What Type Of Company You Should Avoid?

RicheHo

Publish date: Thu, 17 Sep 2015, 05:17 PM

There are always some type of companies that we shall avoid. I am not saying the following companies is not good, but it is just not suitable for me.

1. Too diversify in term of business

Insas Berhad

Core business:

- Stock broking

- Property

- Technology

- Car Rental

- Fashion Retail

- Food & Beverage

- Project Financing

Based on Annual report 2014, Insas has 56 subsidiary companies, 42 associate companies and 2 joint venture companies! FYI, Insas has 33.1% equity interest of Inari Amertron Berhad and 12.0% equity interest of Omesti Berhad. Furthermore, they also have a substantial investment of 27.9% in Ho Hup Construction Company Berhad through Omesti.

In an age of corporate takeovers, it's quite common to see a company expand into a field that's totally unrelated to its original operations. However, too diversify is not good for a company. The below is the few reasons why too diversify is not good.

- Overextension

- Lack of expertise and experience

- Cost

- Less focus

Of course, this is just theoretically. The main reason I will avoid this type of company is because I don’t even know which segment of the company I should focus on. In addition, I will not be able to estimate the future earnings of this type of company too. There are too many revenue contributions from different business. Besides that, there are also many shares subscriptions activities by INSAS.

Indifferent with companies such as Inari, Latitude and LCTH, they mainly focus on one business only. As an investor, I can easily understand the company business and performance.

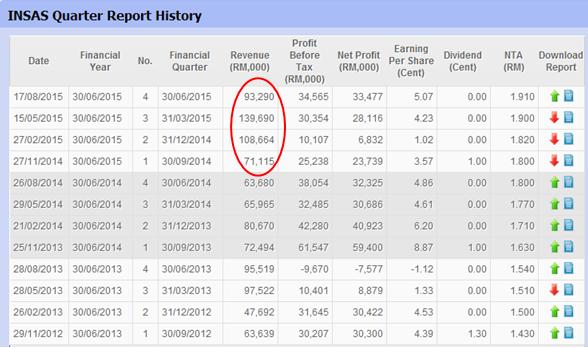

Refer to INSAS quarter report history, the difference among INSAS quarter revenue is quite huge. For the past 1 year, the largest revenue is MYR140m while smallest is only MYR71m, it was almost double! That's why it is quite volatile and unpredictable.

During the recovery period in the first half of 2015, INSAS price is still moving down. FYI, the bull trend from year 2013 to 2014 is stimulated by robust growth of INARI.

2. Too much issuance of shares

I-City which located at Shah Alam is developed and belongs to I-Berhad.

Year 2014

- Share splits 1 into 2

- Issued Redeemable Convertible Unsecured Loan Stocks (“RCUL”) of total MYR201m (201m shares) as settlement for acquisition of land

- Issued Irredeemable Convertible Unsecured Loan Stocks (“ICUL”) of total MYR301m (301m shares) as part of settlement for acquisition of land

- Rights issue 5:4 with free warrants 1:5, raised fund MYR197.5m

- Rights issues – 286m shares

- Warrants – 57m shares

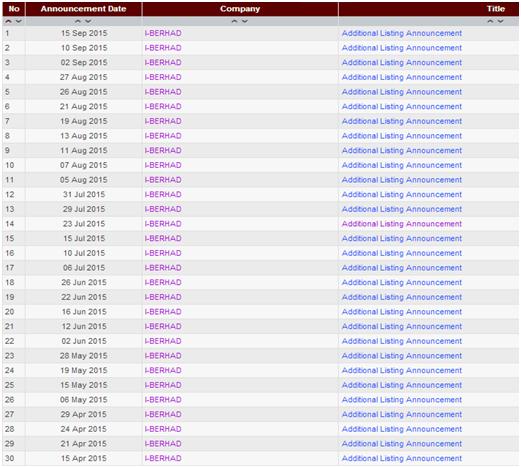

There are 30 additional listing announcements from Apr to Sep (approximately 6 months)!

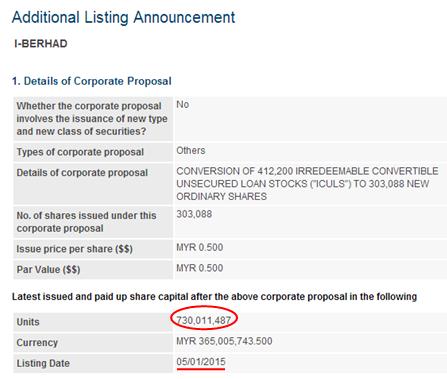

On Jan 2015, I-Berhad latest issued and paid up share capital was 730m.

However, 9 months later, its latest issued and paid up share capital had increased up to 989m. It had listed another 259m shares, which was equivalent to 35.5%!

FYI, there are no rights issues, bonus issues and private placement on year 2015. That’s mean if you bought I-BERHAD at the beginning of this year, your shares had been diluted by 35.5%!

