EKOVEST: The Next Big Thing & Great Upside Potential (+84%) (Part 3).

WealthWizard

Publish date: Fri, 07 Oct 2016, 11:03 AM

Part 1: EKOVEST Is Doing Great & Ready To Shine, Are You Ready?

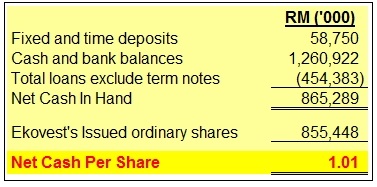

Part 2: EKOVEST: Net Debt Ratio=20% & Net Cash Per Shares=RM1.01 (after 40% sale in Kesturi)

Part 3: EKOVEST: The Next Big Thing & Great Upside Potential +84%

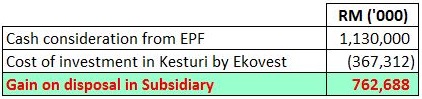

Market has not responded to the sales of 40% shares in Kesturi, let's look again on how the cash disposal affecting EKOVEST financially:

So, asset sales not convicing? Then let's look at the future of Ekovest below.

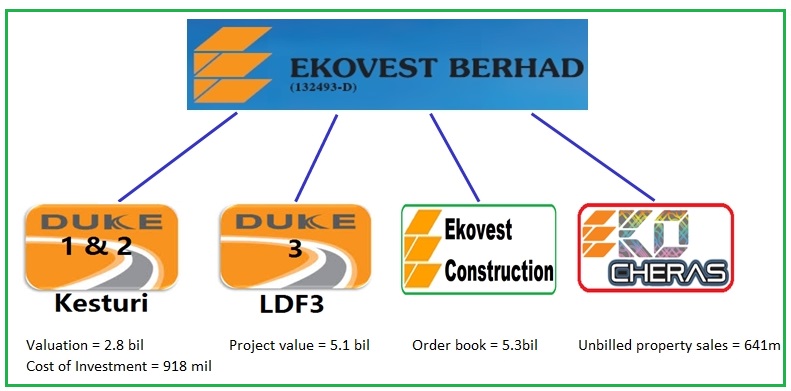

EKOVEST IS DEEPLY UNDERVALUED EVEN @ RM2.08!!!

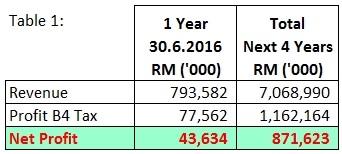

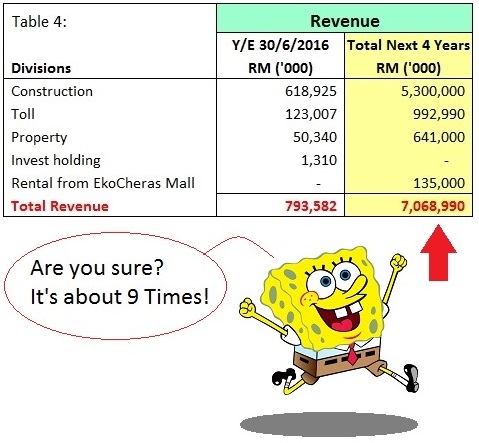

With construction order book of RM5.3 billion & unbilled property sales of RM641 million in hand, Ekovest will deliver following revenue & results below: (Please click links for references)

* Net profit for 2016 excluded fair value adjustment.

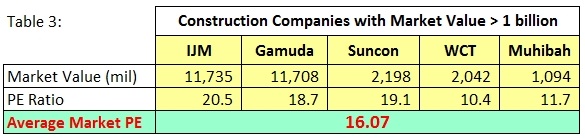

With Forward PE of 15, it gives Ekovest huge potential upside at current price!

Comparing with other listed construction companies with market capitalisaiton of 1 billion above:

Revenue For Next 4 Years

The total estimated revenue in 4 years is illustrated in the Table below:

Important Assumption:

