Flying CRC Steel Producers: Fantastic Business Outlook & Insider's Look (Part 3)

WealthWizard

Publish date: Mon, 12 Sep 2016, 04:28 PM

Part 1: Bright Future for CRC Steel Producers: CSCSteel, Mycron, Eonmetal & YKGI

Part 2: Huge Potential Upside for CRC Steel Producers: CSCSteel (+24%) & Mycron (+90%)

Part 3: Flying CRC Steel Producers: Fantastic Business Outlook & Insider's Look

The above table was updated based on last closing price & please refer to my previous article for more details: Huge Potential Upside for CRC Steel Producers: CSCSteel (+24%) & Mycron (+90%) (Part 2)

Many had sent emails to me to ask: is it the end? Will price up again? Will price drop?

I do not know how price will move as we all know Mr Market is always unpredictable.

All I can do is to read more market news about China CRC & HRC market news & its government's progressive efforts & result in reducing steel industry production capacity, Malaysia economic situation and local CRC & HRC market news & conditions.

So, let's talk about business.

Factors affecting CRC companies

After knowing the positive developments (imposition of anti-dumping duties for CRC & total close of Megasteel), the following factors will affect the performance of CRC companies in coming months/years:

1. Prices of CRC & HRC in China

2. Price of CRC & competition among CRC producers in Malaysia

3. Effect of anti-dumping duties for CRC

4. Effectiveness & efficiency of Royal Malaysian Customs

Prices of CRC & HRC in China

China steel yearly production & export are more than total combination of all steel mills from the rest of the world and majority of the Malaysia imported steels are from China.

The following is the price movement of CRC in China for past 3 months:

Table 1: CRC price in China

Source: http://www.100ppi.com/vane/detail-318.html

Alternatively: http://www.sunsirs.com/uk/prodetail-318.html

Explanation:

Price of China CRC has been increased from RM1,825 (3/7/2016) to RM2,138 (10/9/2016), an increase of RM313 (using conversion rate of RM1 = RMB1.63)

Please note that the average CRC selling price of Mycron during the quarter ended 30/6/2016 was estimated at RM2,059.

According to the source closed to the CRC industry, selling price of local CRC is moving upward to RM2,150 - RM2,200 in recent months.

The following is the price movement of HRC in China for past 3 months:

Table 2: HRC price in China

Source: http://www.100ppi.com/vane/detail-195.html

Alternatively: http://www.sunsirs.com/uk/prodetail-195.html

Explanation:

Price of China HRC has been increased from RM1,552 (3/7/2016) to RM1,677 (10/9/2016), an increase of RM125 (using conversion rate of RM1 = RMB1.63)

Please note that the average production cost of Mycron during the quarter ended 30/6/2016 was estimated at RM1,602 per tonne.

Surge in Prices of all steel products in April & May 2016 explained:

The Malaysian Iron and Steel Industry Federation (Misif) and the Malaysia Steel Association (MSA) have put the current tight steel supply situation domestically and internationally to the recent cancellation of steel supply contracts by Chinese sellers.

“With China preferring to meet its local demand, given the recovery in domestic prices rather than export, China suppliers cancelled a large number of steel contracts signed prior to the price surge, thus resulting in shortage for those who rely on them for their regular supply,” Misif said.

(Source: http://www.thesundaily.my/news/1783203)

Explanation:

China steel prices will have direct & huge influence over the world & local steel prices due to its sizes of production & export.

上半年近7成上市钢企净利大增 秋季行情或再超预期

今年初,国务院发布钢铁、煤炭行业化解过剩产能的“指导意见”,明确提出中国要在三到五年内化解1亿——1.5亿吨粗钢产能。为了妥善解决去产能过程中的富余人员安置等问题,国家还为钢铁、煤炭行业去产能设立了1000亿元的专项奖补资金。

在供给侧改革的大背景下,各级政府连月来纷纷出台了各地去产能计划。按原计划,2016年全国减压粗钢产量的任务为4500万吨。据官方统计数据,截至今年7月,全国累计完成钢铁产能减压2126万吨,完成了年度任务的47%。

