CAB CAKARAN: Achievable Target price = RM3.09? (Part 3) (WealthWizard)

WealthWizard

Publish date: Thu, 06 Apr 2017, 12:08 AM

Part 1: CAB CAKARAN: Malaysia Broiler/Chicken Giant in Making

Part 2: CAB CAKARAN: Something Big Is Coming in Poultry Industry

Part 3: CAB CAKARAN: Achievable Target price = RM3.09?

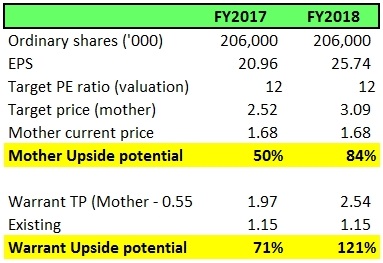

With Forward PE of 12, it gives CAB Cakaran a good potential upside when the price was RM1.68 (Share price of the Company has gone up since the release of my part 1 article):

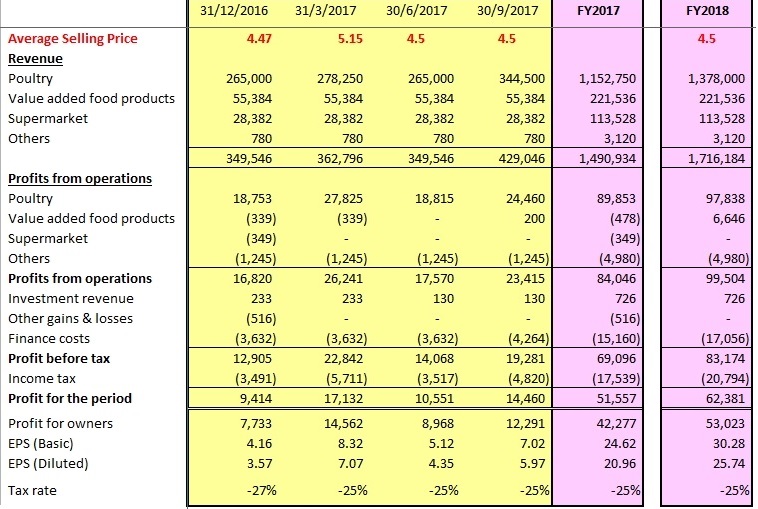

The following are the workings in arriving the sales & profit projections:

Note: There were fair value adjustments income of RM5mil+ recognised in the final quarter of last 2 financial years, no provision has been made in the above projection.

