CAB CAKARAN: Malaysia Broiler/Chicken Giant in Making (Part 1) (WealthWizard)

WealthWizard

Publish date: Tue, 21 Mar 2017, 12:05 PM

Part 1: CAB CAKARAN: Malaysia Broiler/Chicken Giant in Making

Part 2: CAB CAKARAN: Something Big Is Coming in Poultry Industry

Part 3: CAB CAKARAN: Achievable Target price = RM3.09?

Since I came to i3 september last year, I have so far recommended 2 stocks, one was MYCRON & the other one was EKOVEST.

I had predicted MYCRON to reach RM1.12 when price was RM0.59, representing upside potential of 90%. Mycron had reached peak at RM1.20 later.

I had predicted EKOVEST to reach RM3.80 when price was RM2.08, representing upside potential of 84%. (After split, RM3.80=>1.52 & RM2.08=>RM0.83). Today, I have Ekovest valued at RM1.35 & pocketed special & final dividend of RM0.112 (after split). Please click here for reasons I am still holding Ekovest.

Today, I am going to recommend my 3rd stock in i3, that's CAB Cakaran.

My target price will be RM3.04, representing upside potential of 81% based on yesterday's closing of RM1.68.

For more details & information about CAB Cakaran, please find out at CAB's Annual Reports & Headlines at i3.

On 9 Jan 2017, Managing Director Chris Chuah said the sales of quarterly period (31/12/2016) will increase by about 10% compared to the previous corresponding period & he expected improvement in margins. (Source: thestar)

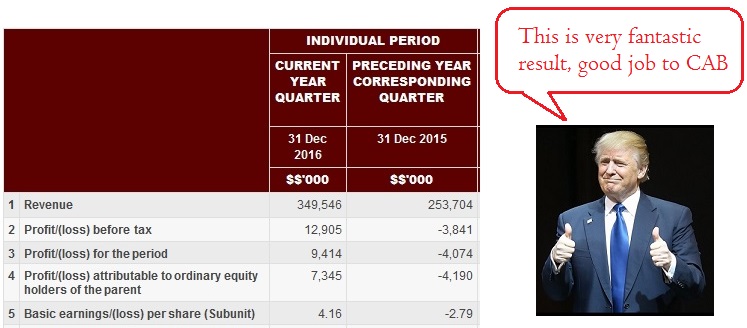

We received the following results on 27/2/2017:

Market has not responded to the above quarterly results. In fact, the company's share price has been flat for almost 1 years as at today:

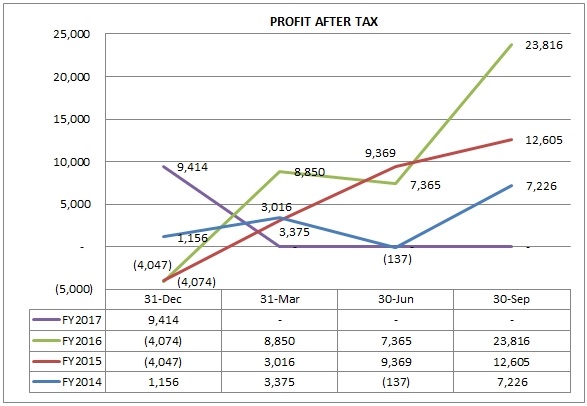

To get a clearer picture of how CAB has been doing in the past 3 years, you may refer to the following chart:

Historically, the 3 months period ending December was the weakest quarter in a year, but the Company has delivered fantastic results in the recently released quarterly report:

Expansion Plans in Malaysia

The acquisition of Farm’s Best Bhd will see an increase in the company’s broiler production capacity, from the current 5 million broilers per month to 7 million broilers.

Concurrently, CAB Cakaran’s production of chicks will increase from about 4.5 million chicks per month to 6 million. “In the next two years, we will be producing 8 to 10 million chicks each month,” Chris Chuah tells StarBizWeek.

Note: The acquisition is expected to be completed by mid of 2017.

Expansion Plans in Indonesia (with Salim Group)

CAB Cakaran’s partnership with Indonesia’s Salim Group is awaiting approvals from the Indonesian authorities before construction of integrated poultry farm and plants in Jakarta can take place.

Land locations for the integrated poultry farm have been identified and confirmed, which are spread across north and south Jakarta.

Earnings contribution from the Indonesian operations will only commence end-2018 or early 2019 & the Indonesian operations is envisaged to produce 4 million broilers per month and 3 million eggs per day

(Source: StarBizWeek)

Note: The Indonesia operations is expected to kick off in 1 1/2 years, it is not so far from now.

