(Icon) Berjaya Corp (5) - BJ Corp : No Muscle, No Brain (Trying To Grow One) Calvin on Icon weakness

calvintaneng

Publish date: Thu, 29 Dec 2016, 01:38 AM

(Icon) Berjaya Corp (5) - BJ Corp : No Muscle, No Brain (Trying To Grow One)Author: Icon8888 | Publish date: Tue, 9 Aug 2016, 02:47 PM

1. Introduction

In my previous article, I complained that BJ Land has a lot of assets, but failed to generate meaningful profit (Plenty of Muscles, No Brain).

My study of BJ Corp showed that the group is even worse. It is not only unprofitable, but also does not have much surplus assets as well. Hence the title for this article "No Muscle, No Brain".

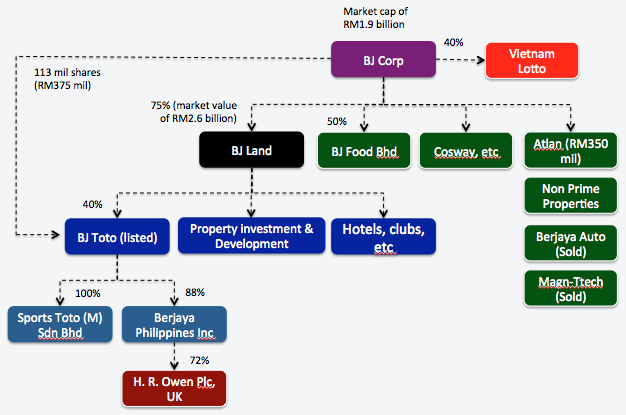

2. Group Structure

BJ Corp's core asset is its 75% equity interest in BJ Land. Please refer to diagram below for details.

The group also owns 40% equity interest in Vietnam lotto operation.

3. Historical Profitability

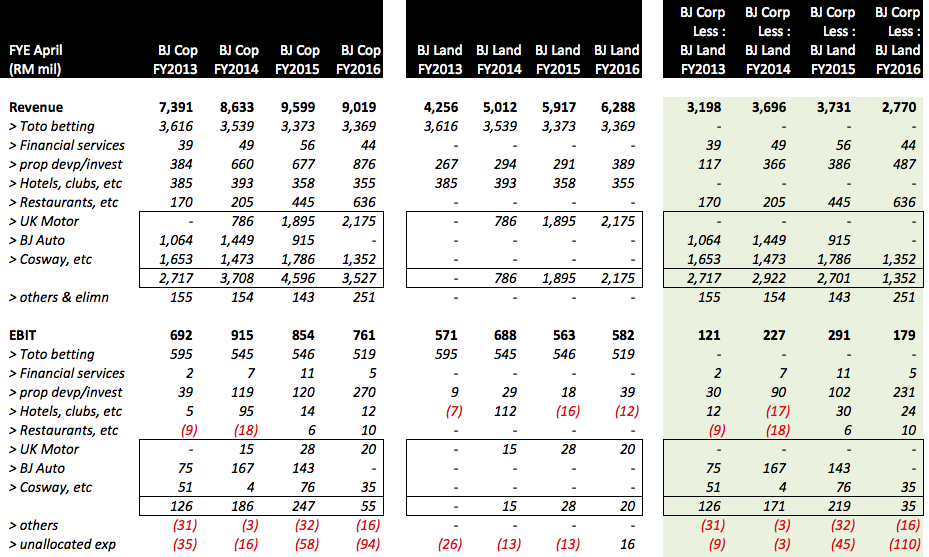

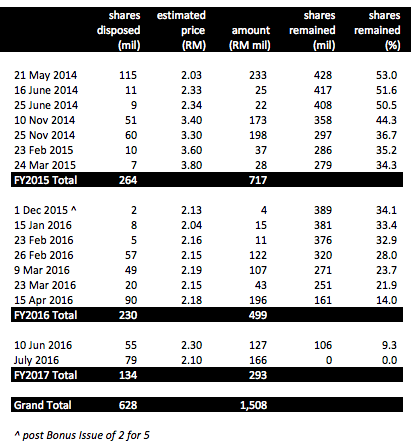

Key observations :-

(a) In the quarterly reports, the Company group its consumer business under one item, "Marketing of Consumer Products and Sevices".

