SAM Engineering - Pros and Cons

RicheHo

Publish date: Sun, 27 Sep 2015, 05:51 PM

Principal activities

- Manufacture of aircraft components and precision engineering parts

- Design and assembly of modular or complete machine and equipment

Financial Highlights

|

REVENUE RM'000 |

|||||

|

Year/ Quarter |

2012 |

2013 |

2014 |

2015 |

2016 |

|

1 |

102,881 |

118,824 |

94,743 |

93,157 |

134,464 |

|

2 |

152,889 |

52,177 |

111,188 |

112,328 |

|

|

3 |

108,609 |

102,641 |

121,021 |

113,542 |

|

|

4 |

166,765 |

109,802 |

125,803 |

132,493 |

|

|

531,144 |

383,444 |

452,755 |

451,520 |

134,464 |

|

|

NET PROFIT RM'000 |

|||||

|

Year/ Quarter |

2012 |

2013 |

2014 |

2015 |

2016 |

|

1 |

3,659 |

9,017 |

2,437 |

1,574 |

13,252 |

|

2 |

4,213 |

883 |

10,262 |

6,129 |

|

|

3 |

1,714 |

3,764 |

5,862 |

11,545 |

|

|

4 |

8,040 |

6,328 |

9,755 |

15,386 |

|

|

17,626 |

19,992 |

28,316 |

34,634 |

13,252 |

|

As above, even though SAM revenue doesn’t shown significant improvement in the past 4 years, but its net profit had increased 100% from year 2012 to 2015! In other words, SAM had done well in cost control part. It managed to increase its net profit margin by reducing its expenses.

The revenue segment breaks down as below:

- Aerospace – 69%

- Equipment manufacturing – 24%

- Precision engineering – 7%

|

YEAR |

2012 |

2013 |

2014 |

2015 |

|

Net borrowings (RM'000) |

35,454 |

22,043 |

15,289 |

9,265 |

|

Free cash flow (RM'000) |

22,338 |

38,213 |

97,961 |

103,585 |

|

Net cash |

(13,116) |

16,170 |

82,672 |

94,320 |

SAM had a very healthy cash flow. They had net cash on hand of MYR94m as at FY15. The borrowings had decreased from year to year. I believe SAM will become a zero borrowing company by next financial year.

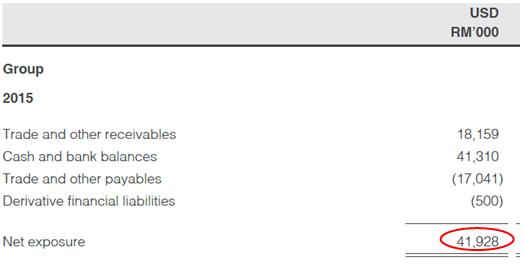

Beneficiary of Strengthen of USD

Based on annual report 2015, SAM net exposure to USD was up to MYR42m! That’s mean SAM is considered as beneficiary of strengthen of USD. When USD had strengthen against MYR by 5%, theoretically SAM net profit will increase by MYR1.57m!

FYI, as at Jan 2015, USDMYR was still 3.60 but now it had came to 4.30. It had depreciated for 19.4%! So, theoretically, SAM net profit will be increase by MYR6m and this amount is just gain in foreign currency exchange!

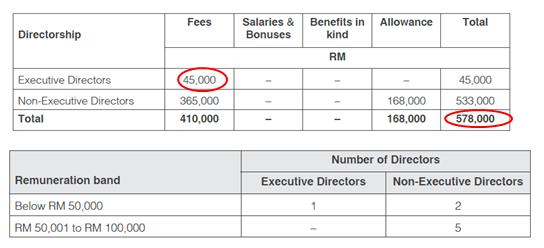

Kind Management

There are total of 8 directors and surprisingly 8 of them only collect MYR578k director fees in FY2015! The only executive director, Mr. Jeffrey Goh, collects directors fees which is below MYR50k. It is even lesser than some of the non-executive directors!

FYI, the executive director of KESM, one person had collect MYR600k, Pentamaster MYR800k, IQ Group MYR1.15m, JCY MYR1.6m, etc. It is higher than the total director fees which collected by SAM directors!

It means that the directors of SAM are willing to collect a small portion of the net profit and share the rest to its shareholders!

Just to add on, the executive director/CEO of SAM is a Singaporean.

