EKOVEST: Net Debt Ratio=20% & Net Cash Per Shares=RM1.01 (after 40% sale in Kesturi) (Part 2)

WealthWizard

Publish date: Mon, 26 Sep 2016, 09:03 AM

Part 1: EKOVEST Is Doing Great & Ready To Shine, Are You Ready?

Part 2: EKOVEST: Net Debt Ratio=20% & Net Cash Per Shares=RM1.01 (after 40% sale in Kesturi)

Part 3: EKOVEST: The Next Big Thing & Great Upside Potential +84%

The main highlights of this article are:

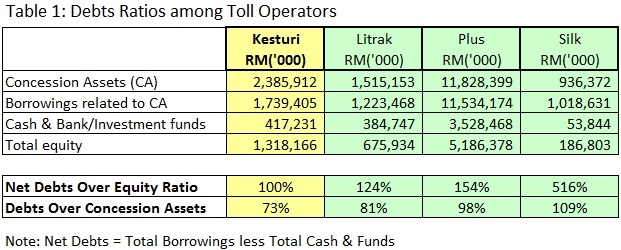

1. Lowest Debts Over Assets Ratio among toll operators (Table 1)

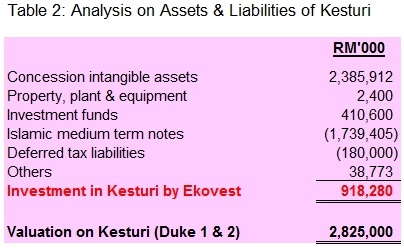

2. Cost of investment in Kesturi by EKOVEST is RM918m (Table 2)

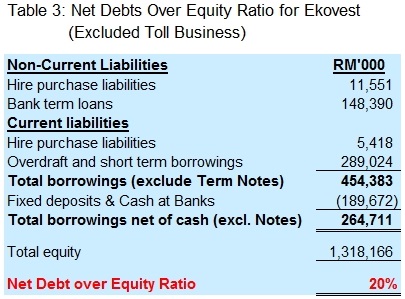

3. Net Debts Over Equity Ratio for EKOVEST (Excluded Toll Business) is 20% only (Table 3)

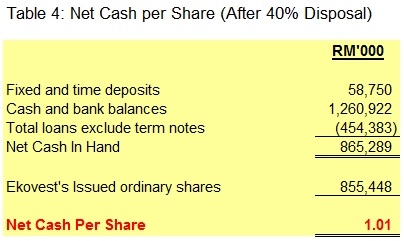

4. Net cash per shares will be RM1.01 (Table 4)

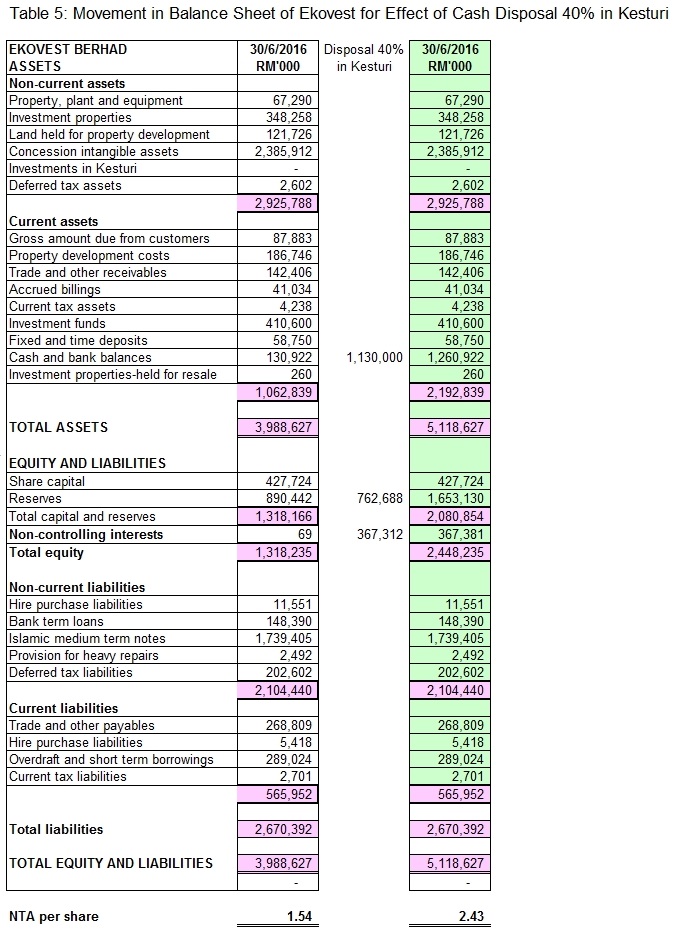

5. Net Tangible Assets Per Share will be RM2.43 (Table 5)

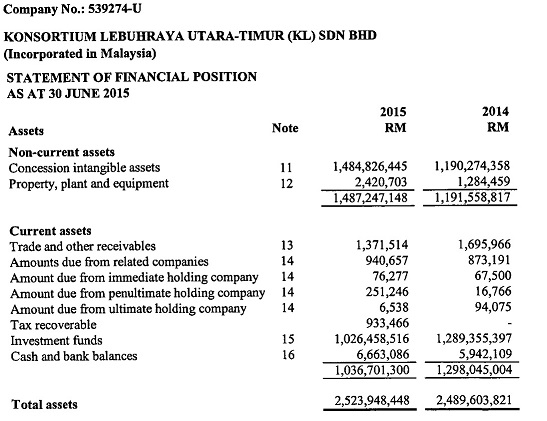

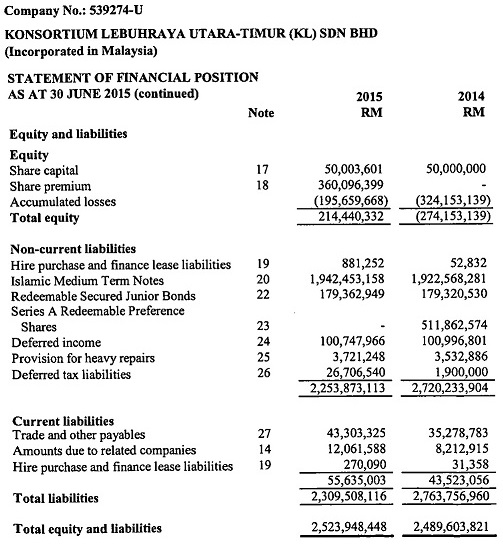

6. Audited Balance Sheet of Kesturi @ 30/6/2016 (Table 6)

Guidance of Reading:

EPF is valuing Kesturi at RM2.8bil and is willing to pay cash RM1.13bil for 40% shares in Kesturi.

By referring to Audited Balance Sheet of Kesturi (Table 6), Kesturi is the one who issued Islamic Medium Term Notes & NOT Ekovest. (Refer to old news here)

So, EPF is buying the toll business with loans & liabilities in Kesturi.

As such, by grouping the assets & liabilities of Kesturi into Cost of investment in Kesturi at Group level of Ekovest, we can see investment in Kesturi of RM918m in the Table 5.

By classifying Kesturi as standalone investment by Ekovest, we can work out actual ratios for other businesses of EKOVEST.

Something Interesting:

UOBKH Analysis Report on Ekovest: Rise of the Duke with Buy Call RM3.00

Debt Stuctures of Toll Business

Since toll business is part of Ekovest, so it is important to understand the common debt strutures of other toll operators, the following are the comparison among toll operators:

Due to the nature of tolled highway business nature, all toll operators are normally having Net Debts Over Equity Ratio of more than 100%.

The main reason why the toll business managed to secure such high gearing over the toll operations is because of Guarantee Terms in the Agreement with Government, where the Government will pay the difference if the actual revenue received during the year is lower than the projected revenue due to lower traffic flow or deferment of rates hike instructed by the Government.