To provide better insight, I break it down to its respective three major components of (i) UK Luxury Motor Dealing (H. R. Owen housed under Berjaya Sports Toto), (ii) Mazda cars distribution under Berjaya Auto and (iii) Cosway, which sells consumer household items.

(b) After removing contribution by BJ Land Group, BJ Corp's own businesses generated revenue of more than RM3 billion per annum. BJ Auto and Cosway were the biggest contributors, accounted for approximately RM1.5 billion each. BJ Food and property development contributed another RM500 mil each.

(c) Cosway had huge revenue. However, it is a low margin business and hence not very profitable. In FY2015, Cosway generated PBT of RM21 mil only. In FY2014, it incurred a loss before tax of RM60 mil.

(d) Berjaya Auto was the star performer. Listed on Bursa Malaysia, the group generated net profit of approximately RM200 mil per annum. BJ Corp owns 50% of BJ Auto, so its share of the profit was approximately RM100 mil per annum.

Annual Result:

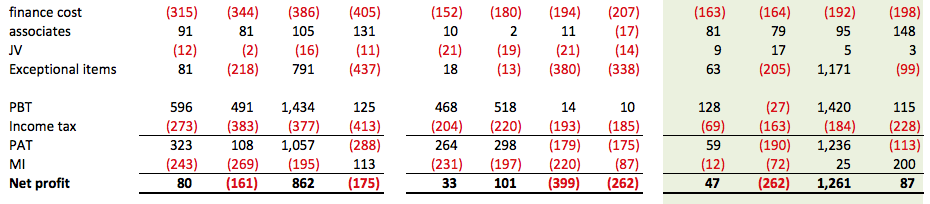

Unfortunately, all these have become a thing of the past. During the period from May 2014 until July 2016, BJ Corp cashed out of its entire 50% stake in BJ Auto through open market disposal (and partially through a Buyout by BJ Auto's Management Team). The disposals brought in RM1.51 billion cash (transaction PER of 15 times).

The details of the disposals are as set out below :-

(e) Due to high gearing, the group needs to service high interest expenses every year. In FY2016, total interest expenses was RM405 mil, out of which RM207 mil belonged to BJ Land Group. This means that every year, BJ Corp group's own operations is repsonsible for servicing interest expenses amounting to approximately RM198 mil. In FY2016, the Group generated EBIT of approximately RM179 mil (please refer to P&L table above). However, after hefty interest expenses and unallocated corporate expenses, there is not much left for shareholders.

(f) Going foward, things are going to get even tougher (from P&L point of view). The complete disposal of BJ Auto will result in disappearance of NET PROFIT of RM100 mil per annum. Unless Vietnam's lotto operation can start contributing in a meaningful way, the group will have a hard time staying in the black.

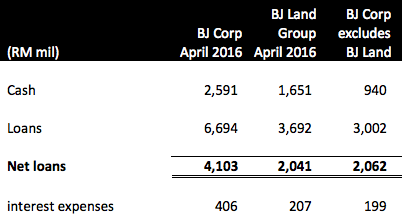

4. Gearing

As at April 2016, the BJ Corp Group has loans of RM6.69 billion, out of which RM3.69 billion is at BJ Land level. As such, its actual loans are RM3 billion.

BJ Corp (excludes BJ Land Group) has cash of RM940 million. As such, net loans are approximately RM2.06 billion.

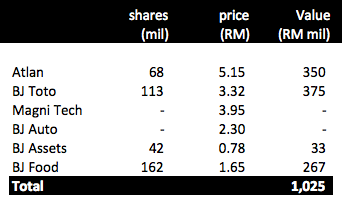

The group holds closed to RM1 billion quoted securities. How much of them will be disposed in the future to help pare down borrowings ?