That's It? What Next?

Based on the above, the company is clearly undervalued & overlooked by the market:

1. Sales & Profit are expected to grow at least 30% in 2017 & 2018 respectively

2. Salim Group (Indonesia's biggest conglomerates) is holding 20% in CAB by paying RM2.07 per share

3. The management is looking to do great with all the expansion plans in the progress

More to come on the following:

1. Good capital management by the Company

2. Lowest PE compared to peers (Lay Hong & QL)

3. The beginning of another growth

I will discuss more on all the above projections & valuation in my next few articles, Part 2.

Please stay tune.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Wealth Creation

Created by WealthWizard | Apr 06, 2017

Created by WealthWizard | Mar 27, 2017

Created by WealthWizard | Oct 07, 2016

Created by WealthWizard | Sep 26, 2016

Created by WealthWizard | Sep 23, 2016

Created by WealthWizard | Sep 12, 2016

Created by WealthWizard | Sep 06, 2016

Created by WealthWizard | Sep 05, 2016

Discussions

tq moneysifu for your kind explanation. The way i look at D&A, is like required maintenance or cost for you to buy new machines to replace the obsolete ones in order to maintain your current business. I understand that not all machines which have been depreciated to zero book value are obsolete. So, my question is actually "are they spending too much capex to cover D&A to maintain current business instead of expansion?" Is it the nature of broiling industry?

2017-03-23 00:30

CAB Cakaran - undervalued hidden gem

https://klse.i3investor.com/blogs/stockkingdom/118895.jsp

2017-03-23 02:54

@ probability - consumption per capita growth is far from being certain if it will catch up to Malaysia. Coca-cola entered Indonesia market ages ago and see the growth potential due to huge population, extremely low Coke consumption vs US (1.4% of US consumption in 1988), massive muslim population that rules out alcohol, but today it remains below world average level. So something worth while to investigate why Indonesia consumption is 25% of M'sia. Might have to do with income per capita I don't know.

@ Iamgoogle - I am always interested to hear and learn what I don't know. You are right. There are many factors that influence business decision and what strategy the company decides to take. And there are many things that can't be readily captured by figures i.e the culture of PBB and LPI that make them a standout in their own industry. But at the same time, it is also true that strategy shapes decisions, decisions drive result, which eventually reflects in financial statement, although there will be a time lag.

Today CAB strategy is to grow, thus their decision is to take over Farm Best and move into Indo. Thus our role as investors is to ask "Given these strategies, how much would they need to put into the business (capex), how much cash flow, and when will they be generated?" Discounting those 3-5 years cash flow back to present gives you a valuation. I will be BS-ing you if this is easy to do, it's not. But 3 simple things, how much they going to put in, how much will they take out, and when.

2017-03-23 04:45

Ada contingency plans ka should bird flu epidemic hit..... Total wipe out loh

2017-03-23 05:24

I trust WealthWizard & his stock selection skills, his write up on a stock is unbelivable great

2017-03-23 07:14

There was no iphone, ipod, ipad, ixxxx before Steve Jobs went for it.

There was no McDonald in Malaysia before Vincent Tan brought it into Malaysia.

There was no Astro before Ananda Krishnan started it in Malaysia.

2017-03-23 07:17

CAB雄踞北方,之所以要买FARM BEST就是看中他们在南方的市场强大占有率,买下FARM BEST能让CAB在全马各地都有肉鸡生产地,就算吉兰丹有传禽流感,也不会影响其他的鸡场。

CAB也逐步建立关闭式的养鸡场来应对。

2017-03-23 07:29

Ricky Yeo recommended APM, go see how good his stock selection & how good is his return. LOUSY!

TALK BIG BUT DELIVERED LITTLE!

https://klse.i3investor.com/blogs/JTYeo/107555.jsp

https://www.facebook.com/notes/contrarian-investing/apm-automotive-holdings-the-rule-of-minimum-valuation/1745265392395019

2017-03-23 07:54

Don't be confused by this Ricky Yeo, he is a talk big guy but never prove his skills

2017-03-23 07:55

Thank you for pointing out, Wonderful Today, no wonder Ricky Yeo never participate stock pick competition. Look at how Calvin Tan perform in stock pick 2017, terrible. Both always talk big.

2017-03-23 08:02

Good to see so many people here in this forum exchanging ideas & opinions, let's see how market decide where it should be.

