(CHOIVO CAPITAL) Fund Update - We now have a credit facility.

Choivo Capital

Publish date: Sat, 24 Nov 2018, 01:18 AM

Dear Investors and IOU Holders,

Unlike my usual extremely long letters. This one will be relatively short as it is a brief update on some of the changes I’m making to the fund.

Previously, I’ve stated that zero leverage will be used. However, I’ve recently signed up for credit facilities of XX with Maybank Investment Bank. This is roughly 27.8% of the current fund size of XX.

Now, make no mistake, there are very good arguments for one to maintain a zero-leverage policy. There is a saying I particularly like from Charlie Munger.

“There is only 3 ways for a smart person to go broke. Ladies, liquor and leverage.”

However, having thought about it very deeply for the last few months, I’ve finally decided to go through with the process (you should read my flip-flopping text messages with my extremely patient remisier).

There are a few reasons for it, and I’ll elaborate about them in full. Before we continue, here are some salient details. Please consider it as an official update and communication.

Overview

Current CDS Account: XX

Pledged CDS Account: XX

Portfolio Value of CDS Account: XX

Portfolio Value of Pledge CDS Account: XX

A certain number of shares with a value of XX have been transferred to the Pledged CDS Account to obtain the credit facility of XX. Interest is 4.95%.

So why did I apply for credit facilities for the fund? There are a few reasons.

- To take advantage of the current fall in prices for equities.

As many of you may be aware, equities globally have seen a sell off, with many markets showing drops of more than 20%. Putting us officially in bear market territory.

The KLSE market, or more specifically the “BURSA MALAYSIA MIDS CAP INDEX” (which consist of companies listed in the BURSA with Market Capitalisation of RM200m to RM2bil and is roughly 84% of our portfolio) have fallen from 17,338.5 to 13,063, or 24.65%.

Meanwhile, the portfolio on a fund unit basis have only fallen by 12.6%. This is an outperformance of 12.05%. Those of you who have purchased additional fund units during the year would likely have obtained better returns on an internal rate of return (IRR) basis.

So, what does this all mean?

This means a fantastic insurance company that is growing at roughly 6% percent per year is only selling for 6 times current year earnings or 16.67% earning yield.

A wonderful petrol retailing, and refinery company is selling for only 5 times of its highly depressed current year earnings or 20% yield.

Profitable and dividend giving steel manufacturing companies selling for less than the net cash value or working capital. Buy the cash in their bank accounts, along with some inventory. The factory, land and everything else give you for free!

Property development companies selling at 70% discount to its book value or 5 times earnings. Why buy houses at 15% off, when you can buy them at 70% off!

In many of these cases, we can buy shares in these businesses at prices far below the cost of setting them up! And they also possess wonderful economic moats, which takes ingenuity, blood, sweat and tears to develop. All of which we are now getting for free!!

And I think having credit facilities ready would allow us to get more aggressive as prices potentially fall further and thus lowering our investment risk.

- Why not raise funds from current/new investors instead of getting credit?

The reason is twofold. As I’ve always said, in this fund, the safety of your capital comes first and foremost. I would rather lose clients than to lose clients’ money. This is doubly true for our IOU holders.

I’ve previously indicated that I would not accept principal guaranteed funds beyond 50% of my equity. And this is something that is ironclad. Because I believe this is the only way I can ensure my ability to pay back the money invested and the trust given no matter how bad things get. With the guaranteed principals currently quite close to that limit, headroom for further fund raising is limited.

The second reason is that, despite the lock period and the penalties that are in place in the event of an early withdrawal. This is not something I intend to enforce except for the direst of situations. At the end of the day, this fund is mainly a test run, and you’re all close friends or family.

As you may have noticed, I’ve added significant funds in the last month or so to take advantage of the cheap equity prices. It was around that moment, when I realized that I was all in and would not be able to fulfil any sudden withdrawals (like the one that has taken place this year) without selling stock that is extremely cheap. This is not a situation I would want to be in, or have the fund be in.

By utilising the credit facility, I would be able to keep significant savings to meet any sudden withdrawals without affecting the fund.

Having said that, I would not recommend selling your fund units at the current time and prices. I’m always more than happy to buy out anyone here. But it’s not my goal in life to benefit financially from the misfortune or the temporary suspension of intelligence from my friends, family and partners.

- Done correctly and conservatively, leverage can be good.

For many here, you may know someone who has lost a lot of money or gone bankrupt in the 1999 Asian Financial Crisis, or the 2008 Financial Crisis.

Personally, my grandfather bought shares using borrowed money near the peak just before the 1999 Asian Financial Crisis. During the crisis, he lost roughly one hill worth of rubber plantation to pay back the loans.

