(CHOIVO CAPITAL) A Quantitative Summary of Malaysian Banks (Bench-marked against Singaporean Banks)

Choivo Capital

Publish date: Fri, 06 Mar 2020, 08:34 PM

For a copy with better formatting, go here, its alot easier on the eyes.

A Quantitative Summary of Malaysian Banks (Bench-marked against Singaporean Banks)

========================================================================

Introduction

Well, given the fall in prices for Malaysian Banks recently (much of it due to the two recent rate cuts, expected additional cuts in the future, and foreign fund outflows), i decided to embark on a surface level study of the numbers for all the banks in Malaysia, and to benchmark them against those of the Big 3 in Singapore.

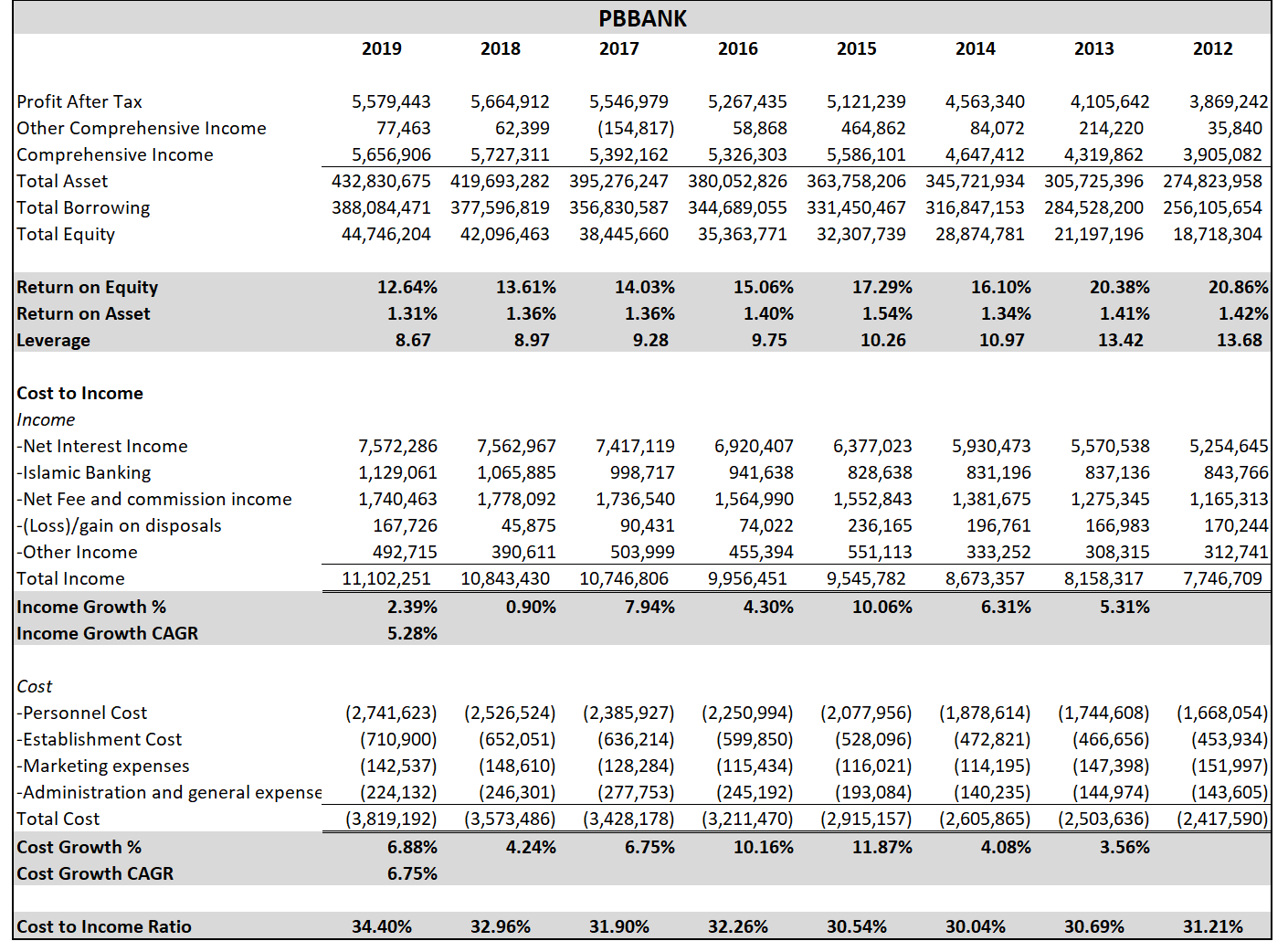

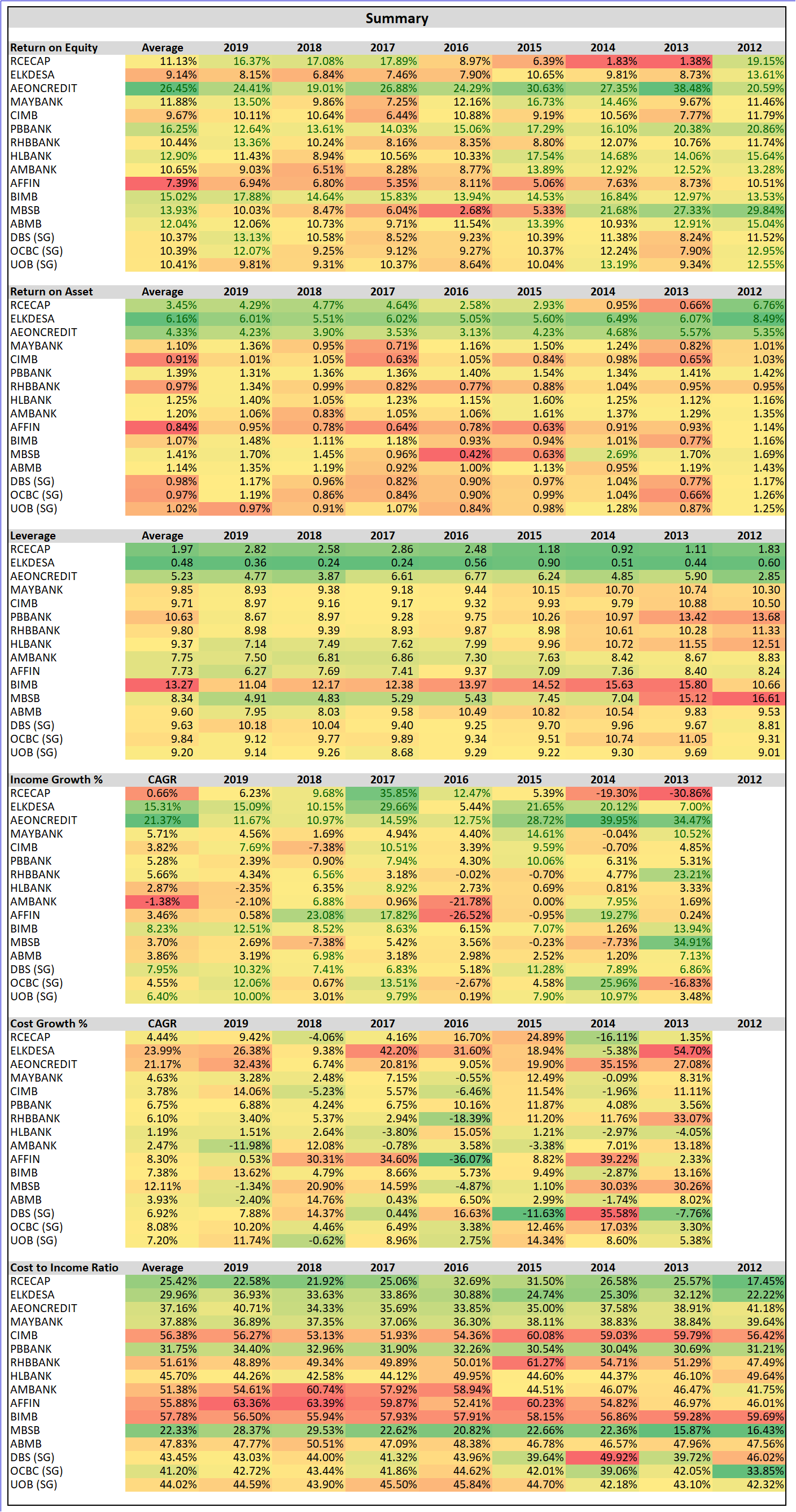

As usual, our Malaysian champion Public Bank hits it out of the park when it comes to Cost to Income Ratio (calculated by dividing the operating expenses by the operating income generated i.e.net interest income, net insurance income plus the other income).

However, that is not the be all end all as you will read in my comments below, Public Bank is currently facing serious challenges.

And as usual, Malaysian Banks and Stocks, are valued much higher when compared against Singapore or South East Asia, mainly due to wanton buying by our sovereign funds.

The Risk Free Rate/ FD Rate in Singapore is 1.6%, while in Malaysia it is at least 3.3% - 3.9% in Malaysia. (Ps, for the highest FD rates, go to MBSB, they actually gave me 4.25% before the rat cut).