2017-03-23 08:15

Let me guess - you checked what I wrote and compare the price, and make a conclusion. How convenient. It is always easy to shout around than sit down and write, cause it is hard work, and no one would bother doing that.

2017-03-23 09:12

That's what we want, Rikcy Yeo, write so much of things but never bring good direction to investors, it is useless, I rather buy Peter Lynch's book, it is more useful. Because he had fantastic track records.

We have money, we need to buy good stock, simple as that.

2017-03-23 09:21

I am a layman type investor, I can't read too technical things, I don't really understand what are you talking, sorry to say that, if you can make it simple in your comments, guess everyone will appreciate that.

2017-03-23 09:23

in share trading there is no sure win , there is can win

we need wwealthwizard and ricky yeo hard work work to come a right decision so the we can win with a good calculated risk

2017-03-23 09:39

there are people who are so scare of me

they will take all the trouble to give me 10 report abuse to stop me making them feel stupid

very soon all my post will be remove quietly by their 10 ID not the i3 admin .

2017-03-23 09:42

Posted by apeng > Mar 23, 2017 09:32 AM | Report Abuse X

wonderful day,

this sort of comment does not make anybody has a wonderful day including yourself

Posted by Wonderful Today > Mar 23, 2017 07:54 AM | Report Abuse

Ricky Yeo recommended APM, go see how good his stock selection & how good is his return. LOUSY!

2017-03-23 09:42

Posted by apeng > Mar 23, 2017 09:29 AM | Report Abuse X

please discuss fact and figures, cautions, positive view or negative view, to help us come to right trading decision. refrain from personal attack , that doesn't prove you are better in whatever way

2017-03-23 09:43

I am very free, i am waiting for the yellow flag,

then I just copy and paste and let you has a busy day deleting my post

haahaha.....

2017-03-23 09:53

For the investing part of depreciation, it all depends on the type of company. If you are looking at a rapid tech company where assets lose most of the value within the first year, needs to be replaced regularly, and costs a lot to maintain, the accelerated method is the right choice.

If you come across a company where the depreciable life of the assets is extended or the useful life is much too long, watch out.

From the point above we know that it depends on many factors that effects D&A, level of maintenance needed , availability of parts , availability of vendor to support and productivity. Most of the the time the depreciation is calculated at the first phase when investing on the machinery/equipment and never been revised after that .

2017-03-23 09:53

I think the vision of company and getting the whole corporation to work towards that objective can overtake all those financial ratios. That is business, how to translate those visions to numbers , yes you can but how many can believe that those numbers is achievable or not. It's creating a perception it's achievable and get them achieve that.

2017-03-23 09:58

Stock Kingdom

1. Peter Lynch definitely can teach you a lot, but if you look at things at skin deep, the problem is on you, not others. I could have asked you to buy Scientex in 2012 at $2.50 pre-split (now $15), SKPRes at $0.30 in 2013, and you wouldn't have hold it until today because of the prevalent idea of profit taking. And now I wrote about APM and Favco, but you won't have the temperament to buy them. Even if you did, you will only hold them for few months, same goes for CAB.

2. If you don't understand, I would appreciate you ask. If you don't understand something that doesn't mean the universe will make things easier to suit your taste. I have explained things as simple as I can.

2017-03-23 10:26

Good comments, Equityengineer, it's the people that manage the company & achieve the business goals.

As investors & outsiders, we can only assess the performance of the company & management based on financial reports & analysis on the financial figures & ratios as well as news in the newspapers.

The management of the company has proved themselves with their past years' records, it become my foundation to judge on their promises to deliver future profits.

2017-03-23 10:26

Barring any unforeseen things, I hope I can complete my part 2 by tonight. Thank you.

2017-03-23 10:27

This Ricky Yeo very lan si, whenever people disagree with him, he sure fight back like mad dog, thought that he is smartest one in i3?

2017-03-23 10:37

Some people never said he is bad & yet want to lan si people & look down at people want to teach people, diu!

2017-03-23 10:38

I don't think Ricky is being lanci. Yes I agree Ricky often can be quite skeptical, but he's definite not arrogant, otherwise he wouldn't offer to teach.

He is just pointing out the facts. I'd say he is closer to Charlie Munger, someone who point out things in a very blunt and critical manner.

Contradictory information is important. It good so that people can activate second level thinking.

If you can't take a little criticism, then you are very blinded by cognitive biases, specifically, confirmation bias.

https://en.wikipedia.org/wiki/List_of_cognitive_biases

2017-03-23 10:44

Does the below perfectly described to Ricky Yeo? Ezra?