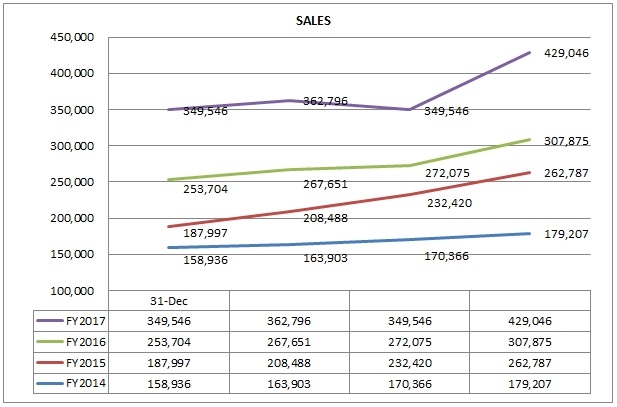

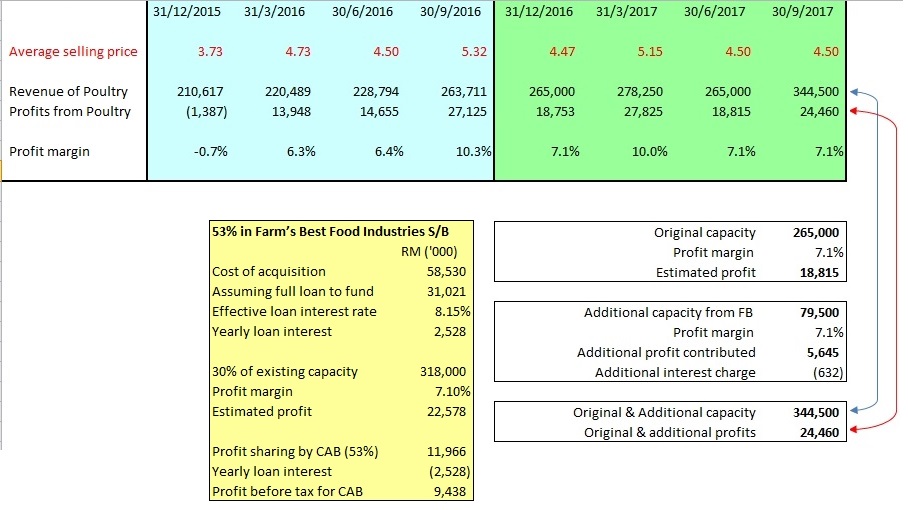

The following are merely my projections for revenue of poultry segment:

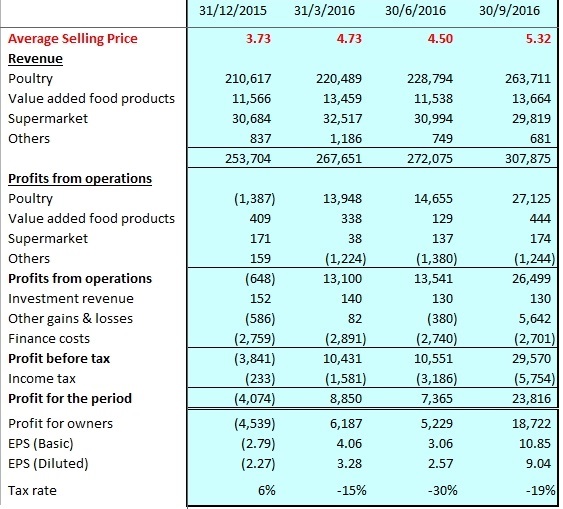

Quarterly Results for 4 Quarters in financial year 2016:

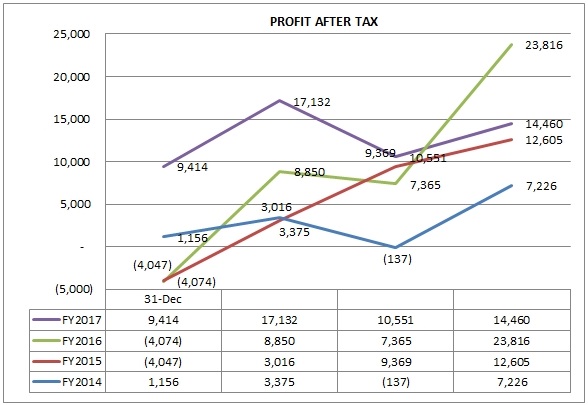

As a result of the above projections, I have prepared the following charts for easier understanding:

Note: There were fair value adjustments income of RM5mil+ recognised in the final quarter of last 2 financial years, no provision has been made in the above projection.

IMPORTANT REMINDER:

All the working, calculation & assumptions are presented based on my personal own judgement & findings, and are for sharing purposes only.

I never think I can move anything unless the thing want to move by itself.

Do your homework, read all news/reports, make your best judged assumptions & understand the business before invest any company.

Invest with FREE money only, using emergency fund to invest is gambling, crazy & suicide act.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Wealth Creation

Created by WealthWizard | Mar 27, 2017

Created by WealthWizard | Mar 21, 2017

Created by WealthWizard | Oct 07, 2016

Created by WealthWizard | Sep 26, 2016

Created by WealthWizard | Sep 23, 2016

Created by WealthWizard | Sep 12, 2016

Created by WealthWizard | Sep 06, 2016

Created by WealthWizard | Sep 05, 2016

Discussions

flawlessly accurate..conservative and real...thats WealthWizard

thanks for delivering as promised

2017-04-06 00:26

hmmm,

by anticipated a x12 p.e. ( conservatively to its peers at 15-18pe )

$3.08 for 2018 is rather cheap still .