Despite this DBS, a very well managed bank is only valued at PE10, which in Malaysia, until recently, most banks sold for far higher than that.

In any event, it was fun doing it, let me know what you guys think.

Summary

Individual Banks

From here, we can see historically, performance of the bank is fairly decent. Cost to Income is largely maintained, which is really good. Profit is maintained despite ongoing deleveraging, mainly from better loan books.

Given the balance of probabilities, i would think the London Biscuit fiasco is a outlier. At the current price of something around 6PE normalized earnings, seems cheap.

In addition, according to an insider in Alliance Bank, they have tightened their credit underwriting across the board since the recent credit loss, which is good for the long term, but also a headwind to loan growth (which i have no problem with).

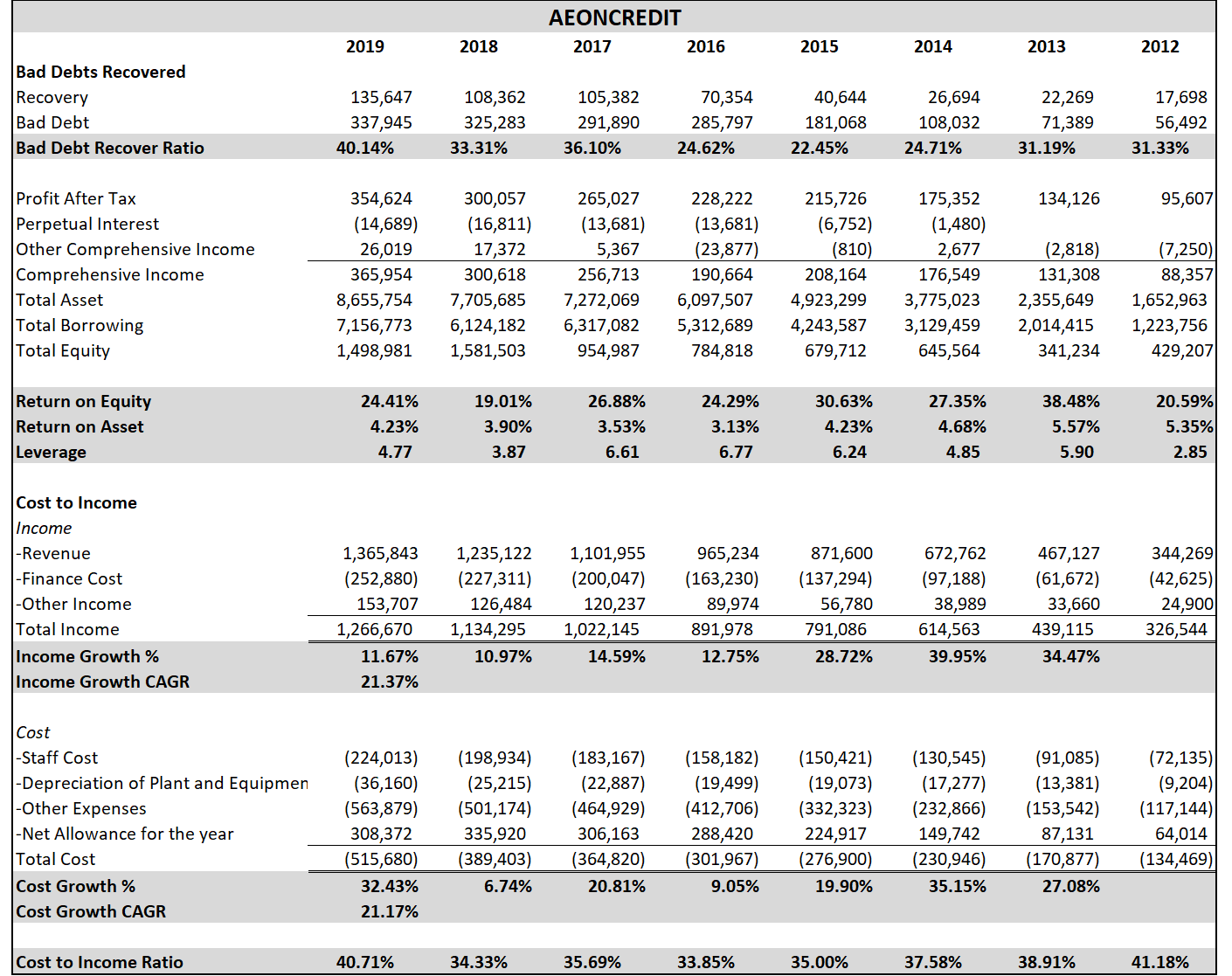

AEON Credit Service (M) Berhad

One of the best performer in this bunch, if not the best. Cost to Income for 2019 shot up from new marketing initiatives to better bundle their products.

Seem particularly attractive as given that the recent fall in share prices from adoption of MFRS 9, which had zero impact on the economics of the business.

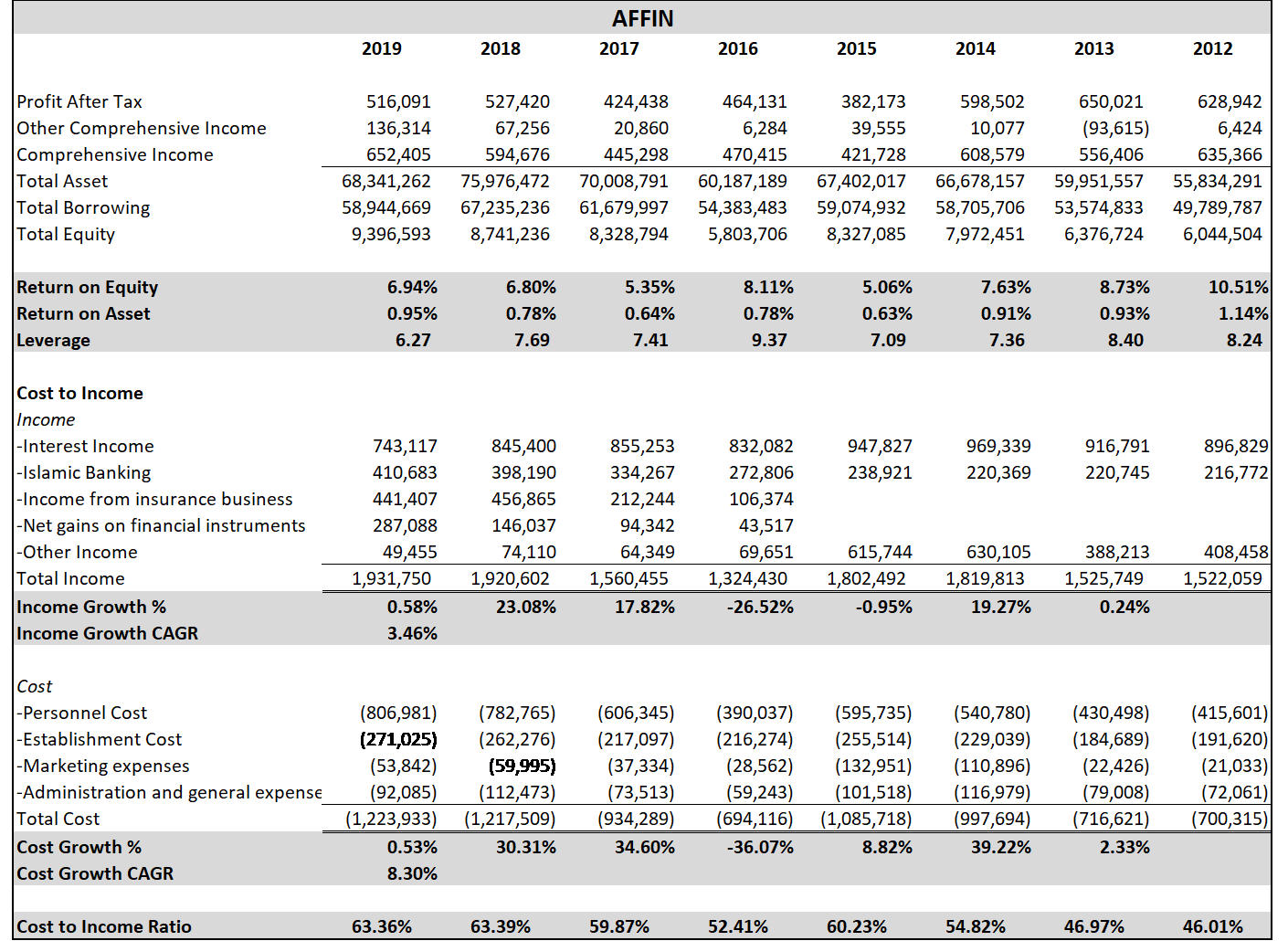

Affin Bank Berhad

Just a shit bank, by far the worst in this group.

If you didn't know this from them building a new HQ worth 15% of their market cap, and more than 1 year's earnings.

The numbers just proved it.