Decades of hard work gone over a moment of stupidity and greed.

Most people in the stock market use borrowed money very aggressively, especially since investment banks allow you to borrow roughly 300% of your capital. For example, our fund of XX, would be able to obtain credit facilities of XX if we wanted to.

However, if one did so, it would only be a matter of time before one goes bankrupt. At 300% debt to equity ratio, the values of one’s stock only needs to fall 30% before you lose it all.

And in times of crisis, the market can fall by 50-60%. We would go from having XX to owing the bank XX.

Even Berkshire Hathaway, one of the greatest and most financially stable company in the world fell by 50%. Google fell from USD346 to USD 155. Imagine being forced to sell it then, and then still owe the bank. Google today is almost USD1,068, even after the 18% drop recently.

Never forget the 6-foot-tall man who drowned crossing the stream that was 5 feet deep on average. In investing and in life, it’s not sufficient to survive on average. We must also survive on the bad days.

The real danger about margin finance is not just because its borrowed money, but because if certain conditions are met, the bank can force you to sell equities at prices you do not want sell.

However, if done correctly and conservatively, it can function just like a typical loan, with no possibility of forced selling.

With that in mind, I’ve decided that credit of roughly 30%-50% would be very conservative, especially with markets already down 25%.

So how does it work?

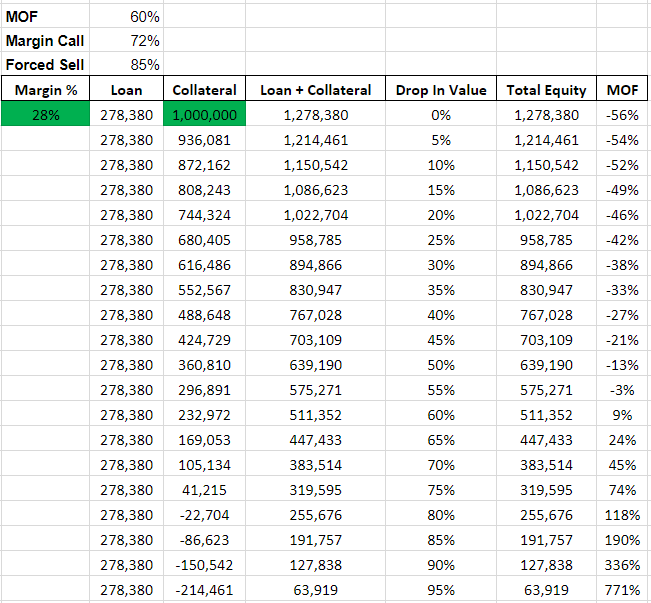

When borrowing money, the investment banks have this rule called a “Margin of Finance” (“MOF”) rule. MOF is basically the net borrowings over the portfolio value. Don’t worry about understanding it for now, I will provide you a table you can see and play with if you wish.

In our case, Maybank Investment Bank would borrow us money up to 60% MOF.

Margin Call is at 72% MOF, where they will request for top up.

Forced selling is at 85% MOF, when the bank will sell your stock for you, regardless of the price, because at 100% MOF, you would have lost it all, and the banks want their money to be safe.

For our more curious IOU holders and investors, below is a link.

https://docs.google.com/spreadsheets/d/1RbxBuvY3h70giCbJPwN6P7tY_MnIyyBSY0XXUgGGMXI/edit?usp=sharing

Based on the table above, our loan of XX starts us off at a very comfortable NEGATIVE 56% MOF.

The markets will need to fall an additional 75% from the current 24.6% drop, before the fund will need to meet any cash calls.

And in the event the 75% drop does happen, a deposit of just XX will bring us back to safety. Which I am very confident of meeting given the ample savings I have.

Incidentally, when Warren Buffet had his own fund or partnership. He too used credit facilities of roughly 35%.

What does a 75% drop mean for us in terms of stock prices?

It means, you can now buy property development companies that pay out dividends of effectively 24% per year at roughly 90-95% discount to revalued book value.

It means that the petrol retailer and refinery company is now selling at 1.5 times earnings or 66.7% earnings yield.

Being long term stock buyers, very few things would be better for us than such incredibly low price.

I would be taking out the special bottle of whiskey (and selling to buy more stocks!) , for any purchases then is virtually guaranteed to make a profit. The profit is earned the moment a bargain is bought, we just must count it later.

Having said that, the nature of borrowings, not matter how small, still results in the probability of bankruptcy going from zero to non-zero. But having considered things very carefully, those are odds I’m willing to take.

- Will this result in any additional charges to the fund?