2017-04-06 00:35

Quick question - I assume your target price for 2017 & 2018 @ $2.52 and $3.09 respectively are the true and fair value of the business.(not share price)

From my understanding a company fair value tracks closely to its ROIC yoy if someone bought it at fair price. CAB has ROIC of 8-9% and lets give it 10%, and with no dividend, at most the true value would compound at 10%-11%, means from $2.52 to $2.77.

Your valuation indicate an intrinsic value growth of 22.6%, mind to explain if I miss out something? Unless you are talking about share price not the value of business, which I hope you're not, considering all the hardwork you put in to produce all these. Thanks.

2017-04-06 05:50

The assumption of increase in revenue for FY2018 4th quarter is based on 30% increase in broiler production capacity following the acquisition of Farm's Best assets. It was supported with the claim by the management in the news. We'll see if they can deliver what they said.

Other than the projection for the possible contribution from newly acquired assets from FB remained to be seen/proven, in my personal opinion, all figures projection are reasonable & cautiously optimistic.

Well done & thank you, WealthWizard!

2017-04-06 07:55

One thing I truly admire WW is that he uses figures to tell the story & not only just a general concept like many others do. It enable us to see things in figures based on information that made available publicly.

My advice is to take our own assumptions or factors to work out our own working based on the sample/sharing by WW & see what are the possible differences/variances. It may help us to make better decisions. It's just my humble opinion.

2017-04-06 08:03

I appreciate anyone to come forward and enlighten me on my question. Thanks

2017-04-06 08:11

财富巫师的风格和优点:

1. 寻找被低估的公司

2. 分析公司所在市场的发展趋势

3. 分析公司与同行的财务差异和优点

4. 分析公司的财务状况

5. 预估公司将来的财务收支情况

第一项是基于股票丰富经验的基础

第二项要求一定的生意眼光和市场分析能力

第三至第五则要求对财务会计能力的掌握和运用

佩服,感恩和加油!

2017-04-06 08:19

Though downside has been taken care off, the price has reached its fair value, make your own decision.

2017-04-06 11:36

Thank you very much to Wealthwizard and Moneysifu.

Appreciate your sharing and recommendation.

I would like to express million thanks for your recommendation.

I will share my top pick later by this weekend.

Lets earn together

2017-04-06 13:24

@ Ricky Yeo,

Wealthwizard has lead us to the visibility of CAB earning and potential to be expanded... the rrest really up to individual to decide. ..

Everyone individual has their own planning and different risk appetite. ..

I got to say, some good with valid finding article may stimulates the share price ahead... I find nothing fishy here... minima risk I can see, if bird flu come attack.

Cheers Ricky Yeo...

2017-04-06 13:44

so all in all, the selling point is the additional capacity from farmbest.

just few question, since farmbest is 53% owned and 2018 would recognise four quarters from farmbest, shouldn't the non-controlling interest get more % out of the net profit? and what are the reasons why CAB will sometimes post quarterly losses? sorry too lazy to check myself so just tap you brain

to me, poultry stocks still doesn't deserve high PE since the industry produce generic products, has little moat and is a price-taker both in terms of products selling price and inputs costs. if assuming 25c is achiveable by 2018, 10 times PE Tp will be 2.50, 8 times will be 2.00. I have no idea how high/low it should be, so will leave it to those interested in CAB

2017-04-06 14:47

Personal view on company valuation in stock market is sometimes varied with market.

To me, Gdex is it never worth more than 15 times PE, but it is 79 times PE now.

2017-04-06 15:44

I pity my colleague who dealing with Gdex, almost shouting the phone everyday asking Gdex why never come to pick up

2017-04-06 15:47

Kino Kow

Thanks WW

2017-04-06 00:19