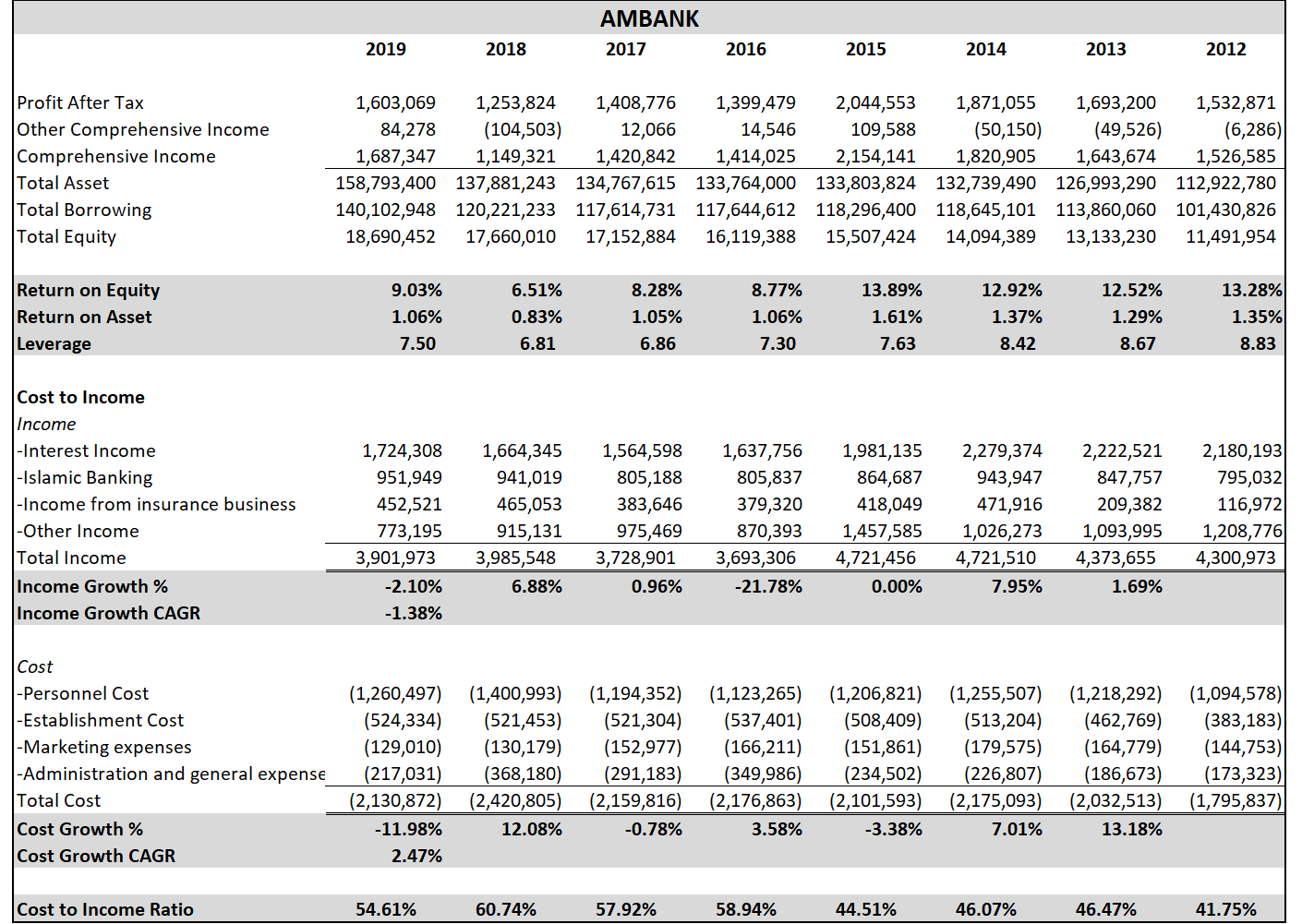

AMMB Holdings Berhad

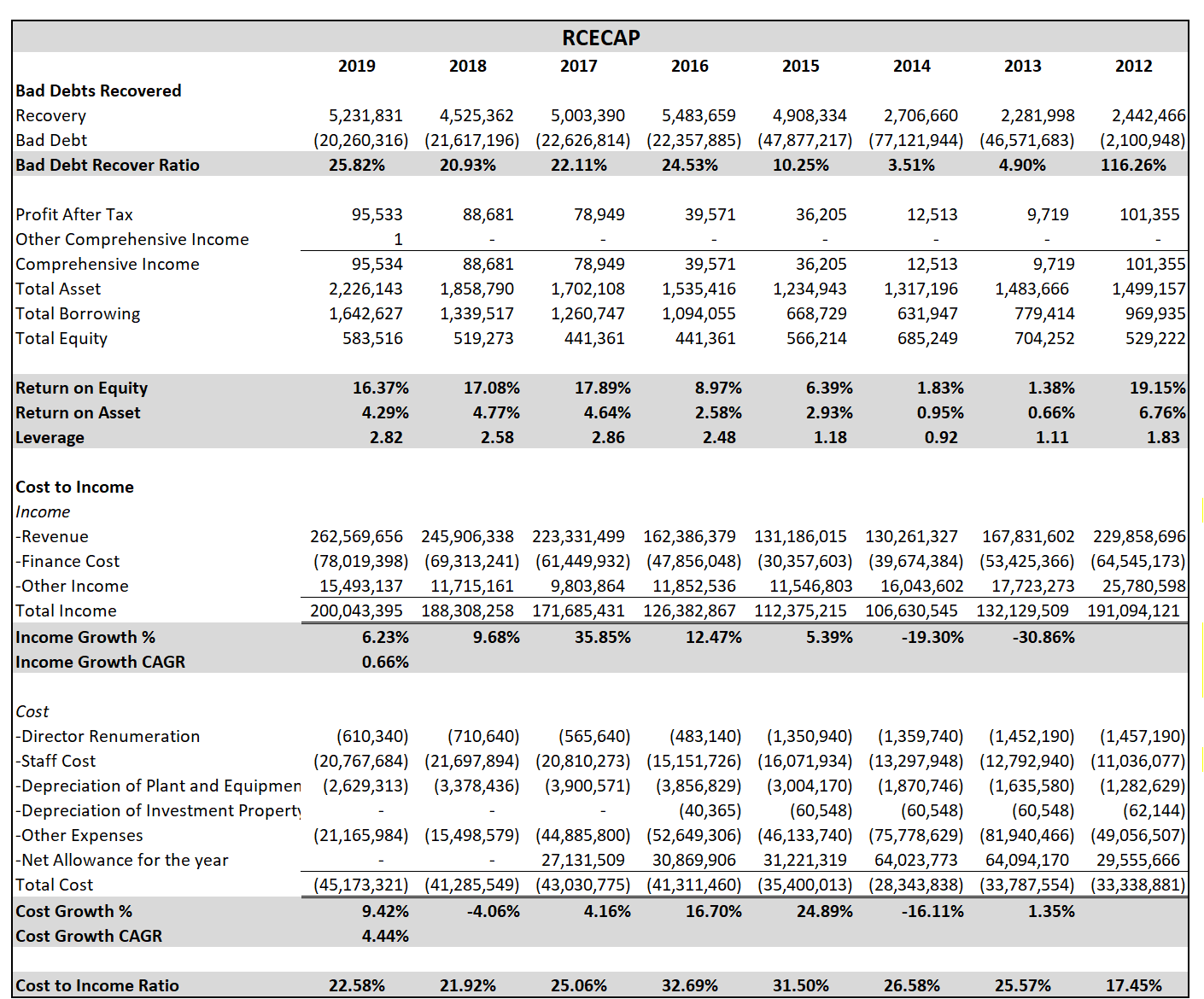

Well, they definitely got beaten down after the 1MDB scandal erupted. Cost to Income ratio is way up. Their little brother RCECAP is doing more than fine though

