(RICHE HO) FACB Industries Incorporated Berhad - A Defending Stock

RicheHo

Publish date: Tue, 13 Sep 2016, 09:10 PM

FACB Industries Incorporated Berhad (“FACB”)

FACB was mainly involved in three business segments, namely:

- Steel manufacturing – manufacturing and sale of stainless steel butt-weld fittings

- Bedding – manufacturing and marketing of mattresses, bedding related products and furniture

In FY16, its bedding division contributed 74% of the Group’s revenue while its steel manufacturing division contributed the remaining 26%.

Bedding

FACB’s bedding division is operated by its subsidiary Restonic Sdn. Bhd.

Restonic is a pioneer in the spring mattress technology. Its bedding division operates under the reputable brand of "DREAMLAND" and has more than 20 years of experience in the industry.

Restonic has 3 factories in Muar and more than 600 wholesale dealership stores in Malaysia that function more as a strategic unit for product offering and to strengthen customer relationship. It operates in a retail type of environment with 7% of its products exported mainly to Singapore and Brunei.

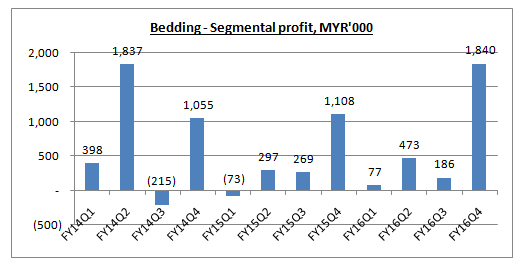

FACB’s segmental profit from bedding division was just average over the past few years due to increase in cost of doing business and slowdown in retail spending.

In latest quarter FY16Q4, FACB recorded a segmental profit of MYR1.8m in its bedding operations, the highest since FY14, achieved on the back of a 30% improvement in revenue. It was also contributed from better margin attained.

In FY17, FACB will continue to build on “Dreamland” and “Chiro” brand. Effective marketing strategy and increase distribution channels will improve market presence. Innovative products will improve sales and profitability.

Besides, in order to widen the Group’s online revenues, Dreamland Marketing (Shanghai) Co. Ltd., with a paid up capital of RMB1mi, was incorporated in China on Feb 2015. The main purpose of the new subsidiary is on marketing which includes marketing of bedding products.

Steel Manufacturing

FACB’s stainless steel division is operated by its wholly owned subsidiary, KT Fittings Sdn Bhd.

FYI, FACB started its fittings operations via Kanzen Tetsu Group since year 1989. Following the Group business streamlining exercises in late 2012, FACB had divested its stainless steel welded pipes division and continued with its stainless steel butt-weld fittings operation via KT Fittings.

KT Fittings exports approximately 80% of its products to over 60 countries worldwide which include United State of America, Canada, European Union, Australia, Brazil and ASEAN countries. Its steel manufacturing factory is strategically located near to Port Klang.

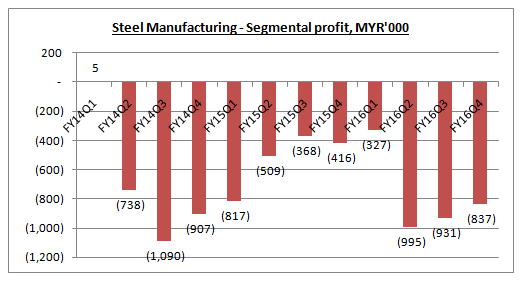

FACB had been making losses for 11 quarters continuously in its steel manufacturing division.

Its stainless steel fitting operation suffered loss before tax due to sluggish international demand and depressed selling price. It faced stiff competition from overseas manufacturers, which led to a lower sales volume.

Contribution from Associates Company

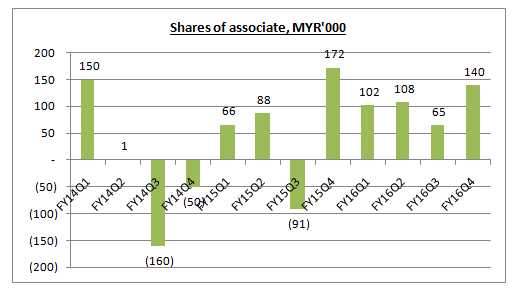

FACB owned 16.5% equity interest in power plant operations in China through Kanzen Energy Ventures Sdn Bhd.

Even though the contribution from its associates company was not significant, the contribution from power plant was still better than its loss making steel manufacturing division. As compared to FY14 and FY15, the contribution in FY16 was more stable and consistent.

The investments in power plants and bedding business in China are expected to contribute positively to the Group in FY17.