Have a look at its past 4 year’s dividend record. The dividend of 32.20 cent per share and dividend payout ratio of 78% in FY15 is a very good proof. SAM dividend payout ratio had also increased from year 2013 to 2015!

|

Year |

2012 |

2013 |

2014 |

2015 |

|

Div. (cent) |

7.46 |

8.30 |

17.25* |

32.20* |

|

Div. payout ratio |

30% |

30% |

51% |

78% |

*Included special dividend

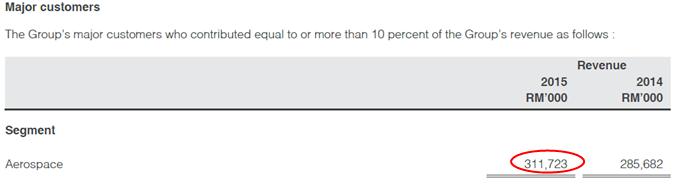

Customer Risk

SAM has only one customer from aerospace segment, which contributed MYR312m, equivalent to 69% of total revenue on FY15! FYI, the major customer of SAM is GE Aviation which mainly involved in manufacturing of aircraft.

It is one of the main risks for SAM. Imagine if one day GE Aviation decides to stop awards contract to SAM, what will happen to SAM? SAM will lose its major customer and no longer have business contribute from aerospace segment!

Other than that, SAM also doesn’t announce its awarded contracts on Bursa. Investors are not able to find any of its contract details on Bursa. SAM only announces and put the circular on its company website. Some investors might miss out some news if they only go through Bursa for announcement news and never go to the company website.

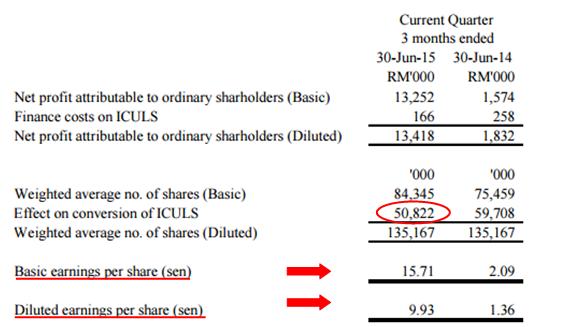

Earnings dilution

During Sept 2012, SAM issued 135m MYR1.00 nominal value of 5-year 4% irredeemable convertible unsecured loan stocks (“ICULS”). FYI, the ICULS are convertible into new ordinary shares from the date of issue until the maturity date on 25 Sept 2017.

Based on latest quarter report, the numbers of shares which still in effect on conversion of ICULS are 50.82m. FYI, SAM current outstanding shares are just 84.35m. That’s mean in the coming 2 years SAM earnings per share might be heavily dilute!

For example, the basic earnings per share in SAM latest quarter report is 15.71 cent; however after taking into account of fully conversion of ICULS, the earnings per share is only 9.93 cent, which had reduced by 37%! It will directly affect SAM share price and dividend!

Just for sharing.

I will be writing some stock analysis report to earn some pocket money.

I will be writing 5 stock analysis reports and 1 comparison of same industry company report a month for a fee of MYR120/month. I believe I can bring out some different things. It will be a simple, easy to read and understandable report. It had included fundamental and also technical analysis.

You may download a sample report of SAM Engineering as below:

https://www.dropbox.com/s/c5da34z4pbgqnk2/Sam%20Engineering%2023%2009%202015.pdf?dl=0

You may also refer some of my articles as below:

1. Export-Oriented Company Not Necessarily Benefit From Weakening Of MYR --> Tongher

http://klse.i3investor.com/blogs/rhinvest/82431.jsp

2. How to Spot Unfavourable Factors of a Company? --> AYS

http://klse.i3investor.com/blogs/rhinvest/81543.jsp

3. Consistently Profit Making Company Not Necessarily Is Good --> London Biscuit

http://klse.i3investor.com/blogs/rhinvest/82368.jsp

4. The Art Of Investing – How To Survive During Market Downturn

http://klse.i3investor.com/blogs/rhinvest/82564.jsp

In addition, you may request to carry out a research on a specific company that you wish to know, for a fee of MYR25/report. For those who subscribe monthly, there will be no extra charges.

For those who are interested, you may contact me at richeho_92@hotmail.com or 016-9392726. Or you may leave your email below, so that I can contact you.