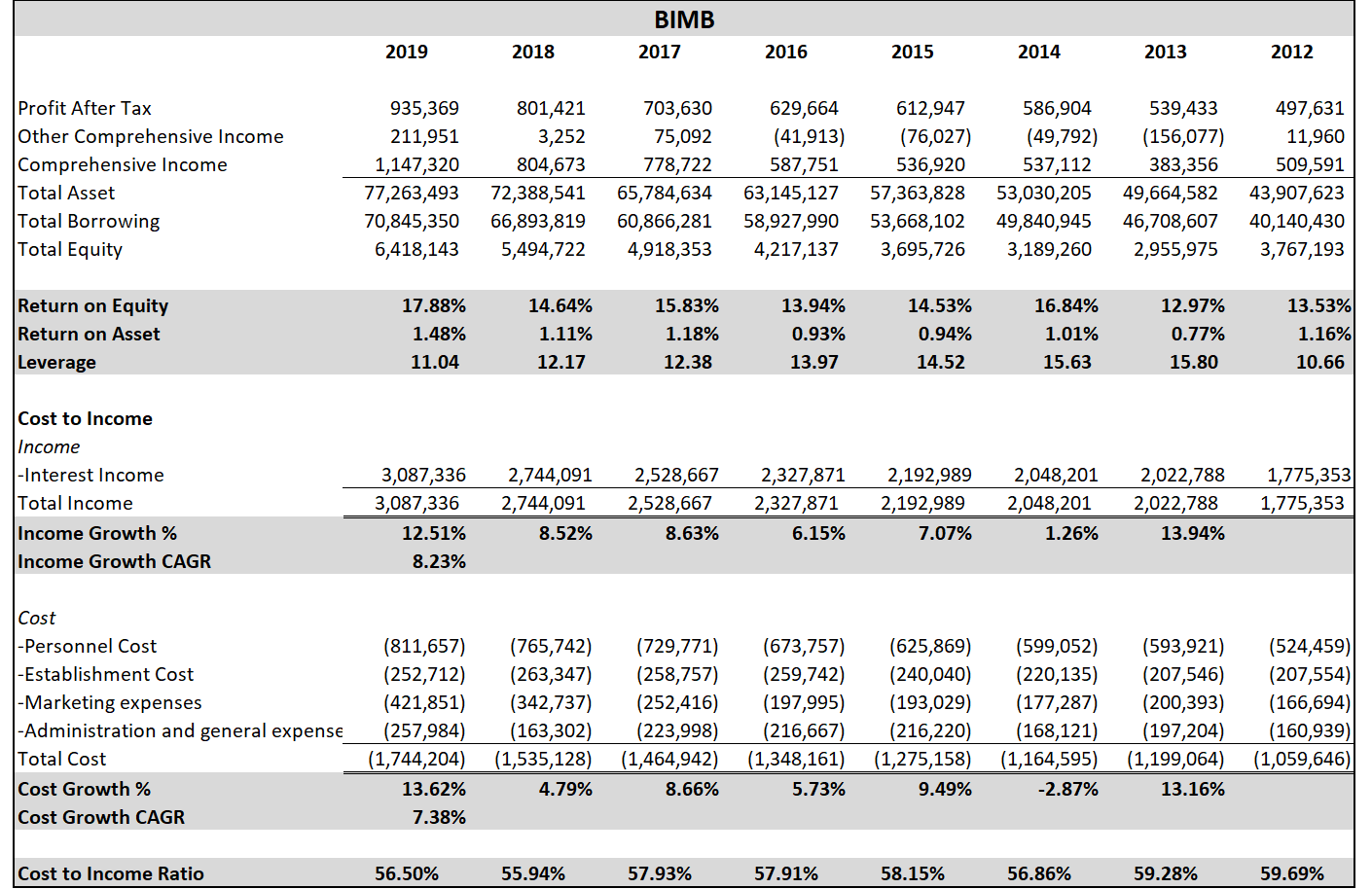

Bank Islam Malaysia Berhad

Highest leveraged bank in Malaysia. They've been trying to reduce this by doing dividend reinvestment schemes. What i find quite interesting, is that their loan book seems fairly good (based off ROA).

Considering this is owned by Tabung Haji, i can't imagine the management being world beaters, as evidenced by their high Cost to Income Ratio.

My guess is that there must be something in the name Islam, that makes people feel like they definitely have to pay back their debts.

Also most GLC's tend to just buy insurance from Takaful. So there's that.

CIMB Group Holdings Bhd

Cost to income ratio seem bad, especially given their size. Reading the annual reports and seeing the numbers, i'm not inspired.

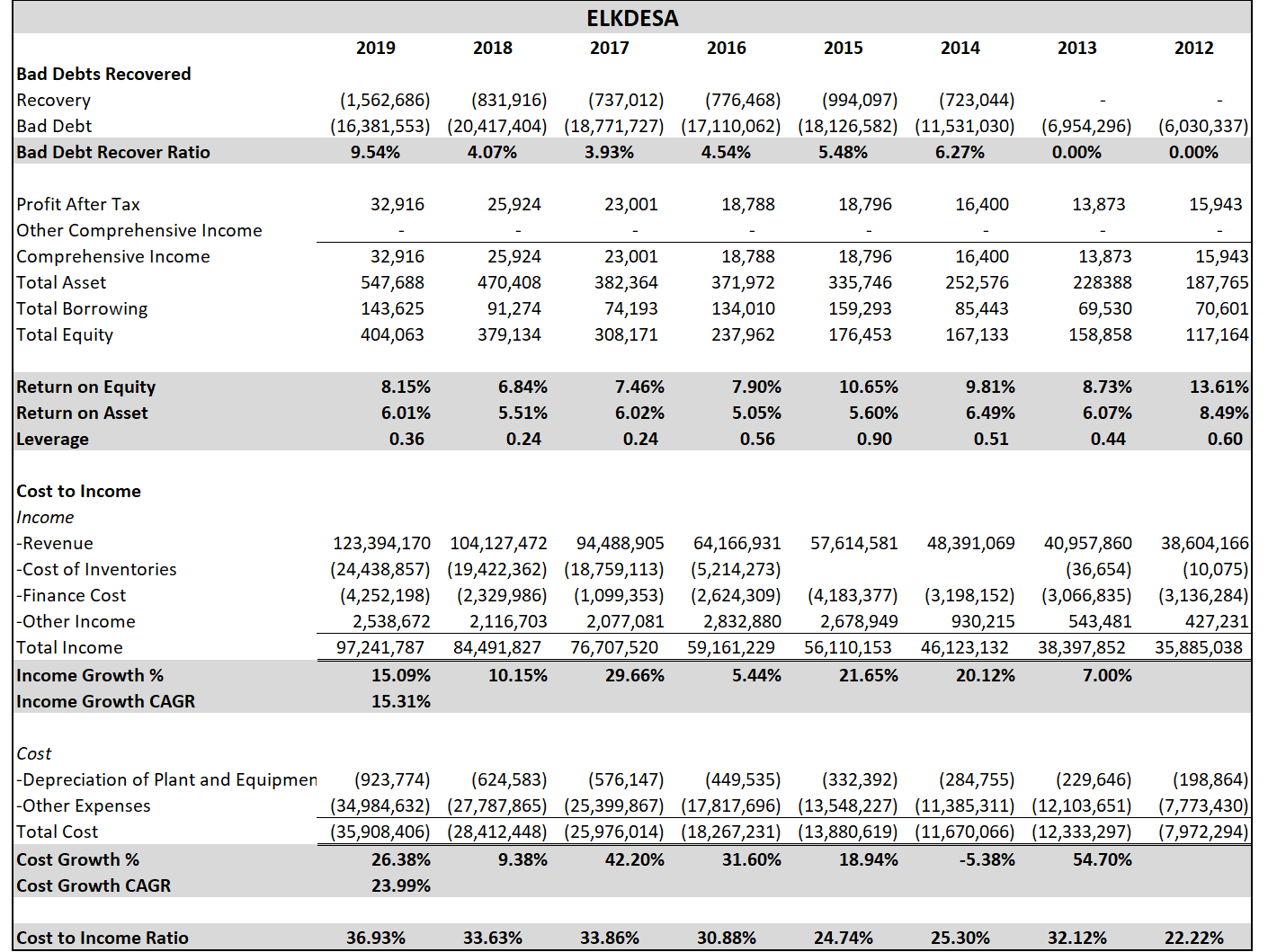

ELK-Desa Resources Berhad

One thing to note, this is not exactly a financial institution, as furniture consist of a relatively large portion of the revenue and cost. So i actually may not make much sense to analyse it this way.

Seems like a weird combination, would prefer them to be separate.