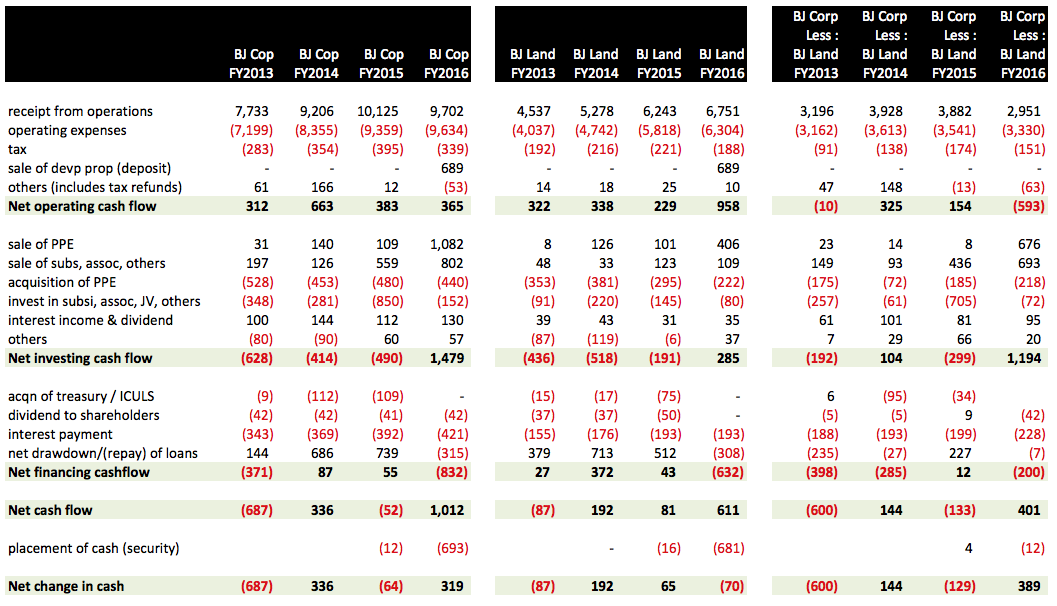

5. Cash Flow

Key observations :-

(a) In FYE April 2014, BJ Corp (excludes BJ Land group)'s net operating cash flow was quite robust at RM325 mil. That was mostly due to contribution by BJ Auto. However, following the gradual disposal of BJ Auto beginning November 2014 (Q3 of FY2015), net operating cashflow has declined substantially (deconsolidated).

(b) In FY2016, they group disposed of a lot of assets, which brought in closed to RM1.4 billion cash.

(c) Every year, the group has to service interest payment of closed to RM200 mil.

(d) Overall, the group's cash flow is quite tight. Further assets disposal is required to pare down borrowings.

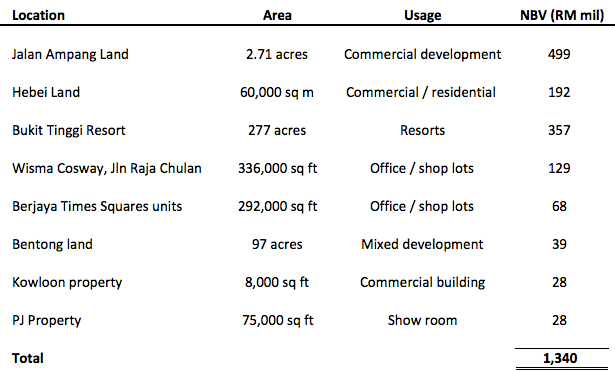

6. Property Assets

Unlike BJ Land, BJ Corp does not have many valuable property assets.

Key obersvations :-

(a) Jalan Ampang Land

This development project comprises Menara Bangkok Bank and Ritz Carlton Residence. Menara Bangkok Bank has already been completed while Ritz Carlton is closed to completion.

(b) Bukit Tinggi Resorts

This property has Net Book Value of RM357 mil. However, I believe the actual realisable value is much lower. The Bukit TInggi Resorts is not profitable. From yield point of view, I believe at most it is worth half of its Net Book Value.

