George Kent (RM 2.80, TP: RM3.22) - Capitalizing on the Rail Investment Boom in Malaysia!

George Leong

Publish date: Tue, 19 Sep 2017, 03:03 PM

1) INTRODUCTION

George Kent has 2 divisions, namely "engineering" & "metering" divisions.

ENGINEERING DIVISIONS:

a) Rail Transportation - Overall system work integrator; design & build, project delivery partner.

b) Water Infrastructure - Turnkey contractor in water treatment plants, intakes & pumping station; solution provider for water efficiency management system. dd

c) Healthcare - New entry in the healthcare sector by constructing hospitals.

METERING DIVISIONS:

a) Meters - Supplier & distributor of water meter solutions for residential, commercial & industrial use.

b) Manufacturing - Manufacturing of brass products & components.

c) Industrial - Distribute non-meter products and industrial equipment

2) FINANCIALS

a) Net Profit Margins

| Financial Quarter | Net Profit Margin (%) |

| Q1 - 30 Apr 2017 | 14.29 |

| Q4 - 31 Jan 2017 | 22.28 |

| Q3 - 31 Oct 2016 | 19.45 |

| Q2 - 31 Jul 2016 | 12.45 |

| Q1 - 30 Apr 2016 | 12.20 |

George Kent's net profit margin has been increasing over the quarters, especially in Q3 & Q4. This is probably due to LRT Extension Line (LRT 2) variation order, plus a lower effective tax rate for FY17, as compared to FY16.

b) Healthy Cash Level

As of Q1 (30 April 2017) financial report, George Kent has a healthy cash level of RM410 million (RM0.73 per share), while its total debts amount to RM47 million, a net cash position of RM363 million.

With this cash level, George Kent can pull the trigger to engage in any Merger & Acquisition (M&A) activities that add value to the company. In addition, the company can bid for larger projects in view of its strong cash flow for hiring workers, leasing construction equipments & materials.

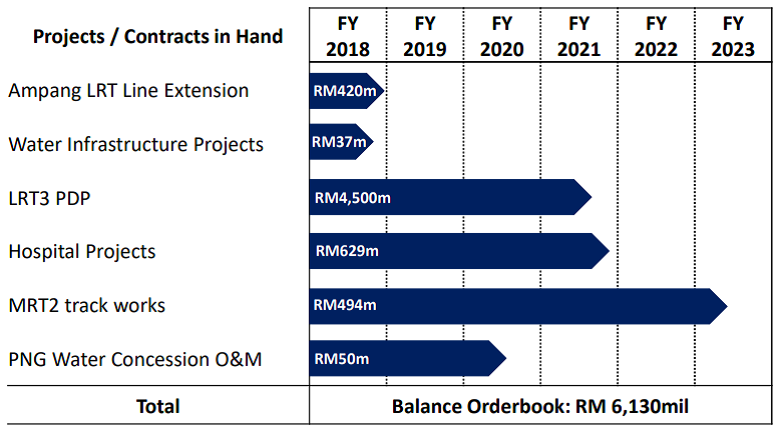

3) Strong Orderbook

Currently, George Kent has a balance orderbook of RM6.13 billion, the company's earnings visibility remains intact for the next 5 years. Please refer below for breakdown:

Source: Company Data / RHB Research

As the company completes its work progressively, unbilled orderbook will be recognized, contributing to topline and bottomline financial performance. Do take note that the company overall sales for FY17 amounts to RM599m, this clearly indicates that the buik of the orderbook is yet to be recognized. The future looks promising for the company.

4) The Bright Future

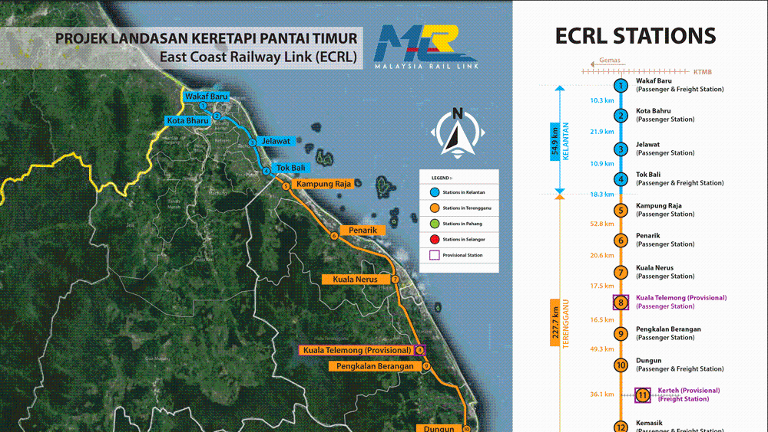

a) East Coast Rail Link (RM55 billion)

Source: Malaysia Rail Link

The Prime Minister has indicated that 30% of the East Coast Rail Link project will be awarded to local companies, which is estimated to be RM16 billion, that is not including any sub-contract work awarded by the Chinese's main contractor.

b) High Speed Rail (RM50 - RM66 billion)

Source: The Star Online

Tenders for HSR is expected to be called in by 4QFY17, and the project cost is estimated to be between RM50 - 66 billion. Local construction companies should benefit immensely from this mega rail project.

c) Mass Rapid Transit 3 (RM 35 - RM40 billion)

Source: The Star Online

As reported recently from our Transport Minister, the government is looking to expedite the award of MRT 3 project. We should see further headlines this year regarding MRT 3, and possibily the cost estimate and alignment distance in FY18. The tendering process is expected to commence in early FY19.

d) Domestic Tender

George Kent is currently tendering for about RM4 billion projects ranging from railways, hospitals and water meters. This would boost / replenish the company's existing RM6.13 billion outstanding order book if successful.

e) Overseas Tender

George Kent is also exploring opportunities overseas in Europe, though it is at the preliminary stage, but there is progress made. According to its Annual Report 2017, the company is positioning itself as a leading and prominent rail systems specialist in the region. It may be a reality soon, that George Kent is able to capitalize the rail boom, not just in Malaysia but the region and across Europe.

5) Valuations

For FY17, George Kent made RM599 million in sales, with a net profit of RM101 million (EPS: RM0.18). For FY18, I would expect the company to register 20% increase in net profit, supported by: a) Remaining variation order for LRT Line Extension will be captured in this financial year; b) Acceleration of LRT 3 construction work which will further increase the company's PDP fees.

The company should be able to make RM120 million net profit (EPS of RM0.21). With a Price-Earnings Multiple of 15x (historical PE / fair PE multiple below big-cap stocks), George Kent should be trading at RM3.22. From current price of RM2.80, there is 15% upside for this stock.

Any downside risks would be a) Delay in construction work; b) Poor cost management due to escalation of construction materials / foreign labour; c) Poor site management.

Note: This article is for educational purpose only. Please conduct your own due diligence before buying / selling any company shares.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on George Leong's Blog

Created by George Leong | Oct 17, 2018

Created by George Leong | Jan 19, 2018