“下半年,钢铁行业去产能的进程将不断加速。”徐向春表示,截止到8月底,全国一共有23个省(市)先后公布去产能方案。其中,22个省市明确了今年去产能的具体目标,炼铁和炼钢产能分别达到了3787万吨和7207万吨,已大大超出了上述全年全国去产能4500万吨的目标。

“从各省公布数据来看,目前全国已列出的粗钢去产能总数就达到了近8000万吨,不出意外,我们对钢铁行业去产能的进度可以保持乐观预期,”徐向春称,“即便只完成6000万吨,今年也将超额完成全年去产能的目标。”

为了加快下半年去产能进度,国务院还于8月底向各地派出10个督查组,部署化解过剩产能专项督查。

(Source: http://www.100ppi.com/news/detail-20160911-902287.html)

Explanation:

China Government has been actively & progressively cut down steel industry production capacity by closing down more unproductive or loss making steel mills.

Improving Demands for CRC & HRC in China:

中建材大宗网高级分析师张琳告诉记者,国家大力去除产能,需要关注一个事实,即可能后续几个月卷板价格不会走低,如果去除太猛的话,可能造成供不应求。因为现在钢厂和贸易商很少存货,“冷轧板可能会出现断货的情况,因为现在南方家电和汽车的需求量很大。”她说。

国家统计局数据显示,7月全国汽车产量同比增长了25.4%,达到197.8万辆。1-7月汽车产量为1507.8万辆,同比增长8.1%。21世纪经济报道记者获悉,冷轧板或者热轧板主要用于汽车和家电。

Source: http://www.100ppi.com/news/detail-20160910-902262.html

Explanation:

Demands for CRC & HRC in China are expected to grow due to progressive improving cars & electrical appliances markets coupled with restocking activities of existing CRC mills & distributors in the coming months due to low level of inventories.

Price of CRC & competition among CRC producers in Malaysia

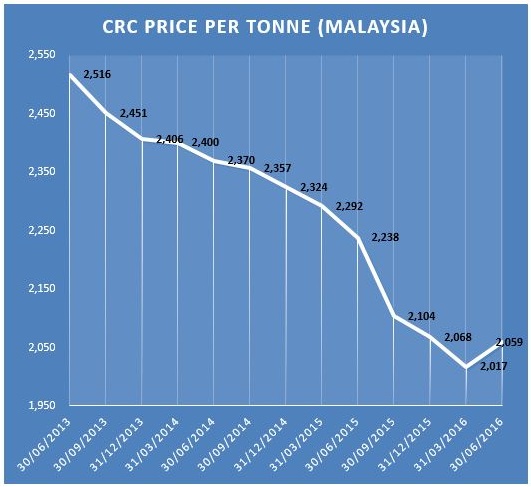

Table 3: Average CRC Selling Price in Malaysia

Source: Analysis from Mycron's Annual Reports

Explanation:

As refer to Table 1, price of China CRC has been increased from RM1,825 (3/7/2016) to RM2,138 (10/9/2016), an increase of RM313 (using conversion rate of RM1 = RMB1.63)

For quarter ended 30/6/2016, the average CRC price in Malaysia was estimated at RM2,059.

Currently, CRC products was said to have transacted at range of RM2,150 - RM2,200, due to the following reasons:

1. increase in tandem with those prices in China, slower pace due to soft Malaysia market

2. lower imports from China due to current strong demands in China

3. effect of Anti-Dumping Duties

Table 4: CRC Production Utilisation Among 4 CRC Producers

How Megasteel affected CRC producers in terms of Pricing CRC

Megasteel which is the sole hot rolled coil (HRC) producer in the country receives protection from the Government, which requires the cold rolled coil (CRC) producers acquiring a chunk of their raw material from Megasteel

Other than high prices for Megasteel’s HRC, many of the CRC players are said to be facing quality issues, as they require HRC made from iron ore, and not scrap metal as used by Megasteel.

