EKOVEST: Doing Great & Ready To Shine, Are You Ready? (Part 1)

WealthWizard

Publish date: Fri, 23 Sep 2016, 11:15 AM

Part 1: EKOVEST Is Doing Great & Ready To Shine, Are You Ready?

Part 2: EKOVEST: Net Debt Ratio=20% & Net Cash Per Shares=RM1.01 (after 40% sale in Kesturi)

Part 3: EKOVEST: The Next Big Thing & Great Upside Potential +84%

EKOVEST has come under the spotlight when the following news were shown in major local newspapers:

EPF buys 40% of Duke operator for RM1,130m

Ekovest sell 40% stake in DUKE operator to EPF for RM1,130m

The following questions are mostly asked by many:

1. What is the total valuation for Kesturi (Duke 1 & 2 highway builder & operator)?

2. How much cost has EKOVEST invested in Kesturi so far?

3. How much profit can EKOVEST make from this disposal of 40% shares in Kesturi?

Let's do a simple calculation to find out:

| Table 1: Calculation for Gain on Disposal | RM('000) |

| Total Valuation for Kesturi (40% = 1,130m, 100% = 2,825m) | 2,825,000 |

| Total cost of investment in Kesturi by Ekovest (refer Table 2) | 918,280 |

| Total Profit for 100% disposal | 1,906,720 |

Gain on Disposal 40% shares = RM762,688,000

Ekovest is expected to pocket Gain on disposal of 40% subsidiary (Kesturi) with rocky RM762,688,000.

Upon completion of disposal, Ekovest will receive CASH RM1,130,000,000

This is awesome if compared the whole market capitalization of Ekovest at yesterday closing:

855,448,000 shares x RM1.92 = RM1,642,460,160

This is my feeling when I heard the news :)

Special Note: The Islamic Medium Term Notes of RM1.7 billion is under Kesturi, so the debt is taken care of within Kesturi. I will disclose detailed balance sheet of Kesturi in my next article.

Hints:

1. Ekovest bought Kesturi when only Duke 1 was operating

2. After award of Duke 2, Kesturi took Islamic Term Notes to finance the construction of Duke 2

3. The machine is running by itself & no loan was raised at Ekovest.

Announcement from Ekovest:

The Board of Directors of Ekovest wishes to announce that its wholly-owned subsidiary, Nuzen Corporation Sdn. Bhd. (“Nuzen”), has today entered into a binding term sheet with EPF to dispose a 40% equity interest held in Konsortium Lebuhraya Utara-Timur (KL) Sdn. Bhd. (“Kesturi”) to EPF, comprising of the following:-

-

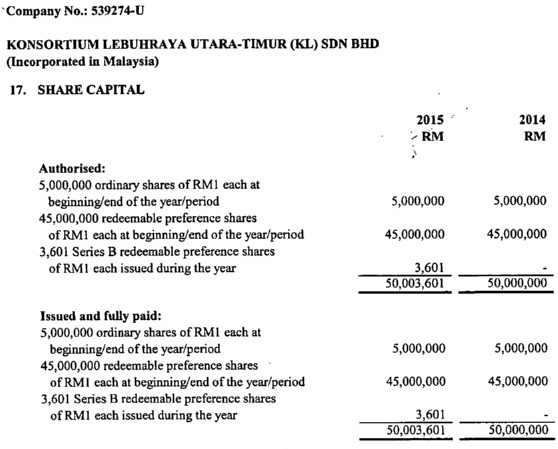

2,000,000 ordinary shares of RM1.00 each and 18,000,000 redeemable preference shares of RM1.00 each held in Kesturi; and

-

1,440,400 new ordinary shares of RM1.00 each to be issued by Kesturi at an issue price of RM100.00 each upon the completion of a proposed capitalisation exercise to be undertaken by Kesturi of the outstanding 3,601 Series B Redeemable Preference Shares in the capital of Kesturi which is currently held by Ekovest Construction Sdn. Bhd. (a wholly-owned subsidiary of the Company),

collectively representing 40% of the issued and paid-up share capital of Kesturi, for an aggregate cash consideration of RM1,130 million.