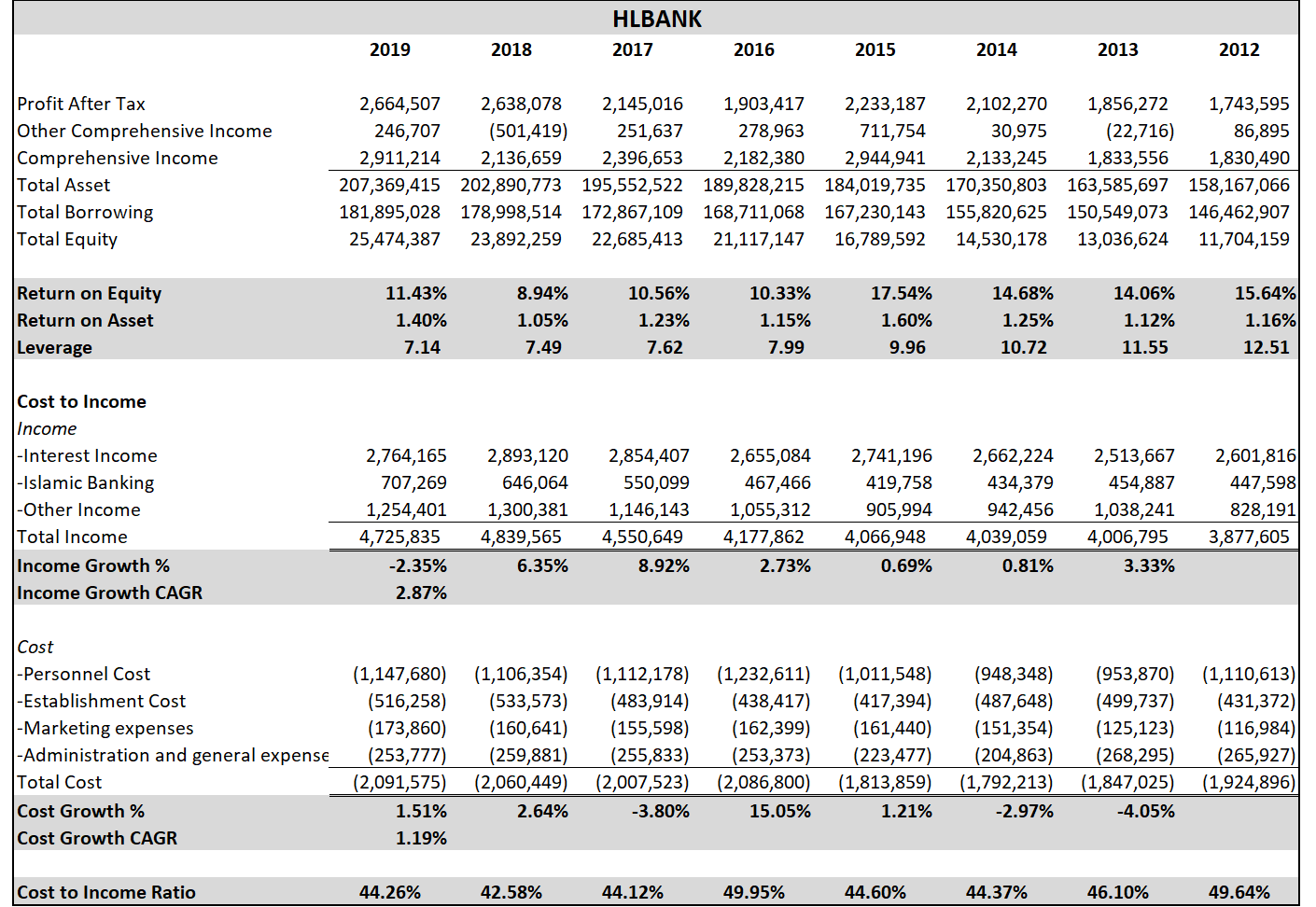

Hong Leong Bank Berhad

Loan book quality is great, as evidenced by their ROA, lowest leveraged bank (not counting MBSB which only just became a bank). Very interesting.

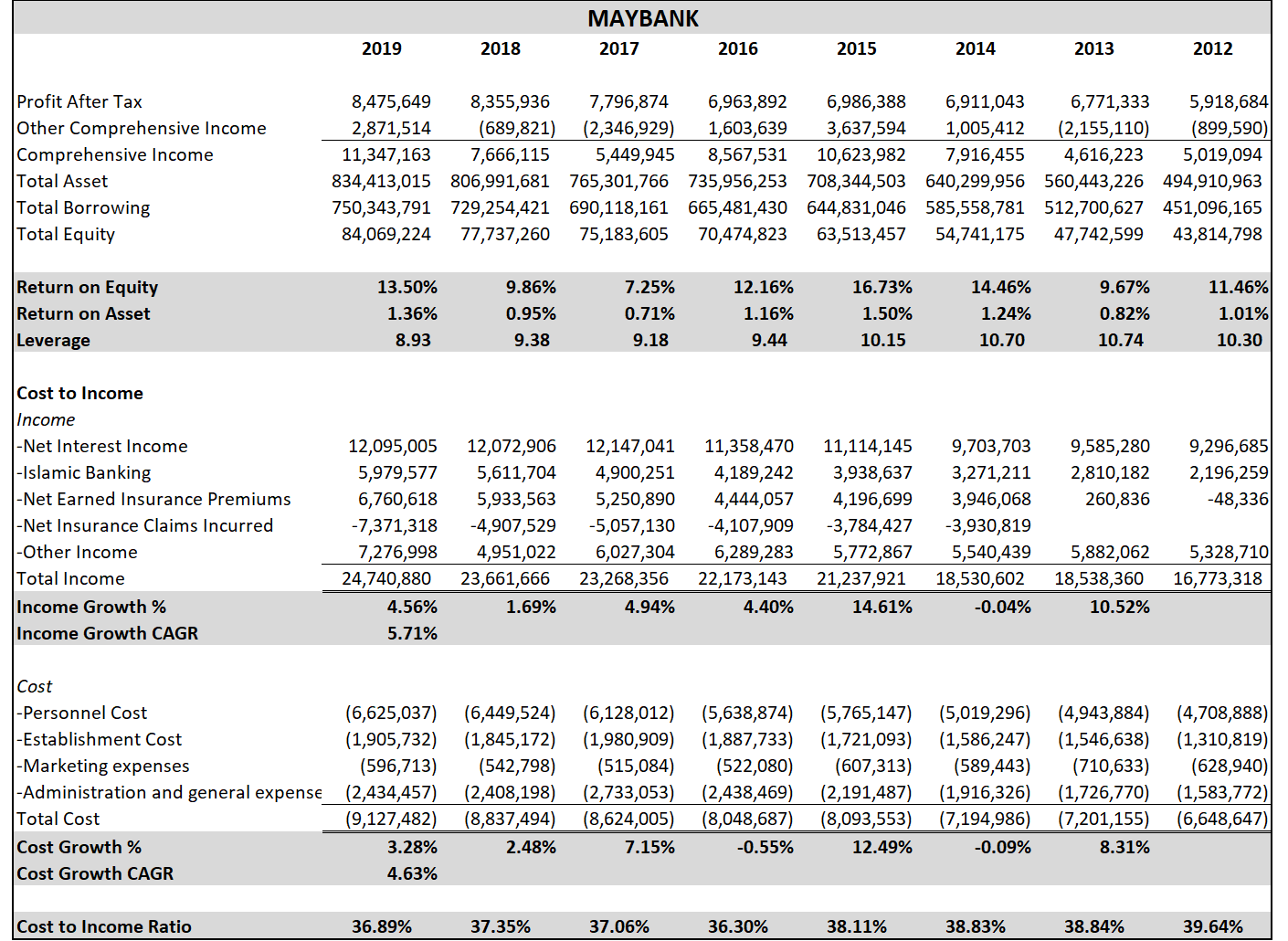

Malayan Banking Berhad

Malaysia Daikor, given the economy of scale, its no surprise they managed to keep/reduce the Cost to Income ratio.

Insurance division growing, but also making less money. Seems ok, but not inspiring.