Have a look at I-BERHAD price chart; same as INSAS, during the recovery period in the first half of 2015, its price was still moving down.

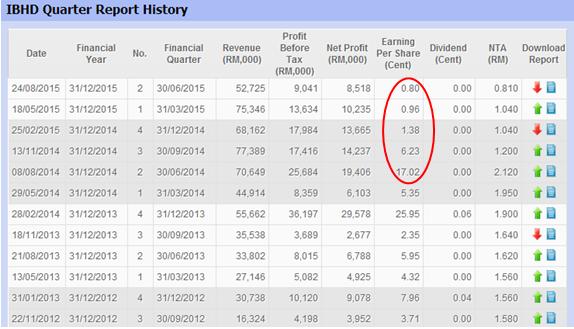

With so much fund raising activities on last year, IBHD net profit doesn’t seem to increase yet in short time and the worse is it is going down from quarter to quarter.

IBHD earnings per share (“EPS”) are getting lesser and lesser. Don’t forget EPS is attributable to owners of the company and it will directly affect the dividend payout. The same theory applies to its share price. For example, last time a cake is only shared among 5 persons, but now the number of people had increased to 8 persons. Automatically, the distributed cake will be getting smaller in size. Even though the cake size might increases, but the distributed cake to each person will not increase also as long as there are getting more people to share.

Let’s take ICUL, RCUL and warrants into account. The potential additional listing shares are up to 559m! But up to date, it had only listed around 260m shares. So, that’s mean it theoretically had another half more way to go!

For all the reason above, I believe I-BERHAD share price will not have too much movement.

The above sharing is just part of my opinion. You may disagree with me as there is no right or wrong.

Just for sharing.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

Agree totally on Insas. Conglomerates means diversifications but more importantly it also means Jack of All Trades but Master of None.

2015-09-18 17:43

There are two more types of company we should avoid :

1. Own a lot of cash , but keep in bank for yearssssss. (maybe they can share buyback / expand their business , but absolutely not going for 3.5% interest rate)

2. Good EPS , but did not declare dividend for several years. (Eg. RHB, ALLIANZ and latitude has good EPS , but EXTREMELY low dividend)

2015-09-18 17:53

The following are also conglomerate :

1)Berkahire Hathaway

2)Genting

3)YTL

1)those who bought and hold these shares since inception already become millionaire -some become billionaire

So it's quite a silly analysis..

It really depend on the profitability and return on equity and revenue growth

Insas is actually not a conglomerate - its an investment company which buy and invest in those company .. Like Inari , syf , hohup etc

2) if the author plot the graph same period. Most of the shares also drop not just this two counter ..

We all know market is not good in 2015- even maybank , am bank ,felda , airasia, and tenaga go down but has since recover a bit ..but look at what happen now to these shares - YES Strong rebound

Another important thing is timing ..

Now it's cheap , that's why both share going up now

When 2weeks ago when its cheap the author of this article shld have bought ..

That's what even warren buffet will do

Look at how these counter has rebounded and I think is still CHEAP at current level

The graph is a bit outdated , now already rebound strongly

2015-09-18 20:10

Companies with degrowth earnings and management with questionable integrity are red flag signs.

2015-09-18 21:52

Why dun u imagine Insas as a closed end fund which is ten times better than Icap, one share of Insas is equal to one share of Inari, not including other asset yet

2015-09-20 09:15

kk123

You are right, the three companies u mentioned above had made a lot of millionaire, but now I am referring to INSAS. So, are you a shareholder of INSAS? You may scroll back to its past 4 to 5 years price chart. From 2010 to mid of 2013, its price is only swinging between 0.4 to 0.6, until it acquired INARI. Now, you compared it with Berkahire Hathaway and Genting? o.O

Yeap agree with you market in 2015 is not good, most of the shares shown a strong rebound after the oil crisis. But, look at INSAS, how it performed?

You might think this analysis is silly, but some of them don't. Compare with others profit making company, it is a fact that its price is not perform well. You might think it is cheap, but for me it's not attractive at all. That's why I said there is no right or wrong.

2015-09-21 08:37

this article make sense? Berkshire Hathaway also conglomerate then what?

2015-09-23 19:12

diversify in business does not mean no good. It has to look into what kind of business they are holding. Insas gem is Inari stock, which no need to talk more everyone knows.

2015-09-23 19:20

good article! keep it up. I will take these as references for my further invest. There is no exactly right or wrong in investment but there is a chance.

For those who know you have known, for those who don't no you will know, for those who known you should know what to know and what to suggest. :)

2015-09-28 01:08

Dummy Blackie

Insas is one of my watchlist :)... it considered as investment co... so the is diversified, inari is one of the best pick of their investment :) besides, the current price is very attractive :P... btw, yr blog dont have follow features... try update so i can follow u kikiki

2015-09-17 23:40