Source: Announcement by Ekovest at Bursa Website

Share Structure of Kesturi:

How Much Has Ekovest Invested in Kesturi?

| Table 2: Total Cost of Investment by Ekovest in Kesturi | RM ('000) |

| Share Swap Considerations for 70% in Kesturi | 330,180 |

| Cash Considerations for 30% of Kesturi from MRCB | 228,000 |

| Capital injection via 3,601 B Series Preference Shares in Kesturi | 360,100 |

| Total cost of investment in Kesturi | 918,280 |

Souce: Please click on links for sources

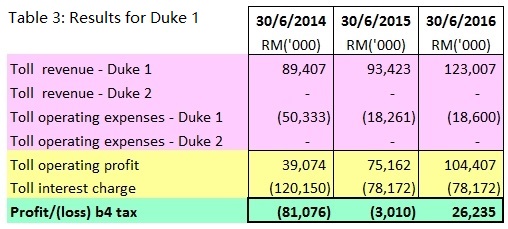

Is the Basis of Valuation RM2.8 Billion Justified?

Please read an old news here:

The price tag of RM230mil for Duke translates to a valuation of approximately 19 times enterprise value (EV) to earnings before interest, taxes, depreciation and amortisation (EBITDA), which is in line with recent toll acquisitions,” said an analyst.

Back in 2010, UEM Group Bhd and the Employees Provident Fund had acquired PLUS Expressways for RM23bil or RM4.60 per share.

“When PLUS Expressways was privatised, the valuation was also around EV/EBITDA of 20 times,” said one property analyst.

Source: MRCB sells Duke Highway

Answer is obviously YES, in fact it is still undervalued!!!

That's It? What Next?

More to come on the following:

1. Valuation for Duke 3 Highway, which is expected to complete in 3.5 years

2. Construction order book in hand = RM5.3 billion

3. Full Valuation for EkoCheras Mall, which is expected to open in January 2018

I will discuss more on all the above projections & valuation in my next few articles, Part 2 & 3.

Please stay tune.

Below is advertising

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Wealth Creation

Created by WealthWizard | Apr 06, 2017

Created by WealthWizard | Mar 27, 2017

Created by WealthWizard | Mar 21, 2017

Created by WealthWizard | Oct 07, 2016

Created by WealthWizard | Sep 26, 2016

Created by WealthWizard | Sep 12, 2016

Created by WealthWizard | Sep 06, 2016

Created by WealthWizard | Sep 05, 2016

Discussions

With same construction speed & without new order, the year of the order can last.

2016-09-24 23:21

The orderbook in the report is not correct, MD said in the interview that the current oustanding construction order book stands at RM6.32bil

http://www.thestar.com.my/business/business-news/2016/09/24/ekovest-addresses-critics-on-highway-sale/

2016-09-24 23:26

paper, looking at the toll business, one can sleep well 'lifelong'...he he

good investment for youngsters. since the toll rates will be hiked, it has assured long term growth rate. Share price can never go down.

2016-09-25 11:35

Yes. I like ekovest due to defensive. I can sleep well even economic crisis happen tomorrow. Next one is keuro. But keuro is 2018. I will buy only next yr.

2016-09-25 13:52

Paperplane, it is defensive but with growth stock nature, since still lots of potential not yet surfaced, now only 40% sale of duke 1&2, the following are more to come:

1. Construction of duke 3

2. Materialisation of Unbilled sales from progressive construction of ekocheras property units

3. EkoCheras mall at jalan cheras & next to MRT station

4. Toll operation f duke 1,2 & 3

no like litrak, nothing much to dig, purely defensive.

2016-09-25 15:08

thanks for the sharing. ekovest could also be a general election stock and chances of special dividend is good. see datuk lim is close to BN so EPF money to buy Duke, Ekovest pay special dividend, datuk Lim then "contribute" to BN election fund. so after merry go round, EPF money indirectly goes into BN election fund. it's screwed up stuff, but what can we do other than ride along?

2016-09-25 20:13

wealthizard, could you look into their earnings prospects for the coming 1-2 years? I think it's clear that it's an deep asset value counter but if they couldn't translate that to earnings, they will still have to rely on disposals to unlock value (which could be in a long time).

2016-09-25 20:28

hmm...what a criminal mind you have! he he...highly plausible :)

Posted by Jay > Sep 25, 2016 08:13 PM | Report Abuse

thanks for the sharing. ekovest could also be a general election stock and chances of special dividend is good. see datuk lim is close to BN so EPF money to buy Duke, Ekovest pay special dividend, datuk Lim then "contribute" to BN election fund. so after merry go round, EPF money indirectly goes into BN election fund. it's screwed up stuff, but what can we do other than ride along?