Note: Bank is not stupid

What Does Ekovest Has in Kesturi?

Net Debts Ratio of Ekovest is 20% only

Net Cash Per Share RM1.01 (After 40% Kesturi Disposal)

Net Assets Per Share RM2.43 (After 40% Kesturi Disposal)

Audited Balance Sheet of Kesturi @ 30/6/2015

Table 6:

Important Advices When Reading This Article:

While I have been trying to simplify the working into more understandable way for your easier reading, the objective is to share what I saw from the business perspective.

For anyone who do not know accounting & also consolidation accounts:

Hope the above is helpful to you.

For anyone who knows accounting but not consolidation accounts:

There are terms in consolidation accounts you may want to know

1. pre-acq & post-acq reserves

2. inter-companies' balances elimination

3. profit elimination within the group

4. consolidation/group adjustments

For those who knows accounting & also consolidation accounts:

I have no idea on the differences on the amounts shown in Kesturi & Ekovest on the following items:

1. Concession Assets

2. Islamic Medium Term Notes

3. Deferred income

It could be profit elements or something else, I don't know, but I accepted it due to the trust on the professionalism of the auditors. However, you may still try to contact the Managemnet of Ekovest to clarify.

Below is advertising

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Wealth Creation

Created by WealthWizard | Apr 06, 2017

Created by WealthWizard | Mar 27, 2017

Created by WealthWizard | Mar 21, 2017

Created by WealthWizard | Oct 07, 2016

Created by WealthWizard | Sep 23, 2016

Created by WealthWizard | Sep 12, 2016

Created by WealthWizard | Sep 06, 2016

Created by WealthWizard | Sep 05, 2016

Discussions

Your point No.3 is not correct, the disposal of any shares in subsidiary will result in gain or loss of disposal in other income or other operating expenditure.

By taking up the effect, the disposal will need to take into the cost of investment in the subsidiary, that's RM918m. So the cost for 40% will be RM367m.

See below double entries for capturing the disposal:

Dr Cash RM1,130m

Cr Gain on disposal of subsidiary RM763m

Cr Non-controlling interest Rm367m

2016-09-26 10:50

ok but you should specify it's just to calculate ratios for Ekovest other business. because the actual balance sheet after disposal will be very different from what you show here, it's kind of misleading

2016-09-26 10:50

Your are right on Point 4, it was my mistake. Now corrected. Thanks for pointing out.

2016-09-26 10:51

on point 3, if you refer to IFRS 10, you will see there's different accounting treatment when it comes to disposal of subsidiary. when no loss of control, it is treated as transaction between equity owners. it will flow directly between equity and not through P/L. in fact, even if later Ekovest dispose kesturi again, the gain this round also won't be recycled back into P/L

2016-09-26 10:52

I did highlight in the title at table 3 where the ratio is excluding toll business

2016-09-26 11:00

yes but for table 5, it gives an impression this is the proforma balance sheet after disposal (which isn't). not saying it's not useful but just to make sure everyone is clear. because I think a lot of readers are concerned of the D/E and was expecting the whole IMTN will disappear after disposal which won't happen, so your table 5 could give them false hope

2016-09-26 11:02

Good discussions here. Jay & W-Wizard...glad to have brilliant guys like you here.

2016-09-26 11:03

It's not false hope, I believe you know it, it is just my flow of thinking where the NTA should be calculated.

My main purpose is to show the cost of investment is right via the movement in balance sheet.

As I said in my earlier comments in my first article, it may be too technical in presenting the adjusted balance sheet.

2016-09-26 11:11

Also, I never said the gain will flow back to PL, it is the changes in reserves in Balance Sheet, so it is correct.

2016-09-26 11:12

I think I need to move away the classification of investment in subsidiary to avoid any further confusion.