The downstream players are understood to be able to import CRC at a cheaper price than buying from the 4 CRC players, due to Megasteel’s high HRC pricing. (4 CRC players = CSCSteel, Mycron, YKGI & Eonmetal)

(Source: http://www.kinibiz.com/story/exclusive/19582/new-issues-at-flat-steel-sector.html)

CONCLUSION:

The CRC price & demand increased in China in recent months and coupled with the imposition of Anti-Dumping Duties on CRC has caused the following situations:

1. China CRC suppliers focus on domestic demands

2. Less competitive in prices of China CRC products

Meanwhile, Malaysia CRC producers are enjoying huge saving in sourcing raw materials (HRC) from international market, especially from China due to the following factors:

1. Closing of Megasteel

2. The application of 9% export tax rebate for HRC products exported by China steel mills

The increase in CRC price and reduction of cost of raw materials (HRC) has given large margin for local CRC companies to compete with China CRC in selling CRC products locally to downstream industries/companies in Malaysia.

As such, local CRC companies are expected to enjoy increase in both sales & profits in the coming months/years.

Other Useful Information:

Malaysian Iron and Steel Industry Federation (MISIF) consist mainly of downstream steel producers.

Malaysia Steel Association (MSA) mainly consist of upstream steel producers.

Below is advertising:

More articles on Wealth Creation

Created by WealthWizard | Apr 06, 2017

Created by WealthWizard | Mar 27, 2017

Created by WealthWizard | Mar 21, 2017

Created by WealthWizard | Oct 07, 2016

Created by WealthWizard | Sep 26, 2016

Created by WealthWizard | Sep 23, 2016

Created by WealthWizard | Sep 06, 2016

Created by WealthWizard | Sep 05, 2016

Discussions

It's double edged sword, lenglui, but seem CSCSteel benefited most from weakening RM while Mycron has been actively hedged its currency exposure, no so much gain or loss last year.

See table 6

http://klse.i3investor.com/blogs/wealth123/103812.jsp

2016-09-12 21:08

The reason Megasteel didn't ramp up production of CRC could be due to no money.

The same reason Kinsteel couldn't increase production, and Perwaja stayed at 0 output, of HRC. Steel price recovery came too late for them. Creative destruction.

In contrast, Ann Joo had surplus inventory to sell into the high prices.

2016-09-12 22:52

ha ha..glad to have the update comparing the CRC manufacturers...those PE used seems so conservative. Thanks WealthWizard :)

2016-09-13 01:57

haha, probability, the CRC industry is merely at the stage of turning up, no many appreciate what's coming, so better conservatively set. :)

2016-09-13 08:00

Most countries have imposed Anti-Dumping Duties for Cold Rolled Steel Coils (CRC), not for rebar yet. So the first wave should be CRC.

2016-09-13 08:02

I never worry on Dow Jones performance, there are always individual stocks shining during bad time.

2016-09-13 08:05

based on news is temporary shut down due to no fresh order since Jan ~ Aug causing 1 shift running…

steel mill HRC shd preferred 24 hours running for production effiency and energy cost wise

running for CRC not worth as compete with other CRC manufacturer… it will be better running HRC which is monopoly biz… in addition no infringement to LIONCOR for monopoly case…possible backdoor resolve with CRC miller? settle

2016-09-13 08:28

Congrats, WealthWizard, enough investors are persuaded by your articles to buy into Mycron and CSCstel, both major gainers today.

Annjoo and Prestar there too.

A strong Steel Day.

2016-09-13 10:07

A senior manager from Megasteel said they need miracle to revive. It's true as Megasteel has been trying to return to profit for so many years with full supports from government but yet couldn't make it.

See below news: http://www.thestar.com.my/business/business-news/2016/09/10/megasteel-closes-banting-plant/

However, despite the protection, Megasteel continued to record huge losses. As at Dec 31 last year, Megasteel had racked up RM2.43bil in accumulated losses.

So far, Megasteel has gone through four debt restructurings, the latest of which in 2014, when it only had consent from two of its seven US dollar term loan creditors.

As at Dec 31 last year, Megasteel owed RM895.7mil to secured creditors, while unsecured creditors and suppliers were owed RM3.28bil.

2016-09-13 10:45

I believe CSCSteel & Mycron will continue to shine due to their positions in CRC market.

Eonmetal has done very well in manufacturing of plant & machinery, need to catch up in their CRC division.

YKGI is doing ok, need more results to prove their potential.

