of profitable associate companies held under holding entity that is undervalued by the market. Anyway, this does not mean MBMR share price will not go up. It may go to RM 3 and I wish you a happy new year!

2019-01-03 15:57

as for Jaks and IPP....no worries...IPP got very high dividend payout ratios and Jaks will not suffer similar fate.

2019-01-03 16:04

Its cheap lah. Was looking at it a month or two back during 3Q.

I dont think the management is any good. They are similarly undervalued business, with much better management.

But 6PE. and roughly half book. FV for me is barely 1.2-1.3bil

Might be worth a 1-3% punt as an NTA. If they ever sold the stake, RM1.5bil for 20% of perodua is possible, and give out the full amount in div.

Would then go up to RM4 or more easily. But so many cheap NTA companies now also haha.

2019-01-03 17:46

Horrible kid.... only know to talk don't know how to listen

Next time your wife will give you hell

Choivo Capital Its cheap lah. Was looking at it a month or two back during 3Q.

I dont think the management is any good. They are similarly undervalued business, with much better management.

But 6PE. and roughly half book. FV for me is barely 1.2-1.3bil

Might be worth a 1-3% punt as an NTA. If they ever sold the stake, RM1.5bil for 20% of perodua is possible, and give out the full amount in div.

Would then go up to RM4 or more easily. But so many cheap NTA companies now also haha.

03/01/2019 17:46

2019-01-04 08:53

Maybe his future wife only obey 100% ler.

Never express her own need and feel one, a all times yes wife.

Thats his Destiny lo.

2019-01-04 08:58

this lazycat totally not lazy, always sniffing around for ideas. I like

few reasons :-

(1) it was sold down drastically from 80 sen to 70 sen last minute before stock pick begins. So I opportunistically pick it. True enough, it now rebound to RM0.75, and I buta buta made few percent gain;

(2) it is not so susceptible to economic condition. So if this year economy not so good, it might be less affected; and

(3) tapioca price has come down so profitability should improve

http://www.thaitapiocastarch.org/en/information/statistics/weekly_tapioca_starch_price/2018

(4) of course it is a good company. I have it in my real portfolio. But my cost 80 sen instead of 70 sen. This stock is long term hold for me. I won't sell so easily.

lazycat icon8888 , why u 20% 3a?

04/01/2019 08:54

2019-01-04 09:13

oic , i introduce u 1 stock , chinwel 5007 , i'm already in , tell me ur view if u free?

2019-01-04 09:25

can you give me your input then I know better where to zoom in

what is the theme ?

2019-01-04 09:39

everything is going right with the company , i switch from genm to chinwel , i think i'll sleep better haha

2019-01-04 09:42

what is going right ? tell me the details lah, why reinvent the wheel ? let me inspect the wheel instead. that is more efficient

2019-01-04 10:01

by Choivo Capital > Jan 3, 2019 05:46 PM | Report Abuse

Might be worth a 1-3% punt as an NTA

============

don't even bother....1-3% not going to make any difference either way.....no 10%, no need talk

2019-01-04 10:09

don't even bother....1-3% not going to make any difference either way.....no 10%, no need talk...successful investors should have somme at least 20%...

no point like calvin got 5% of cash in market spread over 50 stocks.

2019-01-04 10:11

abang_misai

Great stock icon

2019-01-03 08:12