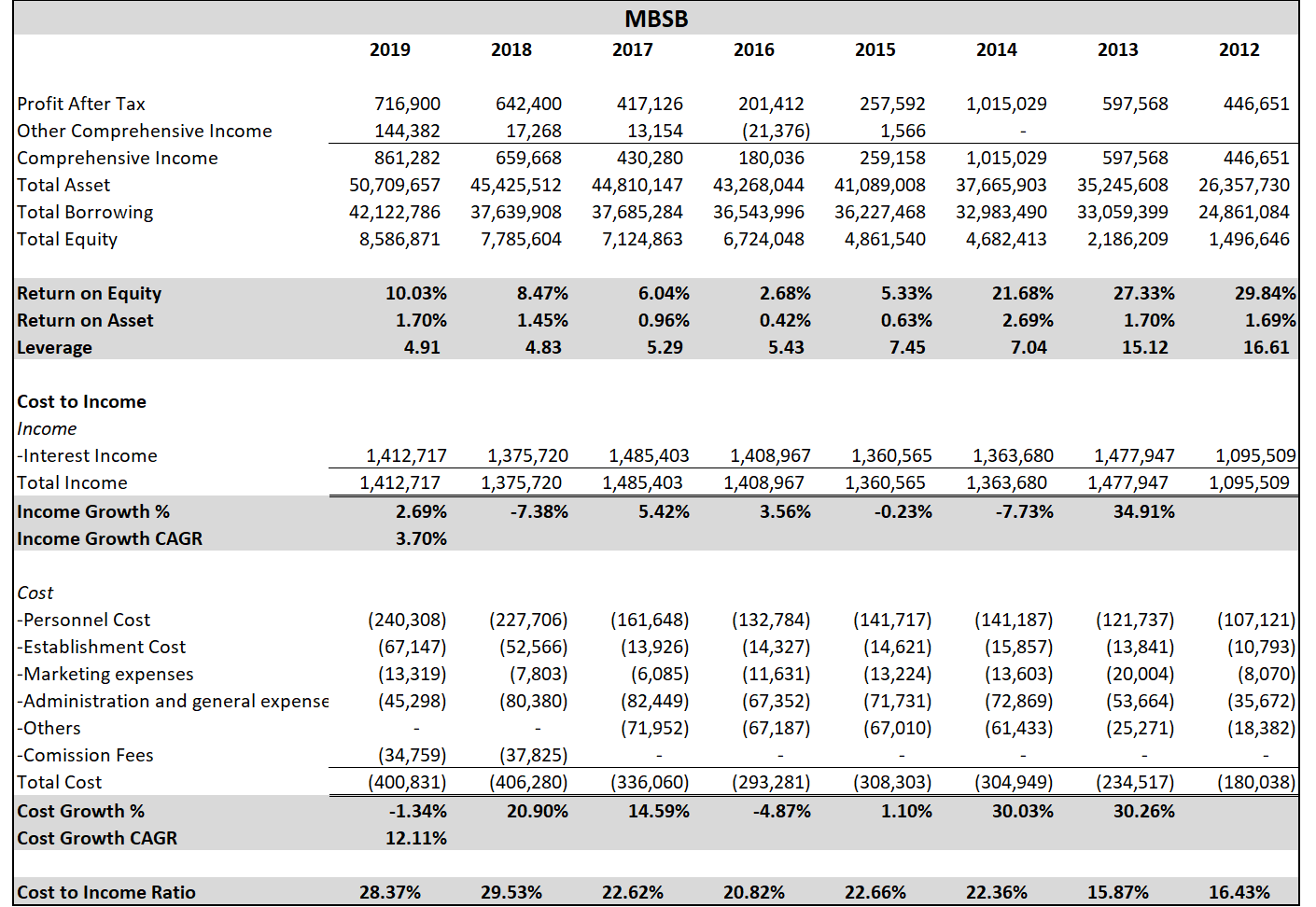

Malaysia Building Society Berhad

Lowest cost to income ratio among all the deposit taking banks. Talk about a surprising result.

I think its mostly from the fact they only just turned into a bank, and quite frankly do not have the same reach as most banks. Which may actually be a good thing.

Still, i would not actually believe their Loan Book quality yet, as the high ROA's in recent year is due to write backs from heavy kitchen sinking in 2016 and 2015.

Public Bank Berhad

Other than MBSB (which i consider an anomaly), Public Bank has the lowest cost to income ratio. No surprises here. But in recent years, this ratio have crept up. This is mainly due to their loan books being primarily housing, which is in the doldrums, resulting in lower revenue growth. Growth in cost however, did not.

Historically, Public Bank have avoided Corporate Banking (except to chinaman companies who don't need the money), which is one of the reasons their profit's are so great.

However, in days when housing/property loan market is drying up, this is biting them in the ass. I have no idea what PBBANK should do, as i would rather avoid corporate banking, other than to really expand into Cambodia and Vietnam.

Now, one would think that its worth it at the current price, but as you can see later when bench-marked against Singapore.

Malaysian banks and stocks are usually overvalued. You can buy DBS for 20% cheaper valuation wise.

RCE Capital Berhad

Quite like this one. As I've written here before.

Lets talk about RCE CAPITAL (RCECAP)

The Black Swan Hidden in RCE CAPITAL (RCECAP)

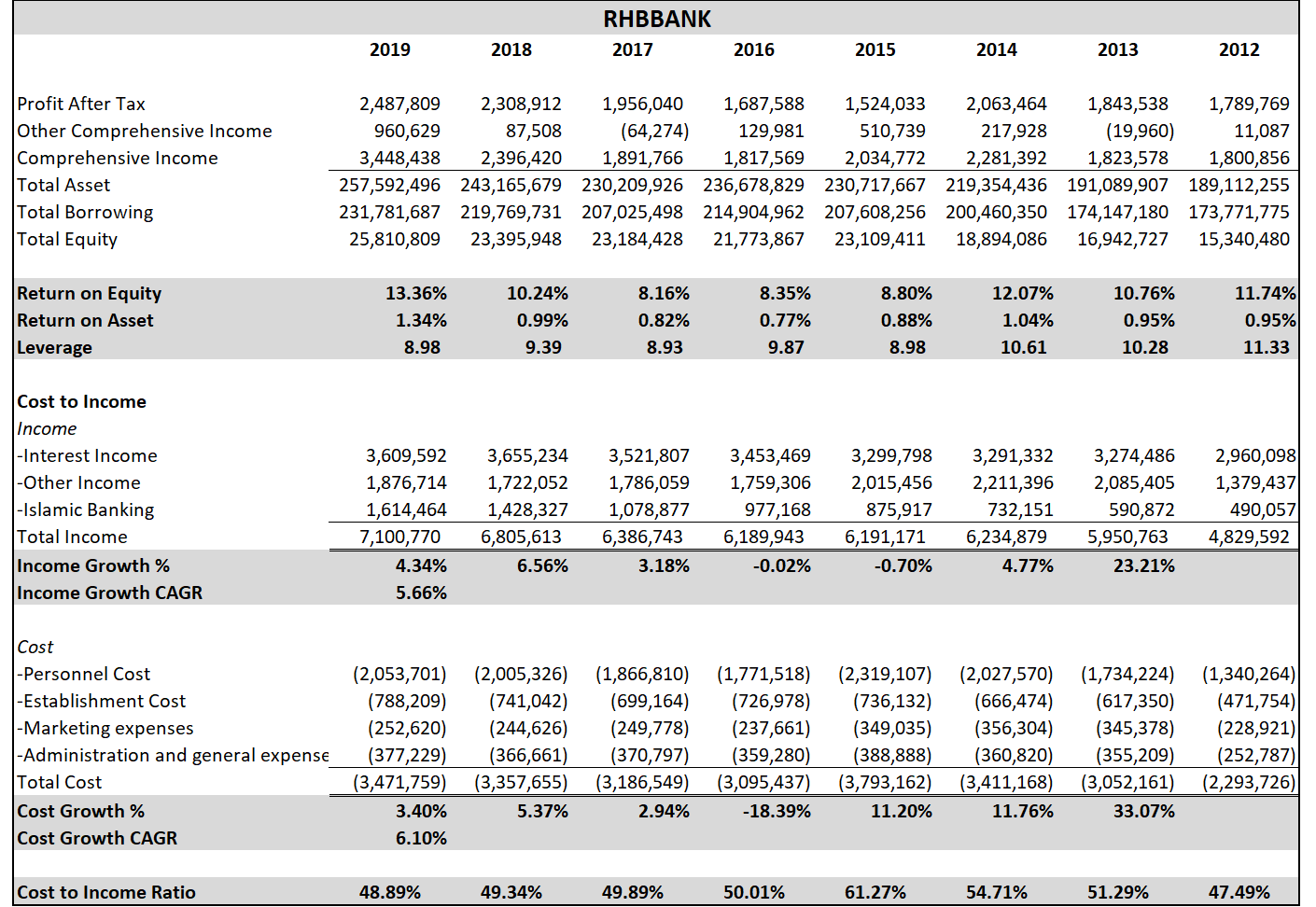

RHB Bank Berhad

Nothing special, or particularly bad about it. Given the prices of Singaporean banks, i wouldn't say its cheap either.