In short, yes. However, it will be very minor.

Our current transaction cost is: RM8 or 0.09% whichever higher. Plus 0.1% stamp duty and 0.03% in clearing fees.

Purchases in the pledged account is: RM12 or 0.38% whichever is higher. Plus 0.1% stamp duty and 0.03% in clearing fees.

As I tend to buy in small numbers when topping up, we are likely to incur only the additional RM4 per transaction. Which considering my past buying or selling history, works out to RM8-RM12 extra per month.

In addition, the investment bank also charges RM2 to collect dividends on our behalf. Which is also why I’ve only transferred out biggest 5 holdings to the account. No point spending money that can be saved.

However, one of the benefits of a nominees account, is the ability for the bank to help us in in participating in any corporate exercises such as subscribing for right issues etc for a nominal fee of RM10 plus cost. These exercises are usually quite tedious and require a lot of form filling, stamp buying, driving around, going to the post office and making sure the company secretary gets everything.

There is also 0.5% stamp duty on the credit facility obtained along with RM10 for each company’s shares transferred. But these are refundable.

The only cost here is the RM60 charged to the fund for the opening of the account.

And in exchange for all this, we now have RM70,000 at 4.95% that we can use to purchase companies yielding 16-20%. Pretty decent deal.

Conclusion

Our more perceptive investors or IOU holders, would have noticed and wondered why not all the stock is transferred.

The reason is simple. At the end of the day, the safety of your capital is paramount. The XX is roughly 140% of the total third-party funds. I believe this provides an adequate buffer.

Also, we would be saving roughly RM60 a year in dividend collection cost, plus any additional RM4 transaction incurred in the event I sell anything. That is at the very minimum 12 plates of garlic chicken rice at Sunway!!

In addition, as your fund manager, I don’t think I will be using the full facility unless truly fantastic opportunities occur. For a day to day basis, only 50% or XX will be used. In the event it exceeds this amount, I’m likely to pay it back down via my own deposits.

There is also likely to be a change in the report presented whenever a new deposit is placed. But I promise it will be clear, concise and easy to understand.

As always, if you have any questions, just call or text me.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

bad market use margin meh? uptrend only use margin ma....low can go lower woh...

2018-11-24 08:56

Lol. 5k fee hehe...

Revised: we need more commission, give us more money to give u fd rate return

2018-11-24 09:17

It is correct to use margin financing in bad market in order to capture the opportunity.

Using margin in bull market means buying more stocks at its peak price and that guarantee downfall.

2018-11-24 09:39

I differentiate bear market into "small bear" and "big bear". Small bear means market down by >20% but less than 50%. Big bear means market down by >50% just like 1997/8 and 2008 crisis.

In big bear market, investor better sell every stocks and run even making a loss because there are a lot more to fall and the bear period will be long.

In small bear market, investor should accumulate undervalued stocks to capture opportunity and wait for better days ahead.

2018-11-24 09:43

I think what happens now is small bear. Hope I am right..

Many analysts and economics also think we will not be in recession in coming one year. Hope they are right..

2018-11-24 09:45

Very impressive Jon Choivo. You can manage your full time auditor job dabbling in the markets everyday?

2018-11-24 10:05

only use margin fund after market crash like early 1999 and end of

2008 and early 2009 but only person with experience and patient and no itchy finger,i already standby coupled of millions from maybank ready for next market crash (don`t kown when,akan datang)

2018-11-24 10:18

Jon Choivo sifu can you elaborate name of the stocks referred? Is it SP Setia for property? Petrol retailer should be either HRC or Petron true? As for HRC so margin financing behind drop from RM 19?

It means, you can now buy property development companies that pay out dividends of effectively 24% per year at roughly 90-95% discount to revalued book value.

It means that the petrol retailer and refinery company is now selling at 1.5 times earnings or 66.7% earnings yield.

2018-11-24 10:21

hopefully market not like end 2000 to 2003,dripping slowly but big CRASH!!!

2018-11-24 10:23

haha....newbie...

Posted by value88 > Nov 24, 2018 09:39 AM | Report Abuse

It is correct to use margin financing in bad market in order to capture the opportunity.

Using margin in bull market means buying more stocks at its peak price and that guarantee downfall.

2018-11-24 10:26

If i were jon i will buy more airasia....jon is this what u r going to do?

2018-11-24 10:46

At one time jon asked me to lend him money so that he can buy more airasia...i scared so i no reply pretending never see his message...

I no scare airasia no up but i scare airasia up but jon never pay me back only

2018-11-24 10:49

Jon Choivo Maybank margin financing rate is 4.95%? How fast can get approval?