2016-09-25 20:51

some interesting pointers, since Ekovest is only disposing 40%, under accounting rules, Kesturi will still be a subsidiary and will be "fully" consolidated. which means on paper, the debt amount, interest will remain exactly the same as before. the only difference you will see will be the profit attributable to owners of parent. profit will drop because sharing 40% to outsider but if the RM1.1b is used to repay some debts, then there should be some interest savings

2016-09-25 20:51

why worry about 40% drop on the Kesturi's earning contribution...when they had sold it at a fair price of EV/EBITDA of ~ 20.

Its definitely interesting to see the savings on interests...Hope WealthWizard come out with all this on Part 2..

2016-09-25 20:57

I can't beat them, so I join the ride, disappointed with the politics, now working hard to earn more, so hope to have more choice where to stay in old age.

2016-09-25 21:38

WealthWizard said will focus on debts and balance sheet on ekovest, guess he will guide us to look deeply what's inside of ekovest, very much look forward for part 2

2016-09-25 21:41

B7 Group Borrowings (Cont’d)

GROUP

AMOUNT REPAYABLE

AFTER ONE YEAR

CURRENT

QUARTER ENDED

30 JUNE 2016

PRECEDING

YEAR ENDED

30 JUNE 2015

RM ‘000 RM ‘000

Bank Term Loans-secured 148,390 136,810

Islamic medium term notes 1,739,405 1,685,359

1,887,795 1,822,169

2016-09-25 22:08

Very heavy indebted company. Everywhere in i3 said debts are bad. Why can be good in Ekovest? No wonder dividend so low.

2016-09-25 22:09

some questions on your valuation, hope you can help to clarify

1. the 20 times referred to in the article was 20 times EV/EBITDA. but your calculation was 20 times EBIT, which is inconsistent. yes EBITDA should be even higher than EBIT, but EV includes debt which Kesturi has quite a bit. so I think it's misleading just using 20 times EBIT and conclude that it is still undervalued

2.I'm not sure if assuming Duke 2 revenue and costs will be equal as Duke 1 is realistic. Duke 1 is 18km, Duke 2 has 2 links (9km and 7km) so toll rates may not be equal to Duke 1. but then again we all have our limitations in projecting these figures

3. personally I think interest cost probably will increase once Duke 2 is completed. this is because accounting rules allow them to capitalise the Duke 2 interest while it is being constructed. so the interest we see in P/L could be just interest related to Duke 1. Once Duke 2 is completed and revenue starts flowing in, the interest for Duke 2 will be recognised in P/L. 4.875% seems a bit low, Litrak's MTN effective interest is about 6.1% p.a. Ekovest 2014 is also around there

2016-09-25 22:11

Interest expense RM 94,785,000. Can go bankrupt if EPF cancel purchase like what happen in Silk Highway.

2016-09-25 22:12

confuse, most of their debts are linked to their highways so it's self-financing by itself. have you seen any highways that make losses in Malaysia?

2016-09-25 22:13

when government awarded Ekovest Duke Phase 2, they extend the whole concession for Duke 1&2 by 30 years. it's good for Ekovest but why do we have such idiotic government? why extend the Duke 1 concession, unless you tell me Duke 2 is toll-free so to compensate them but Duke 2 is going to have its own toll plaza so just why? government simply go all out to reward cronies and highways are the most obvious and blatant one

2016-09-25 22:16

Why not EPF buy Silk Highway which is far cheaper?

http://www.thestar.com.my/business/business-news/2016/09/24/wz-satu-aborts-plan-to-buy-silk-highway/

2016-09-25 22:19

ekovest is definitely for long term if full value is to be realised because earnings will take time to come in. the only major risk in the long term I think is political, if one day BN falls (maybe not next election but future ones), just look at how Puncak fare after Selangor fell to Pakatan and Pakatan government decides not to honour unfair contracts awarded previously

2016-09-25 22:29

@confuse, not sure by what you mean as cheap. silk expires at 2037, Duke expires at freaking 2069 so absolute value of Duke definitely will be more expensive than Silk

2016-09-25 22:34

Guys, use the above EBIT and assume a dividend payout ratio of say 40%. Use the long term growth rate of 8% which I see is possible PURELY from the Toll rate hike (3% per annum) and Vehicles utilization rise (5% annum),meaning you don't even need to reinvest from the EBIT - the 60% retention can be taken as safety.