NO new construction job & NO new property sales in next 4 years

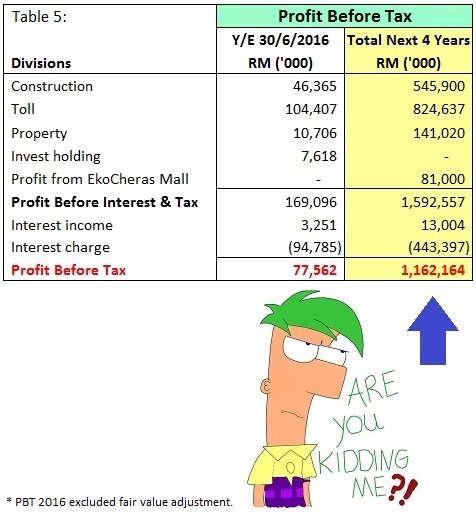

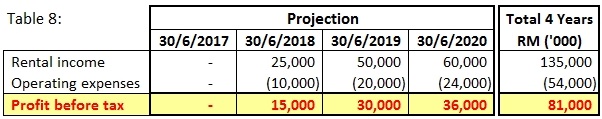

Profit Before Tax For Next 4 Years

Based on the past years' records & other sources, the following margins are used to estimate profits for next 4 years:

1. Construction - 10.3%

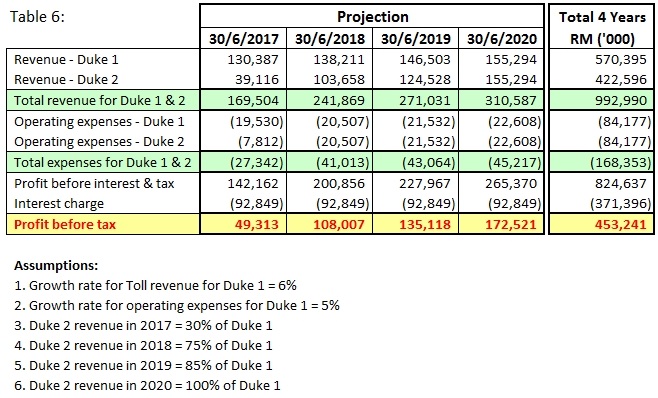

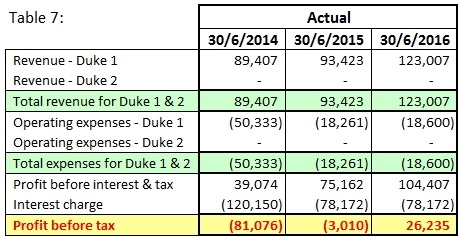

2. Toll business - refer Table 6

3. Property development - 22%

4. Shopping mall - refer Table 8

Important Assumption:

Ekovest still owns 100% Kesturi

Revenue & Profits for Duke 1 & 2

Revenue & Profits for EkoCheras Mall

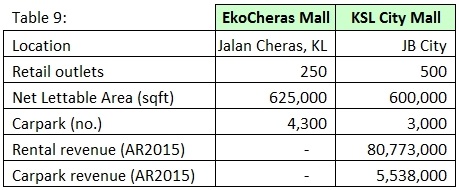

Comparison between EkoCheras Mall & KSL City Mall:

My Words:

All the above working, calculation & assumptions are presented based on my personal own judgement and for sharing purposes only. I never think I can move anything unless the thing want to move by itself.

Do your homeworks, read all news & reports, set your best judged basis & assumptions and make sure you truly understand the business & company before buying any shares.

Invest only with FREE money, never use emergency money to invest, using emergency fund to invest is gambling, crazy & suicide act.

[转贴] 买股不是赌博,晒冷就真的过冬~ (一) - Angel Poi Woon

Below is advertising

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Wealth Creation

Created by WealthWizard | Apr 06, 2017

Created by WealthWizard | Mar 27, 2017

Created by WealthWizard | Mar 21, 2017

Created by WealthWizard | Sep 26, 2016

Created by WealthWizard | Sep 23, 2016

Created by WealthWizard | Sep 12, 2016

Created by WealthWizard | Sep 06, 2016

Created by WealthWizard | Sep 05, 2016

Discussions

soon people would realize this deeply undervalued Gem with huge upside,, as there's only one direction, North.

2016-10-07 11:43

Thank you for your comments, moneySIFU, probabilty, 张天师除妖, ronnietan & williamloh928

2016-10-07 12:09

张天师除妖, it's my hobby & I am not working as analyst. Hope you like it. Thank you.

2016-10-07 12:10

i like the way W-Wizard use those cartoon images....makes me feel young at heart..he he..and color selections (so soothing to the eyes)...and of course the facts presented...simply the best in i3 so far..

2016-10-07 12:16

I know right, i sometimes wonder if he's an auditor, as his presentation is very clear.

2016-10-07 12:18

thanks for the article. I think there are some items which you might want to consider as well.