(c) Investment Properties Wisma Cosway, various floors at Berjaya Time Square and commercial property in Hong Kong are collectively worthed RM225 mil. However, these few properties are quite old already. Furthermore, they are mostly tenanted by BJ Corp and subsidiaries. The Group can't really sell them to unlock value.

7. Concluding Remarks

(a) I think not many people will disagree with me if I say that the BJ Corp group has weak fundamentals.

Its auto distribution business (BJ Auto) generated more than RM200 mil net profit per annum. However, over the years, the group chose to hive it off gradually through IPO (at a very cheap price, on hindsight) and open market disposals.

This is not the first time they did something like that. In the early 2000s, they also disposed of their Hyundai car distribution business, a profitable entity, to Sime Darby.

Why can't they be a little bit more commited ? Instead of spreading their resources all over the place, why can't they stay focus and nurture several core businesses into industry leaders ? I believe this lack of focus is one of the major weaknesses of Berjaya Corp and is responsible for their mediocre performance all these years.

(b) Will the Group ever change for the better ? I believe it is possible.

Tan Sri Vincent Tan ("VT") is not young anymore. The time has arrived for him to pass on the baton to his successors.

VT is famous for his ability to manage borrowings. Despite high gearing, BJ Corp has been able to survive one economic crisis after another. But the same cannot be said of his successors.

To ensure that the Group can continue to survive after his passing from the scene, the most logical thing would be to clean up the group by disposing of non core assets and pare down borrowings.

I believe this is already happening. Over the past two years, the group has disposed of more than RM2 billion worth of assets. The benefit has already shown up clearly in BJ Land Group, which saw its net borrowings dropped to only RM1.15 billion, a relatively small amount for a group with more than RM10 billion assets.

(c) The BJ Corp Group (excludes BJ Land) still has a long way to go. Its net borrowings are quite high at RM2.1 billion. The only bright spot is its Vietnam lotto operation. Launched in July 2016, it seemed that the business has already begun "kicking asses", giving the existing operators a run for their money. http://m.english.vietnamnet.vn/fms/business/161750/the-us-3-billion-game-in-the-lottery-market.html

Having said so, it is still early days. I believe it will easily take another two to three years before Vietnam's lotto operation can start making material contribution to Group bottomline (the group targets full roll out within a period of 5 years).

In the meantime, investors had to contend with lack of core earnings and high interest expenses of more than RM200 mil per annum.

Patience is required. |

||||||||||||||||||||||||||

Calvin comments on Icon8888 weakness in understanding NTA & Asset Value of Bj Corp (also very slip short careless work)

This has been brought up to Icon several times to rectify his careless mistake and overlooking the TRUE VALUE OF BJ CORP

Now please go to Bj Corp Annual Report

Scroll down to Properties Owned by Bj Corp

These are omitted by Icon

1) KM 48, Persimpangan Bertingkat Lebuhraya Karak, 28750 Bukit Tinggi, Bentong Pahang Darul Makmur

Leasehold: 13,737.12 acres (Land held for development N/A 1990 - 1997) RM286,532,000

Bj Corp owns 13,737 ACRES OF PRIME LANDS IN BUKIT TINGGI.

What is the value of Bukit Tinggi Land currently?

Let's SEE

|

NEW |

|

|

| This river which is adjoining the subject property is a major attraction of this land as the water is clean and the river is wide (about 15-20 feet) and is a nice place for the tire soul to unwind. With this kind of water source, there are many thing an owner can do with the land. Coupled with the fact that the air here is cleaner and cooler and the view is unobstructed on one side of the river, one can definately use it as a weekend retreat with friends and relatives. There is a very small waterfall which is partly hidden in the right side of this photo. Access to the land is through motorcycle and 4-wheel drive. |

As advertise you can SEE that asking price of 2.1 acres of Bukit Tinggi land is Rm950,000

Assuming the price is knocked down to RM400,000 per acre

Bj Corp's 13,737 acres would be worth

13,737 x 400,000 = RM5,494,800,000

That's almost Rm5.5 Billions! Just One Piece of BJ CORP'S VALUABLE ASSETS

can settle all debts!