2016-09-13 10:49

I received an email from one of i3 fellow member, where a famous remisier in i3 has a buy call to his subscribers on Mycron with target price of RM1.61, using 5 methods of calculation.

2016-09-13 10:52

While all developments pointed to one good direction, the CRC market leaders such as CSCSteel & Mycon will be the natural choices for investors.

2016-09-13 11:36

Most people tends to sell profitable stocks & retain loss making stocks.

Reason: afraid of losing the profit & hope for the bleeding stock to overturn

Normal outcome: flying stock continue to fly & falling stock continue to fall

2016-09-13 15:48

Very well said, money sifu. It took me 15 years in stock market to understand this theory.

2016-09-13 17:14

Haha, MuttonCurry, yesterday you said today crash, now said tomorrow jatoh, it's fun to see you around.

2016-09-13 17:27

Ha, Albukhary, I am still learning.

Said is always easier than done, when come to making decision, every time have to struggle, do or not to do, that's the problem, haha

2016-09-13 17:35

You must know where is your destination when winning, surely you don't want to jump out of the bus at Tanjung Malim if you want to go Penang.

It's ok to get on board at Bidor, because it is only half way.

As long as you don't get to the wrong bus to Johor instead of Penang, that's still fine.

If you are not sure where the bus go, better take a deeper look & decide later. No make money but also won't lose money.

2016-09-13 21:38

wealthwizard did a good post...salute....

it is not easy to make metal vibrant..

looks like your metallic post already magnetized most of the metal peers...

good job...

2016-09-13 21:51

Thank you for the explanation. Understand a bit more abt the steel industry.

2016-09-14 12:06

I guess no many people realise the powerful effect of Anti-Dumping Duties. Thank you again, KLCI King.

2016-09-14 12:33

wow wealthwizard, i think this is a damn good article leh, clear cut and detailed.. with articles and explanations

Onz la! thumbs up

2016-09-14 13:41

Actually THE SINGLE MOST POWERFUL information... is shown below:

(affects all the counters above.....note that the Forward 12 months Earnings caclculated above is before the Megasteel closure).

According to Choo Bee CEO Mark Tan, Megasteel will normally charge RM400 to RM500 premium per tonne for HRC over international prices.

http://www.klsescreener.com/v2/news/view/81555

Choo Bee hopes for cheaper input to resume export

TheEdge Mon, Jun 13, 2016

This article first appeared in The Edge Financial Daily, on June 13, 2016.

KUALA LUMPUR: Choo Bee Metal Industries Bhd is among the beneficiaries of the government’s decision to knock down trade barrier for imported hot rolled coil (HRC) in the downstream segment.

The Ipoh-based flat steel product manufacturer had to stop exporting hollow and gas pipes to the United States, Australia and the Middle East in 2009 as the locally sourced HRC, which is its key raw material, had weakened the company’s competitiveness in the international market due to high input costs.

“We can’t export when we purchased raw materials from Megasteel [Sdn Bhd]. If our raw material prices are cheaper, we will be more competitive in terms of pricing,” the group’s chief financial officer Mark Tan said in a phone interview with The Edge Financial Daily.

Nonetheless, it is a different scenario now for Choo Bee after Megasteel, a 79%-owned subsidiary of Lion Corp Bhd, has suspended its production again since March this year due to financial and technical issues.

But how long will this situation last, most industry players, including Choo Bee, have no clue to that.

Tan opined that, based on Megasteel’s current financial situation, it could last until the end of the year or even longer. However, he pointed out that once Megasteel resumes operation, Choo Bee will still source from it if the prices are deemed reasonable.

According to Tan, Megasteel will normally charge RM400 to RM500 premium per tonne for HRC over international prices. Raw materials are Choo Bee’s biggest cost, which accounts for about 85% of the group’s operating expenses.

As of now, the group has started to source 80% of its raw materals from other Asian countries since Megasteel, the country’s sole HRC maker, has stopped production. This may in turn help Choo Bee resume its export business to the US and Australia after the third quarter this year, according to Tan.

The group also plans to allocate about RM20 million to expand its capacity for its main factory Pengkalan plant this year, which includes adding new production line. Total output is expected to increase by 20% when the new line is completed by 2017.

“We are upgrading and streamlining production processes to enhance production efficiency for our future growth,” he said.