1. A huge chunk of construction orderbook is from Duke 3, so you might want to include the interest on the sukuk to be issued to finance the construction. It's RM3.64b but of course Ekovest won't max it out and won't issue all at once. But even if another RM2b in debt x 5% interest will shave off your PBT by RM100m a year

2. There are 122m warrants outstanding which is already in the money. as long as share price doesn't fall below RM1.35, we can expect warrant holders to convert. Based on your upside calculations, that would dilute it down to ~RM3.50

If you consider the above factors, the upside may not be as huge but of course this is ignoring future property developments, new construction jobs, Duke 3 etc.

2016-10-07 14:01

Hi Jay, good to point out, my reply is as follows:

1. The interest for sukuk will be capitalised during the construction period of Duke 3 . You may refer to Ekovest account (past 2 years) in treating the construction of Duke 2.

2. Any target price is just a visionary target, market will be the final decider.

2016-10-07 14:57

Before & during construction of Duke 2, the islamic notes were issued & the proceeds received has been put into investment fund.

2016-10-07 15:01

Famous Mohd Fahmi is here, can you talk more rather than just saying:

Sell, down, run....

2016-10-07 15:06

I can guarantee you over the next few weeks one day down, one day up, one day down, one day up.

Sometimes, it will be 2 days up, 3 days down, or 3 days up, one day down.

Its called thousands of human beings buying or selling based on mood. In the end however, it will go back up once they announce the div and the completion of sale.

2016-10-07 15:07

You go everywhere to say same simple word only, pity you.

http://klse.i3investor.com/servlets/cube/post/619963960.jsp

2016-10-07 15:08

Well say, Jon Choivo, market is always emotional one, the same company can be up & down very frequently, kind of crazy stuff. If anyone try to time it, good luck.

I prefer look at what I am going to get & trust my judgement rather than looking at others' people moods.

-----------------------------------------------------

Its called thousands of human beings buying or selling based on mood. In the end however, it will go back up once they announce the div and the completion of sale.

2016-10-07 15:10

Agreed, moneySIFU & Jon Choivo, thousands of people with different backgrounds, financial positions, moods, expectation of risks & rewards, etc.....

Not easy to predict, all we can do is understand ourselves, know what we want & what are we buying.

2016-10-07 15:25

hi wealthwizard,

1. you are correct. Duke 3 will take longer to construct so the interest cost won't appear in the 4 years period.

2. of course market decides the TP, I'm just using your calculations as an illustration. because when market looks at PE, they do look at EPS, which will be diluted when warrants kick in. just highlighting

2016-10-07 16:03

Thank you, Jay, we are all small time investors, I don't think my articles can push up big company like Ekovest, just hope to get something back for our money.

Open up all facts & disclosing all figures will help to make informed decision. Rather than listen to newspapers where only a small portion of facts/info disclosed here & there.

2016-10-07 16:17

Jay, I think your concern about earnings being diluted in the future years is pretty myopic. When people look at Ekovest at the fundamental level, they see high PE and high debt. What they missed was the value behind Kesturi, construction arm and property arm as well as the potential of Duke 3. Perhaps why Ekovest is undervalued now may be caused by the big project at hand - Duke phase 3 where a significant of construction costs may be incurred. The beauty of investing in Ekovest right now is we all know Ekovest is undervalued and EPF had done the maths for us. The price which investors paying at the current price is 60% of kesturi. The key to profitting from this investment is up to the management actions to minimize the disparity between the price and value and investors to ride the wave.

2016-10-07 16:37

Profit projections are way off. Duke 2 revenue ramping up is too optimistic

Construction of Duke 2 is at the tail-end, at the start of this year already 70-80% completed. Duke 3 construction and recognition will only start next year

Revaluation gains are one-off, but then you know that already

Better hope next Q results will include exceptional items or 'early profit recognition' or this is a goner

2016-10-07 18:58

Profit projection is always subjective, so nothing to argue, if you think too otimistic, then it is.

You are right at duke 2. But Duke 3 is started in august, please google the relevant news.

Since this is your opinion saying it's goner, then just let it be gone.

-------------------

Posted by valuelurker > Oct 7, 2016 06:58 PM | Report Abuse

Profit projections are way off. Duke 2 revenue ramping up is too optimistic

Construction of Duke 2 is at the tail-end, at the start of this year already 70-80% completed. Duke 3 construction and recognition will only start next year

Revaluation gains are one-off, but then you know that already

Better hope next Q results will include exceptional items or 'early profit recognition' or this is a goner

2016-10-07 19:09

Valuelurker, mind to share what are your expectation on profit before tax margin for the following?