And with KL to Pahang Railway Passing Through Bukit Tinggi the land prices can only go up!

So BJ CORP Do Have Muscle & Have Brain.

Who has no muscle and no brain? Guess?

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Jul 24, 2024

Created by calvintaneng | Jul 15, 2024

Created by calvintaneng | Jul 12, 2024

Created by calvintaneng | Jul 10, 2024

Discussions

Calvin I have been to Bukit Tinggi resort many times,, there are not many visitors there

The resort is not profitable.

I don't value properties based on Comparison Merhod, I value based on Yield Method. Namely, Market Value is Net Cash Flow divided by expected yield of let's say, 6%. I think at best Bukit Tinggi can generate net cash flow of RM30 mil per annum. Based on that, market value is at best RM500 mil, not RM5.5 billion

2016-12-29 06:04

Now let's talk about Comparison method.

I believes the figure of RM950,000 for 2.1 acres of land near Bukit Tinggi quoted by you is correct. I believe you didn't lie (this round).

I am a big fan of agriculture land, especially near Bentong and Raub, which is near Bukit Tinggi. So I am very familiar with land near those areas.

It is not impossible for land to be valued at more than RM500,000 per acre if there is a river runs through it. This is because it has aquaculture or tourism potential. However, this kind of valuation is applicable to small size of few acres. Once size get big, valuation will drop substantially. I know this because that was what happens to oil palm estates. Planted estates can fetch more than RM200,000 per acre. However, if you check Bursa announced transaction, most matured estates sold at most at RM65,000 per Hectare, or RM27,000 per acre.

Once land size becomes big (like Bukit Tinggi), the value will drop substantially. Drop to how low ? It will drop to a level based on Yield Method as mentioned above (RM500 mil).

Based on 13,737 acres, price per acre will be RM36,000.

Now that makes more sense

2016-12-29 06:19

I am surprised that I need to explain all these things to you. I thought you are a property agent ? Maybe you have no experience in transacting big parcel of land, so you don't know how it works.

This kind of ignorance is very dangerous. It causes you to loss money one stock after another.

2016-12-29 06:23

BJ Corp has a lot of minority interest. Icon sifu, have you minus out the minority interest when calculating the asset value?

2016-12-29 07:45

Calvin surely know how many pieces if plank wood to build it's Chicken shelters.

For land it's visual very bad la, how a chicken See things at night ?

It shud sleep and dream on like eagle free style flying in the sky.

Kikiki

2016-12-29 08:24

Kikiki

If he smart like icon, he will not loss 64% in 2016

He give 100 stock, only 3 go up. The rest go holland. RIP Calvin

2016-12-29 08:26

I dont know wanna cry or laugh for this Calvin Tan Sochai

Here you Go:

BJ CORP THEME SONG

Lyrics Written by Calvin Tan

Music Adapted from FIRST OF MAY By Bee Gees

BERJAYA CORP THEME SONG

1) Oh BJ Corp I bought it for a song;

The Mighty stock that someday will perform.

Don't ask me why;

Don't let it pass you by.

To make money you all must be strong.

2) Star Buck Coffee;

Papa John Pizza too.

Mazda Champion CX5 I drive;

Redtone telco, Atlan and Magni Tech.

Businesses that will last for ever.

3) The Companies

That grew for you and me.

I watch them growing richer one by one.

And I will keep BJ Corp all the way;

This is Asia's Berkshire Hathaway.

2016-12-29 08:54

i think calvin is thinking of some new topic to change to as he has nothing to refute icon

2016-12-29 08:55

HAHAHA

What a joke!

After I told Icon to rectify his error on Bj Corp twice he didn't response.

Now that I posted a correct version he quickly come to his defense 3 times!

See now Icon admitted that Bukit Tunggu lands worth at least Rm500 million!

So book value is Rm286 million

At Rm500 million means the lands are worth 40% more?