Singapore Banks

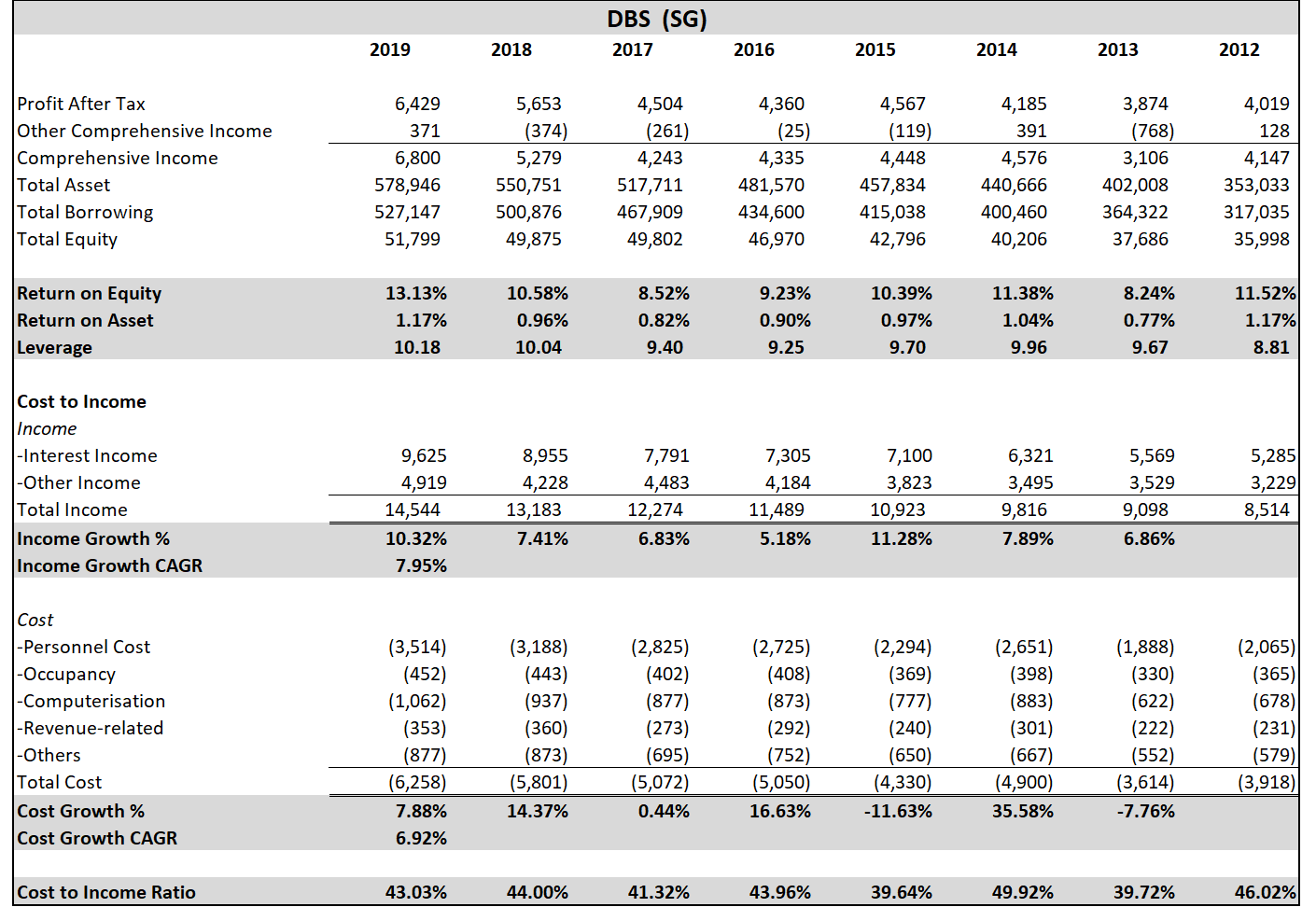

DBS Bank Ltd

Voted best managed bank in South East Asia, numbers look very good.

ROA is thin as hell, which in retrospect, is not surprising, given that all the banks in Singapore are run by Chinaman/Chinese. So very very strong competition.

Also, its about 10PE.

Considering SGD risk free rate is sub 2%, while our's is about 3.3%, when compared against pretty much any bank in Malaysia, its a bargain.

Worth a deeper study.

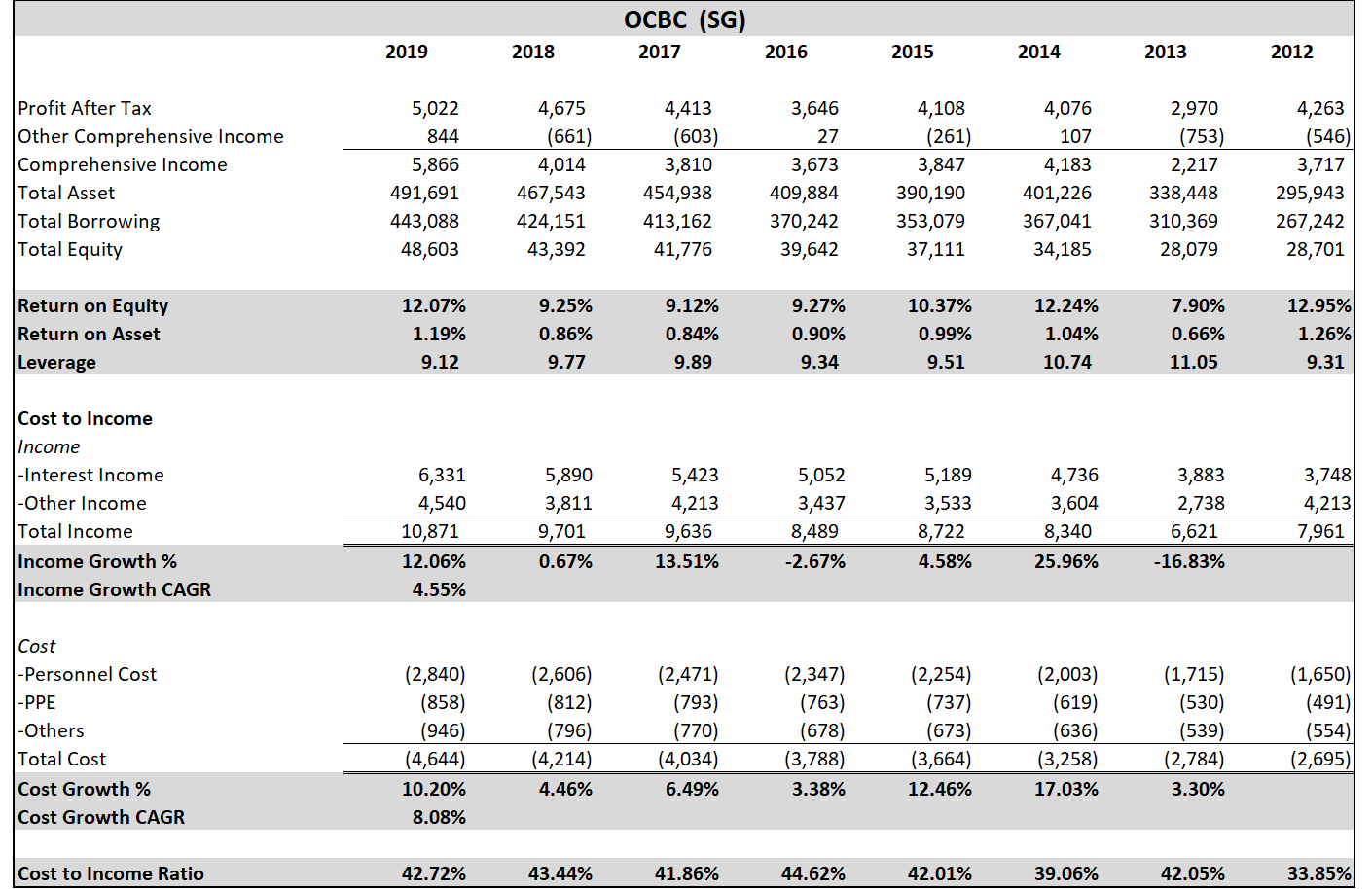

Oversea-Chinese Banking Corporation, Limited,

Also known as Orang China Bukan Cina Bank.

Numbers don't look as good as DBS's. The other 2 of the Big 3 in Sg.

Having said that, both UOB's and OCBS's numbers are not that far off from DBS's.

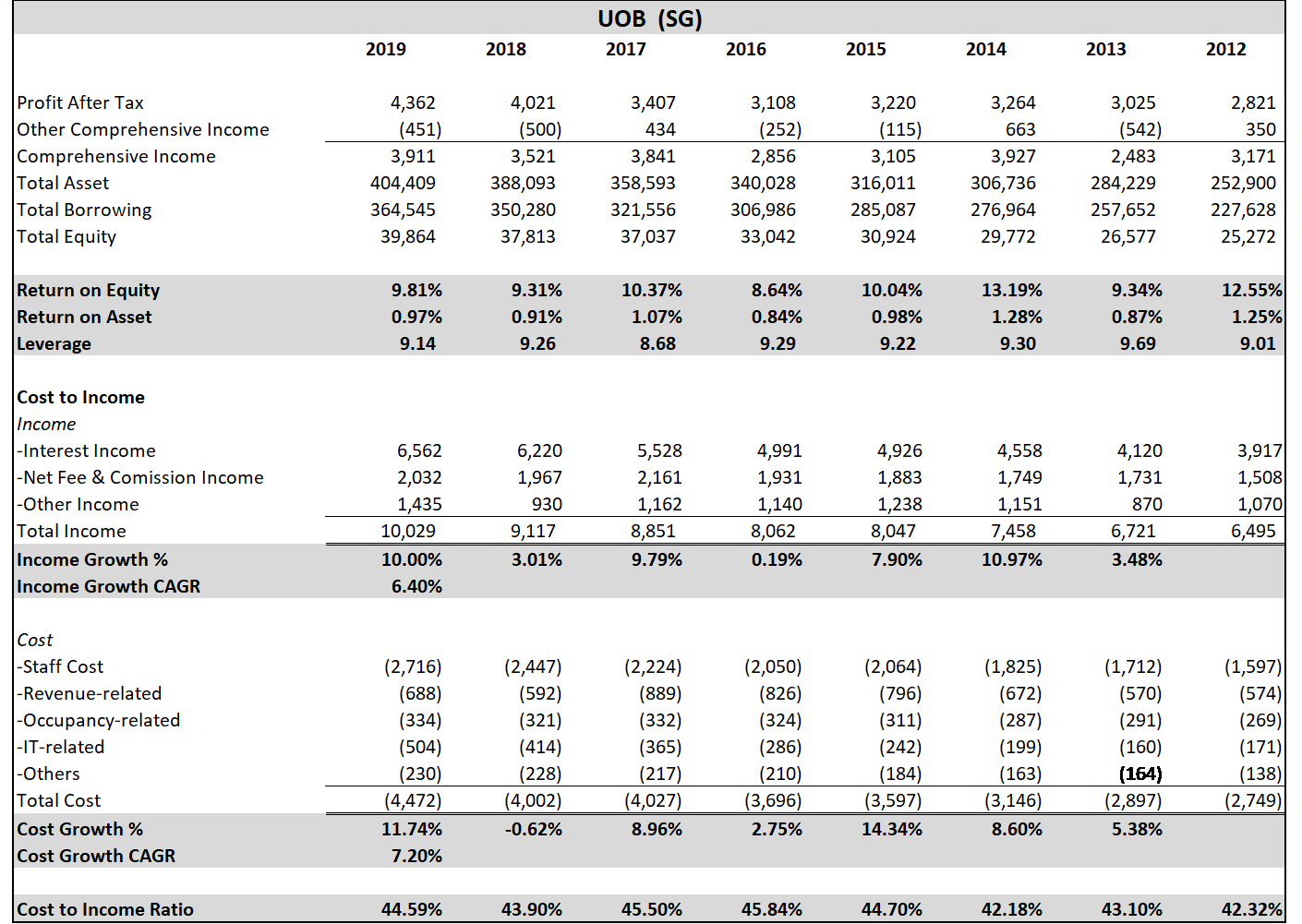

United Overseas Bank Limited

Numbers don't look as good as DBS's. The other 2 of the Big 3 in Sg.