2018-11-24 10:53

lizi..actually value88 and choi is perfectly correct

"It is correct to use margin financing in bad market in order to capture the opportunity.

Using margin in bull market means buying more stocks at its peak price and that guarantee downfall."

want to make some real money , want to make a name for yourself, must take some risk.....better still focus and sailang and margin at times....some more, margin during a hot market no use one.....sooner or later lose back every thing plus interest......margin at times like this, can keep the winnings.

2018-11-24 10:54

when losing money

must double down

that is what all great men do

including Baring Brothers

including Najib and 1 MDB....

including Warren the Buffalo.

lose become prisoners., win become emperors.

fair.

2018-11-24 11:10

qqq3 I thought you support KC Chong no margin financing method why here said different thing?

Posted by qqq3 > Nov 24, 2018 11:00 AM | Report Abuse

Life is a gamble

Have guns will travel

the winners become emperors.

2018-11-24 11:15

u make me laugh only....because the reality is the direct opposite.

newbie4444 > Nov 24, 2018 11:15 AM | Report Abuse

qqq3 I thought you support KC Chong no margin financing method why here said different thing?

2018-11-24 11:19

qqq, so far i have been very successful in sailang using margin during uptrend...same like doing business, u must know when to attack and when to defend...have some business sense plz.

2018-11-24 12:51

"There is simply no telling how far stocks can fall in a short period. Even if your borrowings are small and your positions aren't immediately threatened by the plunging market, your mind may well become rattled by scary headlines and breathless commentary."

But for a levelheaded investor who's not deep in debt during a market crash, there are "extraordinary opportunities," Buffett added.

In an interview with CNBC on Monday, Buffett suggested that greed was a primary driver of margin debt.

"Borrowing money is a way of trying to get rich a little faster, but there are plenty of good ways to get rich slowly," Buffett said. "And - you can - you can have a lot of fun while you're getting rich as well. My partner, Charlie, says that there's only three ways that a smart person can go broke. He says, 'liquor, ladies, and leverage.'"

https://www.google.com.my/amp/s/amp.businessinsider.com/warren-buffett-on-margin-debt-for-stocks-investing-2018-2

2018-11-24 20:46

lizi...then why u post....

Posted by lizi > Nov 24, 2018 10:26 AM | Report Abuse

haha....newbie...

Posted by value88 > Nov 24, 2018 09:39 AM | Report Abuse

It is correct to use margin financing in bad market in order to capture the opportunity.

Using margin in bull market means buying more stocks at its peak price and that guarantee downfall.

2018-11-24 21:30

for new kid on the block, wishing to establish the brand.....of course must be willing to do stuffs others do not do.

willing to hunt at the edges, not just happy to hunt in the middle.....

hunt at the edges where the grass is greener and can grow fat ( like Jho Low).....

2018-11-24 23:56

slowly and slowly finally this joker is reveal himself...as i always said his reason here is just to find a water fish and promote his fund. I wonder how many idiots invested into his fund until the next JJPTR case explode. Haha

2018-11-25 01:46

>>>>Posted by qqq3 > Nov 24, 2018 09:32 PM | Report Abuse

3iii...u worry too much.<<<<

Never. Sleeps very well.

But I am long term .... very very greedy. :-)

2018-11-25 14:03

I'm no longer an auditor.

But oddly, i think i was much more hardworking back in the day when it came to stocks, rather than now, when i have comparatively more time.

I think its mainly because i've already all the annual reports in KLSE. So now, im more focused on expanding/refining my thinking and finding blind spots. Which comes from reading books that are not annual reports, meeting wiser people and living life a little more.

=====

Flintstones Very impressive Jon Choivo. You can manage your full time auditor job dabbling in the markets everyday?

24/11/2018 10:05

2018-11-25 18:22

Haha CharlesT,

As you can see below, its a joke ;) I'm just going to assume things got lost in translation over the internet, instead of any malicious intent.

Having said that, i must thank you for saving me a couple thousand in JAKS-WR by reminding me its an order form. If not for you, i would have only found out potentially a few hours later or even a day after. Which would mean i was unlikely to have been able to sell it all for a small profit.

Allow me to return the favor by answer the Airasia question seriously.

Airasia is currently 2.41% of the fund. And i'm definitely open to increasing it to 5%-7% of the fund. However, this position increase is only after other positions are increased.

Which i should be able to with the financing in place.

The thing about airasia is, its an incredible business that was a pioneer in certain practices in the airline industry, which makes it currently, the airline with the lowest CASK in the industry, currently at 2.02 US Cents Ex-Fuel. This is compared to 2.34 US Cents Ex-Fuel back in 2014.