2016-09-26 11:12

My intention is to show the movement of events, rather than discussing in technical things, not many will understand about it.

2016-09-26 11:14

I agree that too technical can confuse readers. that's why it's actually better just to show the expected NTA per share after disposal instead of the full balance sheet. And I think it would be good to caution readers that IMTN will remain in the balance sheet after disposal so D/E will only improve to the extent Ekovest utilise part of the RM1.1b in repaying borrowings and increase in equity

2016-09-26 11:18

The reason I presented in this way because too many people think that Ekovest is high debt company while it is common nature for all toll operators.

So we need to break it out to see the actual picture of Ekovest by referring to the balance sheets of Group & Kesturi.

2016-09-26 11:22

Wow, very good discussions here, not seeing in other place, well done, Jay & WealthWizard.

2016-09-26 11:25

yup my point here is that the gain on disposal won't be spotted in P/L and D/E won't drastically improve overnight, but these won't dampen the prospects of the company because gain on disposal still reflected in increase of NA and most debts are secured against highway and will be self financing by itself

2016-09-26 11:28

It proved the calculation is reasonable reflecting the actual situation of Ekovest, truly thank you, WealthWizard, for guiding us to understand how to look at Balance Sheets of Ekovest & Kesturi.

It is true where sometimes the newspaper is very confusing. See below:

Ekovest Bhd, controlled by property tycoon Tan Sri Lim Kang Hoo, has issued a RM2.48 billion bond programme to part finance the construction of Phase 2 of the Duta-Ulu Kelang Expressway (DUKE).

In fact, it was KESTURI that issued the bond, not Ekovest.

Thank you again for leading us to undestand above, WealthWizard

2016-09-26 11:29

I like your statement, Jay:

most debts are secured against highway and will be self financing by itself

2016-09-26 11:31

The audited balance sheet of Kesturi presented by WealthWizard has proved it very useful

2016-09-26 11:31

so basically IMO the positive stuffs about Ekovest:

1) Holding good assets or rights (Duke 1-3, Danga Bay landbank etc.)

2) Good construction orderbook (>RM4b)

3) Well-connected shareholders

4) Potential strong partner in EPF

5) Prospects of special dividend

6) Potential proxy for election, property sector relaxation, or Johor property turnaround

Risks

1) EPF withdraw due to public pressure (low probability high risk)

2) earnings won't be great in the short term as Duke 2 slowly kicks in and if residential sector remains weak (high probability low risk)

3) change in concession terms, in term of duration, toll rates revision etc. (low probability medium risk)

4) change in government and new government decides not to honour Duke concession (low probability high risk)

5) Change in traffic pattern whether due to public transport or other highways (medium probability medium risk)

2016-09-26 11:41

it is normal for concession companies to issue bond at the subsidiary level. basically to match the cashflow. so the timing for interest and principal payment will be structured to match expected toll proceeds and toll rate revision schedule. give it enough time, then the debt will be slowly extinguished. this is also why bond investors love concession bonds even though the return is generally lower

2016-09-26 11:44

which is why wealthwizard brings up a good point, it's normal for concession companies to rack up a lot of debts because capex is high and the cost of financing is cheap. same for IPPs or TNB

2016-09-26 11:48

Construction outfit Ekovest Bhd expects to surpass the RM1 billion revenue mark by its financial year ending December 31 next year, driven by strong outstanding order book of RM5.3 billion.

Other than that, Lim said, the group was pre-qualified for the Light Rail Transit Line Three and Mass Rapid Transit Line Two.

http://klse.i3investor.com/blogs/moneymoney/105124.jsp

2016-09-26 12:42

Thank you, moneySIFU, my projection of revenue matches the one that said by the director, please stay tune.

2016-09-26 14:40

After a long time, seeing a constructive comment which benefits all. Win-win situation.Impeccable arguments and points for readers digest by jay and wealth wizard.