Construction

Property

Rental from EkoCheras Mall

2016-10-07 22:44

it's good if all the things mention come through, definitely big upside potential....but the downside potential is also no joke....

2016-10-07 23:38

Will Ekovest benefit from Bandar Malaysia in long term? Since IWH-CREC is the master developer of Bandar Malaysia.

Like Gearge Kent in MRT2, GKent is the Project delivery partner & awarded itself RM1bil MRT2 job.

----------------------------------------------------------------

1. Ekovest's Tan Sri Lim Kang Hoo owns Credence Resources

2. Credence Resources is the 60% shareholders in IWH.

3. IWH owns 60% in IWH-Crec.

4. Bandar Malaysia is 40%-owned by MoF, with IWH-CREC holding the remaining 60%.

With an estimated gross development value of RM200bil, Bandar Malaysia is located on the former Sungai Besi air force base. Its development will be carried out over three to four phases and expected take 20 to 25 years to complete.

News from The Edge Weekly:

Bandar Malaysia, TRX incentives - a boon or a bane? (The Edge Weekly)

http://klse.i3investor.com/blogs/moneymoney/105972.jsp

2016-10-07 23:41

younginvestor92, my 2 cents opinion as I only responsible for my money invested in Ekovest, with such huge jobs in hand, downside is quite limited, unless Malaysia is having war later, then can't say.

While downside is being taken care, it is up to the Market to decide its value in coming months.

2016-10-07 23:43

Just want to refresh memory only (http://klse.i3investor.com/blogs/moneymoney/105124.jsp):

Construction outfit Ekovest Bhd expects to surpass the RM1 billion revenue mark by its financial year ending 30 June 2017, driven by strong outstanding order book of RM5.3 billion.

Besides that, Lim said Ekovest was also bidding for another RM5 billion worth of construction jobs.

He said the company had a good chance of securing several of them including the 1Malaysia Civil Servants Housing project in Putrajaya and the Pan Borneo Highway job.

Other than that, Lim said, the group was pre-qualified for the Light Rail Transit Line Three and Mass Rapid Transit Line Two.

2016-10-09 00:37

slow & steady....or fast & furious...either way, EKOVEST will keep climbing to the TOP! he he..

2016-10-09 10:28

Perhaps director buy big house, big car or pay themselves high salary and give little dividend for shareholders? Hence 2 sen dividend only for us?

2016-10-09 12:46

Hmmm.... Interesting, the directors should be staying at the apartments and driving proton, Pls don't buy since it does not fulfill your requirements. Pls look for Public Bank or BAT, they pay more dividends.

2016-10-10 10:08

It is very interesting to know on "binding term sheet", why not just LOI, Term Sheet or MOU?

http://www.acc.com/chapters/socal/upload/acca-presentation-10-15-08-6-1.pdf

2016-10-10 11:10

Sound interesting, paperplane, but you always have better sense in this.

Hope you are right on this part: Don't be surprise if high end.

2016-10-12 00:47

EkoCheras - A Mixed Development Property by Ekovest Berhad

https://www.youtube.com/watch?v=AhR0fV_c9kk#t=65.939161

2016-10-12 01:01

I think WealthWizard has not incorporated effect of RoL, but existing assumptions are already more than enough to prove how good is Ekovest. With so many good news week in week out, what management is trying to do is very interesting.

2016-10-28 22:58

The projection does not include any new contracts or property sales. What if Ekovest manages to get 1bil project as told by the MD in the news?

Most important is Ekovest has proved has the ability to deliver good result/margin when completing projects in the past years.

2016-11-01 22:14

Thank you WealthWizard, I bought Ekovest after your article published

2016-11-10 11:52

Hi WealthWizard, referring to table 6 above, do you have the data on the tax payable by DUKE 1 & 2 for 2017 and 2018 to derive the PAT ? TQ

2016-11-13 12:04

The management has ambitious & done far better than I initially participated. The following were not available at time of my articles:

River of Life (4b)

Pan Borneo Highway (30% JV of 2.1b)

Duke 2A (6.3b)

2017-01-21 11:15

On the way to 10b cap company. Defensive & yet great potential ahead.

---------------------------------------------

WealthWizard The management has ambitious & done far better than I initially participated. The following were not available at time of my articles:

River of Life (4b)

Pan Borneo Highway (30% JV of 2.1b)

Duke 2A (6.3b)

21/01/2017 11:15

2017-03-28 11:48

ronnietan

You've one up on analysts.

2016-10-07 11:36