Given the standard inflationary pressure of about 4% per annum. This is utterly incredible. The last few years, they have maintained it around there.

What are some of the measures they did to get such low CASK?

The main one is when they pioneered the method of buying hundreds of planes upfront over a long period, enabling them to get in some cases 30-50% discounts and the ability to modify the planes to their own specs. They then leased these planes to their affiliate companies across ASEAN.

They bought the planes so cheap, that they can actually make a profit selling it AAC Aviation in the sale and leaseback. Which is almost reminiscent of the deal Sapura did with Seadrill on the floating rigs. Except in this case, Airasia, like Seadrill is getting the good end of the trade.

The sale makes sense for AAC because interest rates in the US is so low and in the reach for yield, airasia can probably give them an IRR of more than 7-10% on the planes, and still make a profit on the sale due to how cheaply they were bought.

I personally have no preference in regards to them holding the planes or not. But i'm leaning slightly to holding the planes.

The problem now for them is, this method of operation, is copied everywhere now, with many players ordering hundreds of planes upfront as well. So for once, AIRASIA will be having very serious competition from the likes of LION AIR etc.

But at a normalized PE of about 6-7 times earnings, and a big dividend coming up. One would argue it is more than priced into the current price of the company.

========

Nov 12, 2018 12:38 PM | Report Abuse

Sneaky jon doubled position at 2.71.

Price go holland mai go holland loh. We can go visit amsterdam smoke some pot.

Go from holland to africa also can. We can go visit lion and eat lion meat burger.

As long as investment thesis don't change, i can buy till 10% of portfolio. But bolui!

Unker, want sponsor my airasia position boh hahaha

========

CharlesT If i were jon i will buy more airasia....jon is this what u r going to do?

24/11/2018 10:46

CharlesT At one time jon asked me to lend him money so that he can buy more airasia...i scared so i no reply pretending never see his message...

I no scare airasia no up but i scare airasia up but jon never pay me back only

24/11/2018 10:49

2018-11-25 18:42

Jon Choivo

You should be spending 80% of your time reading about companies esp the annual reports.

20% of time spend on refining your philosophy and strategy is adequate.

2018-11-25 18:43

You are not wrong. This was something i considered very deeply.

However, as you can see in my reasoning above, i think 30-40% margin is conservative enough.

I intend to constantly pare down the borrowings. When market gets hot, i expect the margin loan to be fully paid off and not utilized.

=====

3iii "There is simply no telling how far stocks can fall in a short period. Even if your borrowings are small and your positions aren't immediately threatened by the plunging market, your mind may well become rattled by scary headlines and breathless commentary."

But for a levelheaded investor who's not deep in debt during a market crash, there are "extraordinary opportunities," Buffett added.

In an interview with CNBC on Monday, Buffett suggested that greed was a primary driver of margin debt.

"Borrowing money is a way of trying to get rich a little faster, but there are plenty of good ways to get rich slowly," Buffett said. "And - you can - you can have a lot of fun while you're getting rich as well. My partner, Charlie, says that there's only three ways that a smart person can go broke. He says, 'liquor, ladies, and leverage.'"

2018-11-25 18:44

I've spent my 80% far ahead of time. Haha

Does not mean i don't read any more. But its more on maintaining the database in brain for KLSE.

If i were to read in bulk again, ill probably start with SGX. Im currently at the letter "C" for it.

But its a more leisurely pace than last time for sure.

===

3iii Jon Choivo

You should be spending 80% of your time reading about companies esp the annual reports.

20% of time spend on refining your philosophy and strategy is adequate.

25/11/2018 18:43

2018-11-25 19:34

Jon, noticed u kept asking ppl to put money in FD and China index.

what's ur intention, really? lol..

2018-11-26 14:41

Haha yeah.

I don't think much explanation is needed. You yourself can observe the demographic and the quality of investors here. Its probably better for them.

I've recently sat down with a friend, whose family owns a brokerage in Malaysia. A quick hint, it has the lowest transaction cost around for cash. And he stated that less than 25% make any money. Those that beat FD, even less.

Even the US market retailers are flowing in bulk to ETF's and Indexes.

China index is also one of the best for the next 10-30 years imho. If you studied a little about human history and why some societies made it, as well as the securities markets there.

====

Fabien Extraordinaire Jon, noticed u kept asking ppl to put money in FD and China index.

what's ur intention, really? lol..

26/11/2018 14:41

2018-11-26 14:52

Dont dare to answer to my comments anymore ah? Joker or should i say Clown Jon Choivo...kakaka

2018-11-30 12:12

CharlesT

No worries, u either make more or lose more only

2018-11-24 07:10