This article first appeared in The Edge Financial Daily, on November 2, 2015.

Cocoaland Holdings Bhd (![]() Valuation: 1.70, Fundamental: 2.80)

Valuation: 1.70, Fundamental: 2.80)

Malaysian snack and confectionary companies have made their mark on the region. With their low-cost based operations, trusted brands and product innovation, they hold a competitive advantage against expensive products from developed countries.

As a result, export sales are rising, while the ringgit’s depreciation and lower commodity costs are boosting earnings, making many of these stocks attractive growth and dividend plays, yet with defensive qualities.

Cocoaland (Fundamental: 2.8/3, Valuation: 1.7/3) is one such company. It mainly manufactures fruit gummy, hard candy, chocolates, cookies, and beverages under its own brand names — including Lot100, Cocopie, Mum’s Bake, Koko Jelly and Fruit 10.

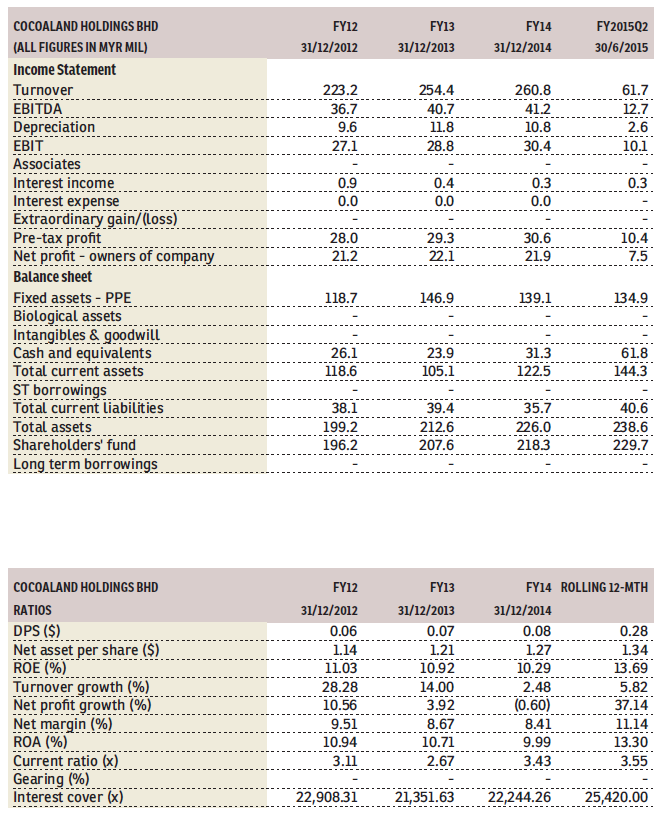

As Malaysia’s sole producer of fruit gummy, it commands high gross margin of about 30%. Fruit gummy accounts for about 38% of sales. Sales and margins are expected to grow with the completion of its recent aggressive expansion exercise, which saw capacity increase by 160% for fruit gummy and 260% for hard candy.

Cocoaland is also a beneficiary of the stronger USD, with some 60% of sales derived from exports. Meanwhile, the price of sugar — a key raw material — has declined by 10.8% year-to-date.

For 1H2015, net profit surged 98.2% y-o-y to RM15.6 million, while sales grew 4.1% to RM129.4 million. With capacity utilisation running at only 50% due to the major expansion exercise, there is ample room for future sales and margins to improve.

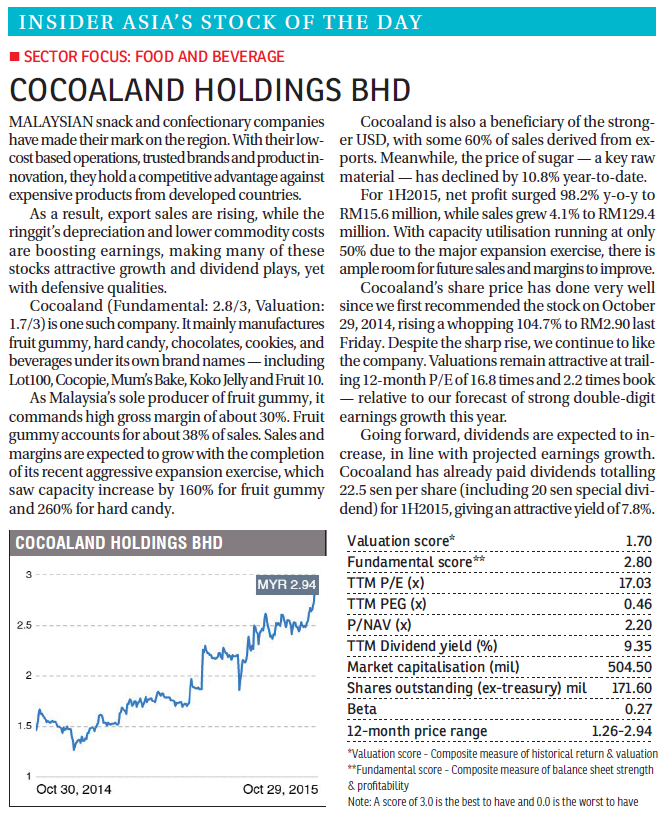

Cocoaland’s share price has done very well since we first recommended the stock on October 29, 2014, rising a whopping 104.7% to RM2.90 last Friday. Despite the sharp rise, we continue to like the company. Valuations remain attractive at trailing 12-month P/E of 16.8 times and 2.2 times book — relative to our forecast of strong double-digit earnings growth this year.

Going forward, dividends are expected to increase, in line with projected earnings growth. Cocoaland has already paid dividends totalling 22.5 sen per share (including 20 sen special dividend) for 1H2015, giving an attractive yield of 7.8%.

http://www.theedgemarkets.com/my/article/insider-asia%E2%80%99s-stock-day-sector-focus-food-and-beverage-cocoaland