How come Icon call this a small matter.

If you are the boss & your accountant omitted this half billion Rm asset and call it insignificant what should you do? You got to reprimand him mah!

Remember the lands are 13,737 Acres!

For comparison look at Bandar Malaysia (Sungei Besi Old Airport)

It has 495 acres. Bkt Tinggi is 26 times more! That's the size of 26 small airports! How could Icon omit these?

To be continued....

2016-12-29 08:55

Here you Go:

BJ CORP THEME SONG

Lyrics Written by Calvin Tan

Music Adapted from FIRST OF MAY By Bee Gees

BERJAYA CORP THEME SONG

1) Oh BJ Corp I bought it for a song;

The Mighty stock that someday will perform.

Don't ask me why;

Don't let it pass you by.

To make money you all must be strong.

2) Star Buck Coffee;

Papa John Pizza too.

Mazda Champion CX5 I drive;

Redtone telco, Atlan and Magni Tech.

Businesses that will last for ever.

3) The Companies

That grew for you and me.

I watch them growing richer one by one.

And I will keep BJ Corp all the way;

This is Asia's Berkshire Hathaway.

And the music by Bee Gees First of May

https://www.youtube.com/watch?v=dvr2n9q8t3I

2016-12-29 09:03

It's not a fair comparison to compare lands of Bukit Tinggi to the lands of Bandar Malaysia (Sungei Besi Old Airport). Compare land size, bukit tinggi lands sure win. I think Sabah and Sarawak also have a lot of lands. But we are talking about value (per acre) now as well as how far and how high it can go in both short and long term future...

2016-12-29 09:43

Bandar Malaysia is valued at Rm25 million an acre

Bkt Tinggi at Rm400K an acre is fair or less than Rm10 psf

http://www.thestar.com.my/business/business-news/2016/01/02/bandar-malaysia-a-boost-for-iwh-listing/

2016-12-29 09:54

sxhxi calvin, comparing bdr msia with bkt tinggi. calvin got mental problem la.

2016-12-29 10:08

calvin

I knew BJ was bad....didn't know it is that bad.

few Malaysian wants to buy any BJ shares and they are right.....so maybe, can con con Singaporean only.

2016-12-29 10:12

Hahaha!

All don't know anything about NTA (NET TANGIBLE ASSET)!

All are chasing hot air balloon stocks & neglect deep value investing

WHY WAS KULIM TAKEN PRIVATE?

ANSWER:

FOR ITS PRECIOUS LAND BANKS!!

WHY WAS TMAKMUR TAKEN PRIVATE?

AGAIN THE ANSWER IS

FOR ITS PRECIOUS LAND BANKS!

AND WHY WAS THE STORE TAKEN PRIVATE

SAME ANSWER LAH! DUMMY!

FOR ITS PRECIOUS UNDERVALUE ASSETS & LANDS!!

ALL PLEASE WAKE UP!!!

CALVIN MADE 147% JUST BY BUYING INTO VALUE!!!

2016-12-29 10:24

stockmanmy calvin

get back to BJ.....

only can con con Singaporean

29/12/2016 10:26

I think I agree with OTB that you are really a fake accountant!

2016-12-29 10:36

Raider still remember helping my boss to complete the sale of Bukit Tinggi Bungalow land at Rm 50 psf....but of course this are converted land loh..!!

But this is 15 yrs ago mah...!!

Raider think price of converted land at Bkt Tinggi should be around Rm 80 psf loh...!!

Thus raw land in Bkt Tinggi around Rm 400k per acre should be palatable loh....!!

2016-12-29 10:43

calvin

I no fake accountant, but I hate fake thank yous.

at least Calvin got no fake thank yous.

2016-12-29 11:02

Good, Stockraider has given a fair comment.

Now how much is Rm400,000 acre if per sg ft

Divide Rm400,000 by 43,560 sq ft = Rm9.12 psf

Only less than Rm10 psf with roads leading up to Colmar Resort Hotel Resort in Bkt Tinggi is actually very cheap!