Cash Rich

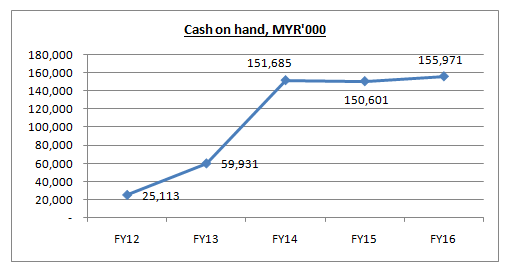

As to date, FACB has MYR156m cash on hand with no borrowings. Based on its outstanding shares of 83.88m, FACB’s current net cash per share is MYR1.86!

FYI, FACB’s current share price is MYR1.06 and it is only 57% of its net cash per share. In other words, in term of net assets, FACB was deeply undervalued.

FACB’s cash on hand had increased significantly in FY14, which contributed from the disposal of land with two detached factories for MYR97m.

With this big chunk of cash on hand, FACB will be able to seek for other business opportunities or investment in China.

So far, FACB had no intention to distribute special dividends to its shareholders even though it had been holding its MYR150m cash for 2 years.

Steel Price

Source: https://www.quandl.com/collections/markets/industrial-metals

Steel prices had been rebounding since Apr 2016, from the price below USD100 per tonne to current USD300 per tonne. It could be a potential sign of recovery for the struggling steel industry.

Many steel companies had made a surprisingly good result following the rise of steel price, such as ANNJOO, CSCSTEEL, YKGI and MASTEEL.

So far, FACB’s steel division still doesn’t show any sign of recovery yet. However, with the current steel prices stabilize around USD300 per tonne, FACB’S steel division is likely to deliver better result in next quarter onwards.

Perhaps, it is just matter of time.

In Aug 2016, BMI Research had came out with a research note that global steel prices will rise gradually from 2017 onwards due to “Chinese supply moderation”.

It is definitely a good sign for steel business, including FACB’s steel division.

Substantial Shareholder - Tan Sri Dr. Chen Lip Keong

Currently, Tan Sri Dr. Chen owned 30.16% equity interest in FACB. According to Forbes, he was the 23rd richest man in Malaysia, with net worth of USD620m.

He was also the controlling shareholder of Karambunai Corp Bhd. (68.46%) and Petaling Tin Berhad (65.07%).

In Apr 2016, Chen intended to take both Karambunai Corp Bhd and Petaling Tin Bhd private — a move that will cost him MYR166m. Chen’s offer was not conditional upon any minimum level of acceptances of the offer shares as he holds more than 50% of the voting shares in the company. He did not intend to maintain the listing status of Karambunai.

Over at Petaling Tin, Chen had launched a mandatory general offer (“MGO”) to buy out shares he and his family do not own after he bought some 133.24m shares, or 38.53% stake. The share purchase bumped up his stake from 26.45% to 65.07%, which triggers the threshold for a MGO.

FYI, these 2 companies had registered net loss for many years.

So far, FACB was a much better profitable company as compare to Karambunai and Petaling Tin. It owns net cash of MYR1.86 per share.

So, will Chen privatizes FACB as well? By that time, it will definitely create an arbitrage opportunity for FACB’s shareholders.

Technical Chart

As at 8th Sep 2016, FACB closed at MYR1.07.

Technically, FACB is still consolidating between its upper and lower trend line. It is testing for a breakout from this area.

Besides, FACB’s transaction volume had surged in recent weeks. So, it might be a sign of accumulation by some parties.

In near term, FACB is expected to test its resistance level MYR1.13.

Conclusion

FACB is a very low profile stock with not much corporate exercise and news.

Following by the recovery of steel price, FACB’s steel division might be able to turn profitable for the first time in the past few years.

Besides, its bedding division in China is still growing as well. In previous year, FACB had set up a subsidiary in China to boast its online bedding sales. In FY16Q4, this division had delivered an excellent profit, with 30% improvement in revenue. It is expected to continue deliver good result.

Technically, FACB is looking for a breakout soon, supported by an increase in volume.

With its huge chunk of cash on hand, FACB is considered a highly defensive stock in weak sentiment market. In other words, its downside is limited.

Just for sharing!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

speakup was one of the investors who bought FACBIND upon disposal of their steel unit, hoping for special dividend. But when Dr Chen said NO SPECIAL DIVIDEND....speakup DUMPED all FACBIND around 1.50.

2016-09-13 22:06

You want to trust Chen Lip Keong?

You will like to trust VT, WC, KKP, and all the Red Chips.

They have one thing in common, bring you to holland in fastest jet along great circle..........direct and non stop.

2016-09-13 22:44

Dun be like that, at least facb got pay a little bit of dividend what, some more it is still operating a steel division.

and the good stuff is reflected in the latest quaeter

2016-09-14 11:09

paperplane2016

Forget it. You want the money? Next life! Or you wait him die first

2016-09-13 21:24