Then, determine its should be Price to EBIT with WACC of 10%.

The P/E deserved is 21.6.

2016-09-25 22:40

2.825 billion/368 million= 7.7 can buy 7.7 Silk highway for 1 Duke. Duke 1-34 years concession. Silk-36 years concession. Why EPF fund manager so dumb?

2016-09-25 22:50

EPF already paid for Duke? If WZ Satu can cancel Silk Highway purchase why not EPF?

http://www.thestar.com.my/business/business-news/2016/09/24/wz-satu-aborts-plan-to-buy-silk-highway/

2016-09-25 23:00

Why no answer? Why not EPF buy Silk highway and not Duke?

Posted by confuse > Sep 25, 2016 10:50 PM | Report Abuse

2.825 billion/368 million= 7.7 can buy 7.7 Silk highway for 1 Duke. Duke 1-34 years concession. Silk-36 years concession. Why EPF fund manager so dumb?

http://www.thestar.com.my/business/business-news/2016/09/24/ekovest-addresses-critics-on-highway-sale/

http://www.thestar.com.my/business/business-news/2016/09/24/wz-satu-aborts-plan-to-buy-silk-highway/

2016-09-25 23:20

Posted by Icon8 > Sep 25, 2016 11:00 PM | Report Abuse

EPF already paid for Duke? If WZ Satu can cancel Silk Highway purchase why not EPF?

http://www.thestar.com.my/business/business-news/2016/09/24/wz-satu-aborts-plan-to-buy-silk-highway/

please go n check how much wzsatu has la~~ can they afford another 260m debt? EPF? they got billions... nak buy many cincin also no problem

2016-09-25 23:21

Lousy highway give you 100 also no use lah. Then you would also ask why it buy senai dreary tht lousy highway! Downgraded one! More cheap!

2016-09-25 23:21

If EPF buy wrong company my retirement dividend will be affected sure I concern unless you don't have EPF money.

2016-09-25 23:22

Icon8, good questions, please call EPF tomorrow to tell them what should they do, better buy Silk, much cheaper.

Also, please tell them don't play play with your retirement fund, you are very concerned now.

2016-09-26 00:54

Icon8, I agreed with your statement on Silk is cheaper now, please go ahead to buy silk, wish you good luck.

In case you don't know, please write down the following:

full name is SILK HOLDINGS BERHAD.

the counter code is 5078

2016-09-26 00:57

Confuse, my next article will answer your question about high debts, please stay tune. Thank you.

2016-09-26 01:33

Duke concession is no longer 34 years, it has been extended for another 20+10 years up to 2069 when Duke 2 was awarded

2016-09-26 08:28

paperplane2016 chill, seems like your comments quite fiery these few days. it's ok sometimes for others to have different opinions, whether right or wrong. no need to get angry because of them

2016-09-26 08:31

EKOVEST: Net Debt Ratio=20% & Net Cash Per Shares=RM1.01 (after 40% sale in Kesturi) (Part 2)

http://klse.i3investor.com/blogs/wealth123/105048.jsp

2016-09-26 09:05

Construction outfit Ekovest Bhd expects to surpass the RM1 billion revenue mark by its financial year ending December 31 next year, driven by strong outstanding order book of RM5.3 billion.

Other than that, Lim said, the group was pre-qualified for the Light Rail Transit Line Three and Mass Rapid Transit Line Two.

http://klse.i3investor.com/blogs/moneymoney/105124.jsp

2016-09-26 12:42

fellow sifu, would you mind to explain how actually concession business works? In layman, they get loan from banks, build the highway then collect toll? that simple? how long usually they need to break-even and start to make money? Sorry for asking newbie questions here :)

2016-09-27 02:24

Don't believe everything the IB says! Out to get your money to buy high.

Why didn't promote before, only now?

2016-09-27 04:35

I am not promoting, I am just sharing. I started to look into Ekovest when EPF offer RM1.13 bil to buy 40% in Kesturi, the owner & operator of Duke 1 & 2.

2016-10-05 23:51

WealthWizard

No, orderbook cover = total outstanding order book divided by latest year's revenue derived from construction division.

2016-09-24 23:20