Thanks!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

i think that is not true GE aviation generate 100% profit for 2015, tht list you show from annual report. from my understand, it mean "major customers"(with S), total sum of the customer more 10%. for example, it can be 33% each for 3 customer.

and from the contract rewarded from customer, you can see SAM received supplier award from SNECMA and get contract extension for EXTRA USD 64m on 25 June 2015

2015-09-28 00:41

Lookout for ever uptrending fundamental stocks...might turn out to be long term winners!

2015-09-28 10:26

Want to add something:

1) The borrowing amount is ICULS not bank borrowing

2) The revenue will continue increase in this year due to equipment sector have been recover during the year.

3) In aerospace, not only GE is the only customer, Snecma and Pratt & Whitney also their loyal customer

4) Only for FY2015 alone, the company have signed total contract of USD569mil contract, which is equivalent to RM2.276 (using USD1=RM4). Imagine if every year SAM are able to secure RM2billion, how much is the revenue in the next few years. Currently only at RM500 per year.

Anyway good article. Thank for sharing. Cheers

2015-09-28 12:08

Thanks Pingdan, I never know ICULS is consider as part of borrowing. Thanks for pointing out!

2015-09-28 12:20

SAM - about GE Aviation, Snecma & Pratt and Whitney

http://klse.i3investor.com/blogs/ss2020_SAM/83536.jsp

2015-09-28 13:44

rohank71, i like to discuss few points you raised, im neutral on SAM

1. Why do you consider illiquid stock as a negatives? Unless you personally wanted to invest a large sum in SAM which will potentially push up the share price. If business performs well, share price shall reflect it in the long run, no matter how illiquid it is.

2. Giving out dividends doesnt mean it is always a positive things. Comes down to how the management allocate their capitals in the most effective ways. If they can reinvest all earnings and earn >20% ROE, that would make the decision to issue dividend looks bad, in contract, if the mgt can't reinvest all earnings due to reasons like business throwing off too much FCF that theyre unable to reinvest 100% and the share price isnt undervalued to warrant buyback, then issue dividend would make sense.

2015-09-29 07:49

JT Yeo, why giving out good dividend also not positive thing? SAM is a net cash company. Not like other company, go and borrow money and pay dividend. Then some company got alot of money but dun wan give good dividend. Then what you want?

People pay good dividend also complain. If I am the management I will scold you also.

You attended their AGM? They got say dun wan to invest? You think set up new factory no need time one? Just doing magic? Do you know that their machine need special design? Also, it is not easy to set up a factory.

They need to copy the patent using one machine. Then let the suppliers come and inspect. Then 1st production, their suppliers also need to inspect. Then the employees need to learn how to produce.

Usually at the start of the process, employee need time to learn how to do. So defection or wastage will incurred.

Then need to cut the steel by using one machine. Then need to polish it by using another machine, then need to wait the polish stable.

Then need to inspect every single part of the machine cover to ensure no damages incurred. For checking, they already spend 6 hours to inspect the machine. They using high tech machine like x-ray to check is it any defection incurred in the casing.

Then they also need to colour the engine case, then package the engine case into a box. You think if wan to set up this factory, no need any planning?

The management already said in AGM they will set up a new factory in 2017. Why you said they did not invest?

2015-09-29 15:29

Also, you think that it is so easy to produce engine case by just buying new machine? As easy as ABC?

If it is so easy, why the entries barrier is so high for producing engine case?

First thing, do you understand the business? You don't know. Please shut up.

Please dun use any invest term like CFC or anything. You know nothing about producing aeroplane casing business. Even setting up a factory, u know nothing.

You know that General Electric very strict in checking their engine case? Do you know if the engine case incurred accident, the company will need to compensation RM100million USD just for compensate the accident?

So when setting up new factory, do you tink they no need time to set up?

Also, the main cost of producing engine case is the material cost, employee cost but not machine cost. Although the machine is a few million per machine, but the cost of producing one engine case already reach a few hundred thousand.

Also, they need time to train their employees. Their employees is skilled labour.

Not like other company such as furniture company, glove or other manufacturing company, they require alot of skilled labour.It is because if there is any small mistake they made in producing the casing, they need to scrap the whole engine case to ensure the quality.

Hence they need skilled worker with alot of training before they able to increase their production. It is not easy as you think to increase production. It need time and effort from management.

2015-09-29 15:29

so what's the valuation of SAM based on your deep research and knowledge on the aerospace industry ? is it still a good buy ?

2015-09-29 15:39

Probability

Yup...look for strong USD beneficiary

but without the ICULS!...

2015-09-27 20:25