2016-09-26 21:08

Please take note that I have just amended Table 5 incorporating the effect of 40% disposal in Kesturi to suit the purpose of title, changes in NTA.

2016-09-26 22:54

Thank you, Equityengineer, I believe figures will tell the story & sometimes we need cross checking from our fellow members to make sure the calculation is not far away from the facts.

Respect disagreement & ready to accept reasonably differences.

2016-09-26 22:59

Jay, I suggest you to state full name of the accounting terms used in your comments as normal people may not know what are these terms.

2016-09-26 23:02

Look at George Kent & Gadang, when results out, market only realise the true value.

Since I am in the collection mode, so the cheaper the better.

2016-09-27 20:44

Ekovest secured the 53 year concession in January this year, or eight months prior to the stake sale to the EPF. Plans for the Duke 2 and Duke 3 highways were also announced after the companys 30 percent stake purchase from MRCB.

2016-09-30 19:47

Wizard bro, where did you find the toll revenue and profit under kesturi?

2016-10-05 13:26

Hi Flintstones, I guess you are mentioning the balance sheet of Kesturi, it was extracted from Kesturi's Audited Accounts for the year ended 30/6/2015.

2016-10-05 23:48

Hi Flintstones, the audited accounts of Kesturi is not available online and it is lots of pages, each page 1 file, need to combine into 1 file.

I am working on Part 3 now & will publish complete set of the audited accounts after that.

2016-10-06 14:42

Do share the annual audited accounts of Kesturi. Ekovest does not reveal a lot about kesturi in its financial reports including its sukik coupon rate etc. I think having access to kesturi accounts will allow investors to gauge the true earning power of duke highway.

2016-10-06 14:46

You are right, you won't see much details from Ekovest report as it has consolidated everything as Group accounts.

Yes, it did give clear picture of duke highways.

2016-10-06 14:57

Hi moneySIFU, half way through only, I will try to work it out to see if can finish by end of the day.

2016-10-06 14:58

I think it is important to know 1) The gross margins of Kesturi (before paying interests) 2) Operating costs of Duke highway (in % of revenue) 3) How much interests is Kesturi paying for the 1.7 billion sukuk facility (estimated at RM78 million per year?)

2016-10-06 15:01

Straight to the point & very important questions, well done, Filinstones, you will know all these after reading the audited accounts.

I can give some rough answers where you can verify with the audited accounts later.

1 & 2 are same question, the operating expenses for Duke 1 in year ended 30/6/2016 = RM18m

Q3, the effective rate is 4.78%. The interest charge for the note is about RM92.8m

Please take note that the islamic notes are for refinance of Duke 1 & construction of Duke 2, so there will be no new loan for Kesturi & Ekovest in term of Duke highways

2016-10-06 15:43

Please read the page 47 of Kesturi Audited accounts about effective interest rate for Islamic Notes

http://klse.i3investor.com/files/my/blog/img/bl2751_kesturi_audited_account_page_47.jpg

2016-10-06 15:45

Ekovest has efficiently managed its debts & equity planning & arrangement for its expansion plans.

2017-01-21 11:05

I relook again & study one more time of this article, it is always amazing for me to be part of Ekovest.

2017-03-28 11:46

WealthWizard

Jay, thank you for comemnt, please read my statement below which is also in the article

Guidance of Reading:

EPF is valuing Kesturi at RM2.8bil and is willing to pay cash RM1.13bil for 40% shares in Kesturi.

By referring to Audited Balance Sheet of Kesturi (Table 6), Kesturi is the one who issued Islamic Medium Term Notes & NOT Ekovest. (Refer to old news here)

So, EPF is buying the toll business with loans & liabilities in Kesturi.

As such, by grouping the assets & liabilities of Kesturi into Cost of investment in Kesturi at Group level of Ekovest, we can see investment in Kesturi of RM918m in the Table 5.

By classifying Kesturi as standalone investment by Ekovest, we can work out actual ratios for other businesses of Ekovest.

2016-09-26 10:45