Choo Bee’s current capacity could produce up to 9,000 tonnes a month when supply of raw materials is available. This works out to be about 108,000 tonnes of output a year.

With an additional tube mill line, Tan expected output to increase by 2,000 tonnes per month or 25,000 tonnes annually.

Tan, however, remained cautious about the group’s financial year ending Dec 31, 2016 (FY16) outlook, as steel prices remain volatile and stiff competition is squeezing margin.

Choo Bee achieved a net profit of RM2.85 million for the first quarter ended March 31, 2016 (1QFY16), decreasing by 27.04% when compared with RM3.91 million in the previous year. Its revenue declined 30.47% to RM100.74 million from RM144.89 million in 1QFY15.

Steel prices that have come off again recently are also Tan’s concern. He foresaw steel prices to drop further after the rebound in recent months as supply levels remain high from idle capacity.

“Thus, we need to manage our cost, and make sure we are competitive in terms of raw material pricing,” he added.

Other than the resumption of export markets, Tan saw the government water pipe replacement project, which will be rolled out this year, as another potential earnings driver for Choo Bee.

Based on historical record, Tan estimated the government’s water pipe replacement project could provide a boost of about 30% of Cho Bee’s revenue.

FY15 was not a good year for Choo Bee. Its net profit halved to RM6 million. Besides lower average selling prices compressed profit margin, the group was also hit by unfavourable foreign exchange rate and impairment loss.

However, Choo Bee has a healthy balance sheet which has the attention of some fund managers. As at March 31, the group’s cash balance stood at RM62.93 million against borrowings of RM2.1 million. The rather big cash coffer has enabled Choo Bee to regularly declare dividends. Choo Bee declared a single-tier dividend of four sen per share for FY15.

Choo Bee’s share price staged a mild rally in March in tandem with the spike in interest in steel stocks in the past three months. Its share price climbed to a five-month high of RM1.61 in mid-April from RM1.34 in early March.

2016-09-14 13:51

See something before many others see, know deeper before many others aware, look further when many others still look here & there, you will earn more than many others.

Try to look up to everyone that talk positive & negative, judge yourself, don't blame anyone if you don't get it.

Opportunities are always for those who are ready AND have ability to grab it.

2016-09-17 14:14

My new article:

EKOVEST: Doing Great & Ready To Shine, Are You Ready? (Part 1)

http://klse.i3investor.com/blogs/wealth123/104926.jsp

2016-09-23 11:40

superb article with fact-based projection, very convincing! well done WealthWizard master. Looking forward to reading more of your articles!

2016-10-15 13:32

China CRC price has increased 3.4% since my my first article was published on 5/9/2016, the price was RMB3,480 now it is RMB3,597.

Bright Future for CRC Steel Producers: CSCSteel, Mycron, Eonmetal & YKGI (Part 1)

Author: WealthWizard | Publish date: Mon, 5 Sep 2016, 11:02 AM

http://klse.i3investor.com/blogs/wealth123/103741.jsp

2016-10-17 16:16

China CRC price continue to climb due to increase in car sales in China

2016-10-20 - 3716.67

2016-10-19 - 3681.11

2016-10-17 - 3621.11

2016-10-05 - 3508.89

2016-09-10 - 3485.56

2016-08-22 - 3421.11

2016-07-20 - 3111.11

2016-06-23 - 2950.00

http://www.sunsirs.com/uk/prodetail-318.html

http://www.100ppi.com/vane/detail-318.html

http://klse.i3investor.com/files/my/blog/img/bl2751_crc_price_in_china.jpg

2016-10-21 01:19

China CRC price continue to climb due to increase in car sales in China

2016-11-04 - 4013.33

2016-10-05 - 3508.89

2016-09-10 - 3485.56

2016-08-22 - 3421.11

2016-07-20 - 3111.11

2016-06-23 - 2950.00

http://www.sunsirs.com/uk/prodetail-318.html

http://www.100ppi.com/vane/detail-318.html

http://klse.i3investor.com/files/my/blog/img/bl2751_crc_price_in_china.jpg

2016-11-05 07:18

lenglui

Weakening in ringgit affect steel company?

2016-09-12 20:52