Having said that, both UOB's and OCBS's numbers are not that far off from DBS's.

The Real Risk

Over the last few months, they've been much buzz in the Malaysian Markets on how these rate cuts will decimate the earnings of the banks.

Well, in my opinion, rate cuts don't matter as much to the earnings of the banks over the next 10 years as one would think it would. At most it will effect its earnings for the next 3-6 months, as the fixed deposits paying high rates mature. These fixed deposit rate tenures are quite short most of the time anyway, with the longest being at most one year.

There are two real danger that banks face, they are,

- Negative Interest Rates

Thankfully, we are not here yet. At least not for the foreseeable future.

The problem with negative interest rates is that, in the event that actually happens, most banks would be extremely hesitant to actually charge people money for keeping money in their bank accounts, thereby severely dropping Net Interest Margin as interest rates on borrowings fall in tandem with the now negative interest rate.

I'm not going to speak much more about this, as i'm sure many of us here have read multiple articles this by now.

- Yield Inversion

Yield inversion happens when long term interest rates actually fall below that of short term interest rates.

Now this is quite an abnormal circumstance in financial markets. Normally, short-term interest rates are below long-term interest rates, indicative of the fact that investors require more return for keeping their money tied up for longer.

But, when investors expect that a slowdown is coming, they don’t care about getting more return for keeping their money tied up. They just want to lock in yield. So, they pile into instruments with the best yields, which are long-term fixed income instruments. That flight into safe-haven assets pushes long-term bond prices up.

Alternatively, investors may be expecting that rates will fall in the short term, and in fear of not being able to renew their current bonds at similar interest rates, they then decide to buy longer dated bonds.

I won't be elaborating much further on this as i'm sure that most here would have also read a lot on these, as its been happening everywhere around the world. But what many may not know, is that in Malaysia, the yield curve have also inverted.

The inversion was particularly severe last week, right before the rate cut, which normalized things somewhat.

Now, why is this a bad thing for banks? Its simple, banks take in short term deposits but give out mid-long term loans. If your short term deposit rate is based on the short term MGS interest rates, while your mid-long term loans is based off the lower mid-long term MGS interest rates, well, that will severely impact your profits.

Thankfully, to an extent, by and large, Malaysian Banks do not really tie their borrowing rates to mid-long term MGS, instead adopting a BLR+XX% policy.

Still these are two things to ponder about when thinking about banking stocks.

Negative interest rates was almost always considered to be a theoretical scenario, none of the great economist we study, Keynes and Hayek etc, ever thought it could happen or last for a long time, and yet here we are, with most sovereign bonds at negative interest rates (starting with the EURO, SWISS Bonds etc since 2013).

Still, i don't think one should rely on your conclusions (no matter how clear cut you think they) on the above two things when thinking about buying a banking stock.

There are some topics (like this one) so complex and opaque, that one needs to be highly educated and well versed in the subject, in order to be unclear about the conclusions and be unable to come to an opinion.

The conclusions to the above two scenarios will only seem clear in retrospect. At the end of the day, we need to look back to the fundamentals of the banks.

Conclusion

At current prices, other than ABMB, RCECAP and AEONCR, the rest quite frankly just don't look that attractive to me.

I'm seriously considering PBBANK and HLBANK, but their prices needs to drop below RM15 and RM12 before it makes sense to me.

As always, do let me know what you think and if you guys have any comments.

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

It's interesting how quantitative and qualitative approaches differ. You used pe, income and return on equity to judge the quality of a bank

For me the more important criteria I look for in a bank is the loan impairments ratio and the loan profile. My idea of the perfect bank is a huge savings and fixed deposit accounts, and a every loan protected by solid collateral.

All the criteria you used to define a banks quality leave out the loan profile and the inherent risks in those loans.

During the subprime crises all the investors only looked at how much they made, not the risk they take to make the money. In fact, only a few analysts tracked the loan impairments ratio, and the income group of the individuals making the loans.

When I bought public Bank in 2012, this became the core tender of my investing policy.

In scuttlebutt terms, " how much leverage is the bank giving out to the corporate company in relation to their assets and ability service the debt".

My ex company was able to borrow 25 million in cash and 25 million in overdraft, all with 10 million in assets simply by raising paid up capital to 10m and having a fixed deposit of 5 million and property values at 5 million.

The car loan I have on the other hand, is based on a 5 year loan with a collateral on the car worth 368,000, and where the interest is paid first during the first 1 year, and the principal paid off after that.

If you have ever borrowed money to your friends and family, you will know borrowing money is a risky business. Assuming that your friends will pay you back with interest and expanding out into the next 5-10 years is a very risky risky business indeed.

Maybank had hyflux. Alliance Bank has London biscuit.

You are saying it won't repeat. How do you even know who they loan to?

All I can say is, if you are someone that likes margin of safety, you should find the margin of safety in banks, aka how much profit does the bank gain in relation to the risk it takes from its customer group.

In any case, you should update your graph with their annual impairments of loan profile, their client base breakdown and the growth of those safe loans profile.

It's all there hidden deep in the notes.

Where most of the important things are.

2020-03-08 16:31

Agree with philip.

Wonder which bank lend money to sapura energy and insist ceo pay by hundred of million?

2020-03-08 16:49

you did not manage to get the solution?

coz the ceo owe money to the bank for how much?

Posted by Sslee > Mar 8, 2020 4:49 PM | Report Abuse

Agree with philip.

Wonder which bank lend money to sapura energy and insist ceo pay by hundred of million?

2020-03-08 17:02

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40)

You forgot gross loans impairment.

Pbb 0.49%

Dbs 1.5%

2020-03-08 17:56

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$€£¥

>>>

Philip ( 2.3% fatality rate, 80% recovery rate age 10-40) You forgot gross loans impairment.

Pbb 0.49%

Dbs 1.5%

08/03/2020 5:56 PM

>>>

I was too lazy to look it up. It will be reflected in the NIM. Thanks/

2020-03-08 18:03

This should be reflected in ROA?

Would be great if i could get the data though. Next time maybe.

===

Posted by Philip ( 2.3% fatality rate, 80% recovery rate age 10-40) > Mar 8, 2020 5:56 PM | Report Abuse

You forgot gross loans impairment.

Pbb 0.49%

Dbs 1.5%

2020-03-09 15:33

Phillip,

I'm not sure if you're aware. But a high NPL etc will naturally flow to the PL, and the ROA. This is a sieve.

I don't usually do a NPL analysis unless i am doing an in depth study as the data is much harder to extract.

Feel free to do the same if you want.

No further comments on the commercial loans.

Non Privately held banks usually do alot of commercial loans because by doing so, they get to bolster their commercial current accounts and investment banking business. When it comes to commercial loans, if you get your money back its a good thing already.

Blame it on stupid incentives.

This means, for banks like Deutsche, DBS, Maybank, CIMB etc, i would always expect one extremely big surprise now and then.

This means they are usually not a good investment, unless its at the bottom of a crisis, or post a big fat impairment that really murders the stock price.

Having said that, one needs to note that, in some banks the rot runs so deep, that even if it survives the recession and you were to purchase it post right issues and near the bottom etc.

It can quite simply continue to die by a thousand cuts, and require constant right issues etc.

Deutsche Bank is the clearest example of this. If you bought the shares at the bottom of the financial crisis. You get a nice pop after, but if you held you would have still lost money today (even if you reverse covid stock losses)

2020-05-24 16:51

Most of the malaysian banks are well capitalized to withstand the current financial challenges.

Should able to survive & thrive.

2020-05-25 11:35

teoct

Thank you so much for all the hard work and sharing here.

Yes, I am also looking at DBS vs PBB. You have reinforced my conviction that DBS is a good buy. My take is DBS is in China, HK, Taiwan, India and Indonesia while PBB depended on Malaysia, while HK, Vietnam, Cambodia and Sri Lanka are small, very small.

India and Indonesia are still just breaking even to small loss, but the potential of these 2 markets is many time bigger than those of PBB.

And DBS is embracing tech in a big way compared with PBB. This is another plus point that should keep cost at bay going forward.

Thanks again and happy investing.

2020-03-06 20:58