If you can't take a little criticism, then you are very blinded by cognitive biases, specifically, confirmation bias.

2017-03-23 11:10

This ricky yeo is more suited to become an educator like Hairy Teo. If you guys notice all his postings are very academic based. In terms of market acumen, I afraid ricky yeo has ZERO track record here on i3! Without track record, dont talk so big la

2017-03-23 11:13

Is the comment below talking bad on Ricky Yeo? Just read how Ricky Yeo commented above:

Stock Kingdom I am a layman type investor, I can't read too technical things, I don't really understand what are you talking, sorry to say that, if you can make it simple in your comments, guess everyone will appreciate that.

23/03/2017 09:23

2017-03-23 11:14

Previously I had requested Ricky Yeo to explain on certain matters on one of his articles, he was very obliging. So be fair on ur comments. He is sharing his best judgment basing on financial data available to him. That's is nothing wrong. What is wrong with Rick challenging u? It is ok to be disagreed. Let other evaluate for themselves which informed data sets shud they adopt to formulate their decision.

Some folks may not agree to what he wrote doesn't mean others hv the same opinion. If u disagreed use ur own data or facts to challenge Rick's thesis. Pls don't use sarcastic general statement. We all here wanted to see facts and data to guide us on decision making shud we invest on the counter or not.

2017-03-23 11:38

There are many methods of valuing a company, some prefer discounted cash flow, some like PE, some use sum-of-part, blah blah...

For service industry like audit/secretary/tax, yearly revenue of a firm will be used as important reference.

Ultimately, the deal can only be struck if both parties reach a point where one is willing to pay & the other is willing to accept.

2017-03-23 12:02

Ricky, these are not easy because we are outsiders & we do not have the details. Just like Ekovest selling Kesturi, no one know the details until they announced. Meanwhile, we can only guess.

Ricky Yeo

Today CAB strategy is to grow, thus their decision is to take over Farm Best and move into Indo. Thus our role as investors is to ask "Given these strategies, how much would they need to put into the business (capex), how much cash flow, and when will they be generated?" Discounting those 3-5 years cash flow back to present gives you a valuation. I will be BS-ing you if this is easy to do, it's not. But 3 simple things, how much they going to put in, how much will they take out, and when.

23/03/2017 04:45

2017-03-23 12:14

I will rather put into a simple way of calculation when come to assets acquisition:

revenue

profit

cost of finance (& investment)

If the profit can cover the cost of finance & give good return of more than 10% on investment, it will be good deal.

2017-03-23 12:19

Due to my personal preferences, I don't like to use discounted cashflow due to the variable factors used in the formula are very subjective, but I respect anyone that using it. It is still very useful & powerful.

2017-03-23 12:34

Iamgoogle,

I like this statement you made :"If the profit can cover the cost of finance & give good return of more than 10% on investment, it will be good deal"

mind to provide your calculation for CAB acquiring best farm?

it is very useful for us to make a quick decision whether CAB is a good buy at the current price .

thanks

(i did not any bad about anybody , please do not flag me , if not i got use aseng to post my next comment

2017-03-23 16:12

I do not find ricky yeo argument hard to understand,

in fact , he is just following a basic principle " buy good stock cheap"

now , what he see in the available figures , things are not cheap , so he is putting across his view , hoping some kind souls to help him see that it is indeed cheap, since the article started with the tile " CAB is currently under value with a fair value more than 3.00 ". I am also hoping you can convince me , it indeed worth this value so that I too can put some of my hard earned money into to share the excellent discovery of wealthwizard

2017-03-23 16:20

Don't flag me, you may disagree but I am sure there are people can the logic in my argument

2017-03-23 16:22

you see....management only guided RM 1.6 billion revenue in FY18. assuming margins remain like the most recent quarter, we are only looking at around RM40 million net profits. At a PE of 10-12x, CAB is only worth maximum RM2.01 in FY18. This RM3.04 target price is unrealistic.

2017-03-24 13:56

CAB will never deserve the valuations of QL (PE of 20-25x) because QL is much more efficient....their margins are around 7% compared to CAB's 2.5%.

2017-03-24 13:58

csan, if you refer to the table below, QL is good in marine product, not poultry.

https://klse.i3investor.com/files/my/blog/img/bl2751_cab_industry_comparison_last_4q_v2.jpg

2017-03-28 10:50

culbertlim

xue wen come gadang

2017-03-22 23:56