Now future train from Kl to Kuantan will pass through Bkt Tinggi.

Sure it will be a nice cool hill resort to stay if every morning can commute to Kl by train for work.

In Hong Kong hill lands like The Peak command premium prices.

So the long term fundamental of Bj Corp is very very positive!

2016-12-29 11:05

BJ Group has been around for a long time. One has to ask over the years has minority shareholders benefited from the management of this company (also major shareholder)? Has the management changed for the better or still the same?

2016-12-29 11:54

Hi Calvintaneng, what your TP for BJCorp. Can share with us? Did you have any Telegram/Whatapps group that we can follow? Thanks.

2016-12-30 12:54

stockraider Raider still remember helping my boss to complete the sale of Bukit Tinggi Bungalow land at Rm 50 psf....but of course this are converted land loh..!!

But this is 15 yrs ago mah...!!

Raider think price of converted land at Bkt Tinggi should be around Rm 80 psf loh...!!

Thus raw land in Bkt Tinggi around Rm 400k per acre should be palatable loh....!!

29/12/2016 10:43

I JUST NOTICED GREAT RAIDER SOLD ONE PIECE OF LAND IN BKT TINGGI FOR HIS BOSS?

BOSS IS WHO?

DR> NEOH SOON KEAN

2017-10-01 19:09

Land will only appreciate over time in fact it's the only thing in the world that guarantee appreciations, Nta will just grow. Buying bjcorp is like buying its land. Even the management does nothing or doesn't know how to make money, the downside is very very limited.

If profit is what drives the market value to surge, the assets is what protecting it from diving down

2017-10-01 21:11

i got many, keep few years already...hope ur rubbish talk can push it up

2017-10-01 23:13

Vincent Tan loves to bull-shit & he has influenced his family to do so too, now his influence has reached out to one of his distant relatives.

That guy trumpet BJCorp everyday in i3.

2017-10-01 23:18

Posted by godhand > Oct 1, 2017 09:11 PM | Report Abuse

Land will only appreciate over time in fact it's the only thing in the world that guarantee appreciations, Nta will just grow. Buying bjcorp is like buying its land. Even the management does nothing or doesn't know how to make money, the downside is very very limited.

If profit is what drives the market value to surge, the assets is what protecting it from diving down

CALVIN THINKS THIS IS THE SMARTEST POST TODAY

KUDOS!!!

2017-10-01 23:19

Calvin Tan, why delete your own porfolio? Shame on it?

http://klse.i3investor.com/servlets/pfs/71329.jsp

Ranked 206 over 230, one better than the bottom 10%, if I were you I will do the same, no worry

http://klse.i3investor.com/blogs/ibot/134053.jsp

206) calvintaneng +7.2% 107150.01 http://klse.i3investor.com/servlets/pfs/71329.jsp

27% DUTALND 0.590 0.400 49800|21% PBA 1.260+0.0225 1.150 17300|19% BJCORP 0.345 0.340 58600|18% OPCOM 0.550+0.02 0.600 33200|15% BPURI 0.355 0.435 45800 (106969.25:180.76|237.24)

2017-10-02 10:32

Portfolio?

Got over 150 lah

These 5 will be good for

this year

next year

and 5 years later

For Bj Corp

it is a hold for "forever"

WAKAKAKA!!

2017-10-02 10:38

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥

BCORP

16.12.2016 29 SEN

7.3.2024 30 SEN

2024-03-07 15:58

calvintaneng

Haha!

Just 3 of Calvin's stocks taken private in year 2016 already made

60% from Kulim (SEE KULIM THREAD http://klse.i3investor.com/servlets/stk/chart/2003.jsp)

50% from TheStore SEE http://klse.i3investor.com/servlets/stk/5711.jsp

37% from TMakmur (See http://klse.i3investor.com/servlets/stk/5251.jsp

So just these 3 made

147% PROFIT FOR CALVIN THIS YEAR OF 2016

YAHOOOOOOOOOO!!!!!!!!

2016-12-29 01:55